Wright Financial, LLC

395 Taylor Blvd., Suite 107

Pleasant Hill, CA 94523

925.246.7982

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Equities rebounded in July and remained resilient to tariff and trade tensions. Markets are realizing that the U.S. has been somewhat insulated from lingering trade disputes. Various analysts and market strategists are expecting trade tensions to ease as ongoing negotiations alleviate some of the uncertainty.

China’s ability to retaliate against U.S. imposed tariffs is proving to be difficult for China since the country imports far less from the U.S. than the U.S. imports from China. To China’s benefit, the country’s currency, the yuan, has fallen steadily since the onslaught of the new tariffs, ironically making Chinese products less expensive and more competitive internationally. Should the yuan continue to depreciate versus the U.S. dollar, the imposed tariffs may then be offset by the weakening yuan, creating even more trade tension between the two countries.

Because of a more developed and diverse financial market, the United States has numerous sectors for investors to shield themselves from trade politics and tariff disputes. International markets remain exposed and vulnerable to the trending tariff impositions and trade issues. Trade disputes with various countries have also enhanced volatility throughout the international markets. Emerging market countries, such as Russia, are losing financial ground against the U.S. dollar’s rise. The presence of Russian companies within emerging market indices has fallen from 10% in 2007 to 3% this year, as growth prospects and existing debt has become less favorable.

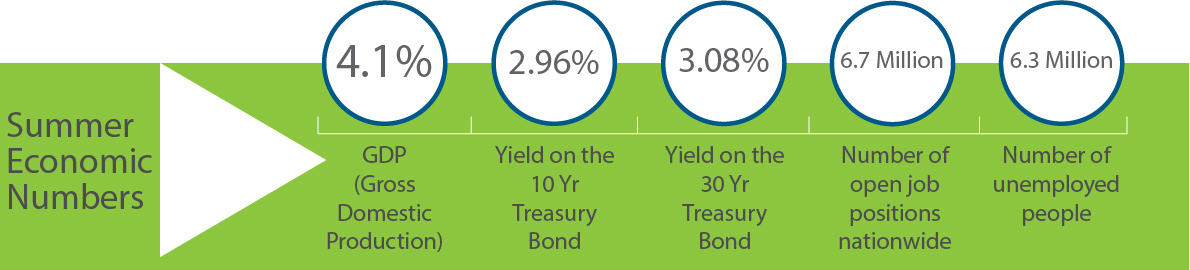

Short-term and long-term rates rose in July as improving economic data drove rates across all maturities higher. The 10-year Treasury yield ended July at 2.96%, extremely close to the yield on the 30-year Treasury at 3.08%.

The U.S. economy grew at a 4.1% annual rate per GDP (Gross Domestic Product) data released by the Commerce Department. The growth rate is the strongest in four years, validating improved business and consumer expansion. Strong consumer spending, increasing business investment, growing exports and additional government expenditures all contributed to an increase in GDP, the value of all goods and services produced across the economy.

A substantial shift with how corporate earnings are achieved occurred this quarter, as expanding earnings are coming primarily from revenue growth rather than from reducing expenses. Economists optimistically view this as an improvement in overall economic expansion due to higher sales and increased demand for products and services nationwide. (Sources: Commerce Dept., U.S. Treasury, Dept. of Labor, Bloomberg)

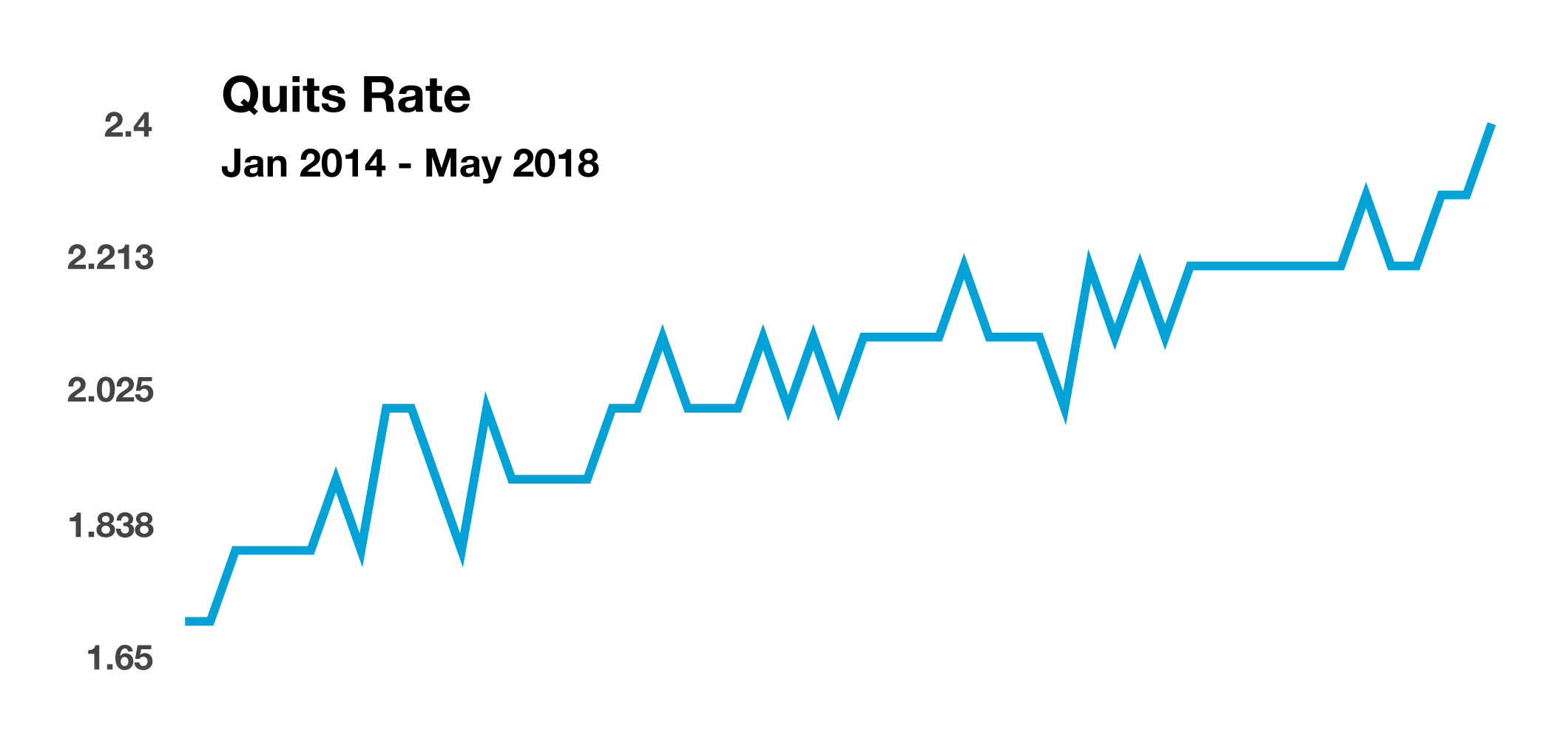

lysts follow the quits rate closely because it reveals how confident workers are. These same workers are also the consumers that the Fed monitors to determine if their confidence is allowing them to spend more, thus lifting economic growth. The most current quits rate rose to 2.4 in May, the highest monthly reading in over 10 years. Following the financial crisis in 2008, the quits rate dropped as workers were less confident in leaving a job they had rather than look for another job opportunity. (Sources: U.S. Labor Department)

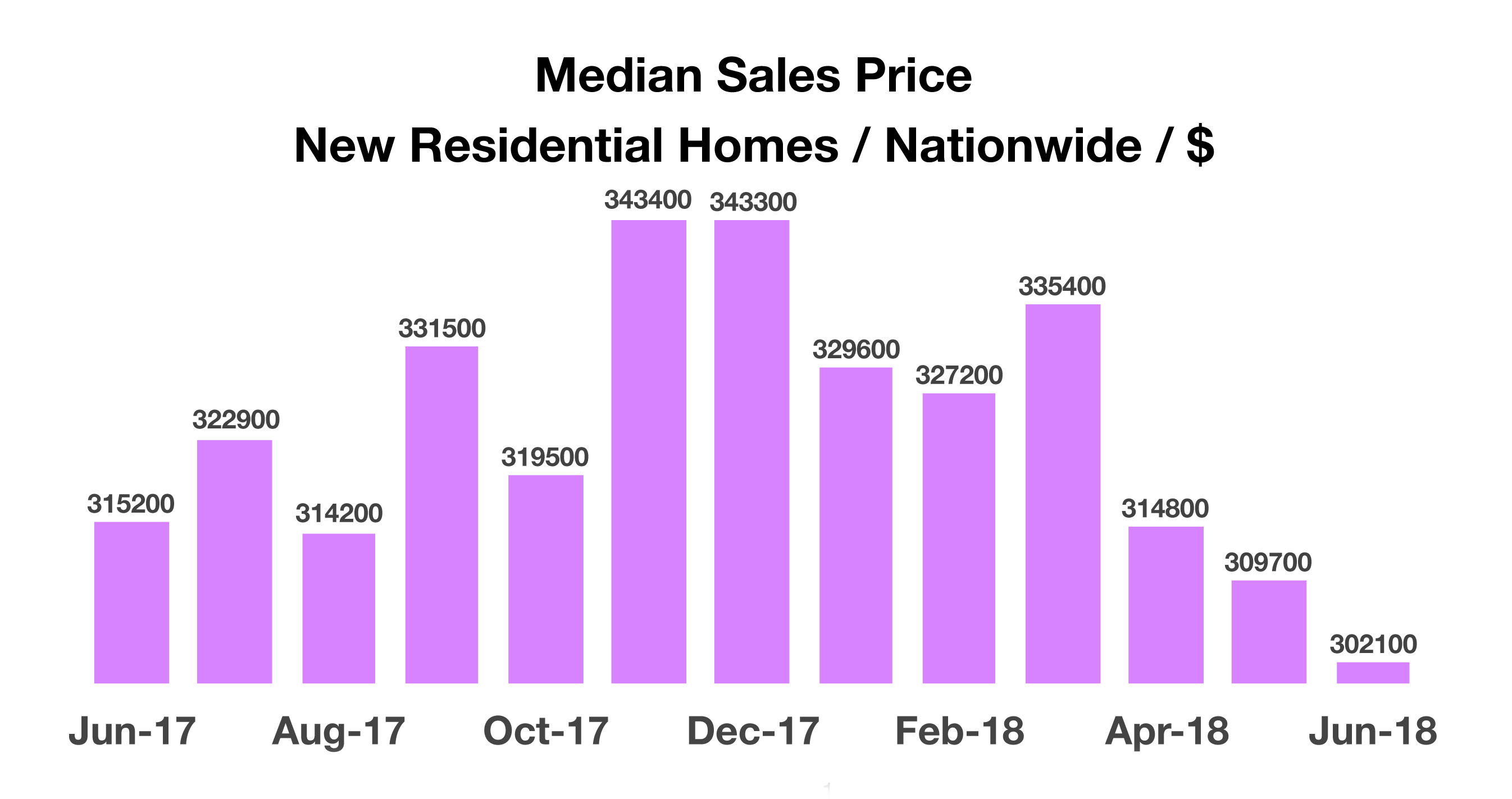

lysts follow the quits rate closely because it reveals how confident workers are. These same workers are also the consumers that the Fed monitors to determine if their confidence is allowing them to spend more, thus lifting economic growth. The most current quits rate rose to 2.4 in May, the highest monthly reading in over 10 years. Following the financial crisis in 2008, the quits rate dropped as workers were less confident in leaving a job they had rather than look for another job opportunity. (Sources: U.S. Labor Department) at is not prevalent with existing home sales.

at is not prevalent with existing home sales.