Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Portfolio Overview

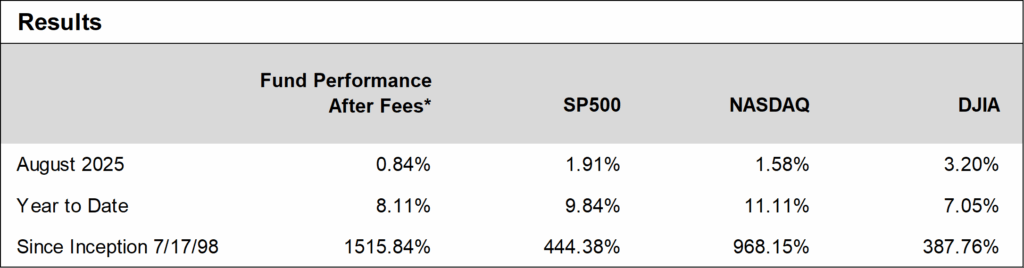

Ocean Park Investors Fund advanced 0.84%* in August, while the S&P 500 gained 1.91% and the NASDAQ Composite rose 1.58%. Our results reflected disciplined trading amid a busy earnings season, with selective adjustments across key holdings.

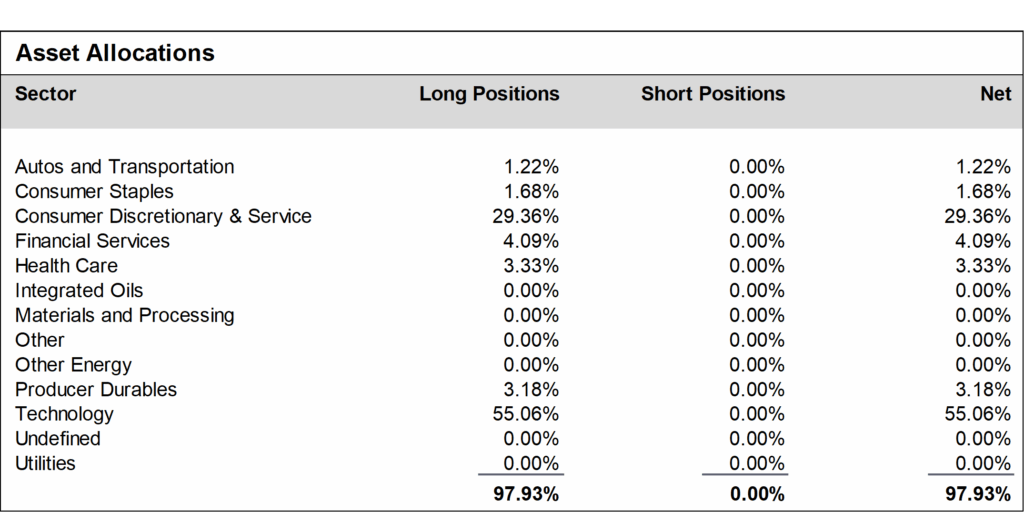

During the month we reduced our position in Amazon following its earnings release and took profits in Wayfair after a strong post-earnings rally. We also exited Disney and Uber, as both failed to deliver the earnings upside we anticipated.

New positions included Hewlett Packard Enterprise, Lumentum, Monster Beverage, Five Below, and Ollie’s Bargain Outlet—companies we believe are well-positioned based on favorable analyst commentary, sector outlook, and company-specific catalysts. For example, Monster continues to capture share in the performance beverage market, while Five Below and Ollie’s offer unique exposure to value-conscious consumer spending trends. We also added to our position in Zebra Technologies after a sharp pullback tied to acquisition news, viewing the weakness as an opportunity to increase exposure.

The fund also hedged risk tactically by shorting the QQQ ETF ahead of a key NVIDIA earnings event, and promptly covering after results proved non-disruptive.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com. To gain access to the site enter password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4. Past performance does not guarantee future results