Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Clients’ and Friends’ Updates

Watch your email inbox for an invitation to one of our Clients’ and Friends’ dinner meetings coming soon to a venue near you. We look forward to seeing you at an upcoming event. And, don’t forget to invite a friend.

Frequently, clients request a one-on-one meeting to review their account, either before or after an event. If you would like to schedule an account review, the first step in our process is to evaluate your current risk tolerance. We recently implemented a web based risk analysis tool for this purpose. You can access our risk analysis tool from the APPROACH page on our web site: www.texaseliteadvisory.com. Just click the FREE RISK ANALYSIS button and follow the instructions.

Newsletter Subscriptions and Archives

We recently added a NEWSLETTERS page to our web site: www.texaseliteadvisory.com. You can access our current newsletter and archived newsletters from this page. In addition, you can subscribe or change your subscription by clicking on the SUBSCRIBE TO NEWSLETTER button.

Macro Overview

Equity markets advanced during the first quarter as improving economic data supported gradually rising earnings. A steady and predictable path of anticipated rate increases this year by the Federal Reserve was well received by financial markets.

The Fed hiked short-term rates as expected in March, on track with two additional hikes in 2017 with improving economic data validating the Fed’s continuance of rate increases. The Fed has so far increased rates only three times in the past 16 months, one of its slowest paces ever. Fixed income analysts view the Fed’s decision to set two additional rate hikes in 2017 as a normalization of the interest rate environment, away from further accommodative policy producing low rates.

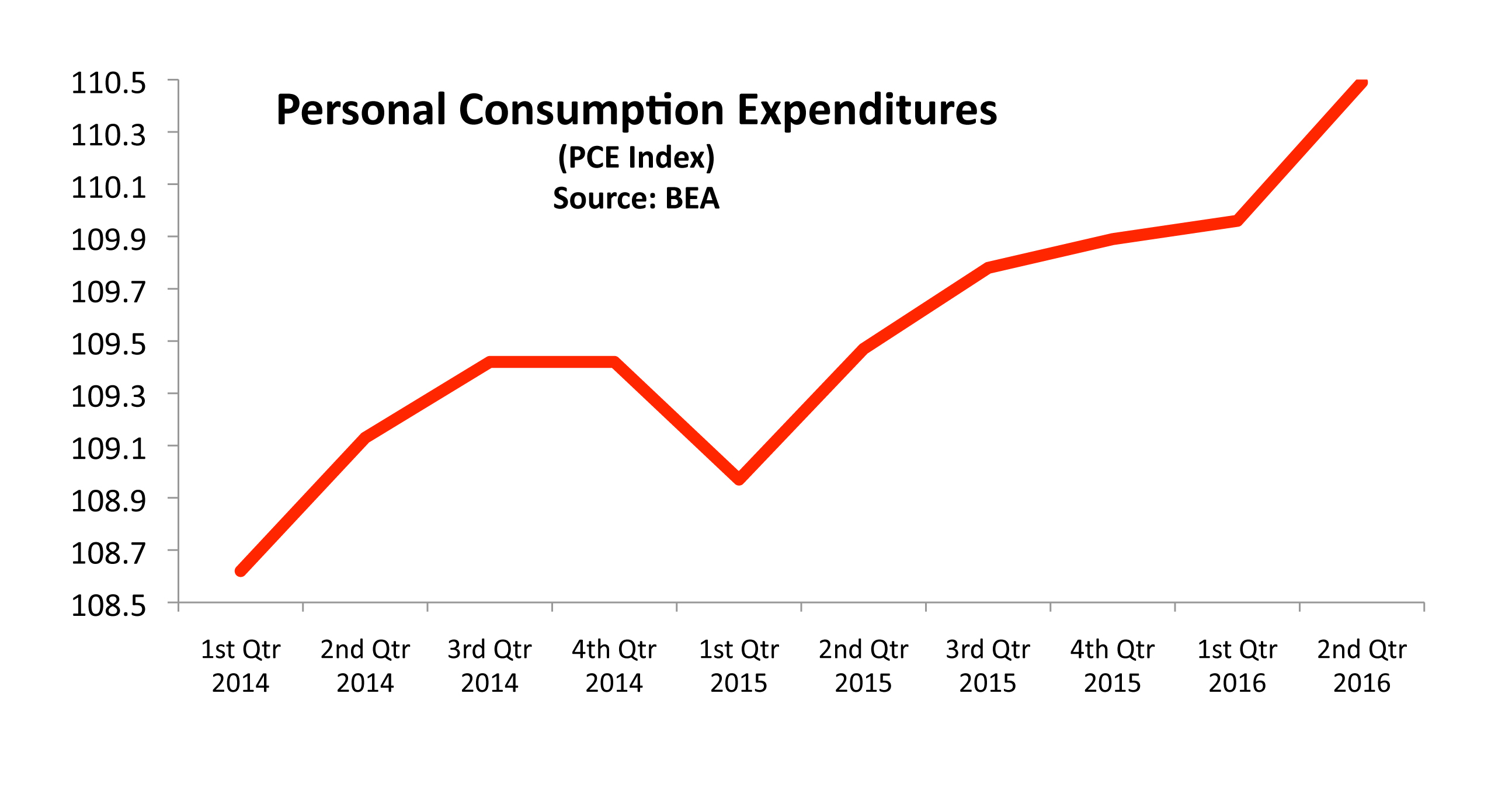

The Consumer Confidence Index, compiled by the Conference Board, and the Consumer Sentiment Index, prepared by the University of Michigan, both elevated to record levels. Since consumer expenditures make up nearly 70% of Gross Domestic Production (GDP), growing confidence among consumers is deemed optimistic by economists.

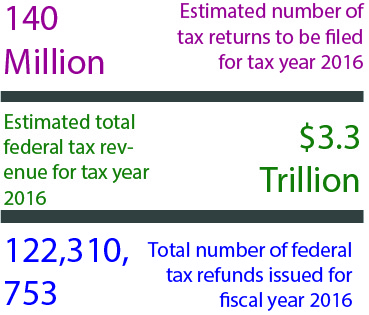

With tax season underway, estimates from the IRS show that over 140 million tax returns will be filed for the 2016 tax year with over $3.3 trillion in federal tax revenue. (Sources: Federal Reserve, Dept. of Commerce, Dow Jones, S&P)

Thankfully, Buffet submitted the argument as an article to Columbia’s business school magazine, Hermes. Do yourself a service and read it in its entirety, available free online. Buffet goes over the investment performance of several cohorts of his at Columbia who were also students and employees of Graham and Dodd. Despite having a variety of investment practices, they generated superior investment performance over many years. While only a dozen pages, I find his argument passionately compelling.

Thankfully, Buffet submitted the argument as an article to Columbia’s business school magazine, Hermes. Do yourself a service and read it in its entirety, available free online. Buffet goes over the investment performance of several cohorts of his at Columbia who were also students and employees of Graham and Dodd. Despite having a variety of investment practices, they generated superior investment performance over many years. While only a dozen pages, I find his argument passionately compelling.