Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Dear Friends,

With time and discipline, you can make good money investing in the stock market. But the successful families we serve require that our expertise add value in all areas of their financial house, not just by managing stocks and bonds. That is how we preserve your wealth for the future. This frequently requires working with experts in technical areas like tax and law, and in this community we are blessed with many skilled professionals that we partner with. At Sweet Pea earlier this month I was a reminded what a fantastic community we live, work and play in. Thank you Montana, I wouldn’t change a thing!

Is the Market showing more False Summits? This was my 5th Ridge Run that I completed and there was plenty of time to contemplate how these comparisons to our erratic and sometimes punishing stock market seem appropriate. Racing the 20 mile Bridger Ridge is basically a day of false summits and all of the emotions you have room for. In the end, markets go up, blisters heal, and cold beer gets passed around. However, in the short term, we are positioned for more false summits and emotional market swings.

Trade tensions with China continue to dominate the headlines, and the impact is becoming measurable. Trade data from the Commerce Department shows imports from China have declined 12.6% over the past year, yet imports from South Korea, Taiwan, and Vietnam rose 9.2% during the same period. This is a good sign. Efficient global markets adjust to new opportunities and adapt. Time and investment discipline will prevail, again.

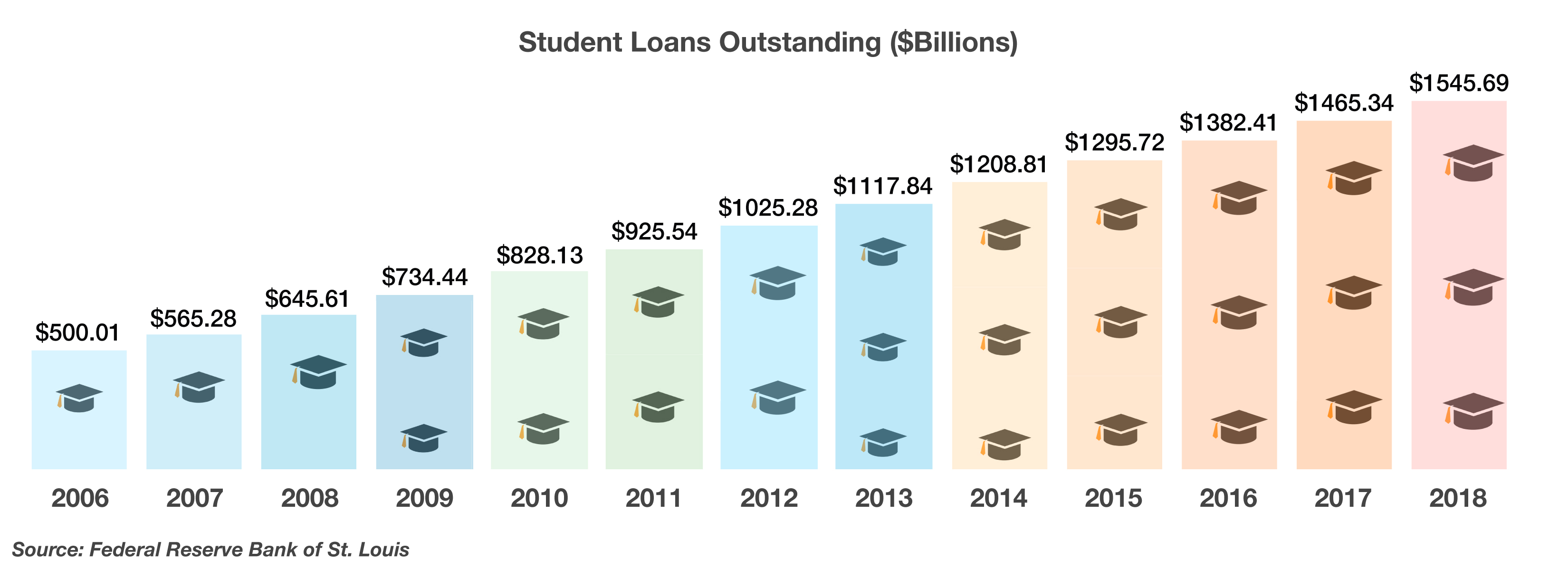

Back to School Alert! Student loan debt has risen to $1.5 Trillion! It is now the second highest consumer debt category (behind only mortgage debt) and higher than both credit cards and auto loans. This debt is reducing home ownership among millennials and generally a big drag on their financial success. College is normally a profitable investment, but borrower beware! We generally suggest you focus first on maximizing retirement savings and reducing debt before saving for college. But there also has to be a plan to make sure any debt for college is repaid, and in short order too!