Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

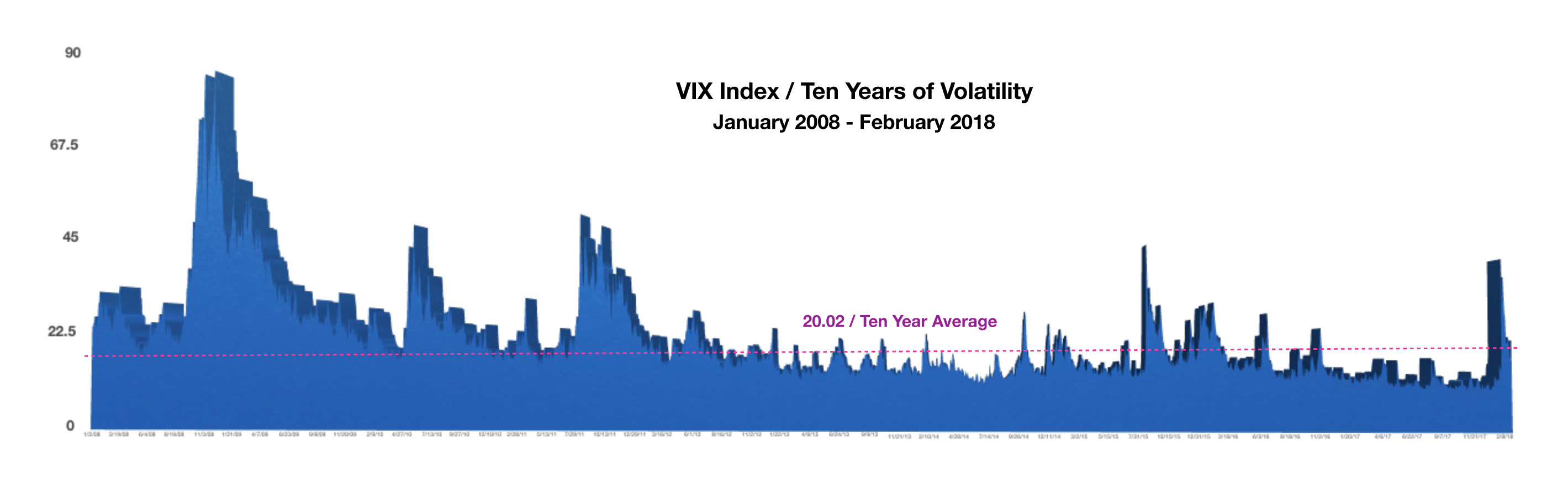

Volatility was rampant throughout the markets as fear of inflation and rising interest rates pilfered gains that had accumulated from the beginning of the year. Some see a fundamental trend is in place as a normalization of interest rates evolves.

The release of a jobs report in early February was the catalyst for volatility, as the pace of wage growth was greater than expected thus raising the specter of more aggressive Fed tightening to combat inflation. The Federal Reserve communicated that it is on track to raise rates three to four times this year, stating that “substantial underlying economic momentum” exists for further rate increases.

Historically when markets experience a volatility spike as we experienced in February, a strong economy is a buffer against any long-lasting downturns. Regardless of the catalyst, both stocks and bonds tend to regain their footing following such an environment.

The abrupt rise in bond yields over the past month is in anticipation that the Fed will continue to raise short-term rates this year. The 10-year Treasury yield, which is established by the markets, rose to 2.87% in February from 2.46% at the beginning of the year. The higher yield on U.S. debt is starting to attract additional foreign assets relative to lower yields from other developed countries. The increase in rates is beginning to affect consumer loans from homes and autos to credit cards, and quite possibly offsetting the initial benefits of the recently passed tax cuts.

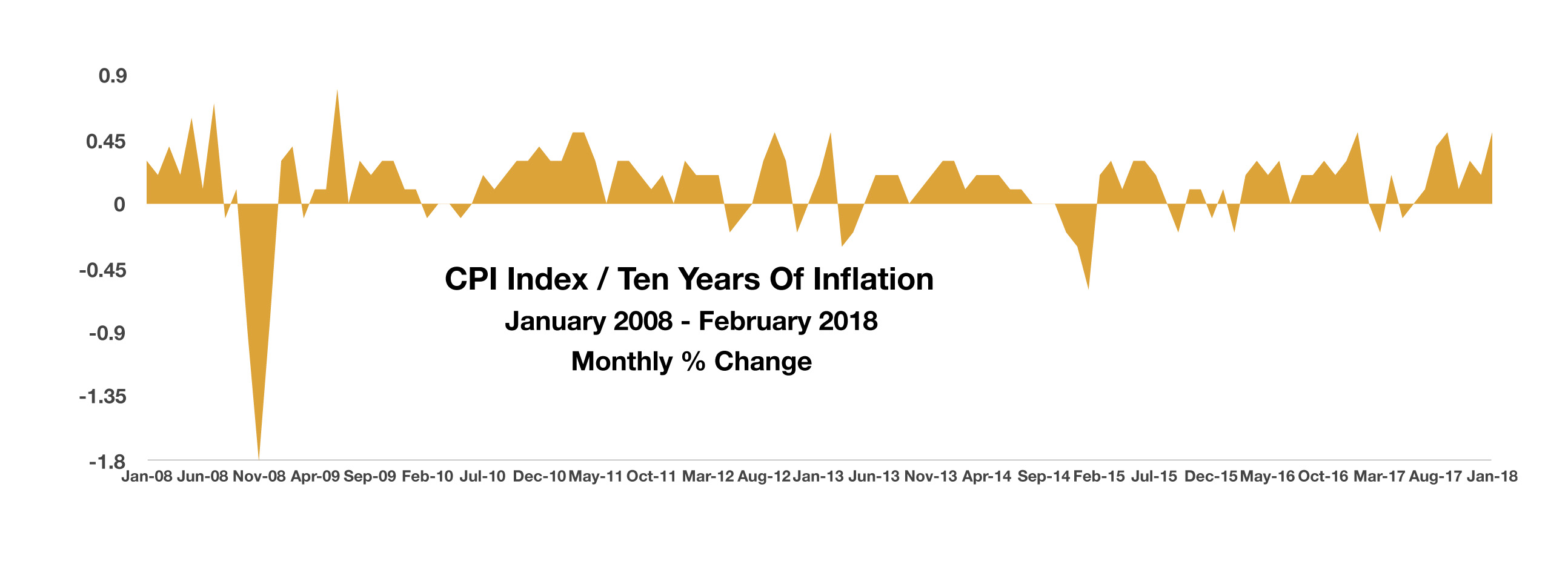

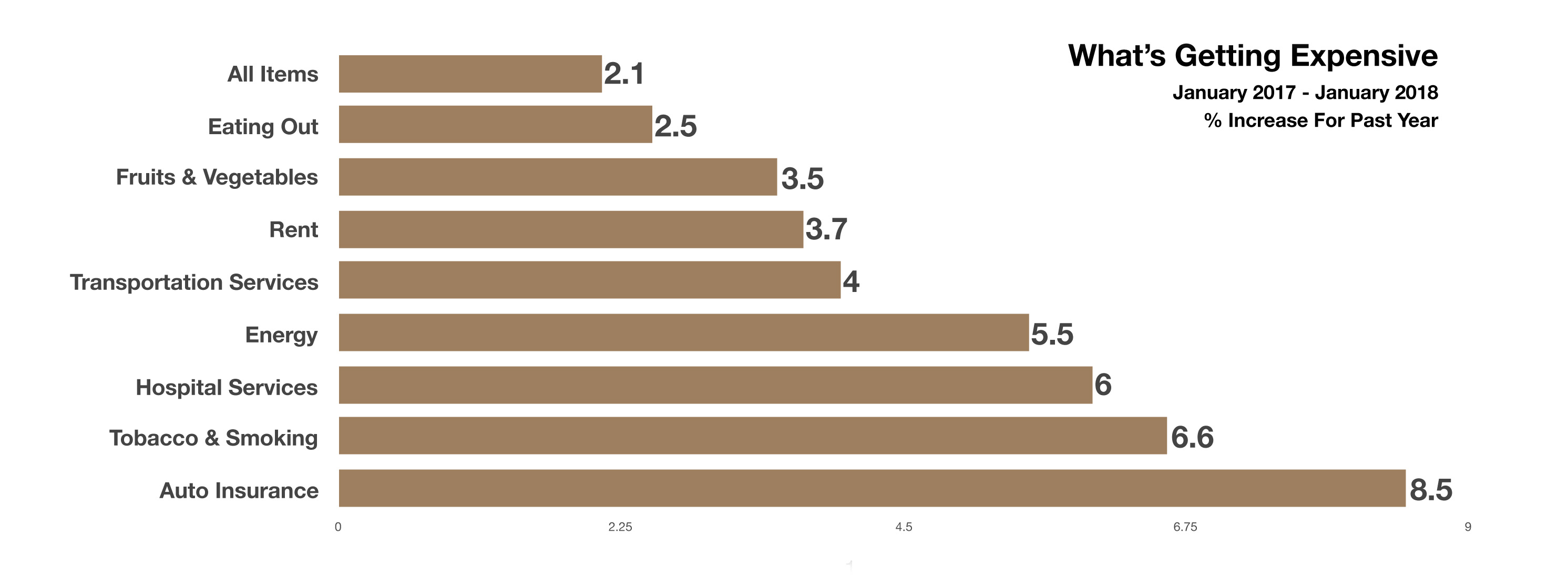

The roughly 50 percent increase in crude oil prices from lows in June 2017 has helped push inflation higher over the past few months of which oil is an integral component. Economists do not consider inflation a threat to economic prosperity as long as it is gradual and controlled, of which inflation is measured by the Consumer Price Index (CPI).

The Labor Department said the cost of employing the average American worker rose 0.5% in the final three months of 2017 and was up 2.6% in the 12 months ending in December. That’s the biggest 12-month gain for the employment cost index in almost three years. There was a 2.9% jump in average hourly earnings over the past year, the highest increase since June 2009. The average work week fell to 34.3 hours from 34.5 hours.

(Sources: Labor Dept., BEA, Federal Reserve, Bloomberg)