Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Dear Friends,

Happy Springtime!!! I hope you had a nice break or are about to go on one. Going on vacation is something everyone needs to do for tons of reasons. We took a trip to the southern end of the Rockies visiting family, searching for higher temps and no snow underfoot (the photo is of my adorable niece at Sand Dunes National Park). Now that we are recharged, it’s time for track season for both girls, and ‘Sports Parenting’ for Jamey and I. It’s awesome fun!

Markets and the economy have almost returned to previous highs and are not finding a lot of reasons to slow down. In this newsletter we address a few concerns we are watching, and below we discuss how investing for social causes may in-fact not sacrifice performance.

Please feel free to modify your newsletter subscription with a simple email. We have a paper and digital version, as well as a ‘no thank you Mike’ list we maintain and respect. This is a 4-6 issue a year project.

Socially Responsible Investing showing encouraging performance

Recently when asked ‘What’s important about money to you?’, a few clients have expressed values other than only making money. Socially responsible investing (SRI)—which seeks to effect positive social change while also potentially generating competitive financial returns—has emerged as a significant, grass-roots trend that we have been following from it’s inception. Since the Forum for Sustainable and Responsible Investment (US SIF) began researching SRI in 1995, the assets in these types of investments have grown from $639 billion to nearly $12 trillion. That’s an 18-fold increase!

| Examples of SRI Factors | ||

| Environmental | Social | Governance |

| Energy Consumption | Child Labor | Board Independence |

| Climate Change | Human Rights | Conflicts of Interest |

| Animal Welfare | Relationships | Shareholder Rights |

It’s significant that SRI funds have tended to keep pace with non-SRI options. For example, the MSCI KLD 400 Social Index averaged an annual rate of return of 7.53% versus 7.77% for the S&P 500® Index over the 15-year period ending in December 2018. Additional data from Morningstar shows that, on average, SRI mutual funds have slightly outperformed their non-SRI counterparts in the short, medium and long terms. (Source: Charles Schwab and Co Inc.)

Let’s ensure that your investments are reflective of your values at our next meeting.

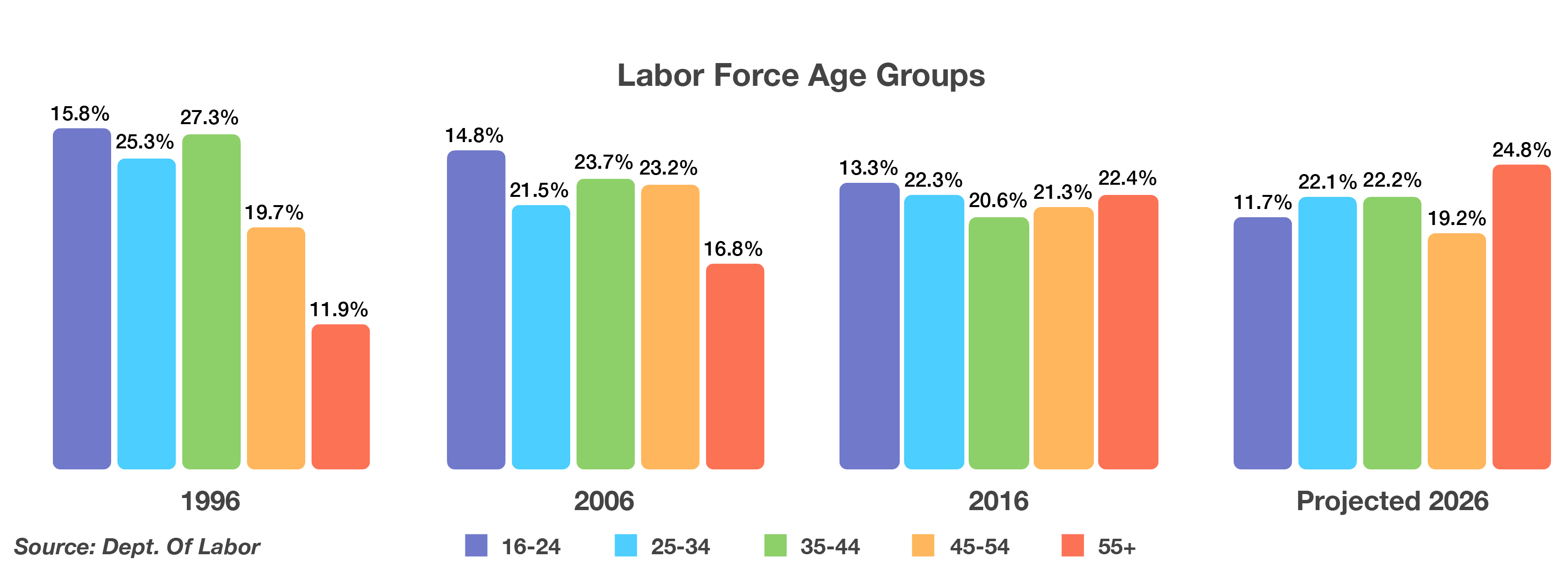

63% of the nation’s labor force, down from 72.3% in 1996. Department of Labor data revealed that over a thirty year period, those aged 55 and older will encompass 24.8% of the labor force in 2026, a stark increase from 11.9% in 1996. As American workers have aged over the decades, longer life expectancy and healthy lifestyles have afforded many the ability to continue employment well into their 60s and 70s. (Source: Department of Labor)

63% of the nation’s labor force, down from 72.3% in 1996. Department of Labor data revealed that over a thirty year period, those aged 55 and older will encompass 24.8% of the labor force in 2026, a stark increase from 11.9% in 1996. As American workers have aged over the decades, longer life expectancy and healthy lifestyles have afforded many the ability to continue employment well into their 60s and 70s. (Source: Department of Labor)