Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

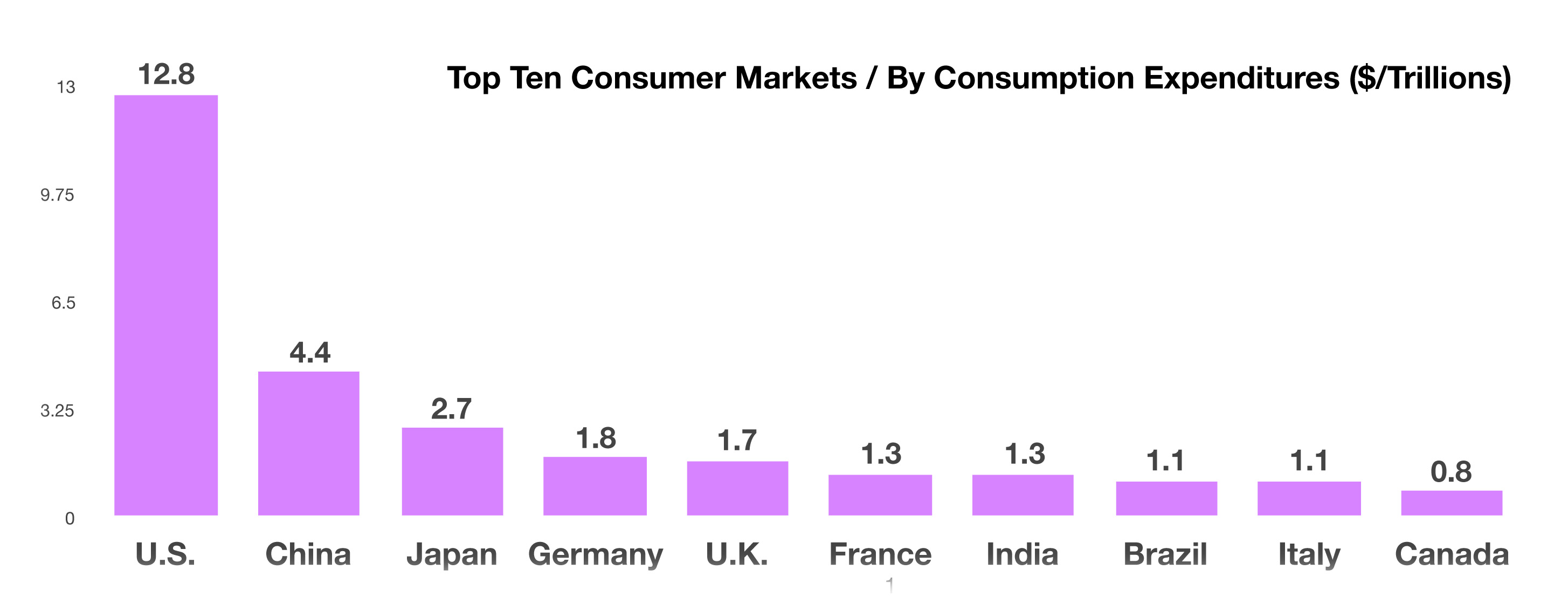

Markets were rattled in March as a looming trade war between China and the U.S. enhanced market volatility. The administration announced $60 billion in tariffs for Chinese imports, with a detailed list of products which will be identified by the Commerce Department in April. China threatened to retaliate by imposing tariffs on U.S. imports as well as curbing U.S. Treasury purchases.

Intricate supply chains have evolved between the United States and China over the past twenty years. Some U.S. manufacturers ship U.S. made components to China for final assembly, then ship finished products back into the U.S., thus posing a challenge as to how trade deficits are calculated.

Key economic data released over the past month revealed that key data points were the strongest reported since 1998. The market has become much more dependent on data as it looks for signs of inflation and rising rates. Various analysts view current market volatility primarily driven by non-systemic events and isolated to specific events and individual company news.

A key lending benchmark, the Libor, has been rising steadily. The three-month U.S. dollar Libor rate surpassed 2% in early March, the highest level since 2008. Based in London, the Libor affects U.S. consumer loans, commercial loans, and adjustable rate mortgages.

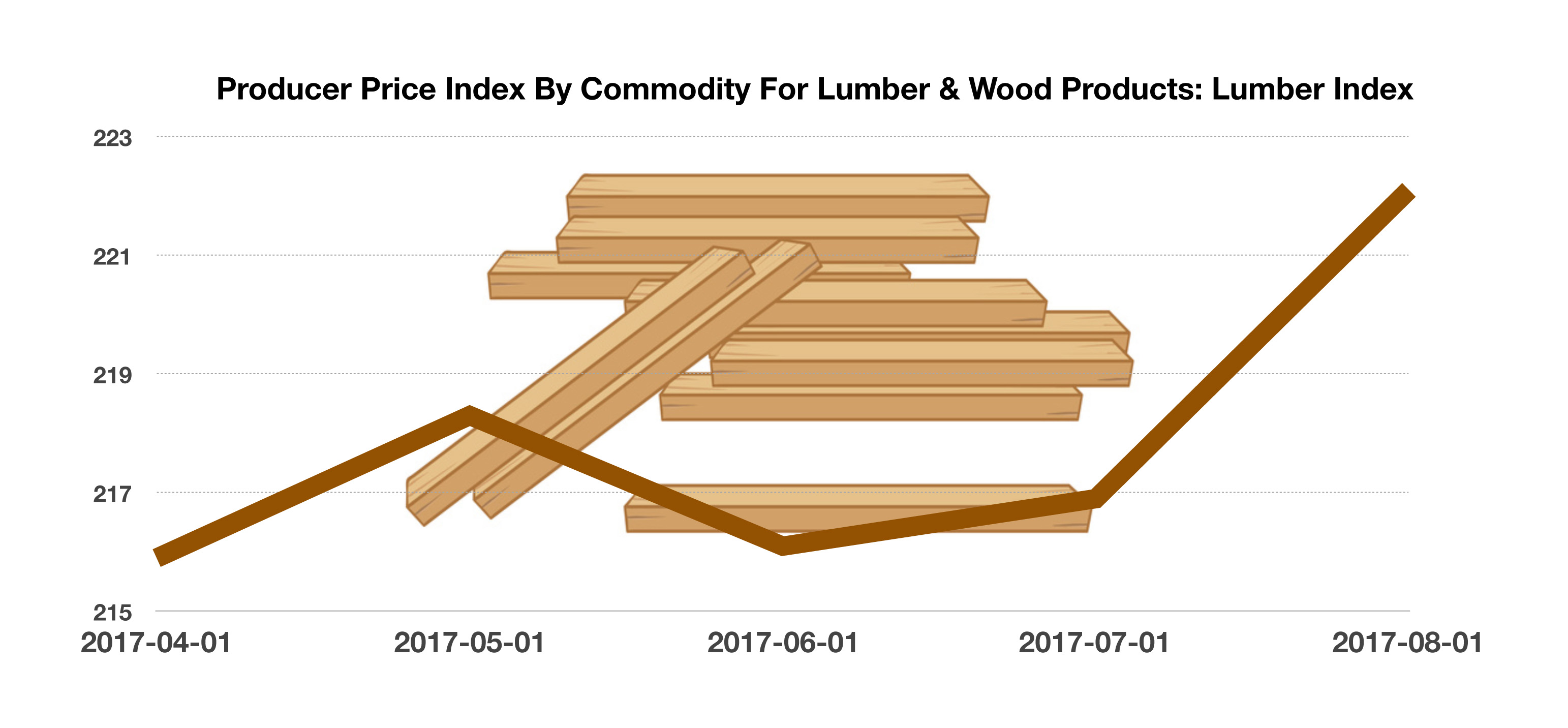

Rapidly rising mortgage rates are dampening the hopes of families eager to lock in rates before payments start to become too expensive. The continued lack of housing supplies has added a double cost factor to the market, with prices elevating due to tight supplies and rising mortgage rates.

Congress reached a $1.3 trillion budget deal that will fund the federal government through September. The extensive 2,232 page bill averts a government shut down and funds special programs for child care, infrastructure, medical research, opioid abuse prevention, and national security. The IRS audited roughly 0.05% (half of one percent) of the 195,614,161 returns filed for tax year 2016. The number of examinations, also know as audits, was higher in the mid 1990s, when about 1.7% of returns were audited. Sources: Dept. of Commerce, Bloomberg, congress.gov