Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

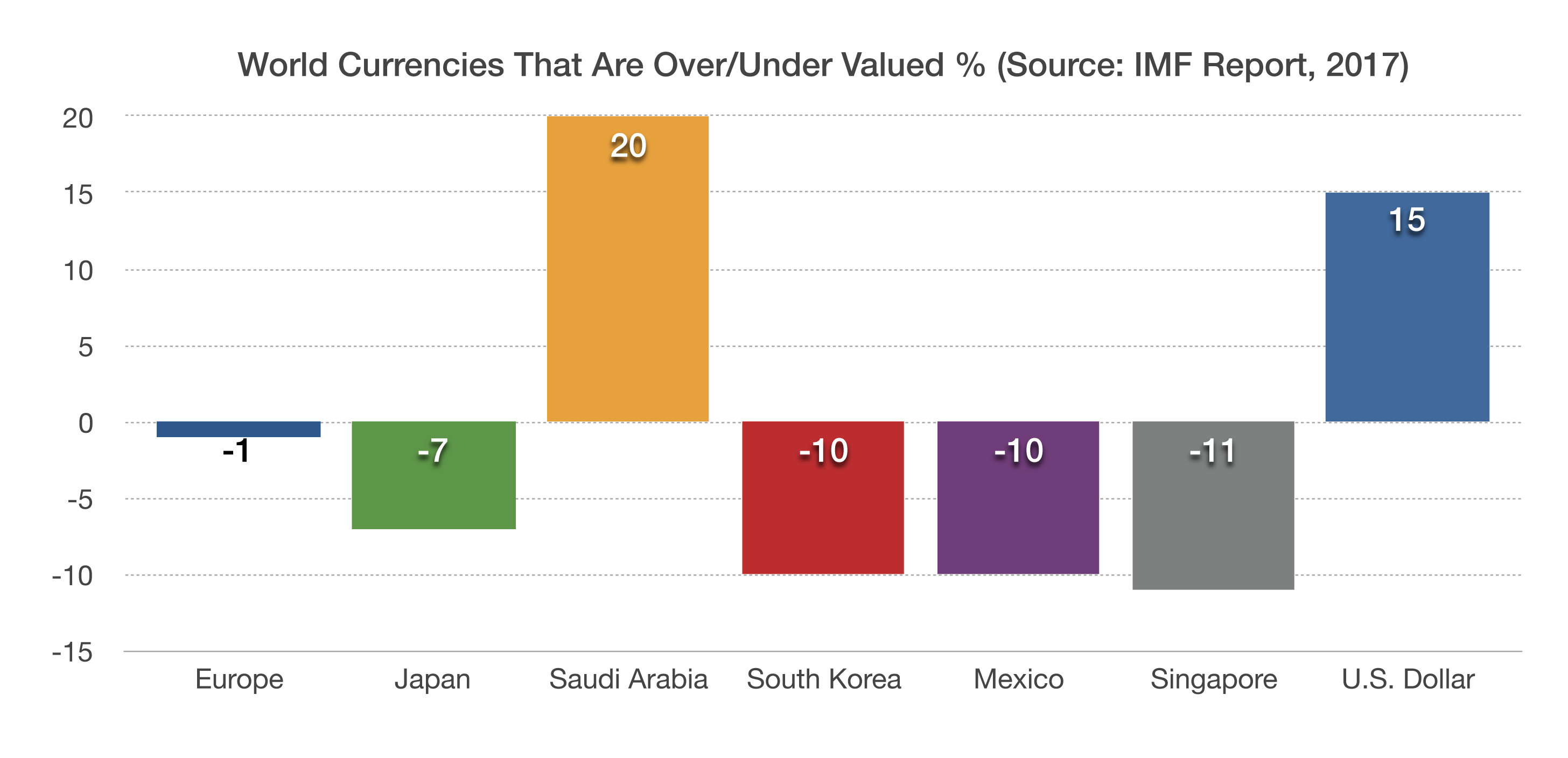

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

Markets seemed undeterred by political indecisiveness in Washington surrounding healthcare reform, which could affect upcoming tax reform in the fall that is hinged on the ability of passage by Congress. Even though lawmakers are coming under escalating pressure to demonstrate legislative progress, the inability of the House to pass healthcare legislation didn’t hold equity markets back from achieving higher levels.

A political debate has begun behind mundane media noise, the debate to raise the federal debt ceiling in order to continue funding government expenses and operations. The debt ceiling, formally known as the statutory debt limit, is the country’s credit limit, which is a legislative restriction on the amount of national debt that can be issued by the Treasury.

The Fed said that it would start paring its $4.4 trillion balance sheet “relatively soon”, language interpreted by Fed watchers to mean possibly beginning in September. This continues to be a critical focal point for government bond traders gauging how markets will absorb the vast amounts of debt efficiently and without disturbing volatility. The Fed also reiterated that future rate hikes would be gradual, thus stemming the probability of erratic rate increases.

Global central bank chiefs and various market analysts believe that current low volatility may be hiding risk in the form of asset inflation engulfed within a low inflation environment. The concern is that investors and central bankers may be viewing circumstances from different perspectives. Low interest rates and international central bank asset purchases have greatly reduced volatility in the global markets.

The synchronized global increase in interest rates is elevating from unprecedented low levels, meaning that it may take some time before rates reach so-called normalized levels.

Oil prices rose after Saudi Arabia cut oil exports and OPEC said it would enforce production cuts among OPEC members. Higher oil prices, as tracked by the West Texas Intermediate Index (WTI), enhance economic activity in various oil related regions of the United States.

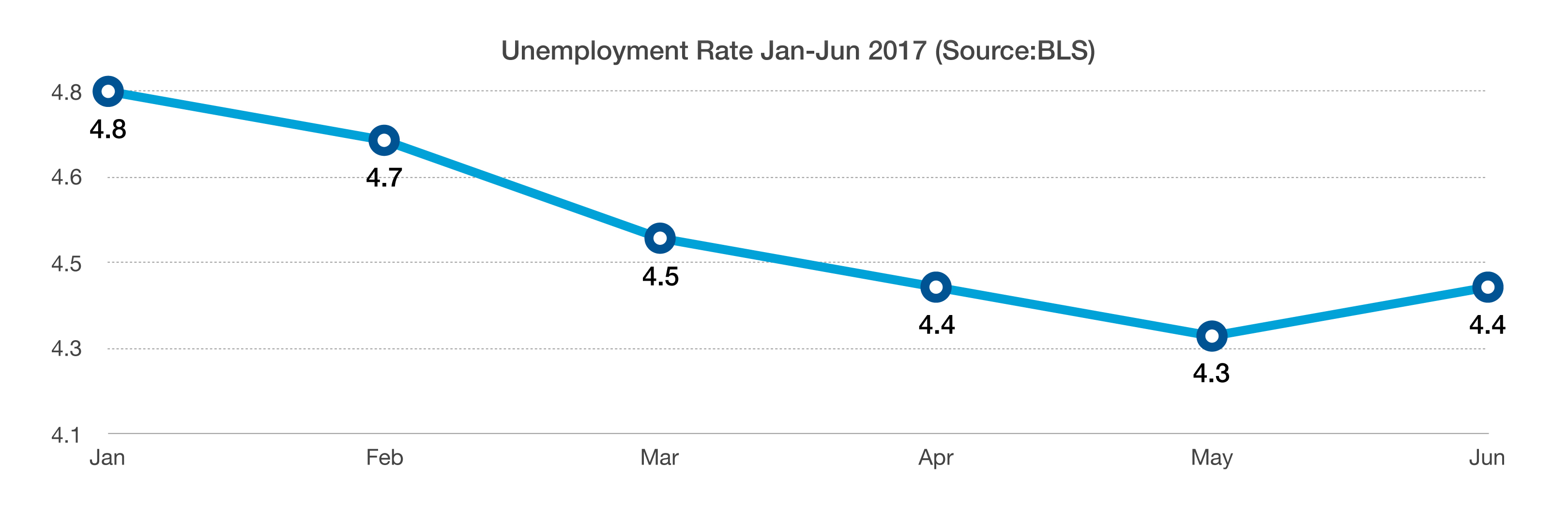

The Department of Labor reported that there were 222,000 new jobs in June, but more people were actually looking for work in June, lifting the unemployment rate to 4.4%. (Sources: Federal Reserve, OPEC, DOL, house.gov)

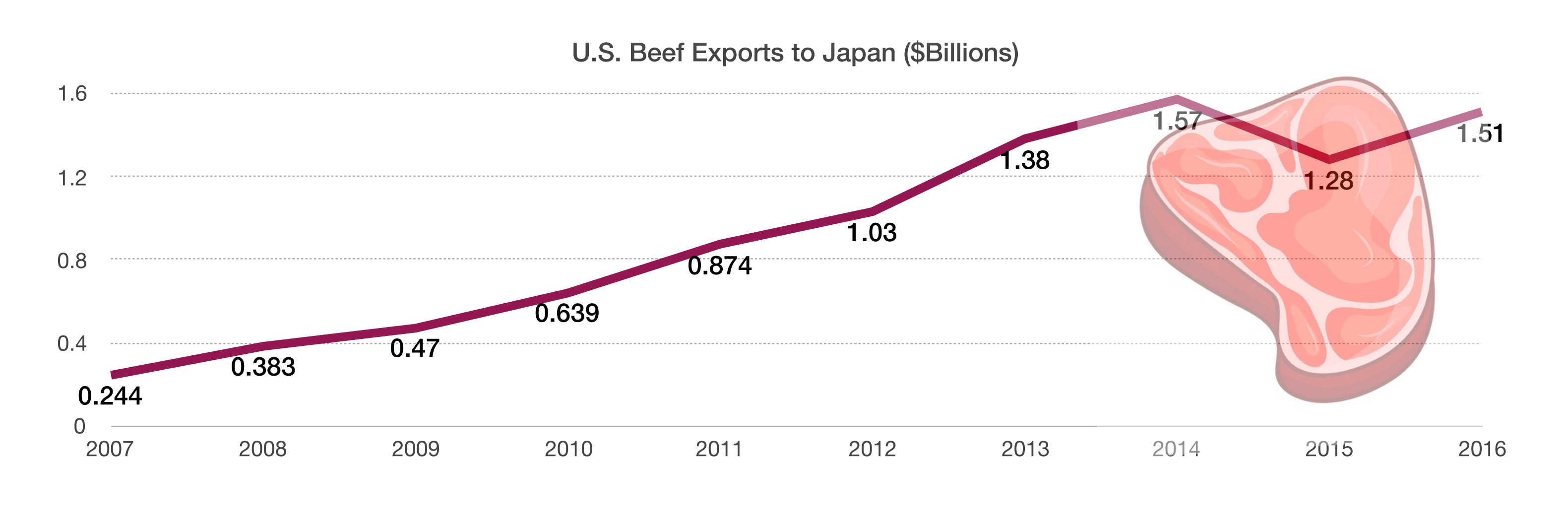

As discreet as it may seem to many, a tariff increase to 50% from 38.5%, based on 2016 export figures, amounts to a $755 million tax on beef exports to Japan. Such tariffs can stifle demand in Japan and hinder beef producers in the U.S. The Trump Administration has been quite vocal about foreign trade practices deemed unfair by the United States. (Source: U.S. Meat Export Federation)

As discreet as it may seem to many, a tariff increase to 50% from 38.5%, based on 2016 export figures, amounts to a $755 million tax on beef exports to Japan. Such tariffs can stifle demand in Japan and hinder beef producers in the U.S. The Trump Administration has been quite vocal about foreign trade practices deemed unfair by the United States. (Source: U.S. Meat Export Federation) Europe and Japan will see dwindling populations as average ages rise and population growth slows down over the next few decades. Japan, which has the oldest average age of any of the developed counties, will lose a third of its population by 2100.

Europe and Japan will see dwindling populations as average ages rise and population growth slows down over the next few decades. Japan, which has the oldest average age of any of the developed counties, will lose a third of its population by 2100.

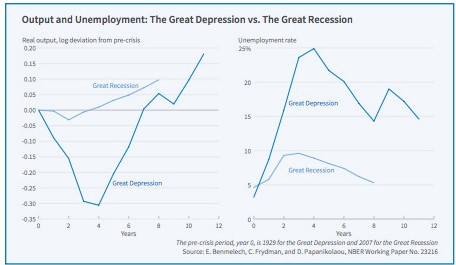

Still on the left side, notice the less bold line.

Still on the left side, notice the less bold line.