CCM Update

Thanks to the continued growth of our business, we are pleased to announce a new addition to our portfolio management department and the advancement of two of our experienced team members. We would also like to warmly welcome the clients of Randy Kryszak, who merged his practice into our firm during the first quarter. Randy founded Randall L. Kryszak, CPA, PC, a tax and accounting services firm for small businesses, in Boulder, CO, in 1988. In 2000 the company became a Registered Investment Advisor licensed by the State of Colorado. Randy, a Personal Financial Specialist, will provide investment advice, in conjunction with CCM staff, to those who were previously clients of his practice.

Zuzana Birova joined CCM in January as Assistant Portfolio Manager. She has decade of experience in equity and fixed-income trading, portfolio reconciliation, client reporting, and asset class research. Originally from Slovakia, where she earned her undergraduate degree in International Business, Zuzana went on to pursue her passion in investment management by completing her MBA at Butler University in Indianapolis. After graduating she joined Deerfield Financial Advisors, Inc., where she managed investment operations and played a key role in implementing new technology for advisors. She is currently in the process of acquiring the Chartered Financial Analyst (CFA) designation.

We are also happy to announce the promotion of Kirsten Roeber from Assistant Portfolio Manager to Portfolio Manager. Kirsten has been with CCM for eight years, serving as a member of the portfolio management team and assisting in research, trading, portfolio construction, and investment strategy since 2014. She holds a bachelor’s degree from the University of Colorado, the Accredited Asset Management Specialist designation, and is a CFP® candidate.

Colleen Harvey, who joined our firm in 2014 as Portfolio Manager and chair of our investment committee, has also taken on new responsibilities. As of January, Colleen became a full-time financial advisor. With almost twenty years of experience in the wealth management industry, Colleen is well prepared for her new role. Colleen has a bachelor’s degree from the University of Notre Dame, a master’s degree from Tufts University, and holds the Chartered Financial Analyst (CFA) designation. We are delighted to share all of this good news, and hope you will join us in congratulating and welcoming Zuzana, Kirsten, and Colleen into their new roles.

Macro Overview

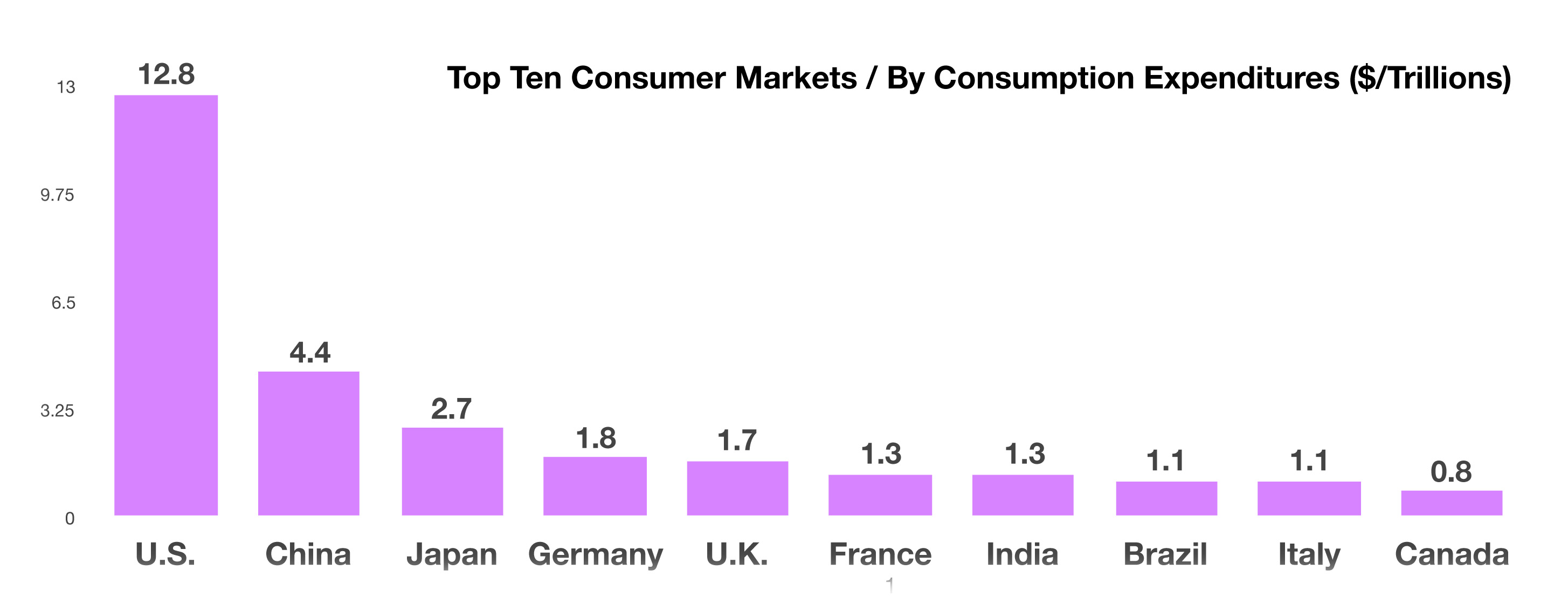

Markets were rattled in March as a looming trade war between China and the U.S. enhanced market volatility. The administration announced $60 billion in tariffs for Chinese imports, with a detailed list of products which will be identified by the Commerce Department in April. China threatened to retaliate by imposing tariffs on U.S. imports as well as curbing U.S. Treasury purchases.

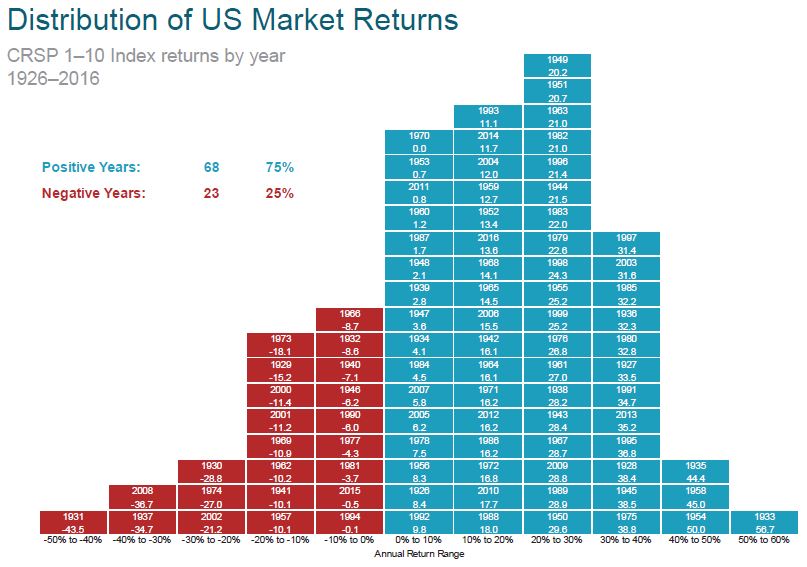

Economic data released over the past month revealed that key data points were the strongest reported since 1998. The market has become much more dependent on data as it looks for signs of inflation and rising rates. Various analysts view current market volatility primarily driven by non-systemic events and isolated to specific events and individual company news.

A key lending benchmark, the LIBOR, has been rising steadily. The three-month U.S. dollar LIBOR rate surpassed 2% in early March, the highest level since 2008. Based in London, the LIBOR affects U.S. consumer loans, commercial loans, and