Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Recession fears weighed on markets as equities pulled back from a mid-summer rally that some analysts suspect was short-lived. U.S. equities began to rebound in August, but reversed course to end the month in negative territory.

Crude oil and gasoline prices declined in August, offering a reprieve for consumers and easing inflationary pressures slightly. Oil prices posted their largest monthly drop for the year, falling to $88.90 per barrel at the end of August, down over 30% from a high of $130 in March. Many analysts expect gasoline prices to follow historical patterns as decreasing demand in the fall and winter months usually brings lower prices.

Demand for homes continued to ease in August as rising mortgage rates and elevated home prices made affordability a challenge for millions of home buyers. The average 30-year conforming fixed mortgage rate rose to 5.66% on September 1st, albeit still below June’s high of 5.81%.

Concerns about an impending recession mounted in August, as equity markets hesitated with further anticipated Federal Reserve rate hikes. Numerous factors hindered economic growth both in the U.S. and internationally, including the invasion of Ukraine, food supply issues, monetary tightening, inflation, and falling corporate profit margins.

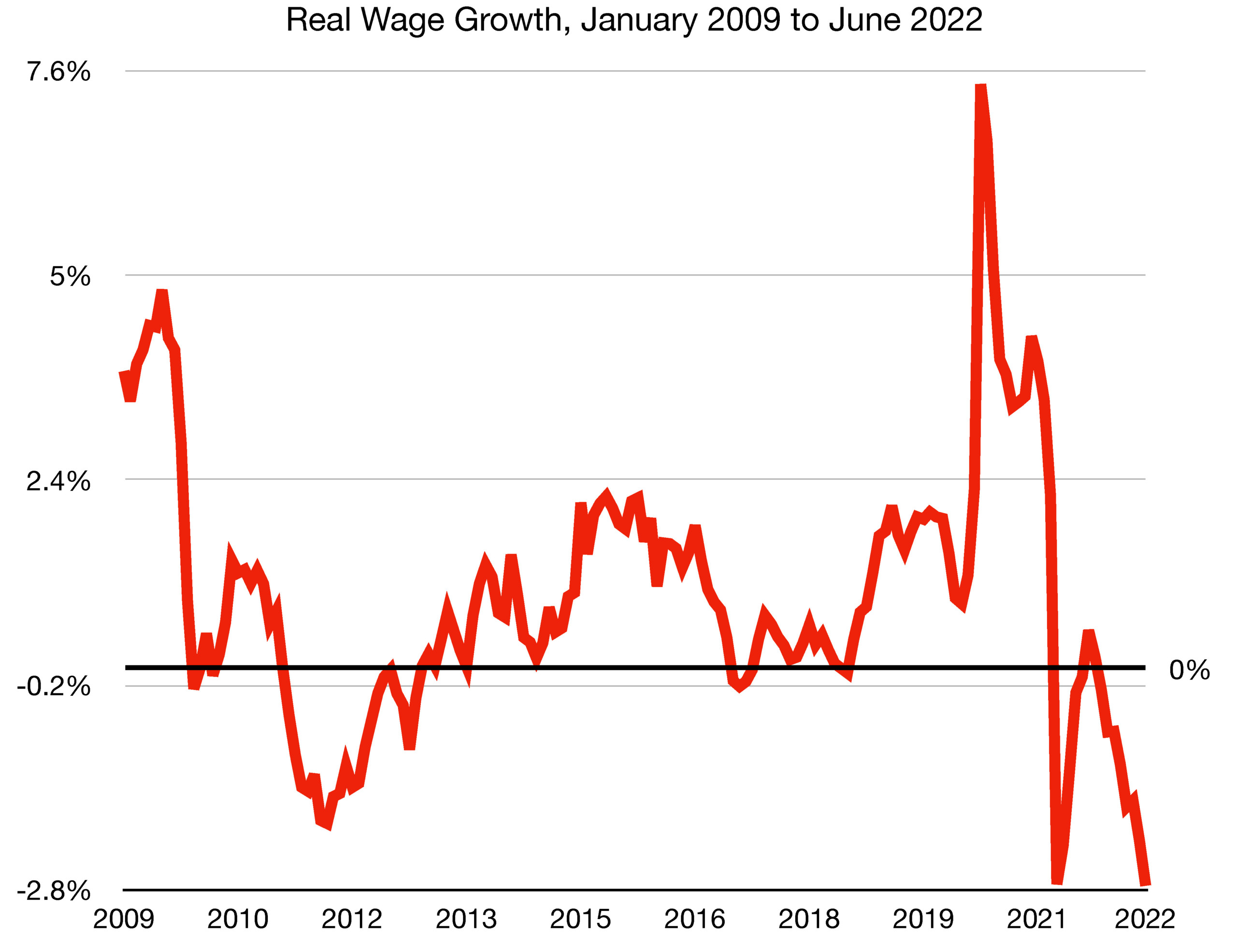

A drop in real wages and heightened layoffs added pressure to the already-uncertain labor market, which seems to be cooling following a year of rapid growth. Many Americans are returning to work from the heights of self-employment in 2021 as uncertainty in the economy grows. Large sectors including technology and finance are seeing companies return workers to the office, decreasing the prevalence of remote work.

Analysts expect that a peak in inflation may stimulate equity market volatility, should the Fed reconsider a continued rise in rates. Modifications to Fed policy might include a halt to raising rates in the event that economic conditions worsen.

The unemployment rate rose to 3.7% in August from 3.5% the previous month, making August’s unemployment rate the highest since February of this year. This indicates a slight slowdown in the labor market.

Retail stores continue to hold excess inventories, as consumers curb purchases. Too much inventory can hinder earnings for companies, especially heading into the holiday season.

China reinstated a zero-Covid policy by extending a lockdown in the western city of Chengdu, slowing Chinese exports and economic growth. Such policies lead to closures of factories and manufacturing facilities, which affect supply chains globally.

Russia halted all gas supplies to Europe indefinitely, complicating finances for European consumers and raising fuel prices to new highs. Europeans are already experiencing broad levels of inflation not seen in decades.

Sources: Freddie Mac, BLS, Department of Energy, Federal Reserve Bank of St. Louis