Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

With the coronavirus continuing to impact markets and economies worldwide, governments and businesses confront an unprecedented environment. In response, massive fiscal and monetary efforts put into motion by the administration and the Federal Reserve are expected to provide unparalleled economic stimulus.

The World Health Organization (WHO) declared the COVID-19 virus a pandemic on March 11th, sending global equities lower and ending the longest bull run in U.S. history. The decline of over 20% for all three major equity indices, from record highs set in mid-February, marked an end to the bull market that began in March 2009. The International Monetary Fund (IMF) determined that the global economy has fallen into a recession due to disrupted global supply chains and a drop in commerce induced by the virus outbreak. Economists believe international markets may eventually rebound if governments around the world effectively mitigate contamination.

The $2.2 trillion stimulus plan passed by Congress, designated as the CARES Act, was the largest in U.S. history, providing critical funds to small business owners and individuals nationwide. Massive federal borrowing will fund the program in the form of U.S. government debt issuance, expected to exceed $2 trillion, in short-term Treasury bills.

Many economists and market analysts note the economic slowdown is a health crisis at its core, rather than a financial crisis, setting this downturn apart from nearly all previous recessions. Atlanta Fed President Raphael Bostic said that “this is a public health crisis and different from a typical recession.” Dallas Fed President Robert Kaplan expressed some optimism, commenting “we’ve got a great chance to come out of this very strong.”

Right now is too early to determine what the overall impact will be to industries, companies, employees, and customers over the next few months. Globalization is under pressure as global commerce has dwindled due to supply chain constraints, along with varying rules and restrictions among countries involving cross-border transactions.

The Treasury Department and the IRS announced an extension of the tax filing deadline from April 15, 2020 to July 15, 2020. Taxpayers may defer Federal tax payments until July 15th, without any penalties and interest. The deferment applies to all taxpayers, including individuals, businesses, estates, and corporations.

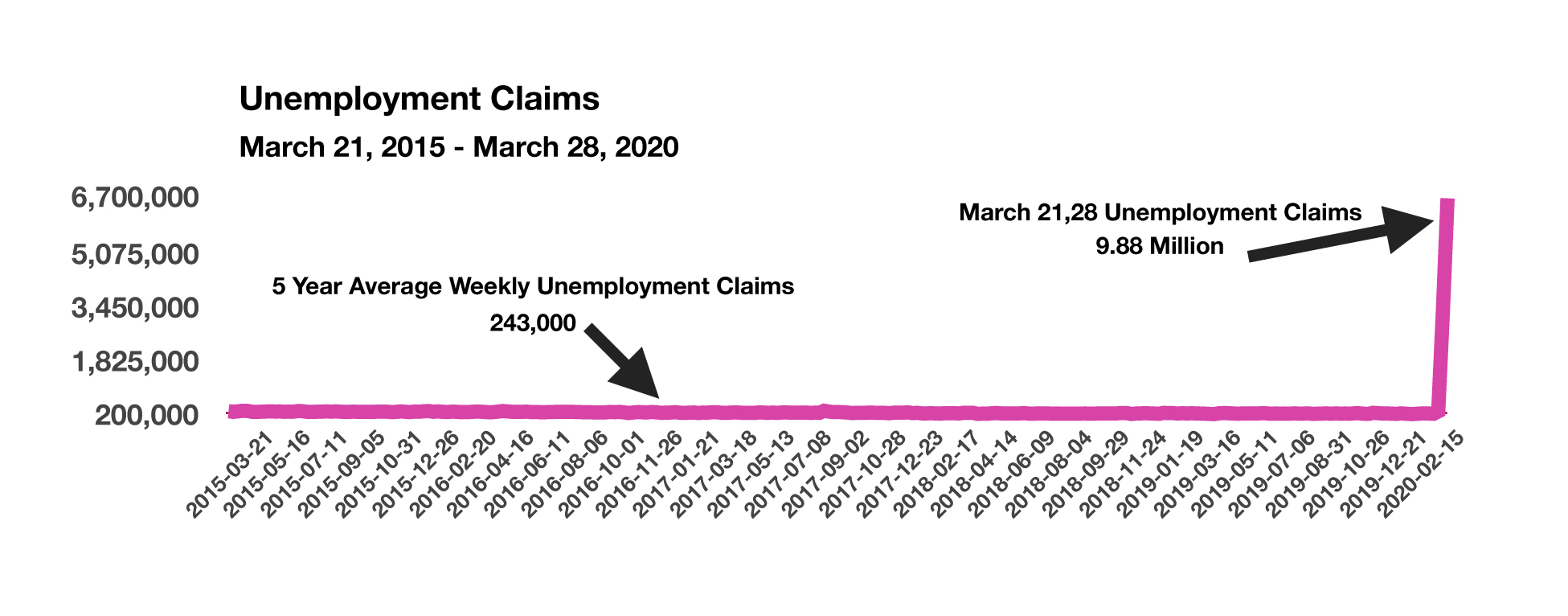

A historic spike of nearly 10 million unemployment claims was precipitated by mass layoffs as governmental entities mandated business closures and restrictions on public gatherings across the country. The immense jump in unemployment claims over the two weeks may worsen, yet is expected to be tempered by funds targeted for the unemployed as part of the $2.2 trillion stimulus plan. The plan also encourages small businesses to re-hire employees as conditions allow. Personal and business bankruptcies are expected to rise dramatically as a result of government-mandated shutdowns, which have decimated incomes for employers and employees across the country.(Sources: IMF, WHO, Federal Reserve, Dept. of the Treasury, IRS, Dept. of Labor)