Innovative Financial Partners

12000 North Pecos Street, Suite 290

Westminster, CO 80234

303.755.1298

Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Macro Overview

The Fed’s decision to ease rates in September may be perceived as a method to alleviate a slowing economy, not entirely a response to diminishing inflation. Markets carefully follow Federal Reserve decisions as a signal of where the economy is expected to head. Labor market data and economic releases provided by the federal government, which the Federal Reserve and economists rely on, are coming under escalating scrutiny. There is an increasing reliance on labor market data compiled by private companies, not the government, as credibility with the Bureau of Labor Statistics has progressively deteriorated.

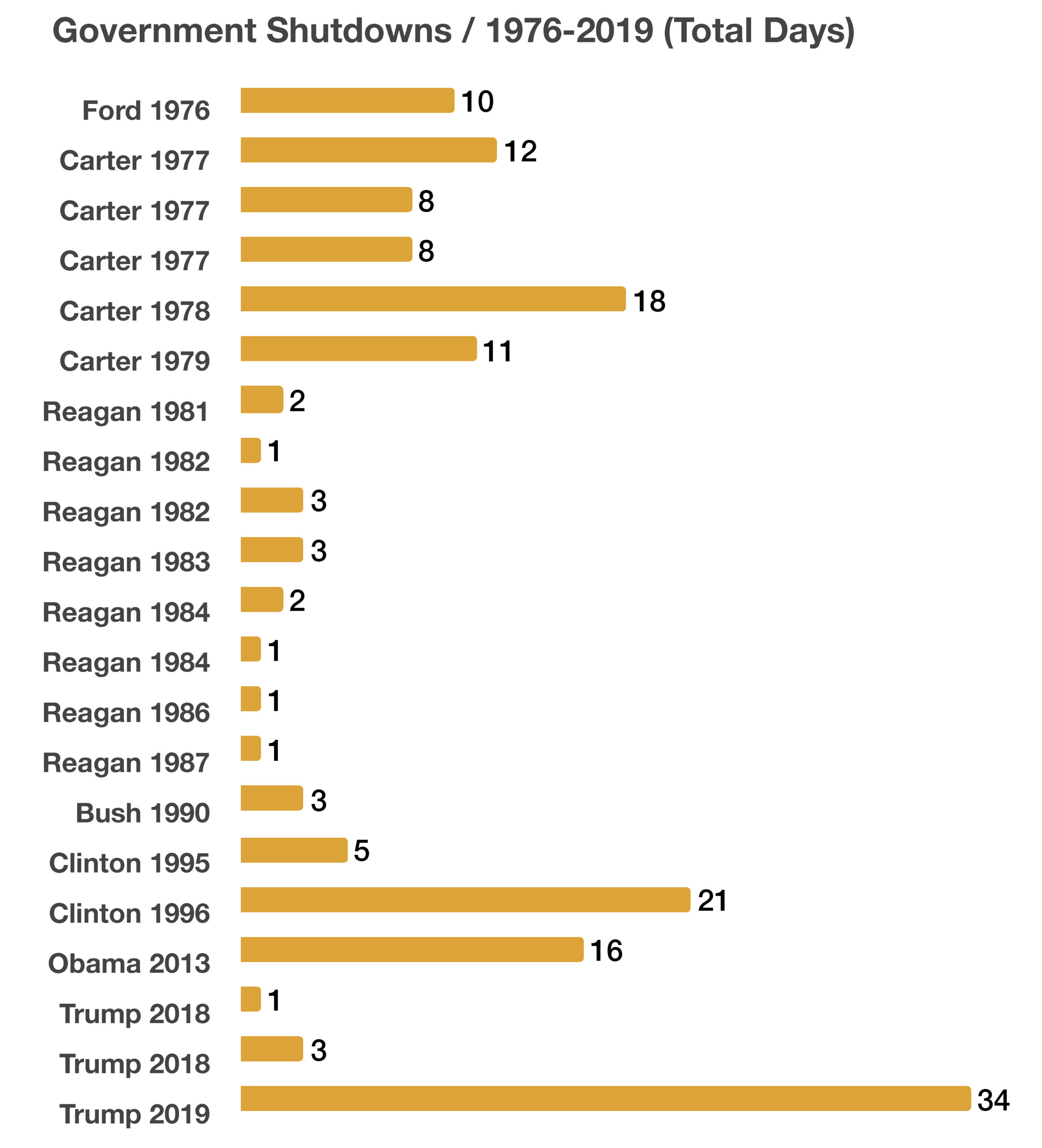

The most recent government shutdown is the first in seven years, when the government was shuttered for 35 days between December 22, 2018 and January 25, 2019. Current federal agencies and departments that are currently closed or affected under the shutdown that began October 1, 2025 include the Department of Health, Department of the Interior, Social Security Administration and the IRS.

Inflation as a result of the recently imposed tariffs is coming into question by some analysts and economists, as a large portion of companies are not passing along the cost of tariffs in the form of higher prices. More companies are absorbing tariff costs in order to maintain market share and to compete more favorably.

A growing number of economists are pinning poor job growth and falling productivity as triggers for a looming recession. Job creation leads to rising consumer expenditures as companies produce more and spend more efficiently, none of which is currently occurring.

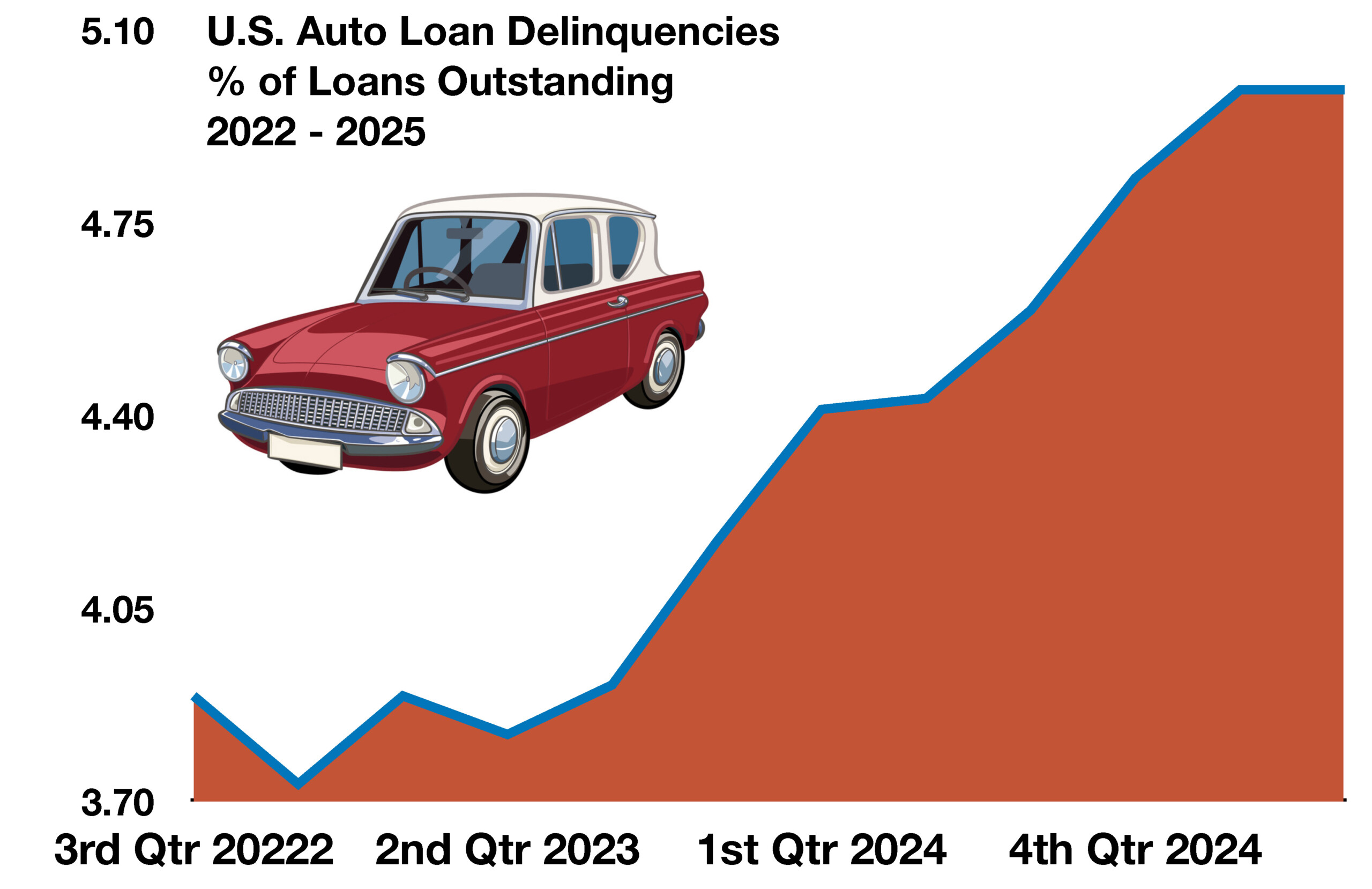

Consumer financial duress is seeping through to portions of the financial markets. Delinquency rates have been rising over the past few months for auto loans, credit card accounts, and certain mortgages. Many economists are attributing the delinquencies to a weakening jobs markets and minimal wage growth.

As the trade climate has shifted over the past few months, some unintended consequences from the tariffs have emerged. The European Union has begun to assemble new trade agreements with the Philippines, Thailand, and Malaysia that will be effective by 2027, in order to avert the possibility of future tariff challenges with the U.S. Such arrangements leave the U.S. out of future trading opportunities that provide favorable terms for U.S. companies and importers.

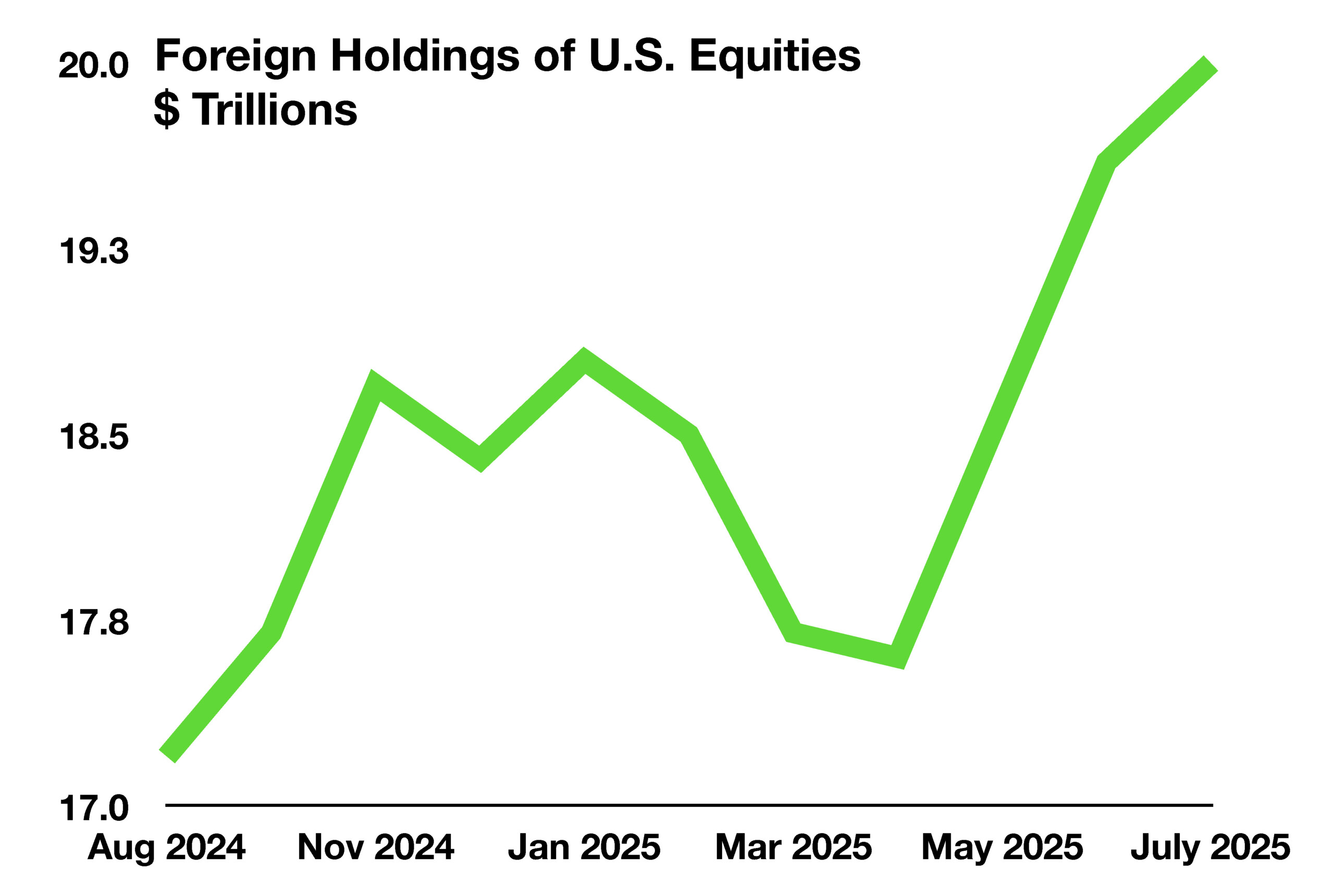

U.S. equity markets excelled in the third quarter, as consumer spending kept momentum on track for a positive trending performance. Analysts are increasingly focusing on company earnings and a feeble labor market as the fourth quarter sets in.

The spread or difference between investment grade corporate bond yields and Treasury bond yields hit the smallest difference since 1998 in the 3rd quarter. The spread is essentially the higher yield that investors demand from investment grade corporate debt versus risk free government debt such as Treasury bonds. Analysts believe that the bond market is signaling a gradual decrease in confidence surrounding government debt and an increasing conviction in corporate financial stability. (Sources: Federal Reserve, Treasury, Bloomberg, EuroStat, BLS)

As credit card balances have been increasing so have delinquencies, with a growing number of consumers falling behind on payments. Credit availability has expanded over the past few years as non-traditional private finance companies and lenders, rather than banks, have been lending in markets that for years were dominated by banks. Exposure to delinquencies and defaults has been slowly shifting from banks to non-traditional lenders. (Sources: Federal Reserve Bank of St. Louis)

As credit card balances have been increasing so have delinquencies, with a growing number of consumers falling behind on payments. Credit availability has expanded over the past few years as non-traditional private finance companies and lenders, rather than banks, have been lending in markets that for years were dominated by banks. Exposure to delinquencies and defaults has been slowly shifting from banks to non-traditional lenders. (Sources: Federal Reserve Bank of St. Louis)