Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Equity markets advanced during the first quarter as improving economic data supported gradually rising earnings. A steady and predictable path of anticipated rate increases this year by the Federal Reserve was well received by financial markets.

Domestic equity indices ended positive for the first quarter of 2017. The Dow Jones Industrial Index was up 4.6%, the S&P 500 Index returned 5.5%, and the technology heavy Nasdaq ended the quarter with a 9.8% gain. Many believe that an underlying global recovery may be underway, leading to domestic equity demand here in the U.S.

The Fed hiked short-term rates as expected in March, on track with two additional hikes in 2017 with improving economic data validating the Fed’s continuance of rate increases. The Fed has so far increased rates only three times in the past 16 months, one of its slowest paces ever. Fixed income analysts view the Fed’s decision to set two additional rate hikes in 2017 as a normalization of the interest rate environment, away from further accommodative policy producing low rates.

Inflation On Track For Fed Rate Hikes – Monetary Policy

A primary determinant for the Fed’s decision to raise rates is inflation. As part of its monetary policy objectives, the Fed had set a 2% target for consumer inflation as a trigger for sustained rate increases.

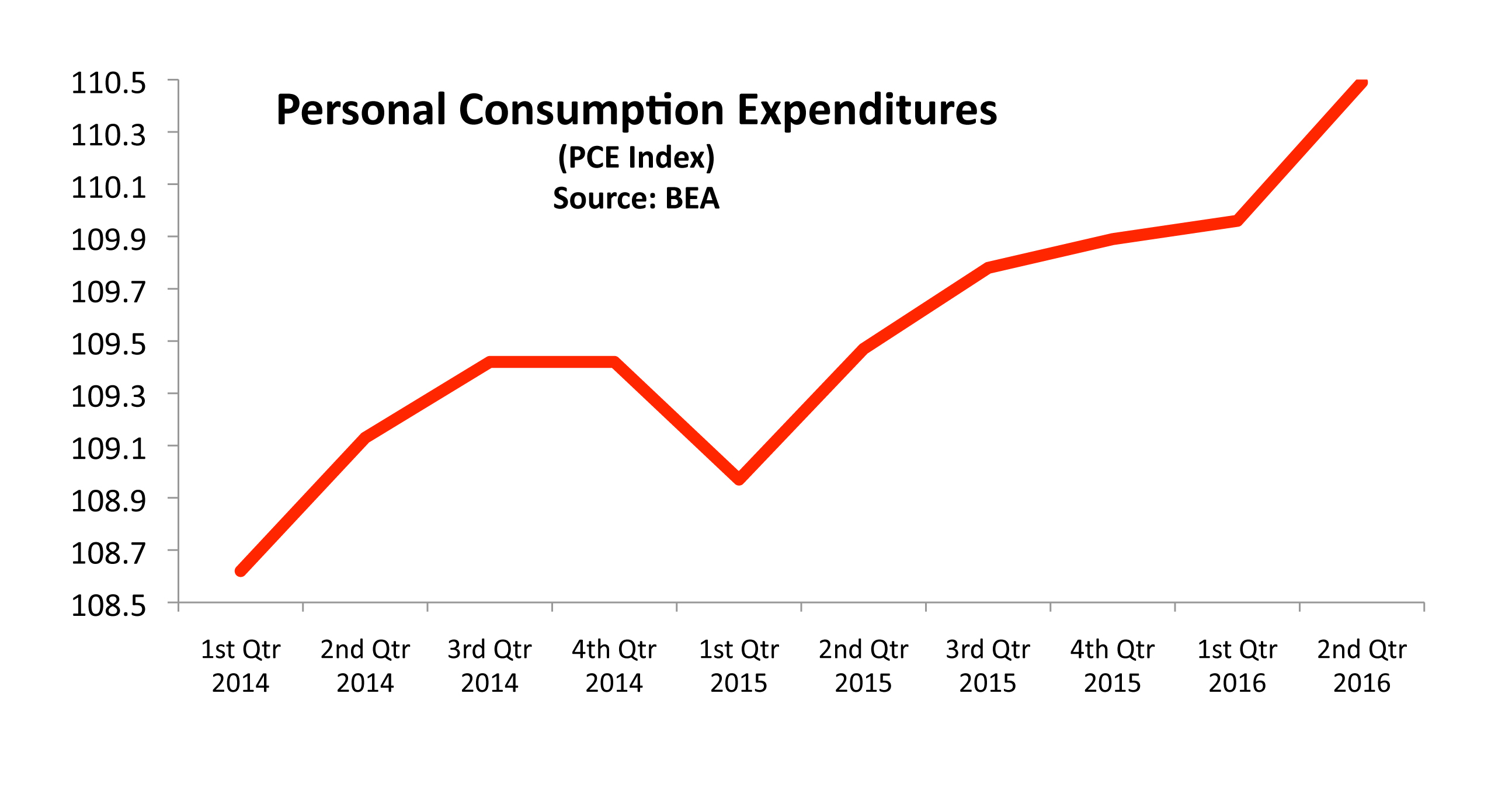

A closely follo

A rising PCE is indicative of rising prices for consumers throughout the economy, in other words inflation. One of the Fed’s mandates is to thwart inflationary pressures with gradual increases in short-term rates. This monetary policy tool has been used for decades as it stems inflation and slows consumers down from spending too much before it evolves into inflation. (Sources: Commerce Dept., Fed.)

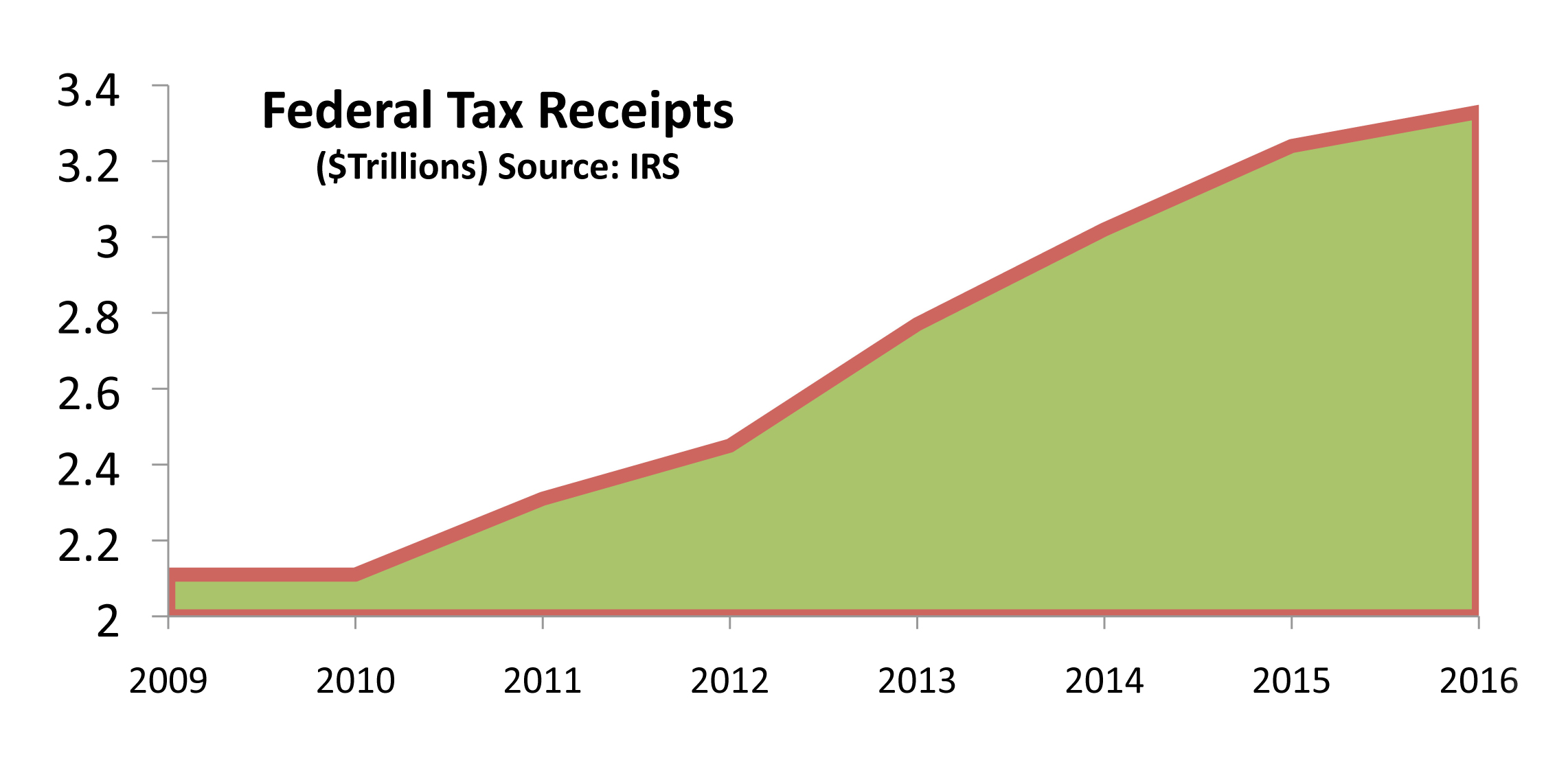

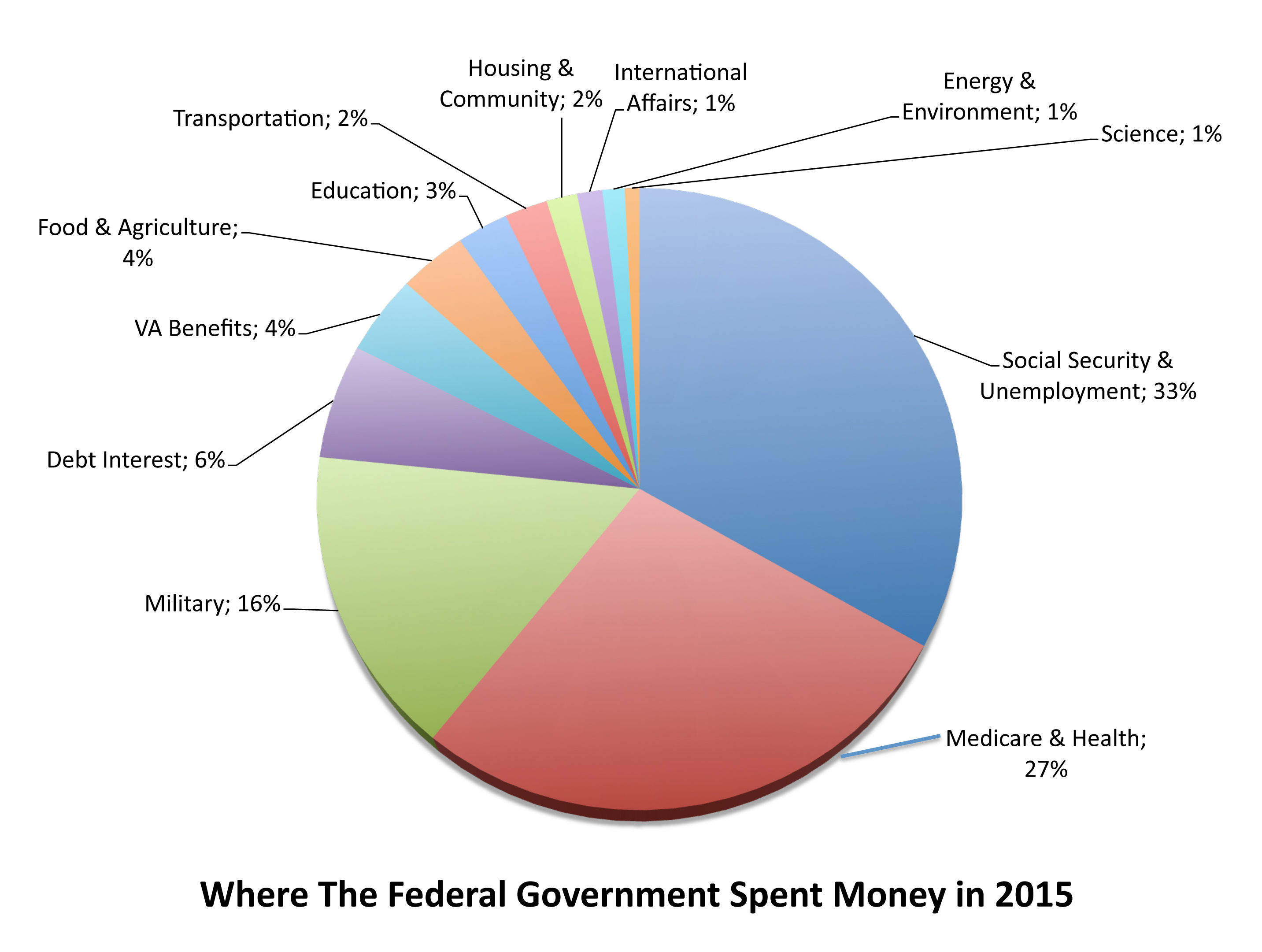

oing discussions surrounding tax rates have been a focus of how to increase tax revenue. However, the other two components include economic conditions and the number of individuals paying income taxes. As new hires enter the workforce, either out of school or as immigrants, additional tax revenue is derived from their incomes. As economic conditions improve, companies may hire additional employees and eventually start to issue pay raises.

oing discussions surrounding tax rates have been a focus of how to increase tax revenue. However, the other two components include economic conditions and the number of individuals paying income taxes. As new hires enter the workforce, either out of school or as immigrants, additional tax revenue is derived from their incomes. As economic conditions improve, companies may hire additional employees and eventually start to issue pay raises.

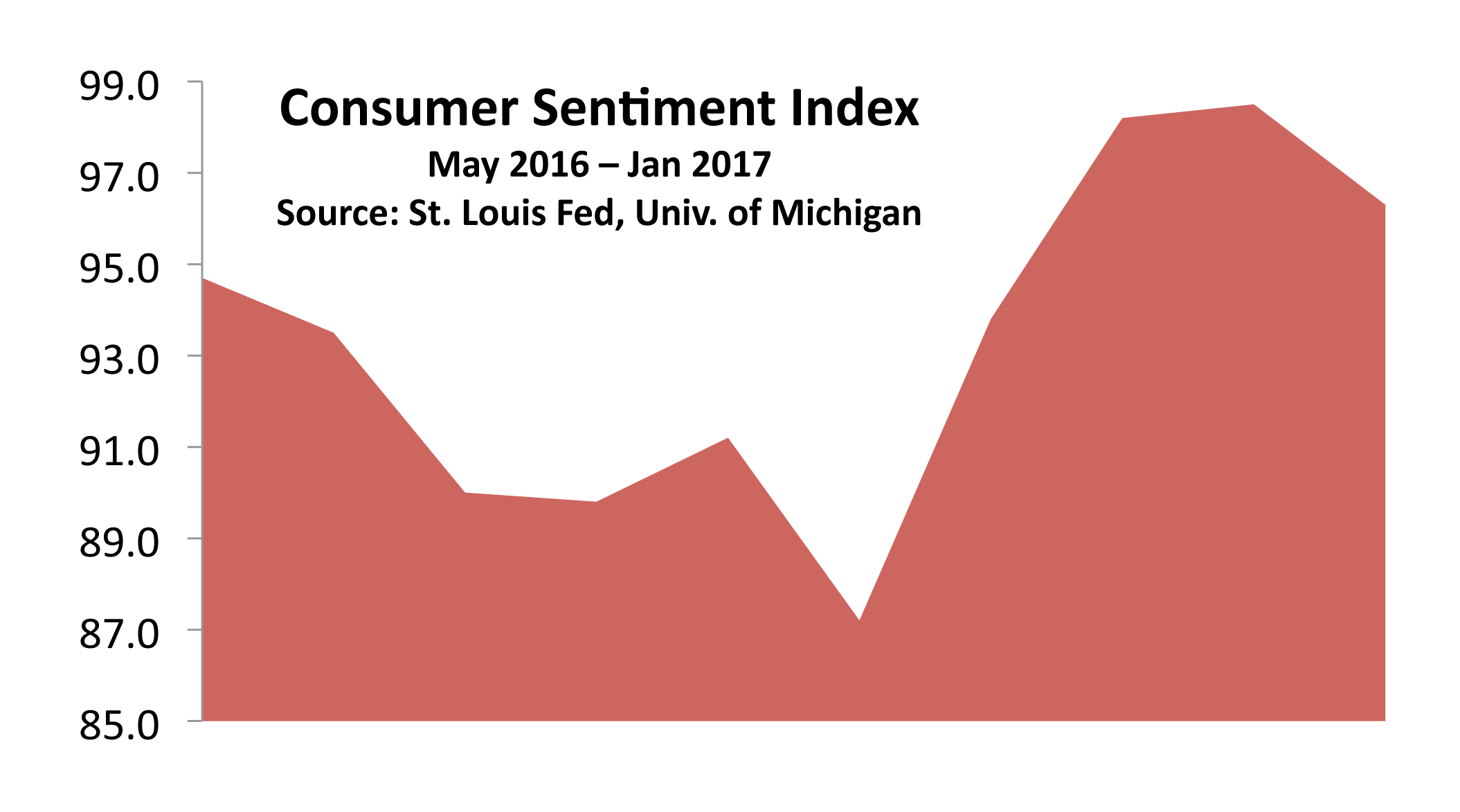

DP), growing confidence among consumers is viewed optimistically by economists.

DP), growing confidence among consumers is viewed optimistically by economists.