Kim Nordmo

Artience Capital Management, LLC

PO Box 777 Genoa, NV 89411

415-354-5574

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Recession fears weighed on markets as equities pulled back from a mid-summer rally that many analysts suspect was short-lived. U.S. equities began August in rebound mode but reversed course to end the month in negative territory.

Crude oil and gasoline prices fell further in August, offering a reprieve for consumers and easing inflationary pressures slightly. Oil prices posted their largest monthly drop for the year, falling to $88.90 per barrel at the end of August, down over 30% from a high of $130 in March. Some analysts expect prices to follow historical patterns as decreasing demand in the fall and winter months usually brings lower prices.

Demand for homes continued to ease in August as rising mortgage rates and elevated home prices continued to make affordability a challenge for millions of home buyers. The average 30-year conforming fixed mortgage rate rose to 5.66% on September 1st, yet still below June’s high of 5.81%.

Concerns surrounding an impending recession mounted in August, as equity markets hesitated with further anticipated Federal Reserve rate hikes. Numerous factors continue to hinder economic growth both in the U.S. and internationally, including the invasion of Ukraine, food supply issues, monetary tightening, inflation, and falling corporate margins.

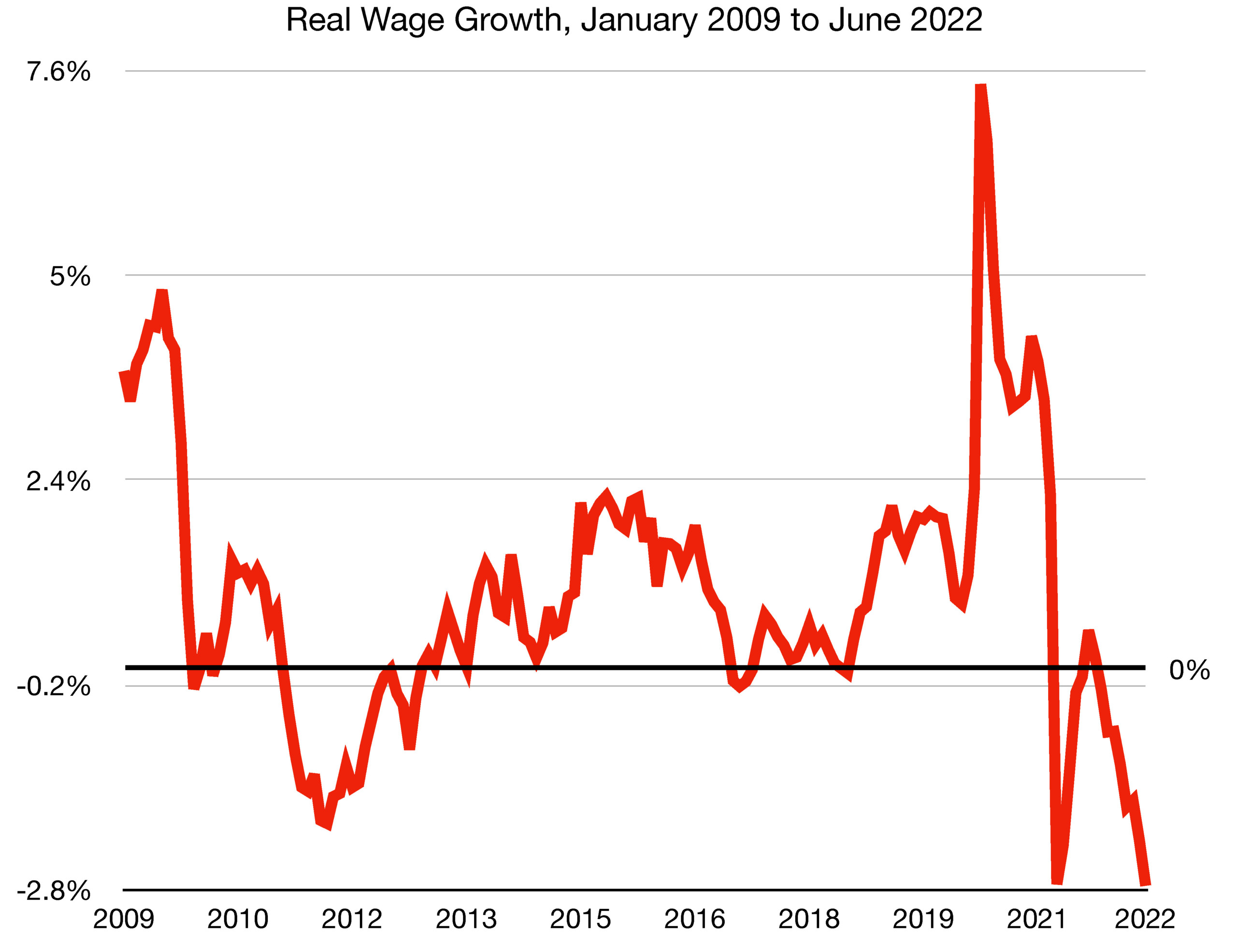

A drop in real wages and heightened layoffs added pressure to the already uncertain labor market, which seems to be cooling following a year of rapid growth. Many Americans are returning to work from the heights of self-employment in 2021 as uncertainty in the economy grows. Large sectors like technology and finance are seeing companies usher plans to return workers to the office, away from the popularity of remote work during the pandemic.

Analysts expect that a peak in inflation may help stimulate equity market dynamics, should the Fed reconsider a continued rise in rates. Modifications to Fed policy might include a halt to raising rates should economic conditions worsen.

The unemployment rate rose to 3.7% in August from 3.5% the previous month, making August’s unemployment rate the highest since February of this year. This indicates a slight slowdown in the labor market.

Retail stores continue to hold excess inventories, as consumers curb purchases. Too much inventory can hinder earnings for companies, especially heading into the holiday season.

China re-instated a zero-covid policy by extending a lockdown in the western city of Chengdu, slowing Chinese exports and economic growth. Such policies also lead to closures of factories and manufacturing facilities, which can affect supply chains globally.

Russia halted all gas supplies to Europe indefinitely, further complicating efforts for European consumers and raising fuel prices to new highs. Europeans are already experiencing broad levels of inflation not seen in decades.

Sources: Freddie Mac, BLS, Department of Energy, Federal Reserve Bank of St. Louis