Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Macro Overview

Macro risks are still prevalent throughout the world as the effects of Brexit and terrorism continue to be ongoing concerns. U.S. markets have been resilient to the uncertainties, as major U.S. stock indices reached new highs in July.

Some believe that the outcome of the EU vote, as well as the sentiment in Britain shortly before the vote to leave the EU, has many similarities to the U.S. presidential race. Key election issues and how they may affect the economy include: NAFTA, immigration, terrorism, and banking regulations such as Glass-Steagall and Dodd-Frank.

The presidential campaign has brought about the suggestion of reforming existing regulations affecting the banking and financial services industry. Some candidates argue for the repeal of Dodd-Frank, regulations put in place during the current administration to regulate banking activity. The problem has been that the costs of the new regulations have inhibited smaller banks and credit unions. Some candidates lobbied to bring back legislation known as Glass-Steagall, put in place during the depression in order to prevent banks from combining financial services, investment banking, and loans simultaneously.

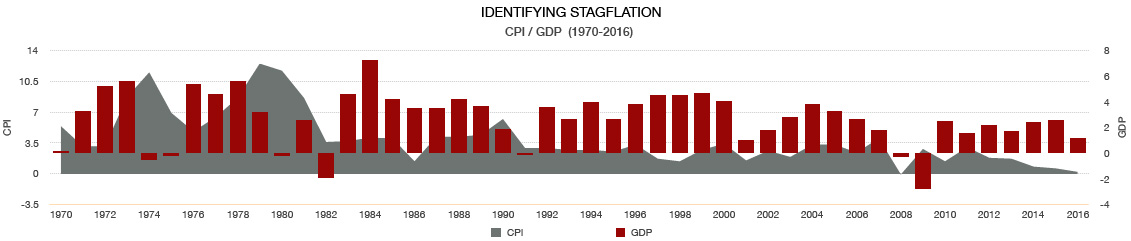

Economic growth, measured as GDP, was reported by the U.S. Department of Commerce to have increased at an annual rate of 1.2 % in the second quarter of 2016, below analysts expectations of 2.5%. The dismal GDP report was accompanied by a drop in oil prices of over 15% in July and a record low for the 10-year Treasury yield hitting 1.37%.

Upcoming economic data for the U.S. may influence the Federal Reserve to act on raising rates rather than waiting any longer. Analysts believe that a rate increase by the Fed before the end of 2016 based on U.S. economic data may be a mistake. Rates in Europe and Japan remain in negative territory due to the uncertainty of growth within the EU and the expected derogatory effects of Brexit on global business transactions. Fed members decided to leave interest rates unchanged during their July meeting, stating that it was prudent to wait for more data following the consequences of Britain leaving the EU.

Banks in Italy have become the latest of concerns in Europe as souring loans are being recognized throughout the Italian banking sector. As the third largest economy in the EU, Italy’s banking sector is prone to a crisis that could have dire consequences for the country and neighboring trading partners.

Sources: EuroStat, Dept. of Commerce, Federal Reserve, ECB

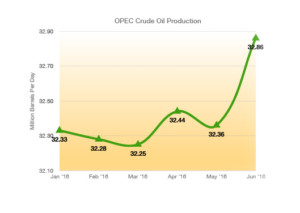

C represents the world’s largest producer of oil, with Saudi Arabia being the single largest producer at over 10 million barrels per day, roughly a third of total OPEC production.

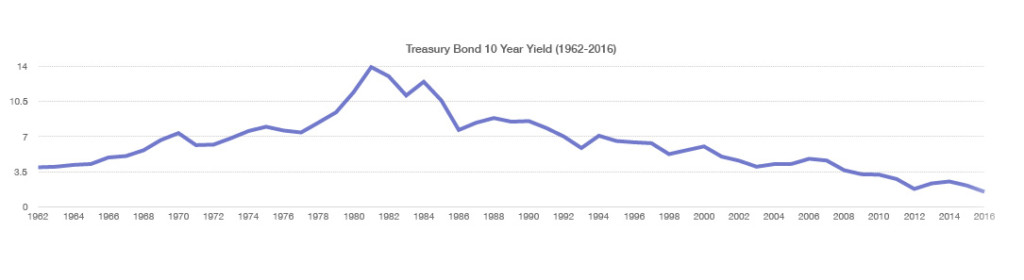

C represents the world’s largest producer of oil, with Saudi Arabia being the single largest producer at over 10 million barrels per day, roughly a third of total OPEC production. The yield on the 10-year U.S. Treasury fell to a record low of 1.318 percent in early July, sending bond prices higher throughout the fixed income markets. Bonds have continued their rally since the beginning of the year as the Fed has held off on raising rates, while central banks in Japan and Europe have maintained unprecedented low rates.

The yield on the 10-year U.S. Treasury fell to a record low of 1.318 percent in early July, sending bond prices higher throughout the fixed income markets. Bonds have continued their rally since the beginning of the year as the Fed has held off on raising rates, while central banks in Japan and Europe have maintained unprecedented low rates.