Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Manager’s Comments – August 27, 2018

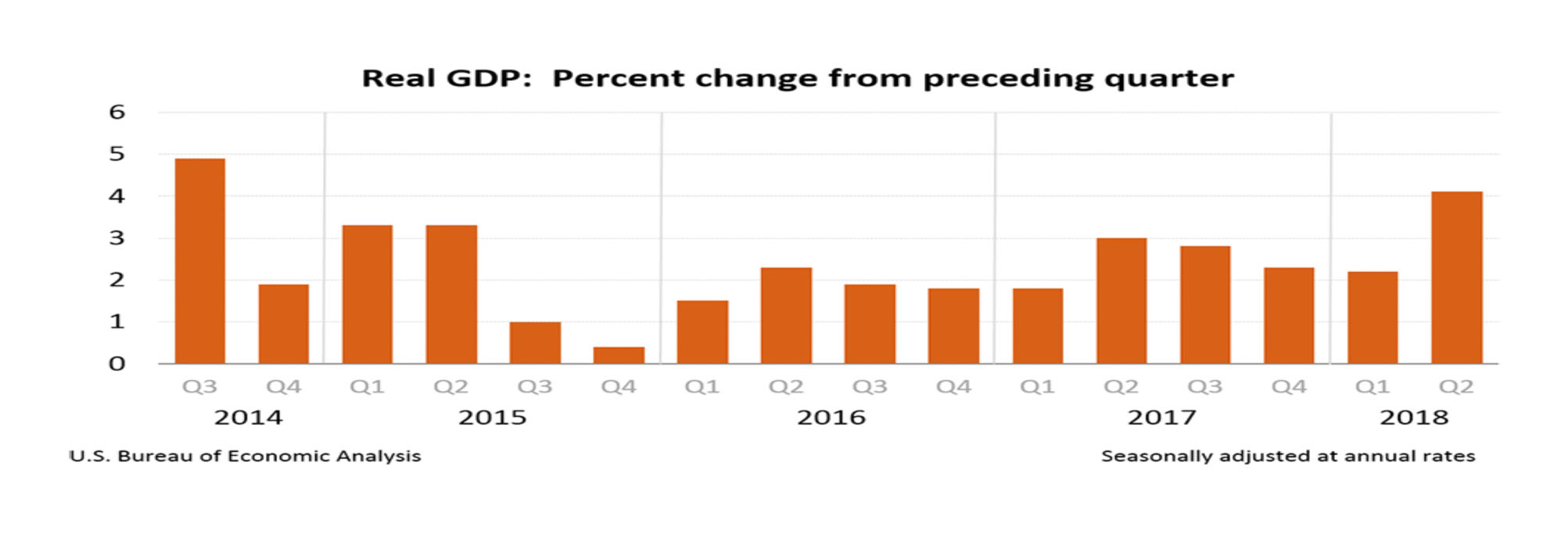

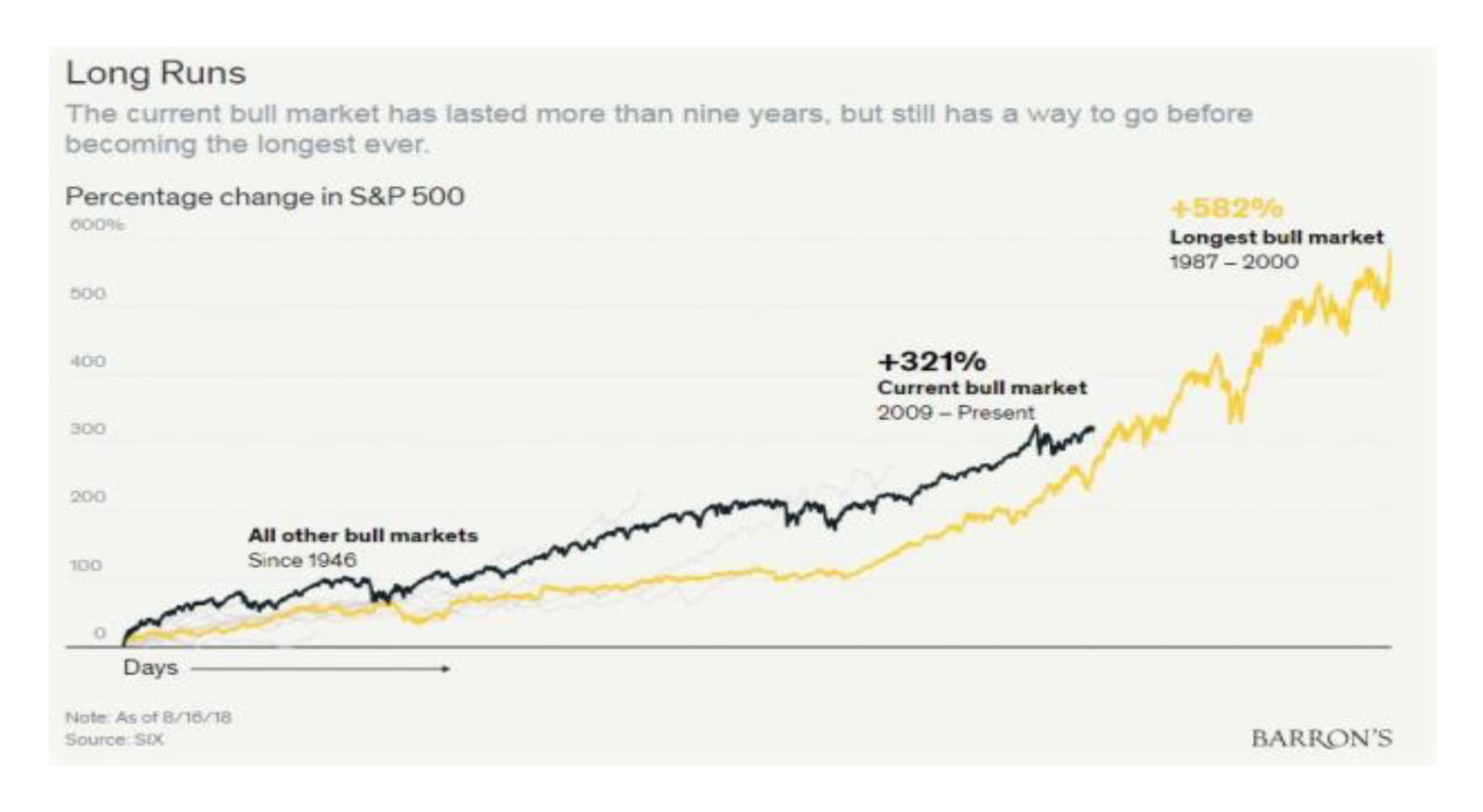

As the Summer lingers on, I hope everyone is enjoying the season and perhaps a well-deserved vacation. Markets are often uneventful during the Summer months. 2018 will go down as an exception. While I would describe current market conditions as stable I also believe sentiment is growing more skeptical. Here are some charts to support this opinion.

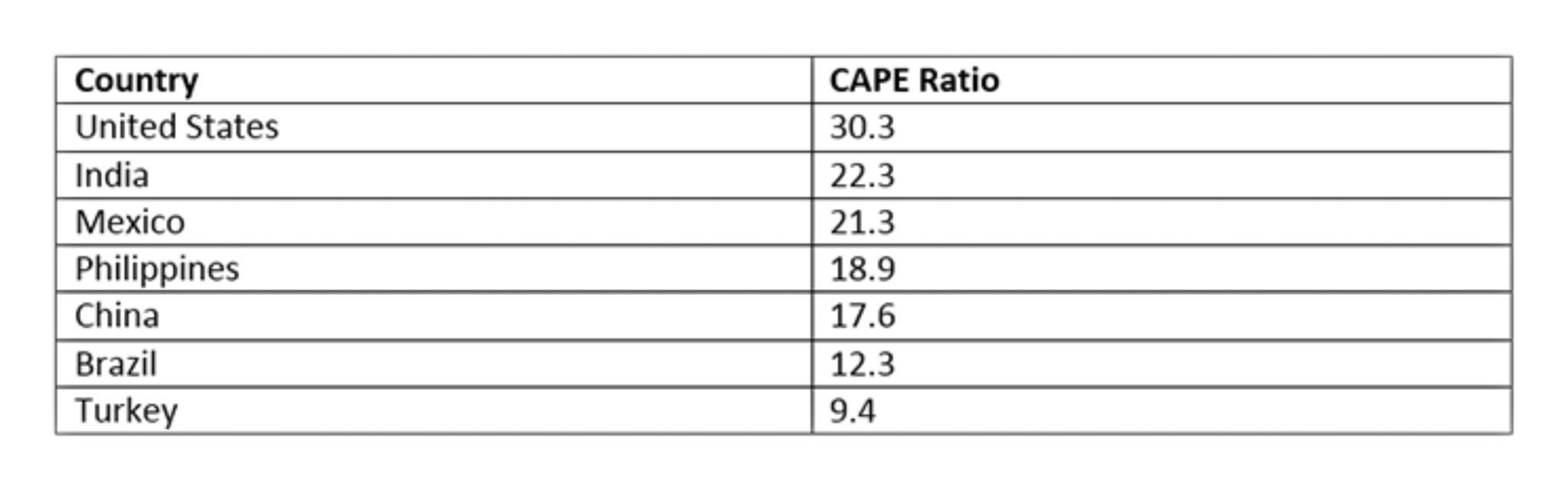

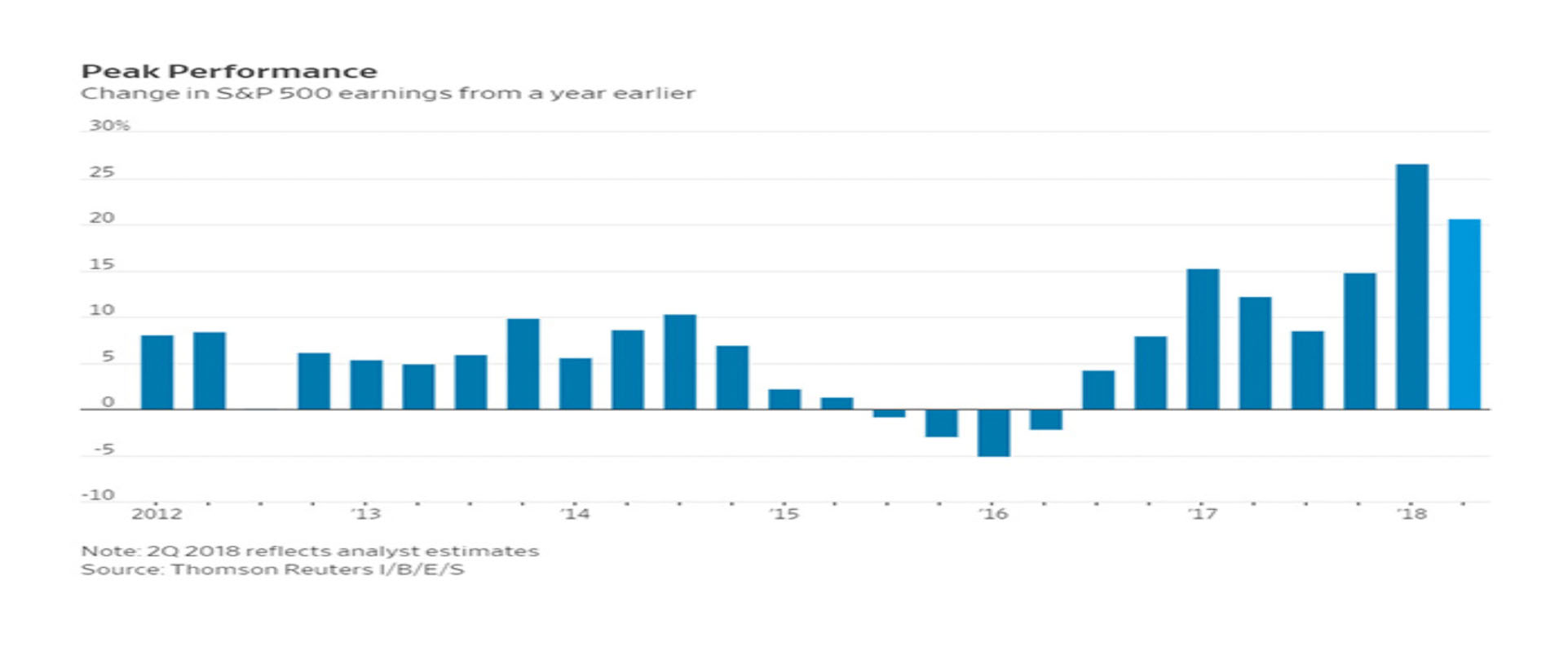

** Markets remain highly-valued. Despite the strong earnings trend, valuations are rich

CAPE stands for – Cyclically Adjusted Price/Earnings Ratio. It represents a leading, historic measurement of overall valuation. Its historic mean is 16. Although I don’t use the CAPE Ratio as a market-timing tool, its extreme level relative to its norm and other similar ratios can’t be ignored. And this indicator is useful in estimating longer-term returns, so I do view it as a potential warning.

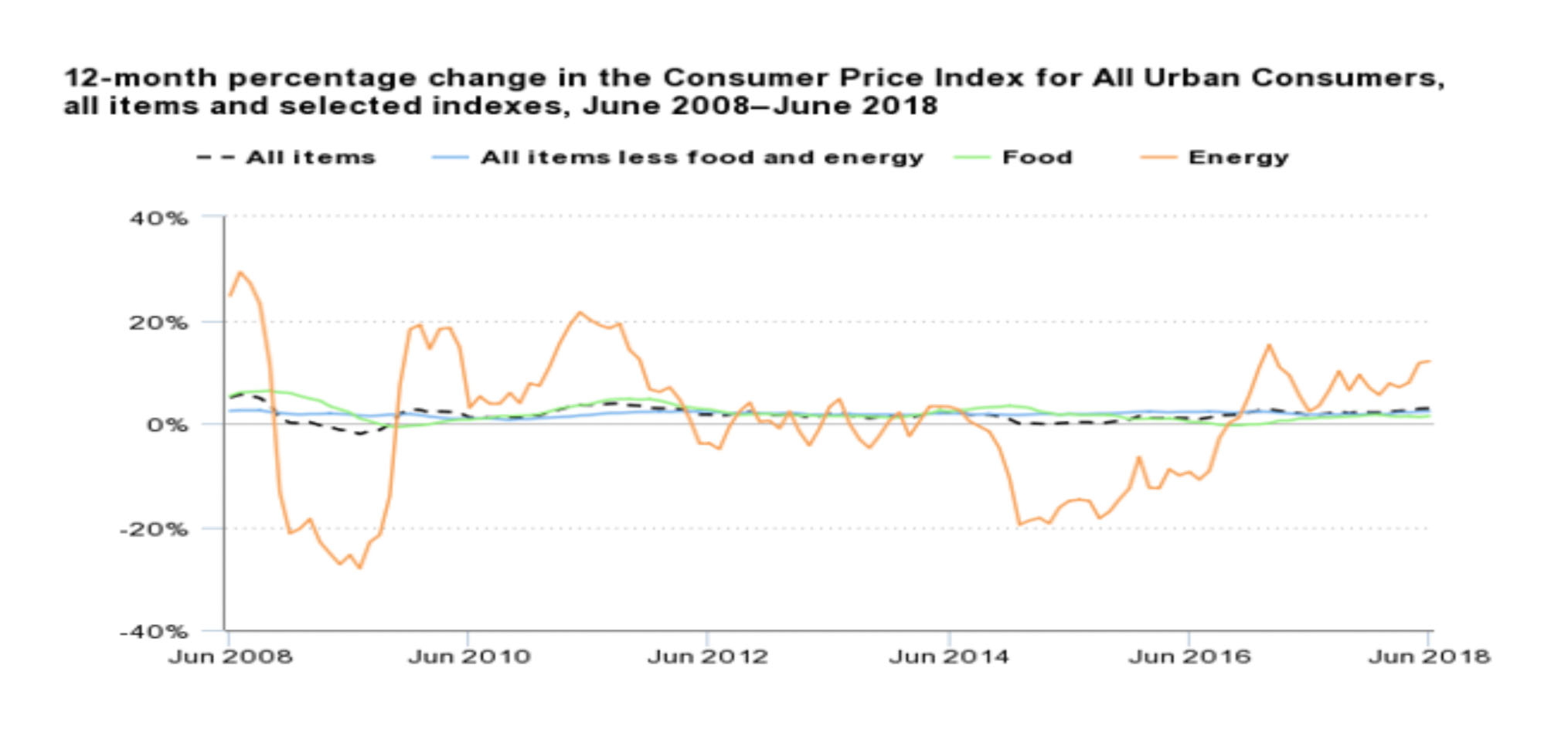

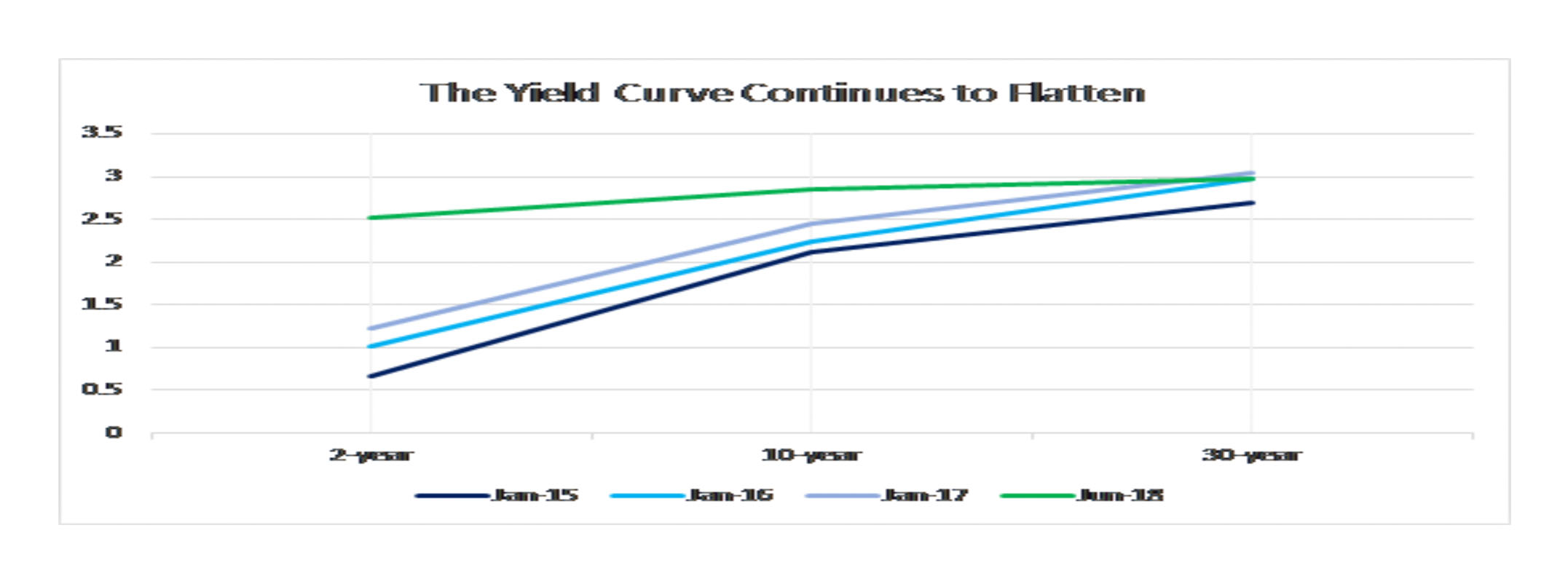

** Inflation and Interest Rates are not an imminent threat to the economy or market

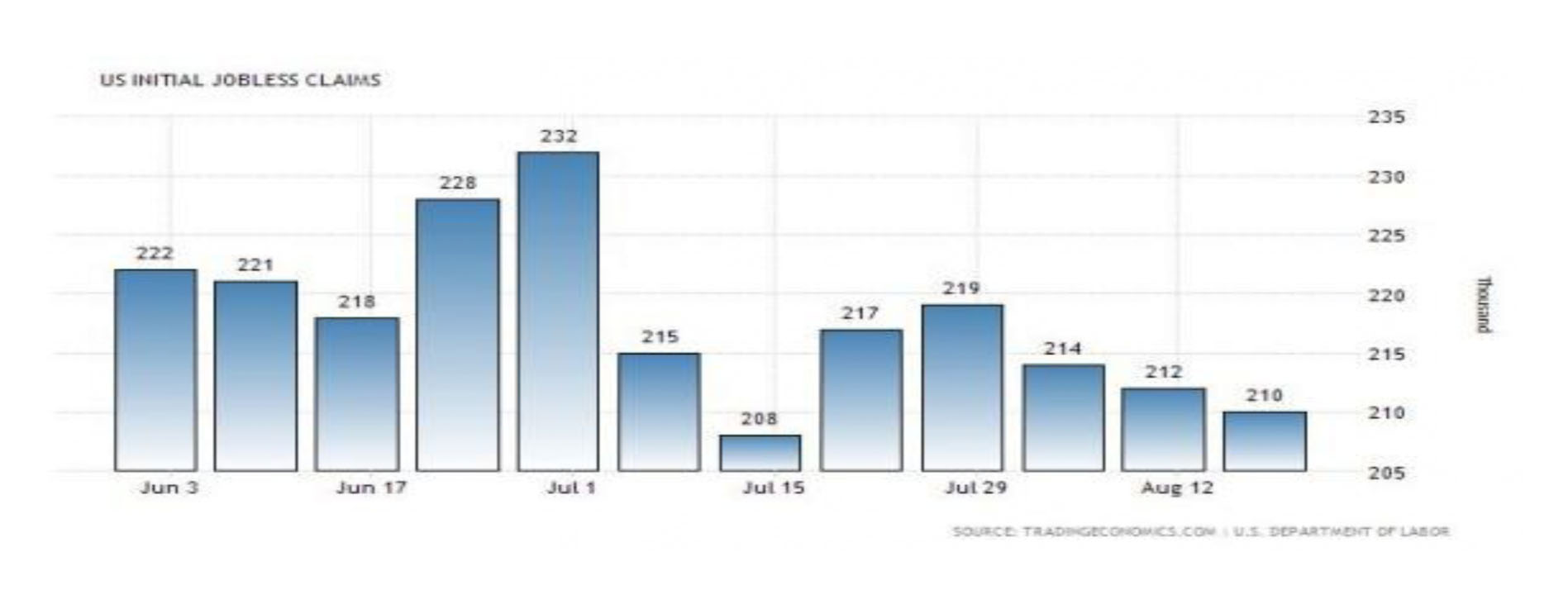

Gasoline prices and some producer input prices have risen. Trade and tariff disputes are minimally impacting business confidence. However, a strong US dollar coupled with minimal wage growth (despite low unemployment) are consumer tailwinds currently. This bears watching but for now, the inflation worry is low. Excepting China, I contend that improved trade relations are imminent.