Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

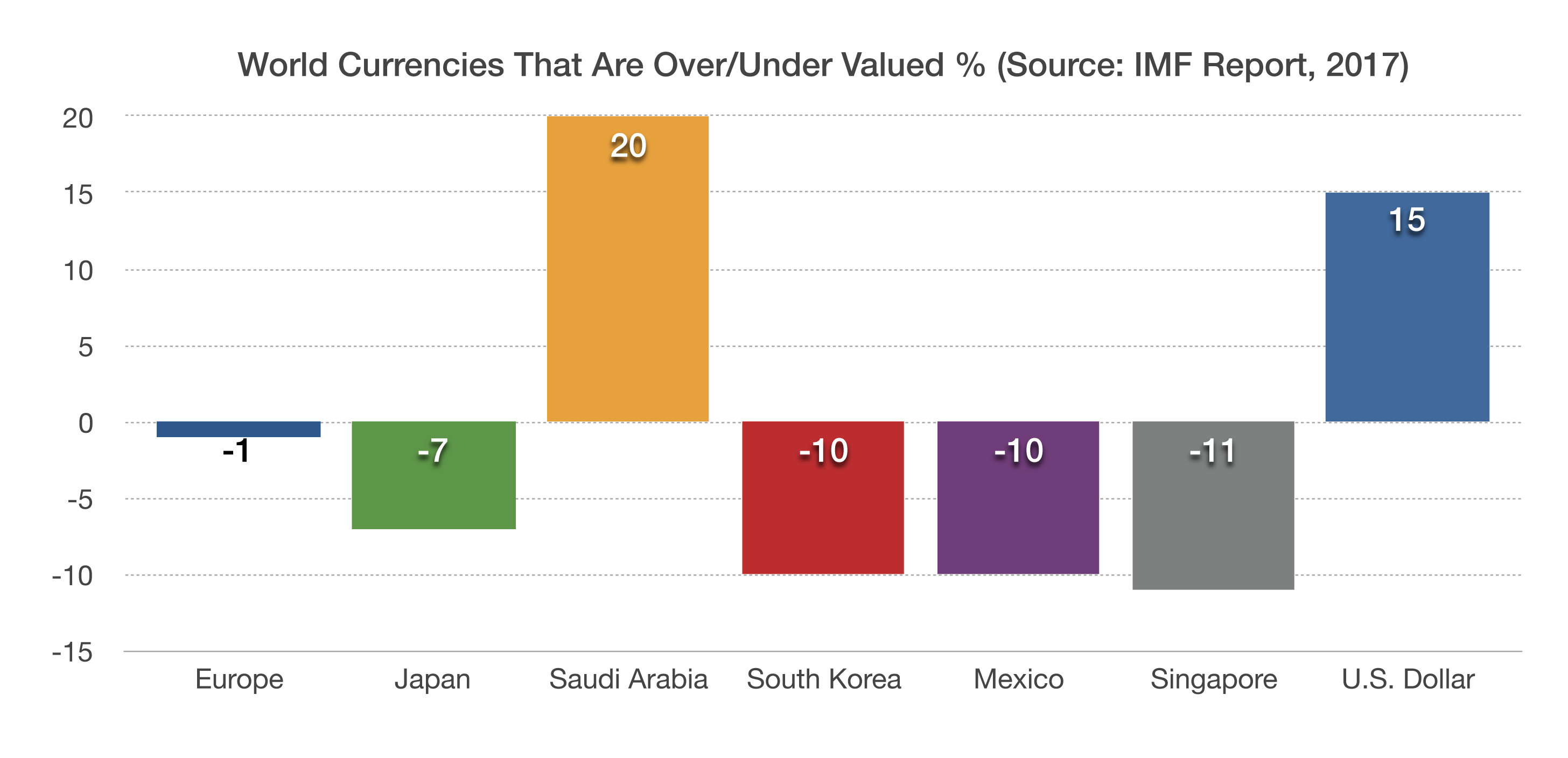

IMF Agrees With Trump On Dollar Valuation – Currency Overview

The International Monetary Fund (IMF) releases a report each year detailing its assessment of monetary policies globally and identifying imbalances affecting global growth. Discrepancies as to how currencies are valued has been a focal point for President Trump, as various countries have been tagged as currency manipulators by the administration. The IMF has concurred with such complaints and has drafted policies to strictly enforce currency valuation policies. China, Germany, and Japan have been accused by the administration of devaluing their currencies in order to boost their exports at the disadvantage of U.S. companies.

The most significant misalignments have been found in emerging market currencies whose countries benefit when their currencies devalue, making their exports more competitive worldwide. In line with President Trump’s suggestion that the U.S. dollar is overvalued, the IMF estimates that the dollar is 15% overvalued relative to other currencies, meaning that U.S. products are less competitive globally. Saudi Arabia’s currency is also estimated to be overvalued by 20%, partly because it is pegged to the U.S. dollar.South Korea, Singapore, and Mexico currently have the most undervalued currencies, giving them a direct trade advantage over other countries. (Source: IMF External Sector Report 2017)

U.S. Beef Exports To Japan Get Hit With Higher Tax – Trade Policy Update

The single largest purchaser of U.S. beef, Japan, announced in July that it would impose a temporary 50% tariff on frozen beef coming from the United States and several other countries. The imposed 50% tariff would be an increase from the current 38.5% tariff on beef imports into the country. Japan accounted for nearly 24% of all U.S. beef exports in 2016. In response, the U.S. agricultural secretary noted that the higher tariff would likely reduce American beef exports in addition to boosting the U.S. trade deficit with Japan.

As discreet as it may seem to many, a tariff increase to 50% from 38.5%, based on 2016 export figures, amounts to a $755 million tax on beef exports to Japan. Such tariffs can stifle demand in Japan and hinder beef producers in the U.S. The Trump Administration has been quite vocal about foreign trade practices deemed unfair by the United States.

Source: U.S. Meat Export Federation