Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

A change in the Federal Reserve’s stance on the direction of interest rates helped buoy equity and bond prices higher in March, allowing U.S. equity indices to post the strongest first quarter in nearly ten years.

The Federal Reserve scaled back its growth expectations for the U.S. economy and announced that it would hold rates steady with no additional rate increases this year. Economists interpreted the comments as a somber assessment of economic expansion, yet positively received by the equity and fixed income markets. The Fed mentioned trade disputes, slowing growth in China and Europe, and possible spillovers from Britain’s exit from the European Union were factors.

Short-term bond yields rose above longer term bond yields in March creating what is known in the fixed income sector as an inverted yield curve. Normally, short-term yields are lower than longer term yields, resulting in a normal yield curve. A persistent inverted yield curve would become more concerning should it linger for several quarters.

Concerns surrounding economic momentum in Europe became more prevalent as Europe’s central bank, the ECB, signaled that it would maintain interest rates below zero longer than anticipated. Slower growth in both exports and imports have been implying a slowdown throughout the EU, which is comprised of 28 European countries. The pending outcome on how and when Britain finally exits the EU is also adding duress to Britain’s trading and business partners all over Europe.

Chinese government data revealed that exports heading to other countries worldwide fell over 20% in the past year. Data also showed that imports had fallen into China, realizing that Chinese consumers were scaling back demand from prior months.

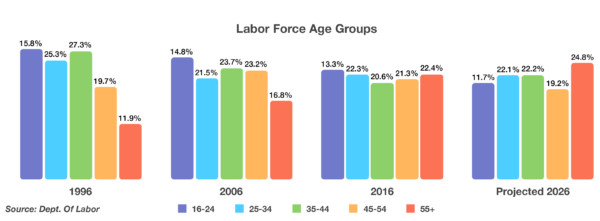

Congressional leaders are considering legislation that would repeal the current age cap of 70.5 for contributing to IRAs as well as increase the required minimum distribution age for retirement accounts from 70.5 to 72. Such legislation, if passed, would be the most significant change to retirement plans since 2006. (Sources: Federal Reserve, Dept. of Labor, IRS, Treasury Dept., ECB)

Lower Rate Outlook & Trade Talks Elevate Stocks In First Quarter – Equity Overview

Optimism over progress on U.S. trade discussions with China seemed to overshadow concerns about a slowing economic expansion helping to propel equity indices towards the end of the third quarter.

Gains were broad for the S&P 500 Index with all 11 sectors ending higher for the first quarter, which has not occurred since 2014. Technology and energy stocks were among the best performing sectors for the quarter, encompassing a broad scope of industries and companies. A counterintuitive environment has driven stocks higher while the bond market is signaling slower growth. Some analysts are expecting a slowdown in corporate earnings growth as global demand projections have been trimmed. (Sources: S&P, Bloomberg, Reuters)

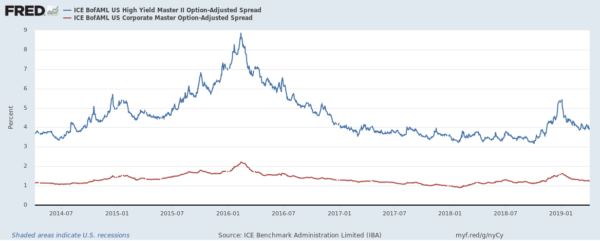

The red line represents the spread on IG bonds and the blue line is the spread for HY bonds. First, it should be clear that IG bonds are significantly more stable than HY bonds as the risk premium has remained between just below 1% to just over 2% in 2016 when the sub $30 oil “crisis” caught investors off guard. During this short spike in volatility and spreads IG bonds moved wider by approximately 50 basis points, however HY spreads moved a whopping 300 basis points. To put this in dollar loss terms, an investor with $1 million of IG bonds would have seen a price decline of approximately 4 points for a loss of $40,000. That same $1 million invested in HY bonds would have seen a price decline of approximately 23 points for a loss of around $230,000. At least in 2016 the spread differential between IG and HY bonds prior to this spike was approximately 450 basis points meaning investors in HY bonds were receiving ~4.5% more for taking risk than IG investors which certainly helps reduce the pain and given enough time (and assuming you didn’t own bonds that defaulted) would help narrow the nearly 4 times greater loss suffered by HY bond investors.

The red line represents the spread on IG bonds and the blue line is the spread for HY bonds. First, it should be clear that IG bonds are significantly more stable than HY bonds as the risk premium has remained between just below 1% to just over 2% in 2016 when the sub $30 oil “crisis” caught investors off guard. During this short spike in volatility and spreads IG bonds moved wider by approximately 50 basis points, however HY spreads moved a whopping 300 basis points. To put this in dollar loss terms, an investor with $1 million of IG bonds would have seen a price decline of approximately 4 points for a loss of $40,000. That same $1 million invested in HY bonds would have seen a price decline of approximately 23 points for a loss of around $230,000. At least in 2016 the spread differential between IG and HY bonds prior to this spike was approximately 450 basis points meaning investors in HY bonds were receiving ~4.5% more for taking risk than IG investors which certainly helps reduce the pain and given enough time (and assuming you didn’t own bonds that defaulted) would help narrow the nearly 4 times greater loss suffered by HY bond investors. As the old saying goes:

As the old saying goes: