Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

The Russia-Ukraine war exacerbated inflation expectations as it impacted commodity prices and global supply chains. Supply chain issues were already wreaking havoc on global manufacturing, production costs, and consumer availability prior to the Russian invasion.

Consumers holding cash are rapidly losing purchasing power as rising rates and inflation have driven borrowing costs higher for homebuyers and consumers overall. Increased mortgage rates have caused some borrowers to be disqualified on mortgage loans that had previously been approved.

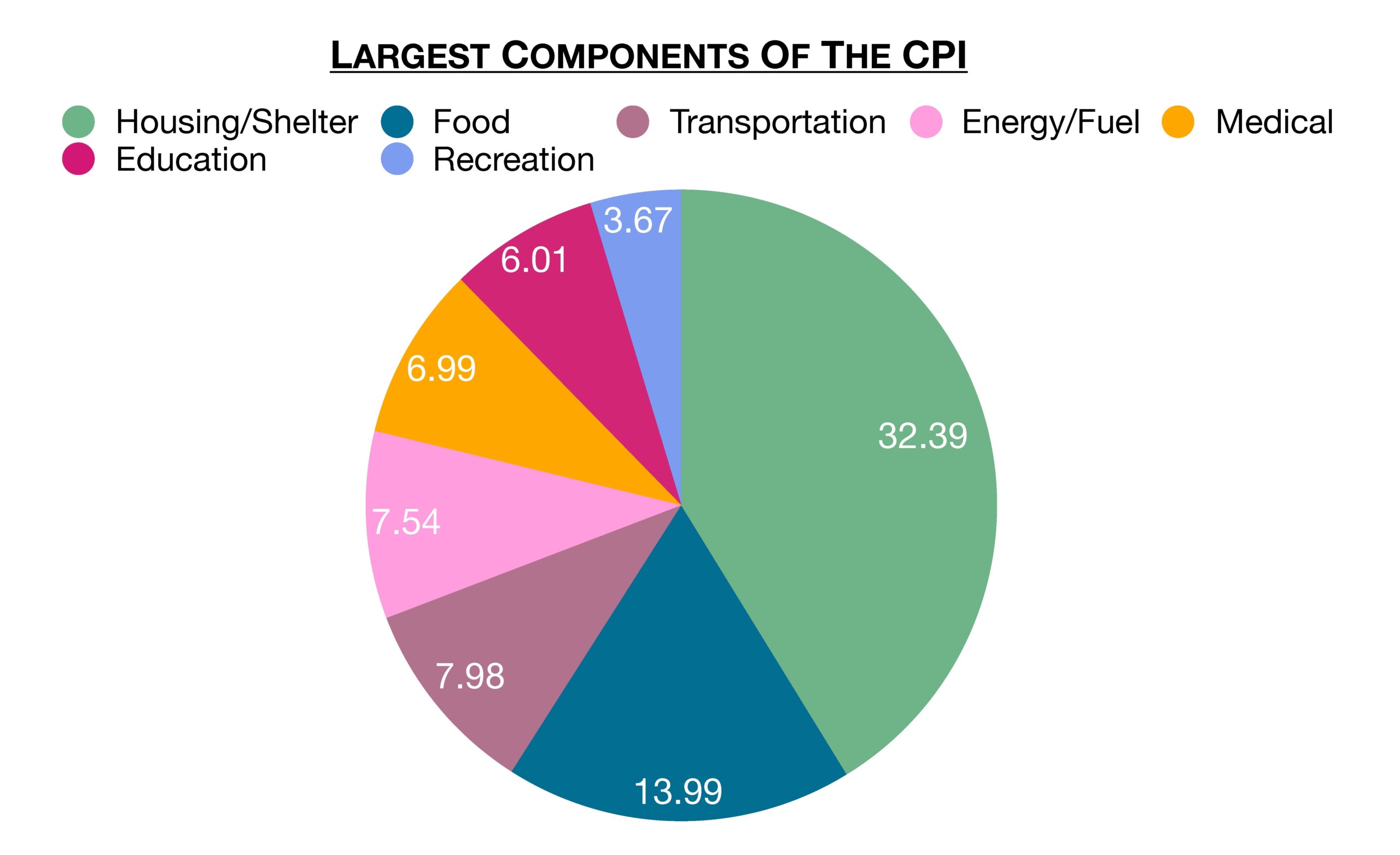

The Federal Reserve initiated its long-awaited rate increase in March, marking the first of several projected increases this year. General consumer loan rates, mortgage rates, and auto loan rates all increased. The Fed’s objective is to counter inflationary pressures by raising rates in order to ease demand for products and services. Economists note that the tremendous spike in global commodity prices is creating commodity-led inflation, which increases costs for production, manufacturing, and transportation.

The high demand for homes nationwide may eventually subside as increased mortgage rates reduce affordability for millions of homebuyers. The average 30-year conforming mortgage rate rose to 4.67% in March, up from a low of 2.66% in December 2020.

Short-term Treasury bond yields moved higher than some long-term Treasury bond yields, which is often interpreted as an indication of a possible economic slowdown. Rising short-term rates reflect inflationary pressures, while lower long-term rates may suggest a future recessionary environment.

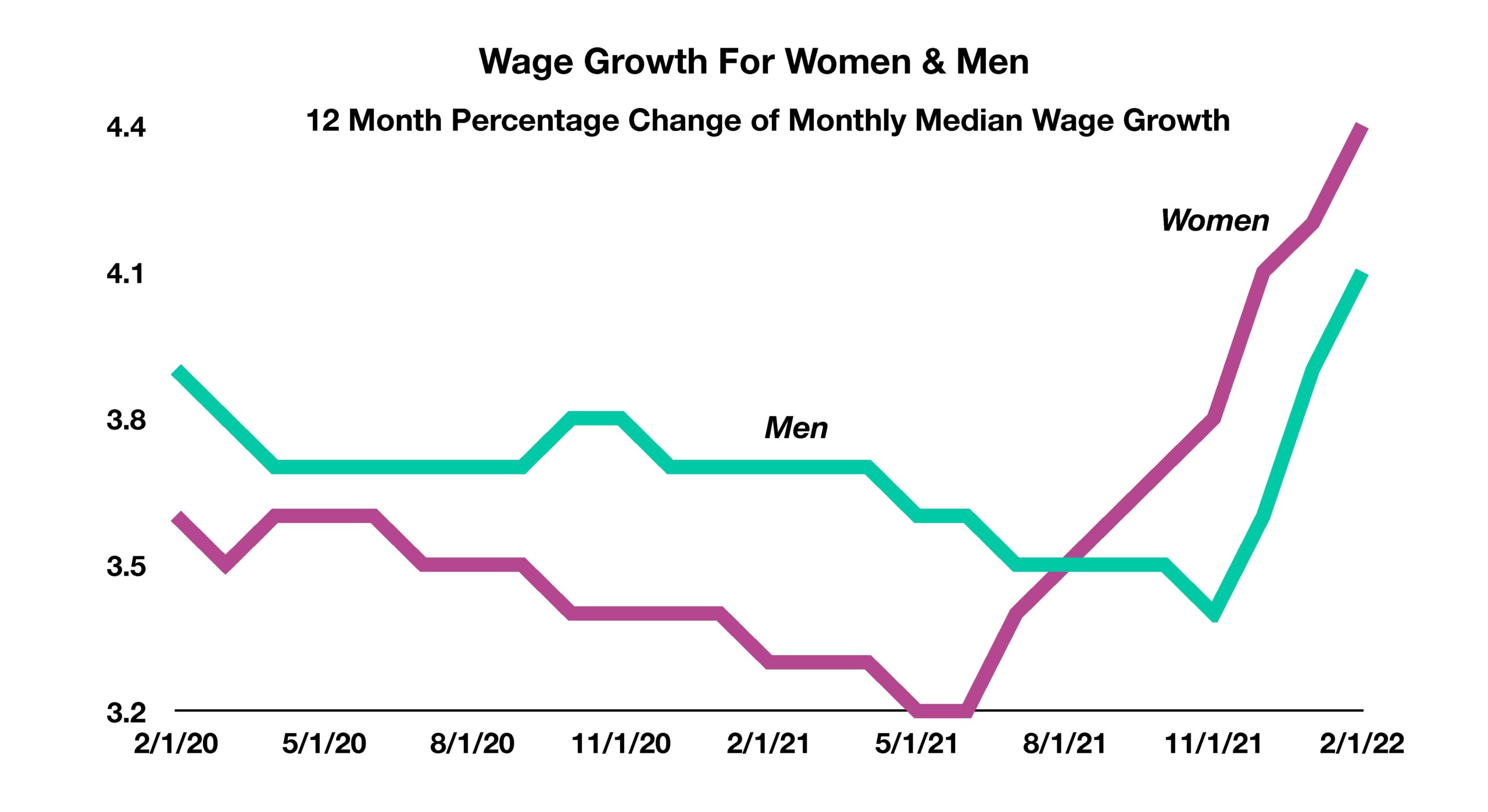

A recent strengthening U.S. dollar was the result of global investors seeking stability as the Russian invasion of Ukraine intensified. Optimistically, a stronger dollar can help stem inflation as it makes imported products less costly for American consumers. The most recent inflation data revealed an annual rate of 7.9%, the highest in 40 years, putting pressure on consumers as wages struggle to keep pace with heightened prices.

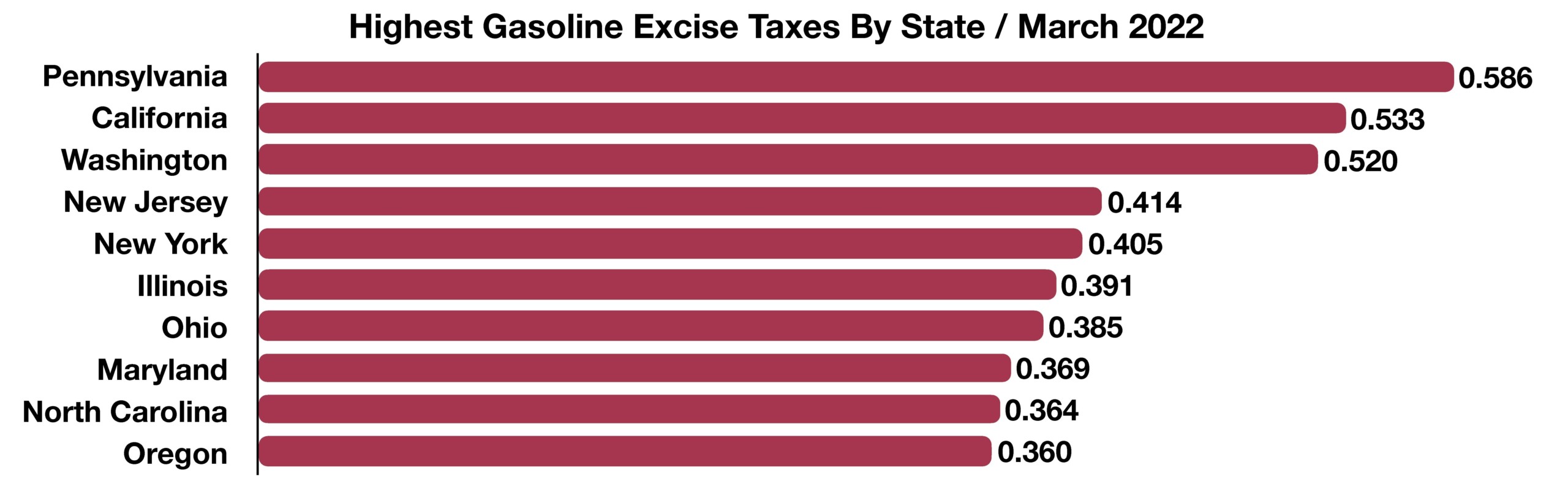

Gasoline prices have soared more in certain states than others, due in part to gasoline excise taxes. The federal government imposes a tax of 18.4 cents for each gallon sold nationally, and some states impose an additional gas tax to raise funds for state infrastructure and highway projects. While the national average cost of a gallon of gasoline was $4.23 at the end of March, several states saw much higher prices. (Sources: EIA, Federal Reserve, Freddie Mac, U.S. Treasury)