Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview – July 2018

Trade and tariffs disrupted markets in June as the U.S. Commerce Department announced tariffs on $250 billion worth of Chinese imports. The 25% tariffs will be imposed on 1,300 items encompassing a variety of products including aluminum, iron, gas turbines, snow blowers, milking machines, and dental drills.

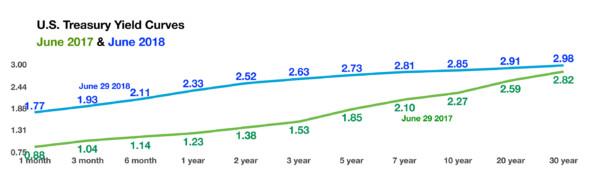

A flattening yield curve, characteristic of rising short-term rates along with lingering long-term rates, startled fixed income markets. Higher interest rates reflect expectations of inflationary pressures and robust growth, while lower rates imply less inflation and dismal economic expansion.

As expected by economists and the markets, the Federal Reserve raised its short-term key policy rate, the federal funds rate, by 25 basis points to 1.75% – 2.00%. The gradual rise in rates is seen as a normalization of interest rates as the U.S. economy continues to expand. The Fed is accelerating the rate of tightening with increases slated for 2019 and 2020 now expected to occur in 2018 and 2019.

Reports from various Federal Reserve district banks reveal that a robust economy, growing tariff pressures, rising wage costs, and a tight labor market are contributing to consumer inflation. The Atlanta Federal Reserve’s economic growth model, GDPNow, estimates GDP growth for the second quarter of 2018 at 4.5%, adding to inflationary pressures.

Household wealth reached $100 trillion for the first time ever, as reported by the Fed. The $100 trillion mark is double of where household wealth was at the lows of the financial crisis in 2009.

The Supreme Court ruled in June that public sector unions cannot charge fees to government employees who do not support the union and who do not want to pay. The decision is expected to further weaken the influence of unions, which have been in a decades-long decline.

Emerging market currencies faltered against the U.S. dollar as global trade tensions and rising rates in the U.S. added pressure on emerging economies. China’s stock market and currency are both off since tariff contentions began, with the Shanghai Composite Index off 13.9% for the year and the Chinese currency off 3.5% against the U.S.dollar in June alone.

Volatility in the second quarter didn’t deter equity indices, as the S&P 500 was up 2.9% and the Dow Jones was up 0.7%. The tech heavy Nasdaq advanced 6.3% for the quarter, driven by buyers seeking shelter from the imposed tariffs. A stronger U.S. dollar is starting to weigh on the technology sector as earnings may become affected.

Sources: U.S. Commerce Dept., Federal Reserve, U.S. Treasury, https://www.supremecourt.gov, Bloomberg, S&P,Dow Jones, Nasdaq

The difference in yield between the 2-year Treasury note and the 10-year Treasury bond narrowed to levels not seen since 2007. Also known as the spread, the difference between the 2-year note and 10-year bond is a barometer of economic sentiment. Should shorter term rates, such as the 2-year note, yield more than longer term rates such as the 10-year bond, then economic growth is expected to be lackluster. Some analysts view this narrow spread as a temporary event until economic growth accelerates driving longer term rates higher. Sources: U.S. Treasury, S&P, Bloomberg

The difference in yield between the 2-year Treasury note and the 10-year Treasury bond narrowed to levels not seen since 2007. Also known as the spread, the difference between the 2-year note and 10-year bond is a barometer of economic sentiment. Should shorter term rates, such as the 2-year note, yield more than longer term rates such as the 10-year bond, then economic growth is expected to be lackluster. Some analysts view this narrow spread as a temporary event until economic growth accelerates driving longer term rates higher. Sources: U.S. Treasury, S&P, Bloomberg We have been discussing the declining yield curve for some time and we are now reaching levels that should give equity investors some concern. The debate rages on daily on CNBC and other financial networks about what the curve is telling us and there is no shortage of “this time it’s different” analyst telling viewers that the curve is not a reliable predictor of future economic activity. As our readers know, generally a very flat or inverted yield curve precipitates a recession and falling stock prices. Over the last 20 years it has been one of the most reliable indicators of an impending recession. Certainly, global central banks have distorted the yield curve with their massive quantitative easing and bloating their balance sheets to historic levels and this time may actually be different – but not in a good way. We believe fed intervention coupled with unprecedented levels of global debt could mean that this time is actually worse and artificially low interest rates have left central banks with very few bullets to fire should we see an economic slowdown or credit event.

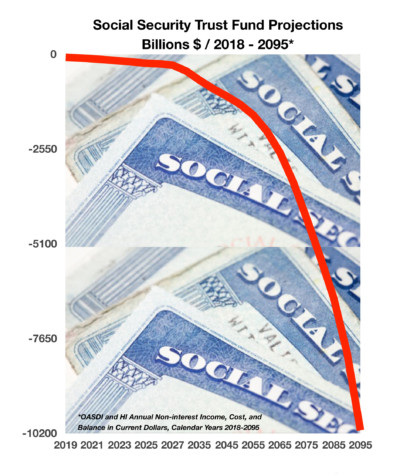

We have been discussing the declining yield curve for some time and we are now reaching levels that should give equity investors some concern. The debate rages on daily on CNBC and other financial networks about what the curve is telling us and there is no shortage of “this time it’s different” analyst telling viewers that the curve is not a reliable predictor of future economic activity. As our readers know, generally a very flat or inverted yield curve precipitates a recession and falling stock prices. Over the last 20 years it has been one of the most reliable indicators of an impending recession. Certainly, global central banks have distorted the yield curve with their massive quantitative easing and bloating their balance sheets to historic levels and this time may actually be different – but not in a good way. We believe fed intervention coupled with unprecedented levels of global debt could mean that this time is actually worse and artificially low interest rates have left central banks with very few bullets to fire should we see an economic slowdown or credit event. no longer be receiving full scheduled benefits. Recipients would receive about three-quarters of their scheduled benefits after 2034. Congress can eventually act to fortify the program’s finances, but it may be years before it actually takes effect and funds.

no longer be receiving full scheduled benefits. Recipients would receive about three-quarters of their scheduled benefits after 2034. Congress can eventually act to fortify the program’s finances, but it may be years before it actually takes effect and funds. The left side of the chart shows the current curve levels and the right side shows the historical high, low, and average for each curve for the last 10 years. Note how close several of the curves are to inverting, 5’s to 30’s is currently 5.42 basis points with a 10-year historical average of 129 basis points. The 2’s to 10’s curve is 18.27 with a 10-year historical average of 154 basis points. Across the board almost all the curves are making new 10-year lows. In the range column you can graphically see how far each curve is from its historical average. The #SD column shows the number of standard deviations we currently are from the 10-year historical average. The 5’s to 30’s curve is -2.1 standard deviations from the mean which is statistically significant in that we can deduce over the long run that we are at historical extremes and while the timing is uncertain a reversion to the mean is almost a statistical certainty.

The left side of the chart shows the current curve levels and the right side shows the historical high, low, and average for each curve for the last 10 years. Note how close several of the curves are to inverting, 5’s to 30’s is currently 5.42 basis points with a 10-year historical average of 129 basis points. The 2’s to 10’s curve is 18.27 with a 10-year historical average of 154 basis points. Across the board almost all the curves are making new 10-year lows. In the range column you can graphically see how far each curve is from its historical average. The #SD column shows the number of standard deviations we currently are from the 10-year historical average. The 5’s to 30’s curve is -2.1 standard deviations from the mean which is statistically significant in that we can deduce over the long run that we are at historical extremes and while the timing is uncertain a reversion to the mean is almost a statistical certainty. The important takeaway from this chart is that if the yield curve never steepens and stays flat or inverted (which has never happened in history) the worst case yield on these bonds is between 3.49% on the BNS (Bank of Nova Scotia) and as high as 4.31% on the GS (Goldman Sachs). If we use the historical yield curve pattern since 2006 the yields are between 9.89% on the GS bond and 14.18% on the BAC (Bank of America).

The important takeaway from this chart is that if the yield curve never steepens and stays flat or inverted (which has never happened in history) the worst case yield on these bonds is between 3.49% on the BNS (Bank of Nova Scotia) and as high as 4.31% on the GS (Goldman Sachs). If we use the historical yield curve pattern since 2006 the yields are between 9.89% on the GS bond and 14.18% on the BAC (Bank of America).