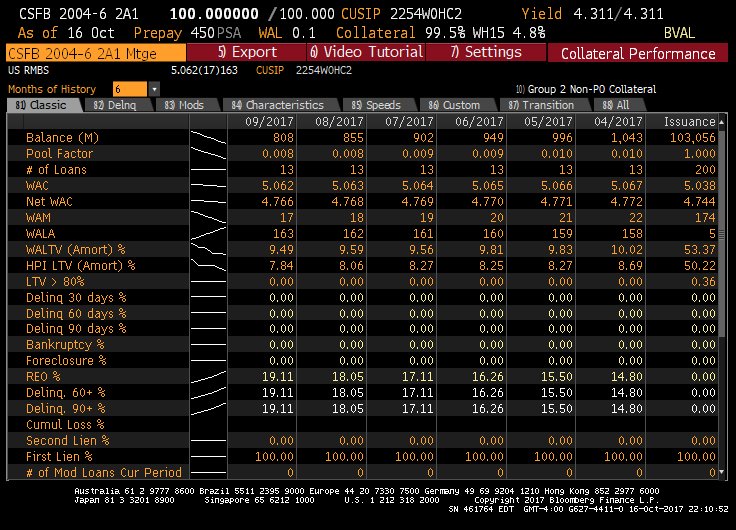

10/17/17 Buy Recommendation CSFB 04-6 2A1

Bond: CSFB 04-6 2A1 Type: Fixed Rate CMO Coupon: 4.75% Price: $99 Rating: AA-/B Estimated Yield: 5.75% Average Life: .75 years

Original Face Amount Available: $3,000,000 Factor: .007 Current Face Amount Available: $21,000 Risk Rating: 1

Credit Support: 6.225% 90+ DQ: 19.11% # of Loans: 13 WAM: 17 HPI LTV: 7.84% Fico: 746 Geo Distribution: 39% CA, 19% NJ, 9% NV

See page 2 for collateral description