Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

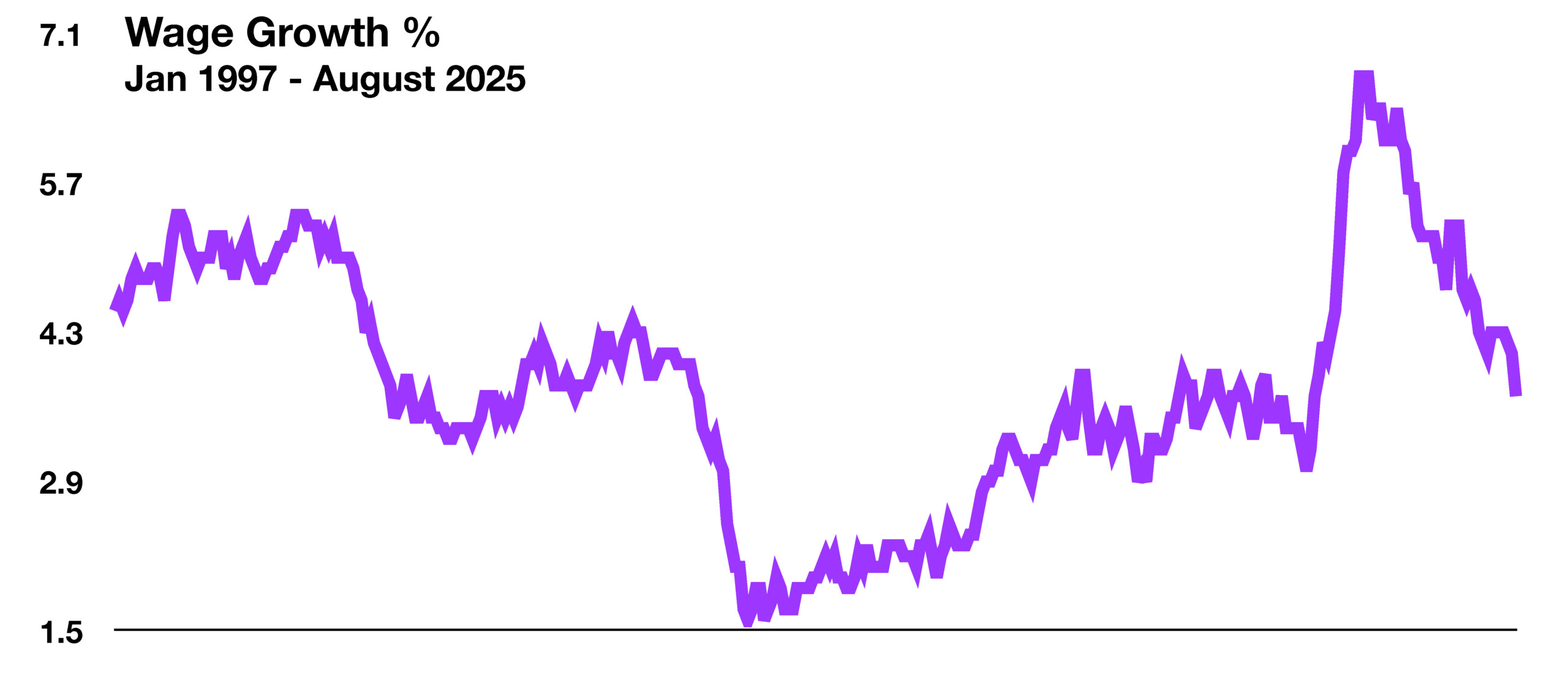

Weakening employment data prompted the Federal Reserve to suggest that a reduction in interest rates would be considered sooner rather than later. The Federal Reserve is becoming increasingly concerned about the health of the employment market, enticing it to possibly lower rates more proactively in order to curtail an economic pullback.

Data detailing the condition of the job market has become an incredibly vital determinant as to the direction of the economy, with economists and analysts becoming increasingly critical of the accuracy of government compiled data.

Weakening employment data can affect markets positively and negatively. Faltering jobs data historically has led to lower interest rates because of an impending economic slowdown pushing bond prices higher, while concurrently hindering stocks as growth prospects are revised down.

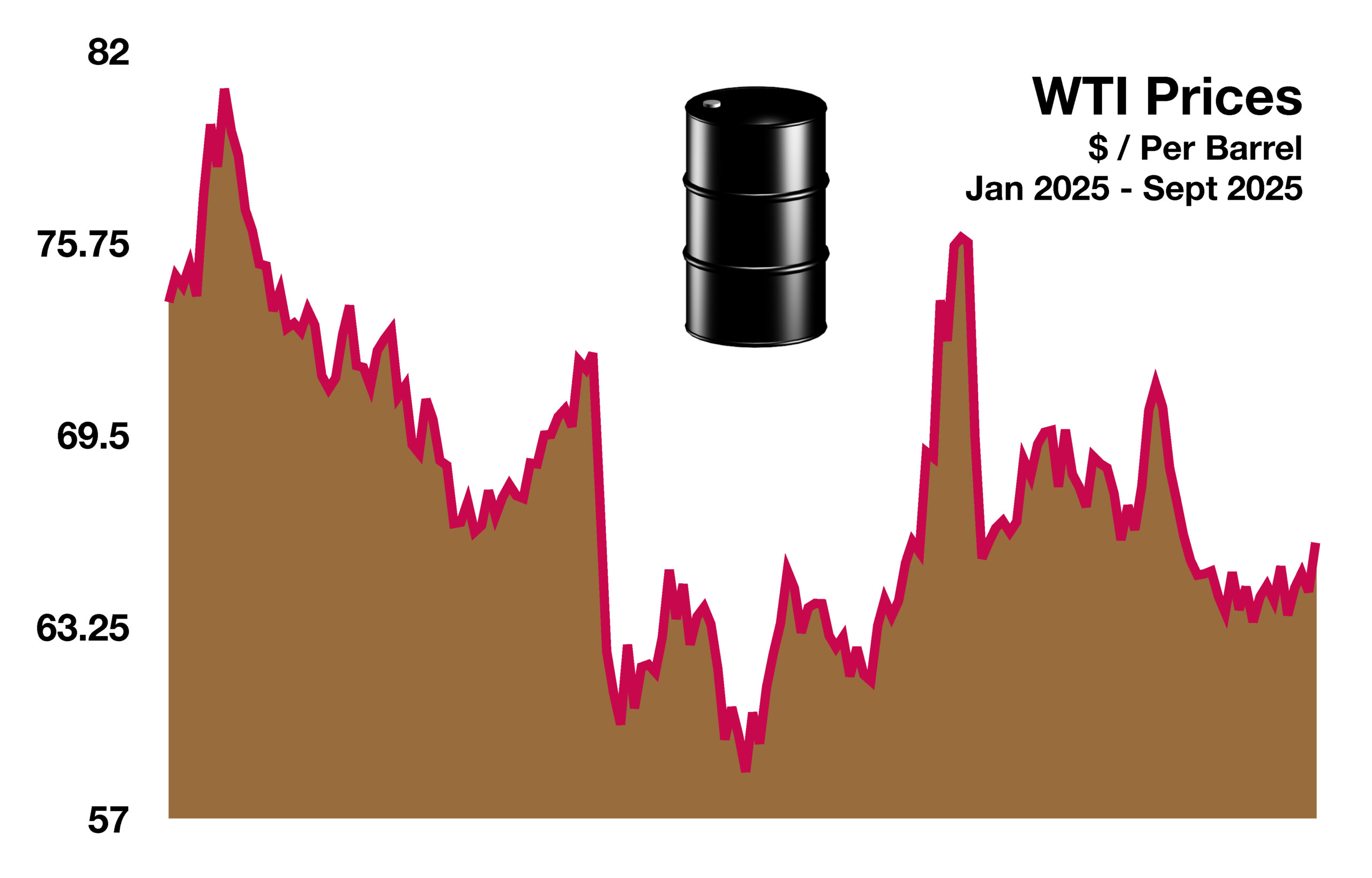

Crude oil prices have dropped over 10% since the beginning of the year, a result of diminishing global demand and excess supply. Any further drop in crude oil prices could eventually translate into lower gasoline prices, alleviating some inflationary pressures for American consumers.

The Fed suggested that a slowing employment market could help offset the elevated prices associated with tariffs in the short term. Company earnings continue to reveal that some companies are absorbing tariff costs while others are passing the costs along to consumers. Various analysts and economists believe that an economic environment encompassing slower growth, moderating inflation and additional easing by the Federal Reserve will unfold over the next few months. Consumer expenditures have become a critical component in the direction of the economy, as lower interest rates would afford consumers greater expenditures.

Gross Domestic Product (GDP) expanded at an annual rate of 3.3% this past quarter, the Commerce Department said in an updated estimate. The department had previously estimated that the economy had grown by 3%. The economy’s recent growth supposedly reflected a drop in imported goods after companies made purchases earlier in the year in advance of new tariffs. Trade can cause swings in quarterly growth because of the method used to calculated GDP.

Australia’s central bank warned that a global change in how financing is being accomplished is veering from traditional regulated banks and transitioning into private markets, which is making it more difficult for authorities to contain risks within the global financial system.

The housing market is anxiously awaiting any rate cuts by the Fed in anticipation that a drop in mortgage rates will soon follow. Housing sector analysts are projecting a continual cooling housing market as inventories grow and buyers retract. Lumber prices and container shipping rates are falling as a result of easing demands due to imposed tariffs, as well as a slowing economic environment. Lower lumber prices historically have translated into lower housing material costs, while falling container shipping costs can lead to lower costs for imported items. (Sources: Commerce Dept, BLS, Labor Dept, Federal Reserve, EIA)

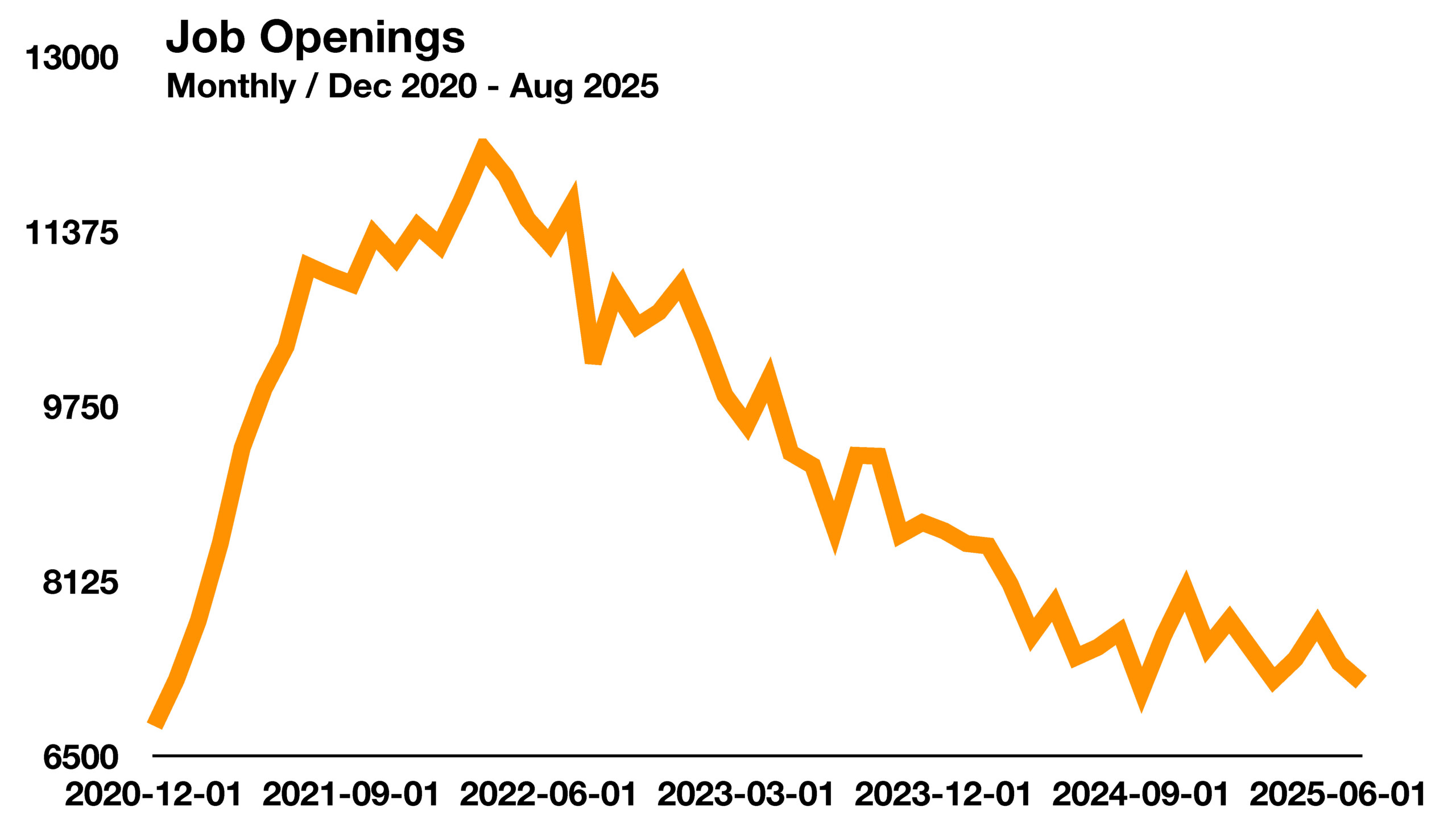

The health of the employment market has become worse than originally believed with hundreds of thousands of fewer jobs being offered by companies than initially reported. The desire by companies to hire and expand their employee base is measured by the number of actual job openings. Since March 2022, job openings have been steadily falling as companies scaled back from ambitious hiring during the pandemic. Several analysts and economists believe that faulty data gathering and reporting methods by the Labor Department’s Bureau of Labor Statistics may have misguided the Federal Reserve with its monetary policy objectives for more than the past year. (Sources: Dept. of Labor, Federal Reserve)

The health of the employment market has become worse than originally believed with hundreds of thousands of fewer jobs being offered by companies than initially reported. The desire by companies to hire and expand their employee base is measured by the number of actual job openings. Since March 2022, job openings have been steadily falling as companies scaled back from ambitious hiring during the pandemic. Several analysts and economists believe that faulty data gathering and reporting methods by the Labor Department’s Bureau of Labor Statistics may have misguided the Federal Reserve with its monetary policy objectives for more than the past year. (Sources: Dept. of Labor, Federal Reserve) Lower oil prices can alleviate inflationary pressures for businesses and consumers, in the form of falling jet fuel, diesel, and gasoline prices. Reduced oil prices may also contribute to increased earnings for energy consuming companies, yet may also result in decreased earnings for oil drillers and producers. (Sources: Department of Energy, Bureau of Labor Statistics)

Lower oil prices can alleviate inflationary pressures for businesses and consumers, in the form of falling jet fuel, diesel, and gasoline prices. Reduced oil prices may also contribute to increased earnings for energy consuming companies, yet may also result in decreased earnings for oil drillers and producers. (Sources: Department of Energy, Bureau of Labor Statistics)