Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Macro Overview

The Federal Reserve’s decision to cut rates in September was seen less as a response to cooling inflation and more as a preemptive move to counter a slowing economy. Investors regard Fed policy shifts as key signals of where growth is headed. Labor market data and other government economic reports—long relied upon by the Fed and economists—are facing growing skepticism. Analysts are increasingly turning to private-sector employment data as confidence in the Bureau of Labor Statistics erodes.

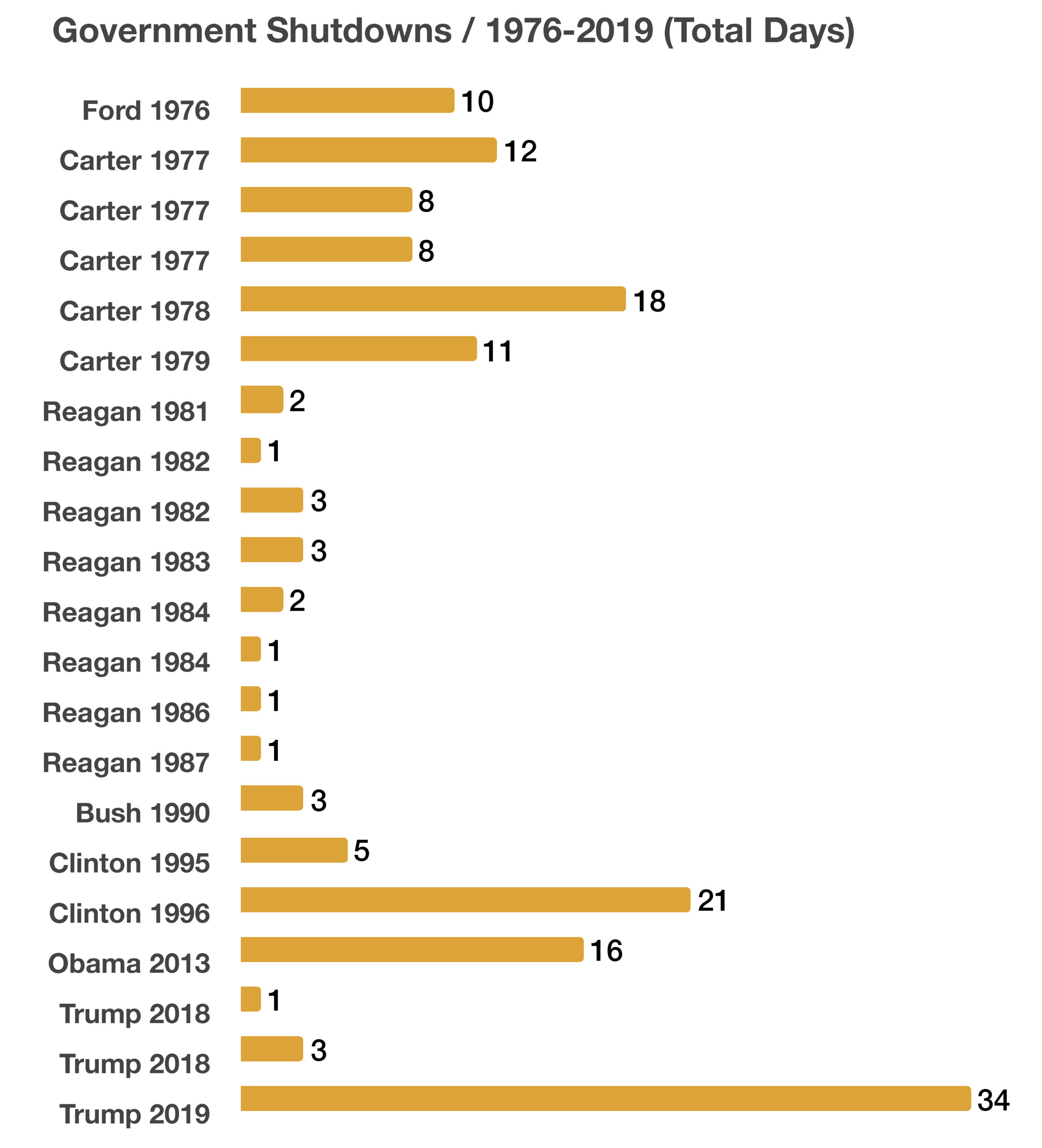

The latest government shutdown, the first in seven years, began October 1, 2025, and has shuttered or disrupted several federal agencies, including the Department of Health and Human Services, the Department of the Interior, the Social Security Administration, and the IRS. The last shutdown, in late 2018, lasted 35 days—the longest on record.

Economists are questioning whether the latest tariffs will meaningfully add to inflation, noting that many companies are choosing to absorb higher import costs rather than pass them to consumers. Firms are protecting market share and competitiveness, even as profit margins tighten.

Weak job creation and declining productivity are increasingly cited as early warning signs of a potential recession. Normally, rising employment fuels consumer spending and business investment—dynamics that have lost steam in recent months.

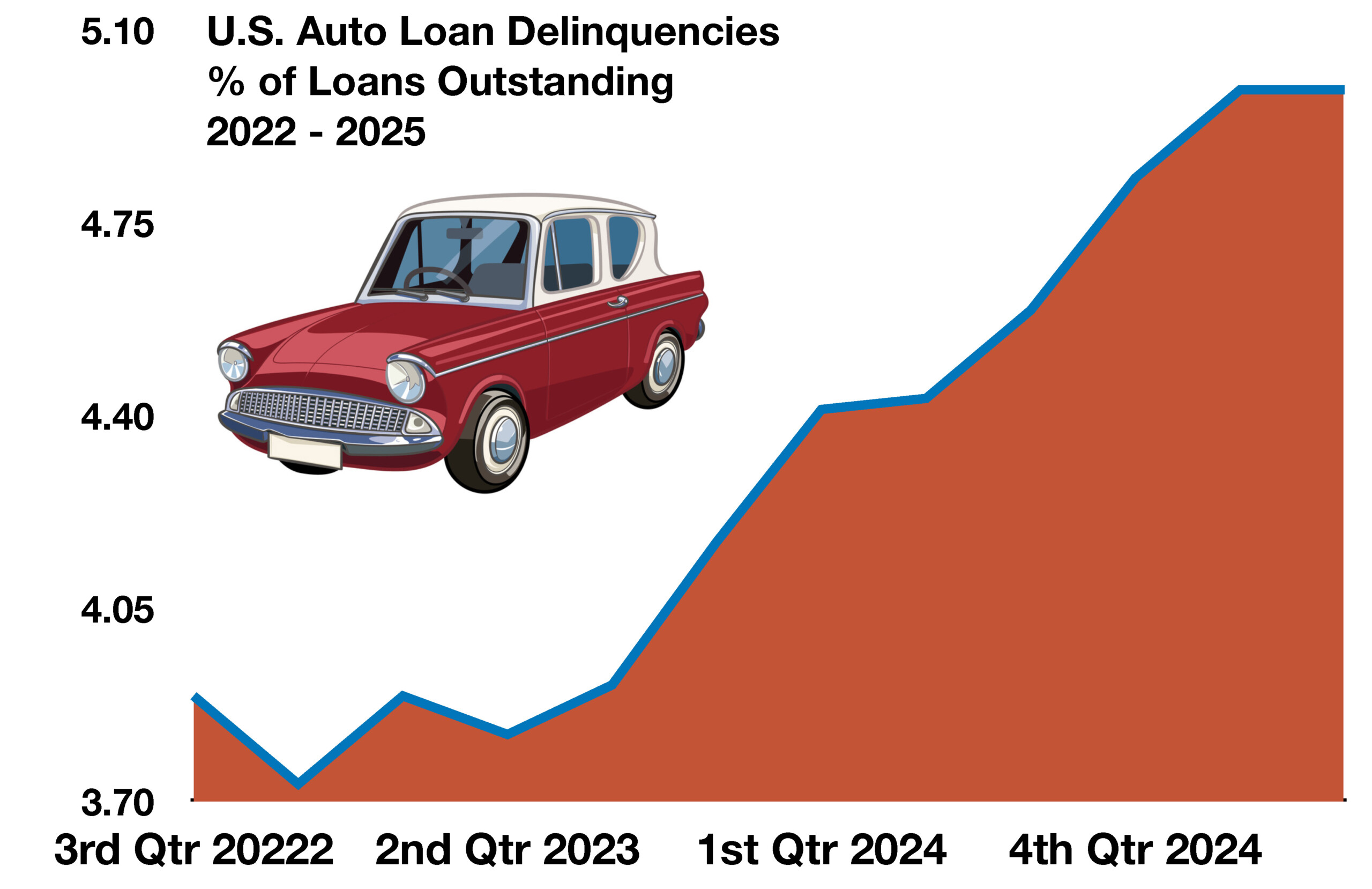

Financial stress among households is beginning to surface. Delinquency rates on auto loans, credit cards, and certain mortgages have climbed, reflecting a cooling labor market and sluggish wage growth.

Global trade dynamics are also shifting. The European Union is advancing new trade deals with the Philippines, Thailand, and Malaysia, expected to take effect by 2027. The agreements are aimed at minimizing tariff risks with the U.S. but could sideline American exporters from emerging opportunities in those markets.

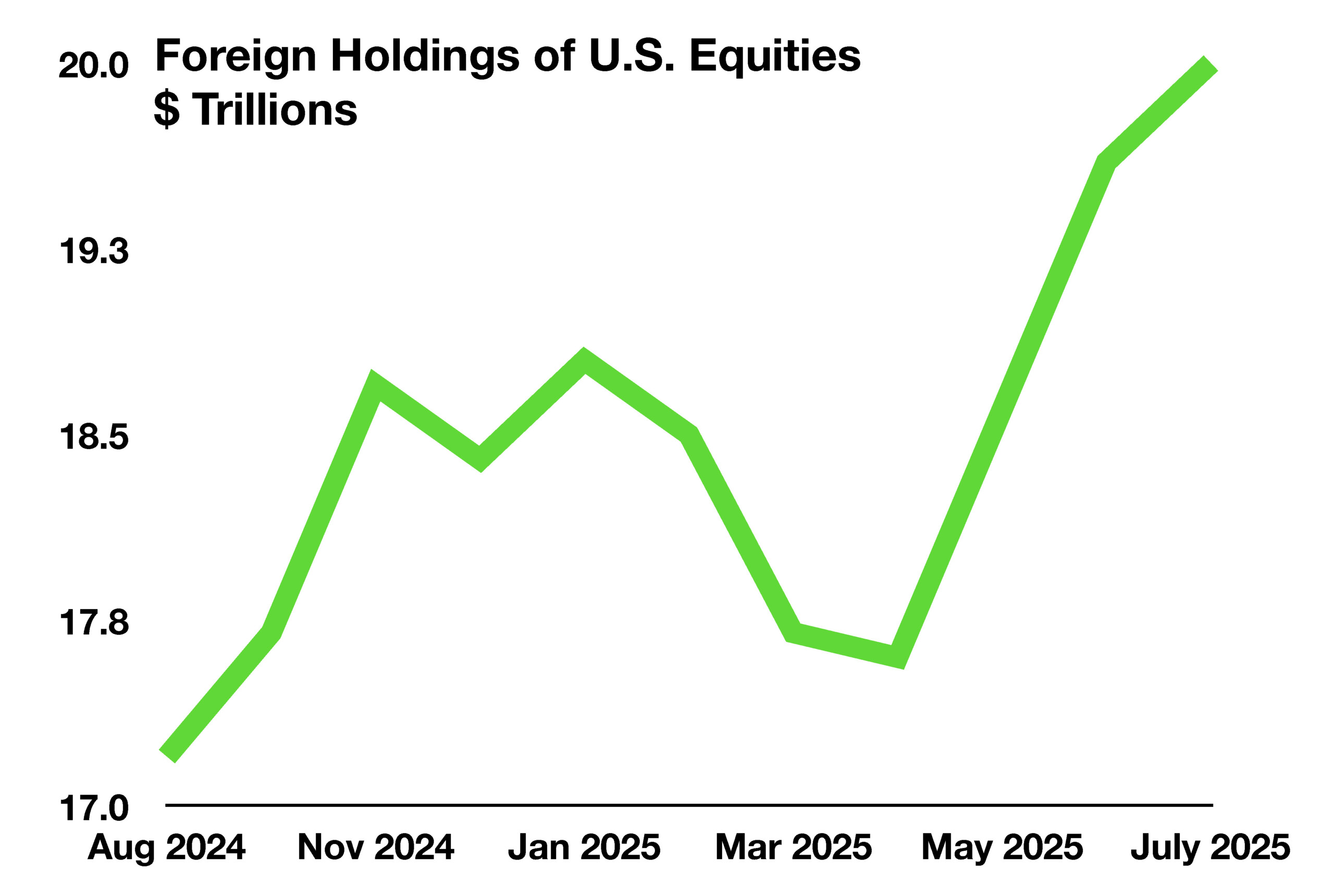

U.S. equities posted strong third-quarter gains, supported by resilient consumer spending. As the fourth quarter begins, analysts are focusing on corporate earnings and labor market data for clues about whether economic momentum can endure.

Meanwhile, the spread between investment-grade corporate bond yields and Treasurys narrowed to its lowest level since 1998. The shrinking gap—essentially the extra return investors demand for holding corporate debt—suggests growing confidence in corporate balance sheets and a more cautious view of government credit. It also reflects investors’ search for alternatives to richly valued equities, as the bond market increasingly serves as a barometer of both economic sentiment and portfolio rotation.

(Sources: Federal Reserve, Treasury Department, Bloomberg, EuroStat, Bureau of Labor Statistics)