James Altschuler, CPA, CFP

Altschuler Financial Services

594 Marrett Road Suite 13

Lexington, MA 02421

781.674.2297

www.altschulerfinancial.com / james@altschulerfinancial.com

Macro Overview

Credit Card Debt On The Rise – Consumer Finance

U.S. banks have ramped up lending to consumers through credit cards at the fastest pace since 2007. The industry has accumulated an additional $18 billion of credit card loans and other types of revolving credit in the past three months.

Data released by the Federal Reserve shows that the U.S. banking industry has seen credit card and other revolving loans rise at a annual rate of 7.6% in the second quarter of 2016, to $685 billion. The credit card business remains among the most profitable in banking as banks can charge much higher interest rates than other loan types, with average credit card rates between 12% and 14%.

Yet as credit card debt levels have risen, so have reserves for losses as banks anticipate delinquencies to rise. Within the past year U.S. banks have piled on about $54 billion worth of loans to consumers through credit cards, according to Federal Reserve data. Financially savvy consumers that pay their balances down each month avoid hefty interest charges, but those that don’t, known as “revolvers,” pay average rates of between 12% to 14% and significantly more if they are considered higher risk.

Seven years since the recession ended, consumers who were hit hard during the financial crisis have found their credit scores improving. Bankers attribute a rise in credit card issuance to rising home prices and low unemployment. Banks are also lending more since one of the most important drivers of their profits are net interest margins, the difference between returns on assets and the cost of funds, which remain near their lowest levels in decades. The average credit limit per card for a subprime borrower is about $2,300, compared with about $11,500 for the safest customers.

Sources: Federal Reserve Credit Card Debt On The Rise – Consumer Finance

U.S. banks have ramped up lending to consumers through credit cards at the fastest pace since 2007. The industry has accumulated an additional $18 billion of credit card loans and other types of revolving credit in the past three months.

Data released by the Federal Reserve shows that the U.S. banking industry has seen credit card and other revolving loans rise at a annual rate of 7.6% in the second quarter of 2016, to $685 billion. The credit card business remains among the most profitable in banking as banks can charge much higher interest rates than other loan types, with average credit card rates between 12% and 14%.

Yet as credit card debt levels have risen, so have reserves for losses as banks anticipate delinquencies to rise. Within the past year U.S. banks have piled on about $54 billion worth of loans to consumers through credit cards, according to Federal Reserve data. Financially savvy consumers that pay their balances down each month avoid hefty interest charges, but those that don’t, known as “revolvers,” pay average rates of between 12% to 14% and significantly more if they are considered higher risk.

Seven years since the recession ended, consumers who were hit hard during the financial crisis have found their credit scores improving. Bankers attribute a rise in credit card issuance to rising home prices and low unemployment. Banks are also lending more since one of the most important drivers of their profits are net interest margins, the difference between returns on assets and the cost of funds, which remain near their lowest levels in decades. The average credit limit per card for a subprime borrower is about $2,300, compared with about $11,500 for the safest customers.

Sources: Federal Reserve Fixed Income – Global Bond Markets

Some fixed income analysts believe that the Treasury yield curve is showing signs of mispriced bonds between long-term and short-term maturities, adding volatility to the overall bond market.

It is now estimated that there are over $12.6 trillion worth of bonds globally that yield less than zero. This dynamic is placing tremendous pressure on the world’s central banks to find a policy that will eventually stimulate economic growth and inflation. The Bank of Japan has had little if any success with its ultra-low negative yielding government bonds. All in all, this essentially means that Japanese rates will stay well below those in the United States for quite some time.

Money market funds reform has triggered a change in the London interbank offered rate, also known as Libor. Historically, higher Libor rates translate into higher long-term bond yields.

U.S. money fund reforms are set to take effect in the middle of October and have already affected short-term rates, notably the benchmark London Interbank offered rate also known as LIBOR. LIBOR is the base rate for many U.S. loans including various home mortgages, thus if LIBOR increases, then some mortgages in the U.S. could also see an increase in lending rates. Libor has risen by over 50 bps in the past year to 0.8456%, while the Fed has barely raised its short-term rate just 25 bps to 0.25-0.50%.

Sources: Bloomberg, ReutersA tightening of presidential polls added to market ambivalence as uncertainty regarding what fiscal and regulatory policy changes might affect the economy and markets. The outcome of the U.S. elections is considered by many to be a primary determinant of how the rest of the year could evolve.

Fiscal policy has now become a central concern as monetary policy, which is dictated by the Federal Reserve, has become less effective and predictable. A reduction in federal income tax rates could lead to higher deficit spending, yet may contribute to a rise in GDP and consumer spending.

During its September meeting, the Fed decided to leave rates unchanged but strongly implied that an increase was on the horizon. The Bank of Japan kept its key rate unchanged at negative .10% with a target for its 10-year government yield at zero, a stark contrast to U.S. government bond yields.

Lagging retail sales and stagnant industrial production reports possibly encouraged the Fed to hold off on a rate rise during its September meeting. The Fed has two more meetings before the end of the year, one the week before the presidential election and another in December. Several market analysts believe that the Fed won’t raise rates in November, but will in December as it did in 2015.

The Atlanta Federal Reserve said its forecast of third-quarter real consumer spending growth fell from 3.0 percent to 2.7 percent, influenced by stagnant personal income and spending data for August. U.S. consumer spending fell in August for the first time in seven months while inflation showed signs of accelerating, mixed signals that could keep the Federal Reserve cautious about raising interest rates. The Fed is in danger of losing credibility as it continues to hesitate and postpone another rate increase.

The U.S. Senate voted to allow the families of victims from the 9/11 attacks to sue Saudi Arabia for damages and restitution. The same day that the Senate voted, OPEC, which is controlled by Saudi Arabia, decided on an oil production freeze with other member OPEC nations. The coincidence of the two happening simultaneously may be a validation that Saudi Arabia may need to quickly address the country’s rapidly deteriorating financial situation. OPEC agreed to cut oil production among its 14 member countries by 750,000 barrels a day, the first cut since 2008. The cut won’t take effect until November, yet still managed to lift oil prices and energy markets on the announcement.

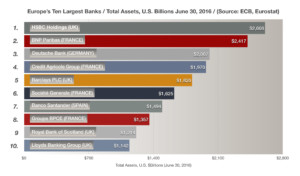

Anxiety over European banks has risen since the British voted to exit the EU. At first only smaller peripheral banks in Italy, Spain and Greece were of concern, but now larger banks in Germany have become focal points. Pressures are mounting for European banks as the low rate environment set by the ECB is starting to take its toll on bank earnings. An assemblance of dynamics has propelled Germany’s largest bank into a precarious position.

Sources: Fed, OPEC, Eurostat, Reuters, ECB

A data sensitive environment has evolved into a wait and see scenario as the Fed’s uncertainty regarding interest rates continues to cause volatility in the equity markets.

The third quarter was positive for equities as the technology and financial services sector provided gains for the major indices. For the quarter, the Dow Jones Industrial Average was up 2.78% and the S&P 500 Index added 3.85%, both on a total return basis. The technology heavy Nasdaq Composite Index was up 9.69% for the third quarter.

It’s always welcoming when the bond market helps the equity markets. The benefits of rising prices for high yield corporate bonds translate into lower borrowing costs for companies, thus leading to greater margins and propelling stock prices.

Sources: Reuters, Bloomberg Market Indices (all values as of 08.31.2016) Stock Indices: Dow Jones 18,400 S&P 500 2,170 Nasdaq 5,213 Bond Sector Yields: 2 Yr Treasury 0.80% 10 Yr Treasury 1.57% 10 Yr Municipal 1.43% High Yield 6.01% YTD Market Returns: Dow Jones 5.60% S&P 500 6.21% Nasdaq 4.11% MSCI-EAFE -1.79% MSCI-Europe -3.45% MSCI-Pacific 1.54% MSCI-Emg Mkt 12.53% US Agg Bond 5.85% US Corp Bond 9.49% US Gov�t Bond 6.85% Commodity Prices: Gold 1,312 Silver 18.72 Oil (WTI) 44.83 Currencies: Dollar / Euro 1.11 Dollar / Pound 1.30 Yen / Dollar 102.40 Dollar / Canadian 0.76