Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

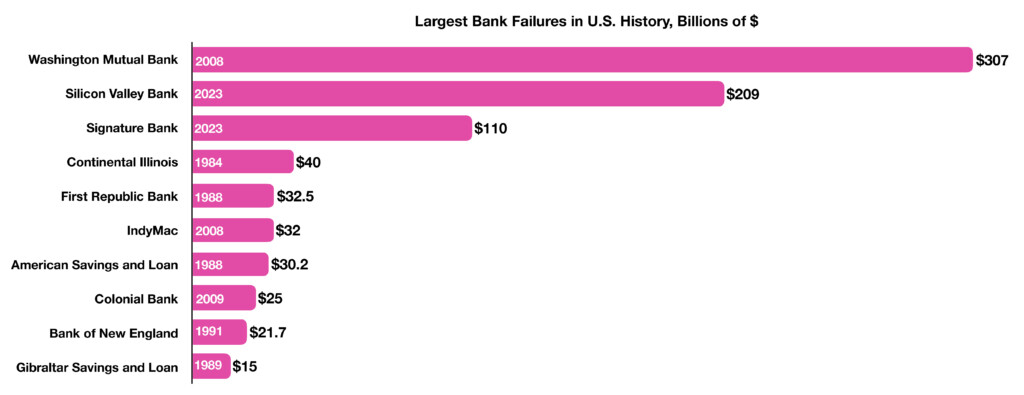

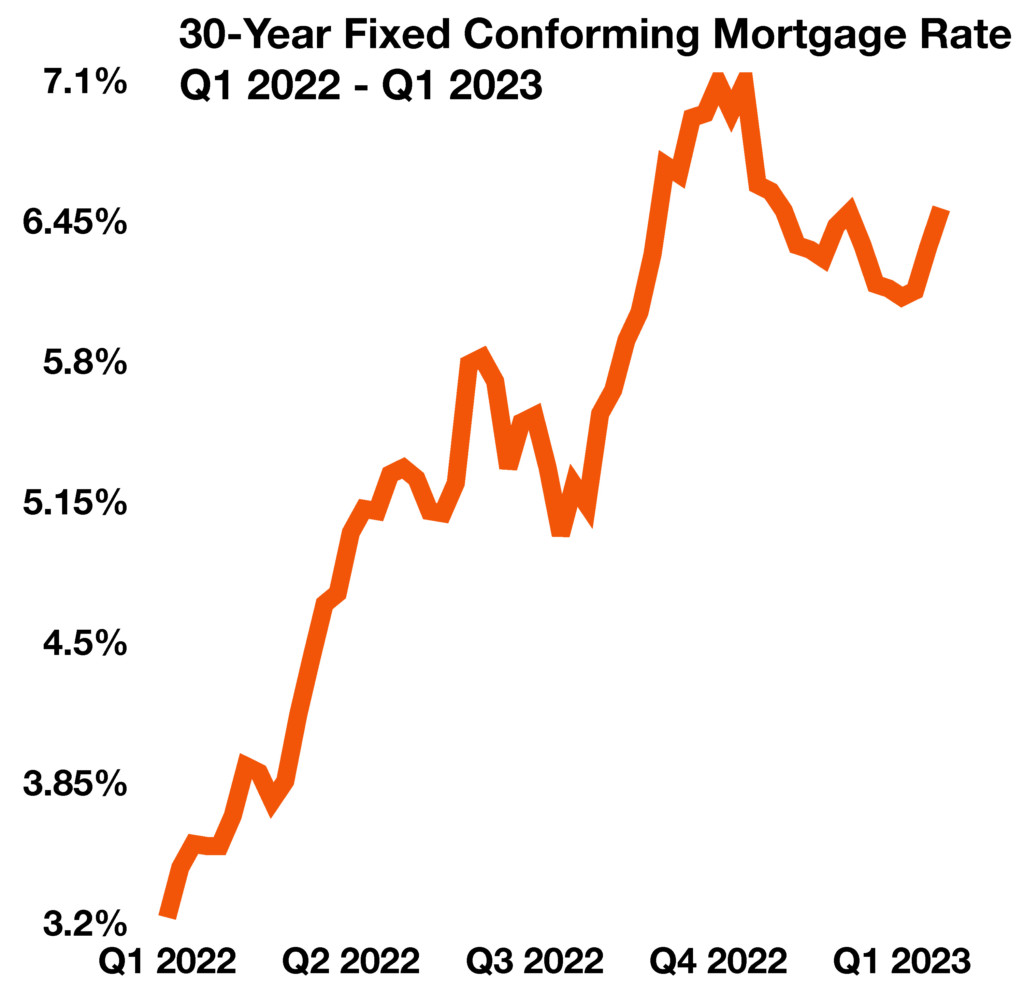

The failure of two regional banks unsettled equity and fixed-income markets globally in March. Financial risks were at the forefront of the financial markets as the closure of Silicon Valley Bank and Signature Bank fostered turmoil throughout the banking sector. The recent banking crisis may alter the Fed’s rate increase trajectory, as various analysts believe that the Fed’s rapid rate increases may have triggered the banking mayhem.

Various bank analysts believe that the recent bank failures are more centralized than widespread in the banking sector, different from the crisis in 2008 when numerous institutions were affected. Some economists are forecasting the likelihood of a heightened recessionary environment should additional banks fail and if the Fed continues to hike rates. What occurred in 2008/2009 was systemic, which means that there was a broad effect across many institutions with the same exposure, such as Mortgage Backed Securities (MBS). This so far has not been the case and is contained to just a handful of regional banks catering to a select group of depositors and customers.

The events in March precipitated a migration to bonds, creating a drop in interest rates which is advantageous to offset inflationary pressures. The concern is that falling rates may also be indicative of a slowing economic environment, with a possible recession should economic activity significantly curtail. The Fed may or may not continue to “fight” inflation by raising rates, depending on economic data and how the bank crisis unfolds. There is a growing consensus that the Fed may be ready to halt raising rates because new data is showing that inflation is definitely cooling off.

The Fed’s latest survey on the economy, the Beige Book, reported that overall loan demand is falling, bank credit standards are tightening and delinquency rates are edging higher. The survey also identified rising rates as a factor in diminishing loan quality as well as inhibiting consumer borrower sentiment.

Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Federal Reserve Bank of New York, U.S.Treasury, Bloomberg