Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

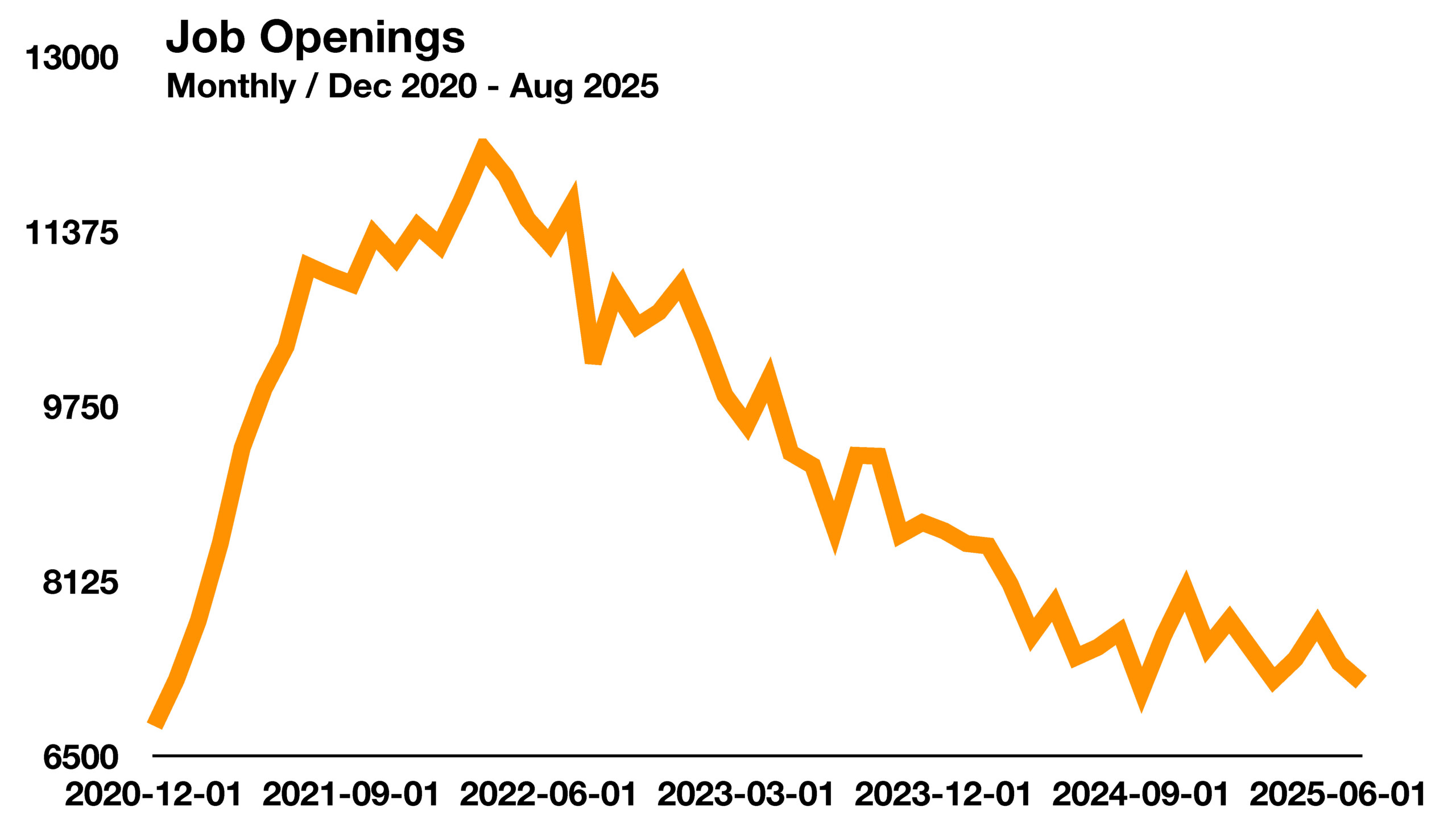

Weakening labor data has prompted the Federal Reserve to signal that interest-rate cuts may occur more quickly than previously expected. Mounting concern over the health of the job market is pushing policymakers toward more proactive easing in an effort to stave off a broader slowdown.

Employment figures have become one of the most closely watched indicators for the direction of the economy, though economists and analysts increasingly question the reliability of government statistics.

Softening labor trends can move markets in opposite directions. Historically, faltering jobs data has pressured the Fed to lower rates, boosting bond prices amid expectations of weaker growth. At the same time, slower hiring can weigh on equities as corporate earnings prospects dim.

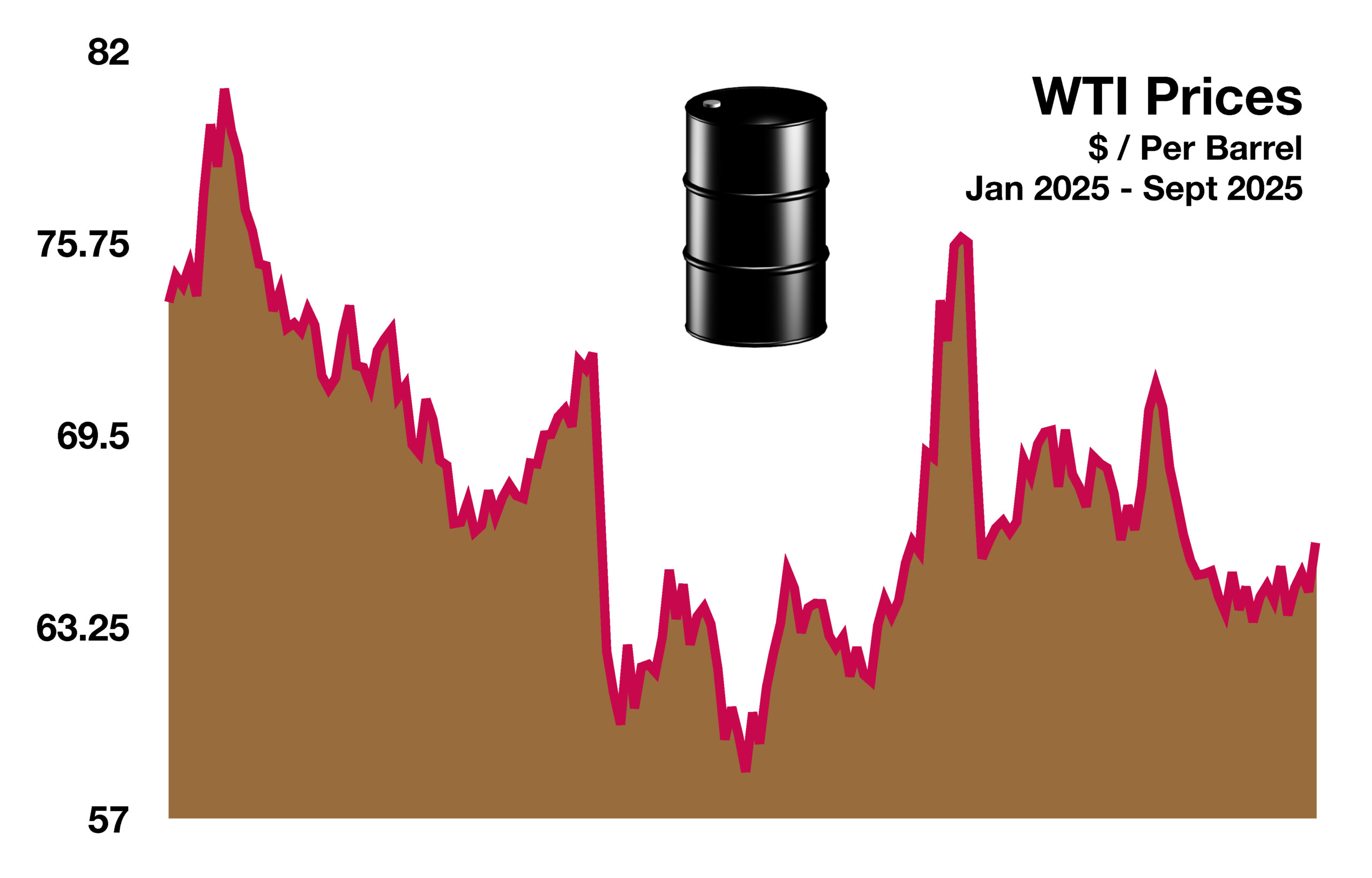

Crude oil prices have slid more than 10% since the start of the year, reflecting softer global demand and ample supply. A further decline could filter through to lower gasoline prices, easing inflationary pressures for U.S. consumers.

The Fed has suggested that a cooling labor market may help offset the near-term impact of higher tariffs. Corporate earnings show a mixed picture: some firms are absorbing tariff costs, while others are passing them to customers. Analysts broadly expect an economic backdrop of slower growth, moderating inflation, and additional Fed easing in the months ahead. Lower rates would, in turn, give consumers more room to spend—a key driver of overall activity.

Gross domestic product grew at a 3.3% annual rate in the latest quarter, according to a revised Commerce Department estimate, up from an earlier reading of 3%. Much of the growth reflected a pullback in imports after businesses front-loaded purchases earlier in the year to get ahead of tariff hikes. Trade flows can swing quarterly GDP because of the way growth is calculated.

Meanwhile, Australia’s central bank warned of a global shift in financing away from regulated banks and toward private markets, a development that complicates efforts by authorities to monitor and contain risks in the financial system.

The housing market is closely watching the Fed. Analysts expect a cooling trend to persist as inventories rise and buyers step back, though a cut in mortgage rates could offer some relief. Lumber and shipping costs are falling as tariffs and weaker demand ripple through supply chains. Historically, cheaper lumber has lowered construction costs, while declining container rates reduce the price of imported goods.

(Sources: Commerce Dept, BLS, Labor Dept, Federal Reserve, EIA)

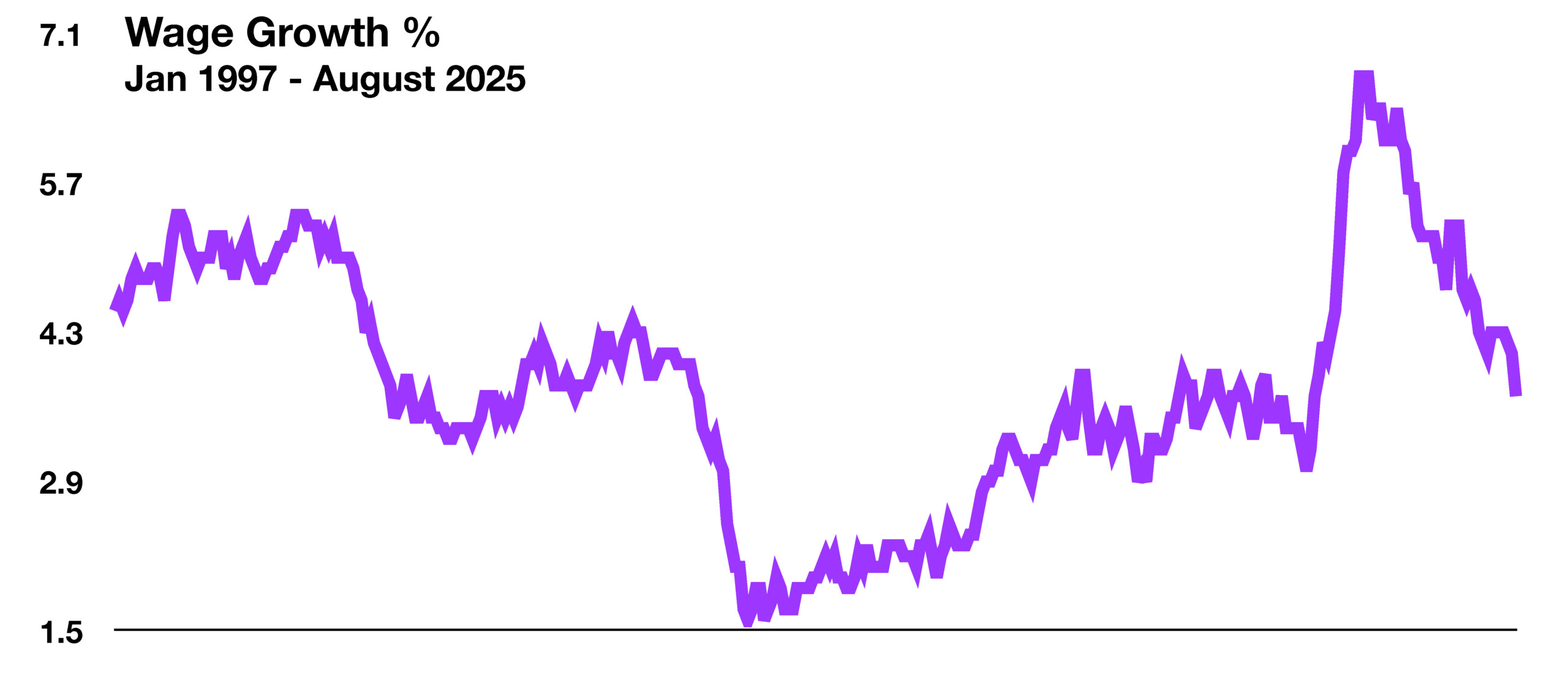

One concern weighing on consumers is the sharp slowdown in wage growth since 2022. During the pandemic and its aftermath, employers boosted pay to attract scarce workers, driving salaries higher through 2021 and early 2022. But since then, wage gains have steadily cooled.

One concern weighing on consumers is the sharp slowdown in wage growth since 2022. During the pandemic and its aftermath, employers boosted pay to attract scarce workers, driving salaries higher through 2021 and early 2022. But since then, wage gains have steadily cooled.