Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

With the coronavirus continuing to wreak havoc on markets and economies worldwide, governments and businesses are confronting an unprecedented environment. In response, massive fiscal and monetary stimulus efforts put into motion by the administration and the Federal Reserve are expected to provide unparalleled economic stimulus.

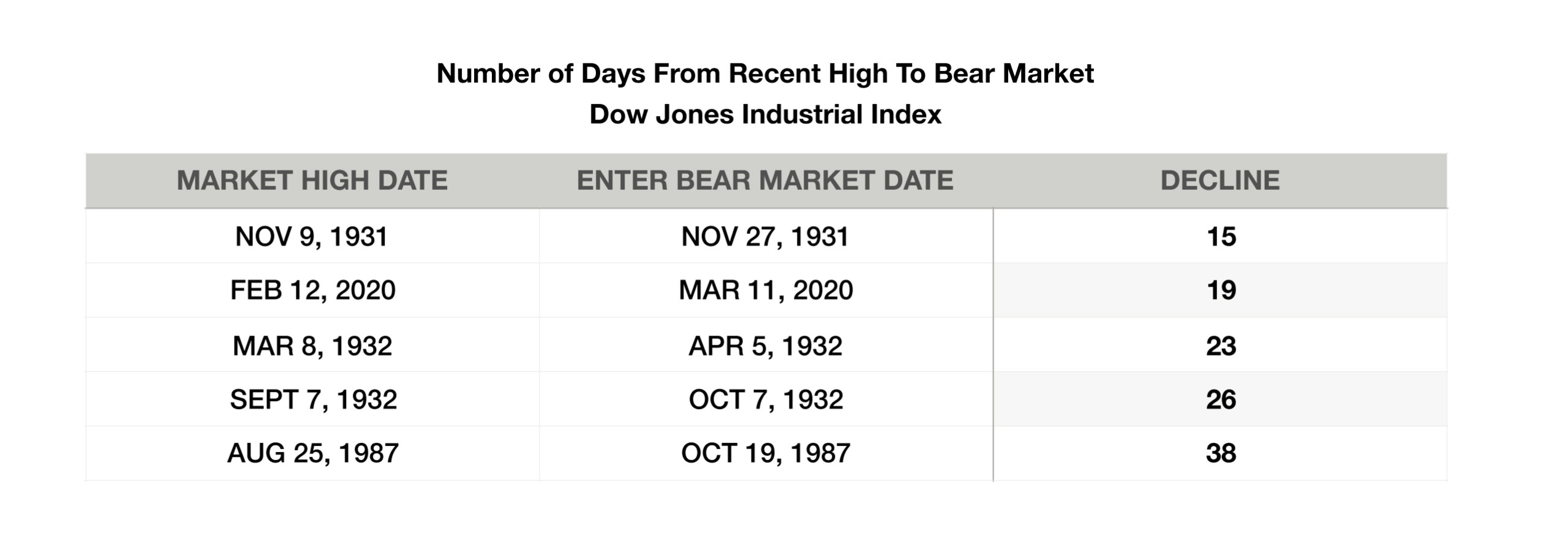

The World Health Organization (WHO) declared the COVID-19 virus a pandemic on March 11th, sending global equities further down and ending the longest bull run in U.S. history. The 20% plus decline for all three major equity indices, from record highs set in mid-February, qualified the rapid descent as an end to the bull market that began in March 2009. The International Monetary Fund (IMF) determined that the global economy has fallen into a recession due to disrupted global supply chains and a drop in commerce induced by the virus outbreak. Economists believe that international markets may eventually rebound should governments around the world effectively mitigate contamination.

The $2.2 trillion stimulus plan passed by Congress, known as the Cares Act, was the largest in U.S. history, providing critical funds to small business owners and individuals nationwide. Massive federal borrowing will fund the program in the form of U.S. government debt issuance expected to exceed $2 trillion in short-term Treasury bills this year alone.

Many economists and market analysts view this pandemic as a health crisis at its core, not a financial crisis, which has preceded nearly all previous recessions. Atlanta Fed President Raphael Bostic said that “this is a public health crisis and different from a typical recession”. Dallas Fed President Robert Kaplan expressed some optimism by commenting “we’ve got a great chance to come out of this very strong”. Some view government restrictions and mandatory closures as the reason behind crippled businesses and the economic contraction, not the coronavirus itself.

It is too soon to determine as to what the overall impact will be to the multitude of industries and companies over the next few months. Globalization is in question as global commerce has dwindled due to supply chain constraints, along with varying rules and restrictions among countries involving cross-border transactions.

The Treasury Department and the IRS announced an extension of the tax filing deadline from April 15, 2020 to July 15, 2020. Taxpayers will be able to defer tax payments until July 15th, without any penalties and interest. The deferment applies to all taxpayers, including individuals, businesses, estates, and corporations.

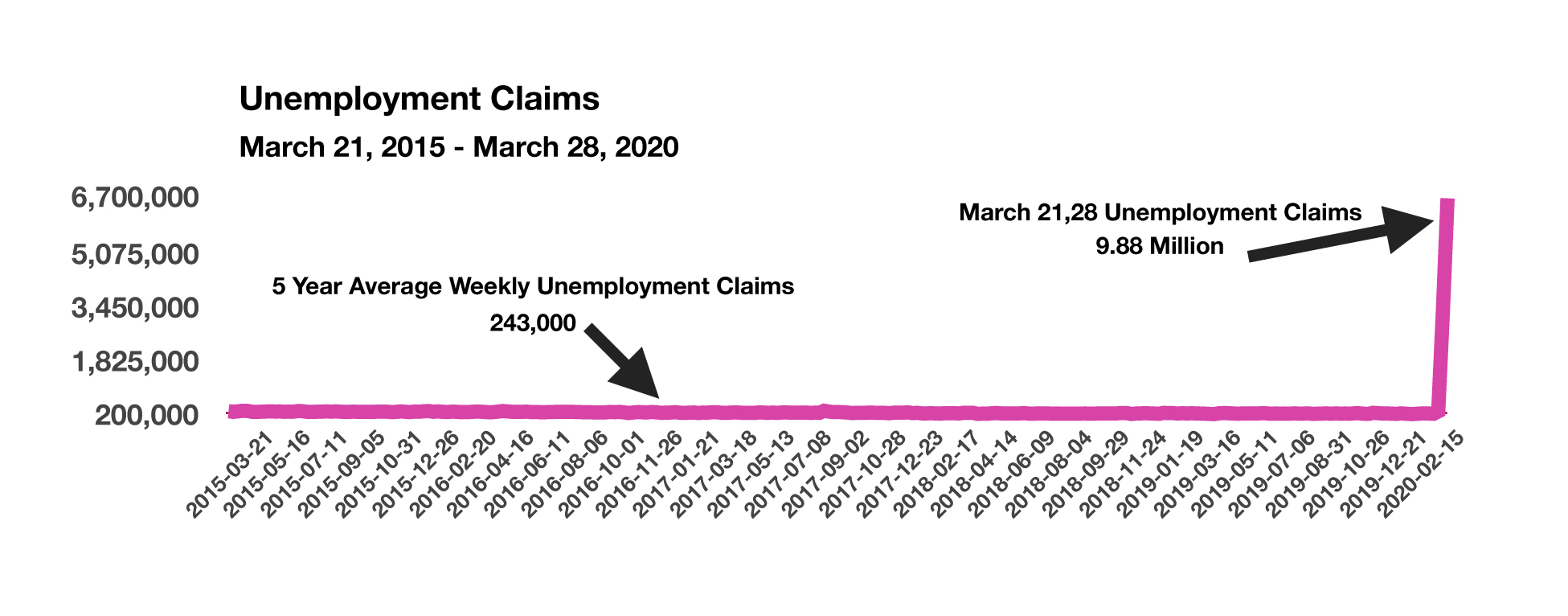

A historical spike in unemployment claims of nearly 10 million was brought about by mass layoffs as governmental entities mandated business closures and restrictions across the country. The immense jump in unemployment claims over just two weeks may worsen, yet expected to be buffeted by funds targeted for the unemployed as a result of the $2.2 trillion stimulus plan. The plan also encourages small businesses to re-hire employees as conditions warrant. Personal and business bankruptcies are expected to rise dramatically as a result of government mandated shutdowns, which have halted incomes for employers and employees across the country.(Sources: IMF, WHO, Fed, Treasury, IRS, Dept. of Labor)