Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

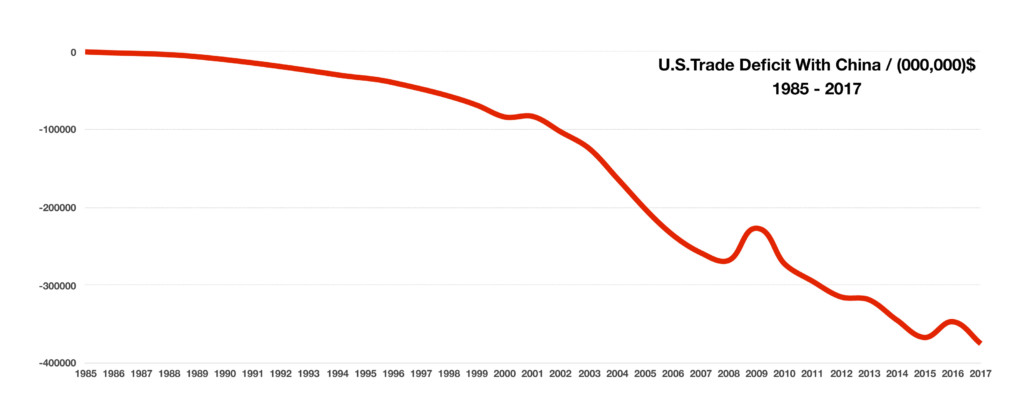

Markets were rattled in March as a looming trade war between China and the U.S. enhanced market volatility. The administration announced $60 billion in tariffs for Chinese imports, with a detailed list of products which will be identified by the Commerce Department in April. China threatened to retaliate by imposing tariffs on U.S. imports as well as curbing U.S. Treasury purchases.

Intricate supply chains have evolved between the United States and China over the past twenty years. Some U.S. manufacturers ship U.S. made components to China for final assembly, then ship finished products back into the U.S., thus posing a challenge as to how trade deficits are calculated.

Key economic data released over the past month revealed that key data points were the strongest reported since 1998. The market has become much more dependent on data as it looks for signs of inflation and rising rates. Various analysts view current market volatility primarily driven by non-systemic events and isolated to specific events and individual company news.

A key lending benchmark, the Libor, has been rising steadily. The three-month U.S. dollar Libor rate surpassed 2% in early March, the highest level since 2008. Based in London, the Libor affects U.S. consumer loans, commercial loans, and adjustable rate mortgages.

Rapidly rising mortgage rates are dampening the hopes of families eager to lock in rates before payments start to become too expensive. The continued lack of housing supplies has added a double cost factor to the market, with prices elevating due to tight supplies and rising mortgage rates.

The International Energy Association (IEA) projects that the United States is on track to become the worlds single largest oil producer by 2023. The estimates are based on production growth and supplies generated by U.S. energy producers over the next few years. U.S. daily oil production alone is expected to reach over 12 million barrels per day by 2023, a 20% increase from the current levels of 10 million barrels per day.

Congress reached a $1.3 trillion budget deal that will fund the federal government through September. The extensive 2,232 page bill averts a government shut down and funds special programs for child care, infrastructure, medical research, opioid abuse prevention, and national security.

The IRS audited roughly 0.05% (half of one percent) of the 195,614,161 returns filed for tax year 2016. The number of examinations, also know as audits, was higher in the mid 1990s, when about 1.7% of returns were audited.

Sources: Dept. of Commerce, Bloomberg, congress.gov

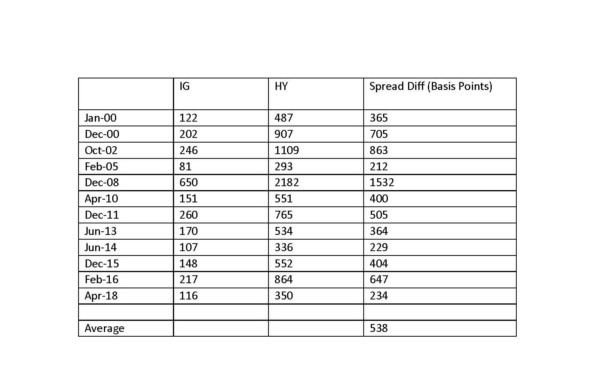

The top graph shows the spread on investment grade (IG) corporate bonds while the bottom graph is the spread on high yield (HY) corporate bonds. At first glance they look similar, the key is to look at the scale on the Y axis. The IG chart runs from 80 basis points to 220 basis points (0.8%-2.2%) while the HY chart covers an area from 250 basis points to 1000 basis points (2.5%-10%). Looking at the charts you would think that IG spreads have spiked significantly but again this is due to the scale, the actual move is only 26 basis points. What is clear however is that spreads on both IG and HY bonds have been steadily moving lower since the spike in 2016 and if we were to expand these charts to 10 or 20 years you would see that we are at or near historic lows. This means that investors are currently receiving one of the lowest risk premiums in history. We have discussed in detail on our website the reason for the low spreads but the main culprit has been central bank intervention meaning that central banks have been continuous buyers of world-wide debt of nearly every type (quantitative easing). However, central banks are now beginning to unwind their balance sheets (or at a minimum slow their purchases) and it doesn’t require a Ph.D in economics to guess how that will affect bond pricing and spreads in the long run. Now let’s look at several data points to understand the current relationship between IG and HY spreads.

The top graph shows the spread on investment grade (IG) corporate bonds while the bottom graph is the spread on high yield (HY) corporate bonds. At first glance they look similar, the key is to look at the scale on the Y axis. The IG chart runs from 80 basis points to 220 basis points (0.8%-2.2%) while the HY chart covers an area from 250 basis points to 1000 basis points (2.5%-10%). Looking at the charts you would think that IG spreads have spiked significantly but again this is due to the scale, the actual move is only 26 basis points. What is clear however is that spreads on both IG and HY bonds have been steadily moving lower since the spike in 2016 and if we were to expand these charts to 10 or 20 years you would see that we are at or near historic lows. This means that investors are currently receiving one of the lowest risk premiums in history. We have discussed in detail on our website the reason for the low spreads but the main culprit has been central bank intervention meaning that central banks have been continuous buyers of world-wide debt of nearly every type (quantitative easing). However, central banks are now beginning to unwind their balance sheets (or at a minimum slow their purchases) and it doesn’t require a Ph.D in economics to guess how that will affect bond pricing and spreads in the long run. Now let’s look at several data points to understand the current relationship between IG and HY spreads. The difference between investment grade and high-yield currently sits at 234 basis points meaning investors are receiving 2.34% more compensation for investing in HY vs. IG rated bonds. As the chart shows, there have only been two other periods that this spread was lower. The average spread using these data points has been 538 basis points or more than double the current risk premium. Examining this chart more closely you will notice a not so obvious but very important trend. Two times in the last 20 years the spread differential between IG and HY has been below the current level of 234 and both times signaled a major widening in the relationship within 3 years. In 2005, the spread difference reached 212 basis points and by 2008 it was an astounding 1532 then again in 2014 the credit spread reached 229 and by February of 2016 it was 647. To put this in perspective, if you owned $100k of a high yield bond with a 7 year maturity the approximate decline in value would have been $51,000 in 2008 and $21,000 in 2016 based solely on the spread differential.

The difference between investment grade and high-yield currently sits at 234 basis points meaning investors are receiving 2.34% more compensation for investing in HY vs. IG rated bonds. As the chart shows, there have only been two other periods that this spread was lower. The average spread using these data points has been 538 basis points or more than double the current risk premium. Examining this chart more closely you will notice a not so obvious but very important trend. Two times in the last 20 years the spread differential between IG and HY has been below the current level of 234 and both times signaled a major widening in the relationship within 3 years. In 2005, the spread difference reached 212 basis points and by 2008 it was an astounding 1532 then again in 2014 the credit spread reached 229 and by February of 2016 it was 647. To put this in perspective, if you owned $100k of a high yield bond with a 7 year maturity the approximate decline in value would have been $51,000 in 2008 and $21,000 in 2016 based solely on the spread differential.