Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

Trade tensions escalated as the U.S. announced a 10% tariff commencing September 1st on $300 billion of Chinese imports that haven’t yet been subject to any tariffs. The additional tariffs would essentially apply to nearly all imports from China. Another $250 billion in Chinese imports have already been subject to a 25% tariff for the past few months.

Trade data from the Commerce Department shows imports from China have declined 12.6% over the past year, yet imports from South Korea, Taiwan, and Vietnam rose 9.2% during the same period. Other Asian countries are becoming substitute exporters of goods to the U.S. as Chinese exports to the U.S. have been subject to increasing tariffs.

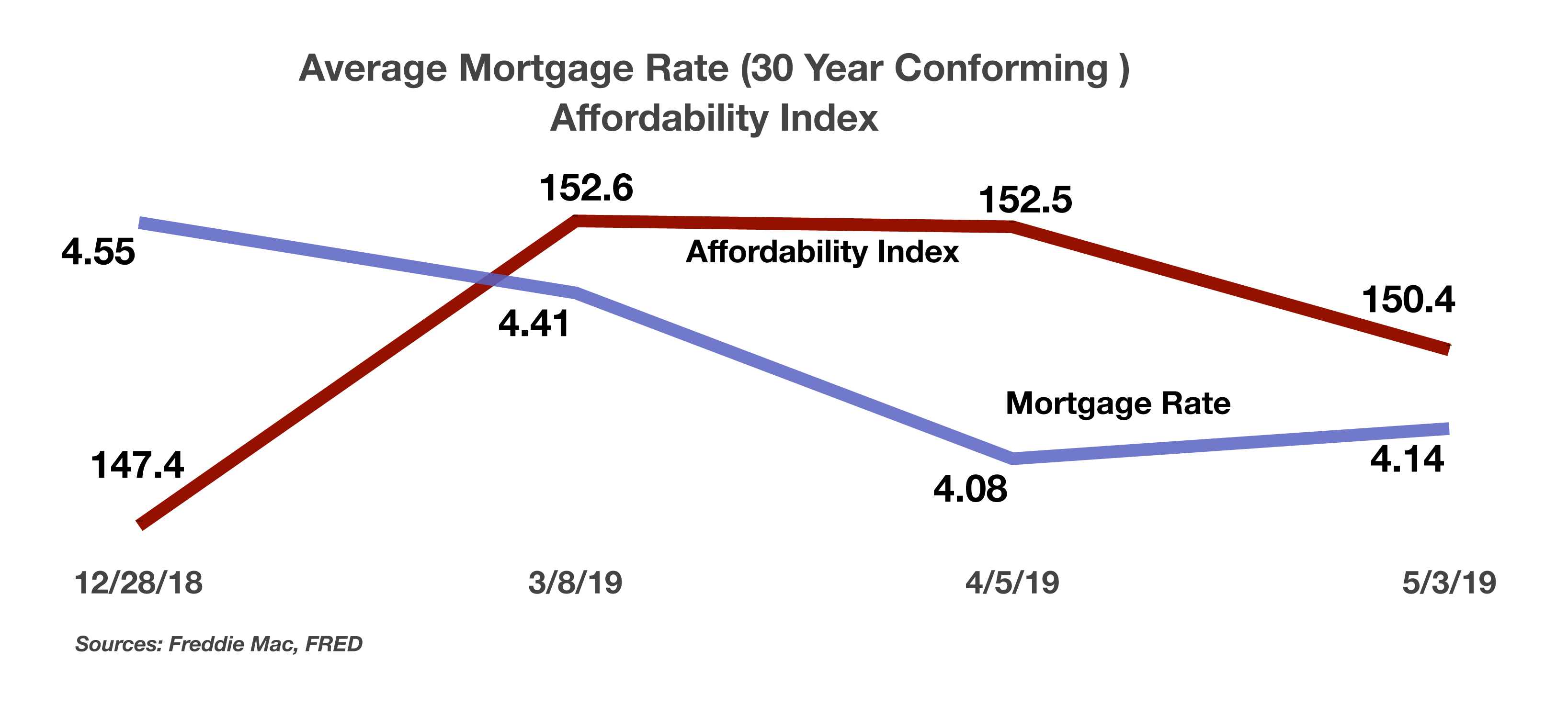

Analysts and economists believe that a continuing low interest rate environment will help to offset the impact of escalating tariffs, as the low cost to borrow for consumers minimizes some of the tariff costs passed along to consumers.

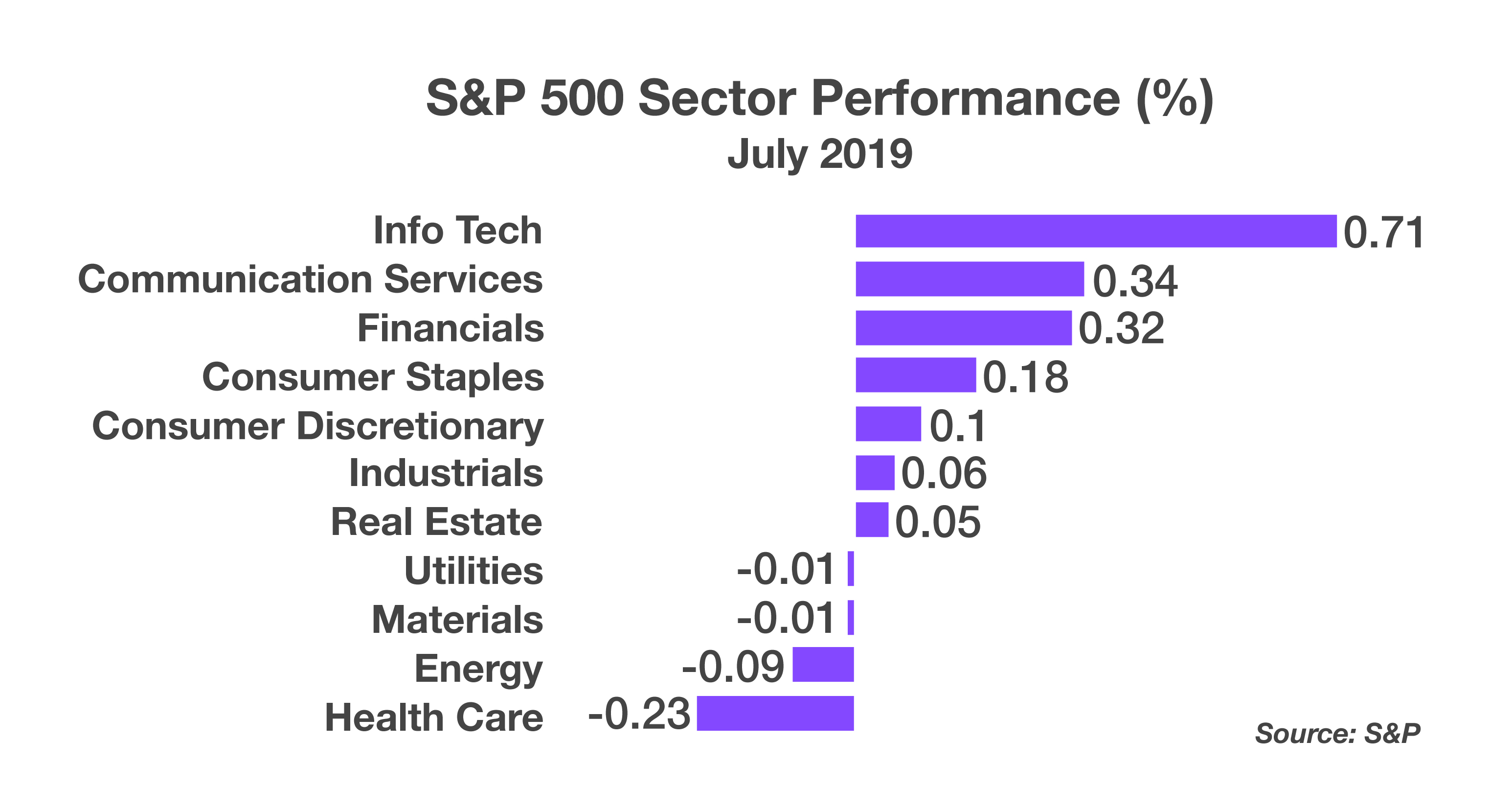

Stock indices climbed in July to reach new record levels, driven by indications that the Federal Reserve was on track for an imminent rate cut. Equity and bond markets continued to move higher following a strong June, propelled by improved earnings and gradual economic expansion.

The newly elected Prime Minister of the United Kingdom is positioning the country for departure from the EU, also known as Brexit, on October 31st. Britain’s exit from the EU has several other European countries closely monitoring how the exit will be orchestrated. The British currency, the pound, has fallen to its lowest levels against the euro since September 2017.

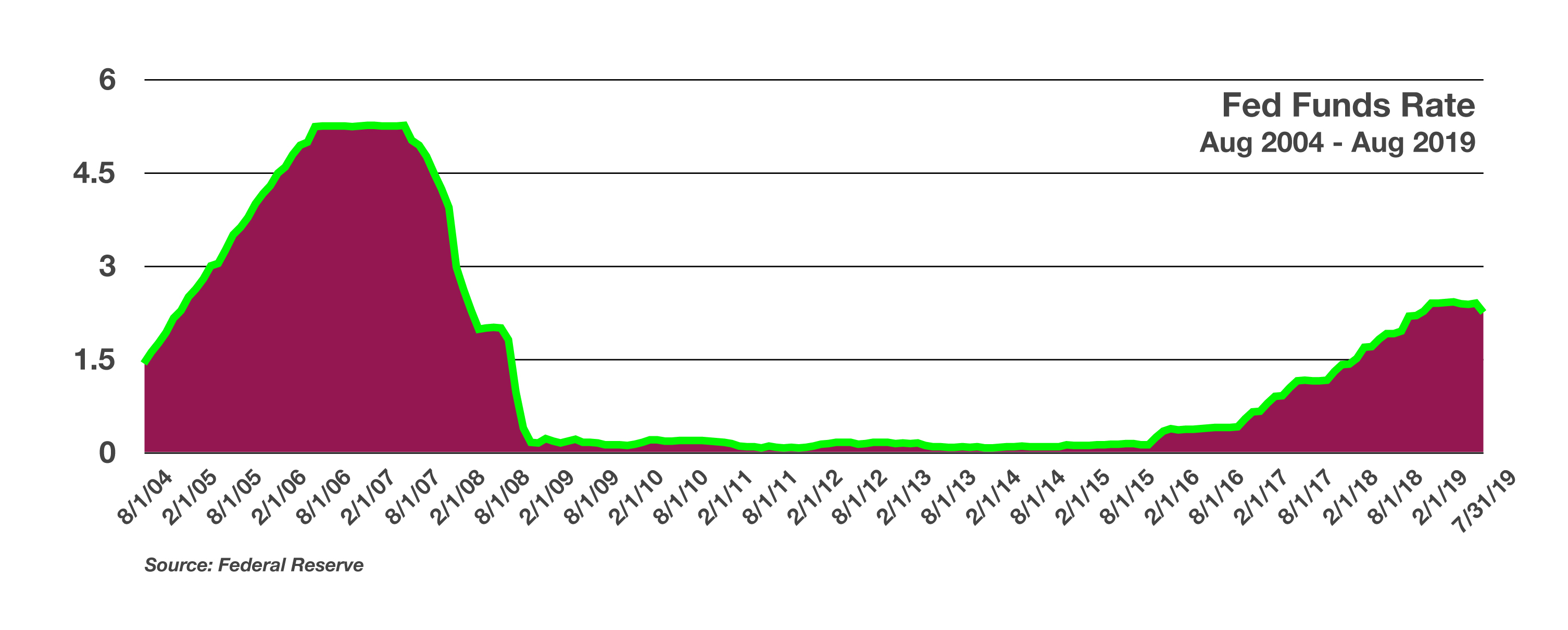

The Federal Reserve cut the Fed Funds rate on July 31st, making it the first rate cut since 2008. Markets pulled back as the Fed Chairman signaled that additional rate cuts were not expected to be ongoing. The rate reduction follows a series of gradual rate increases that began in 2015. The Fed Funds rate is a monetary policy tool used by the Federal Reserve to control the interest rate charged by banks for funds loaned amongst each other. It eventually affects consumer loans and mortgage rates as banks adjust to the modified Fed Funds environment.

Even as the 10-year Treasury yield fell below 2.00% in July, it is still offering a more attractive yield than most other developed country government bonds. Yields for 10-year government bonds in Germany and Japan yielded -0.44% and -0.16% respectively. Such negative yields mean that investors are basically paying the governments of Germany and Japan to hold on to their funds. The U.S. economy has thus far not participated in the international slowdown prevalent in other countries. Stimulus efforts by the central banks around the world have lowered rates to where $14 trillion of global bonds are generating negative yields.

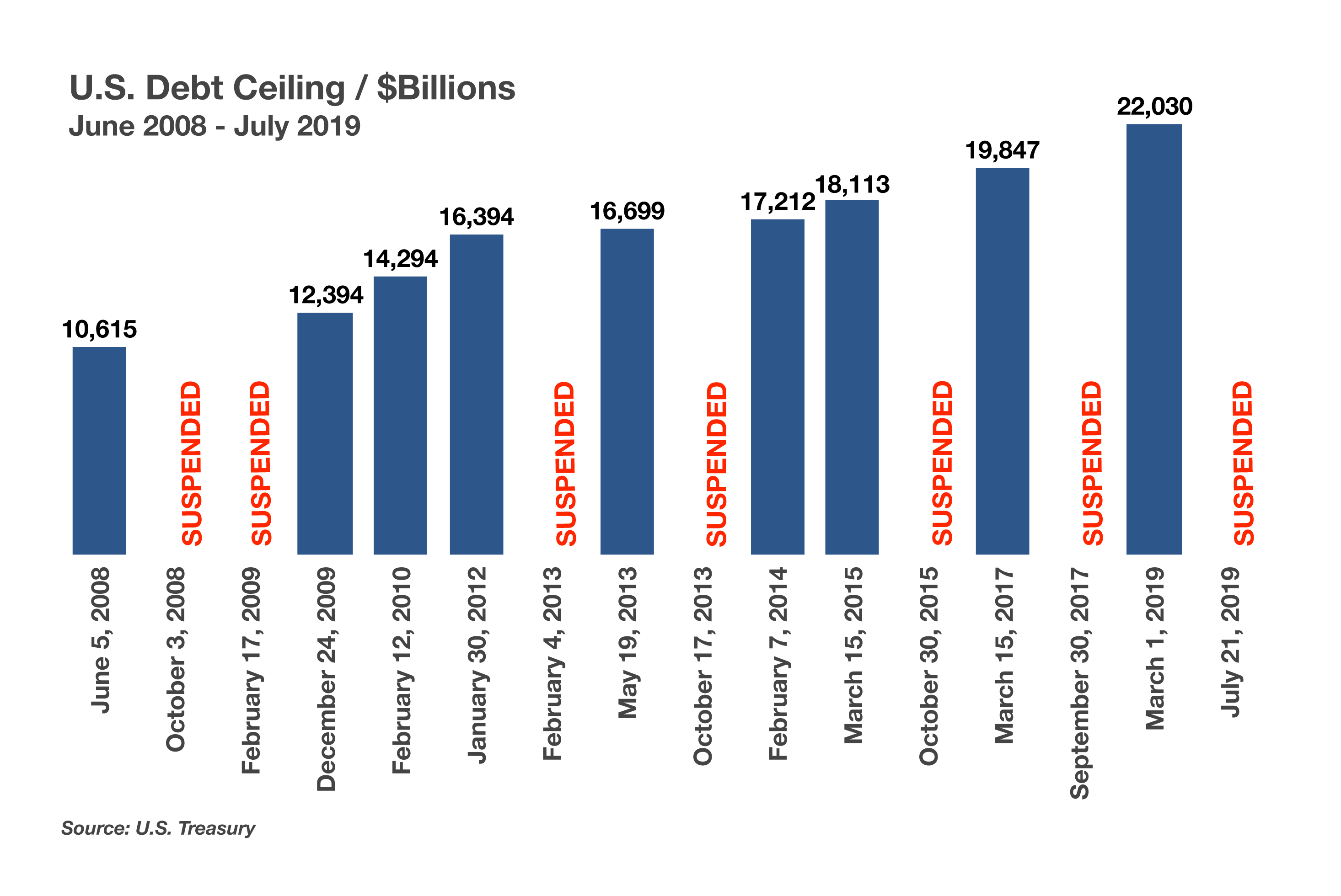

The Senate passed legislation to suspend the debt limit for two years through July 31, 2021, eliminating the risk of default until the Senate votes on increasing it again in 2021. The existing limit as of the suspension currently exceeds $22 trillion, nearly double from where it was 10 years ago. (Sources: Commerce Department, Federal Reserve, Bloomberg, U.S. Treasury Department, TreasuryDirect.gov)

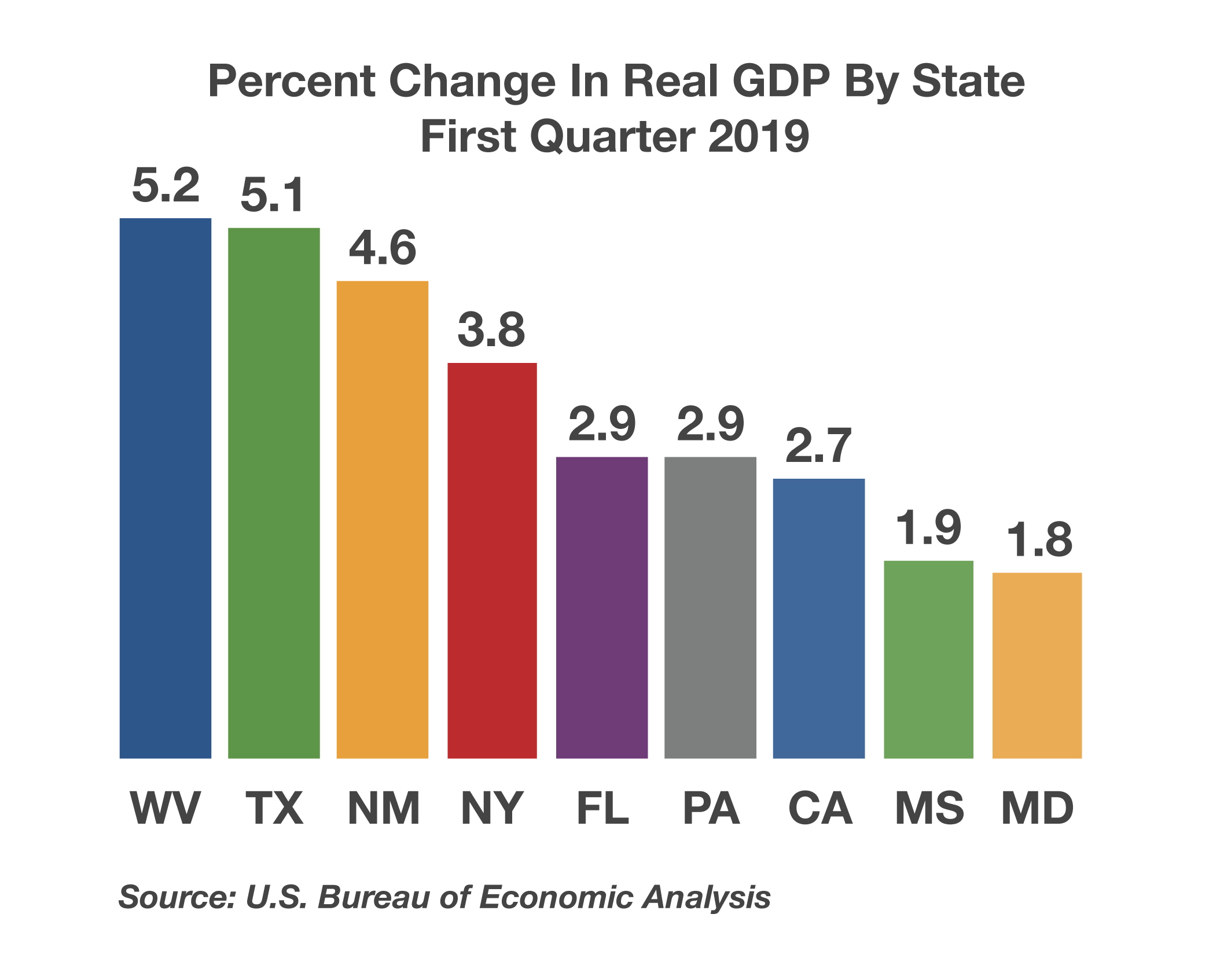

States with older populations and less qualified workers are seeing less growth and even an exodus of people. New Jersey, Maryland, Mississippi and Hawaii were among the slowest growth states in the first quarter, where demographics and the cost of living influence the local economies more than other states.

States with older populations and less qualified workers are seeing less growth and even an exodus of people. New Jersey, Maryland, Mississippi and Hawaii were among the slowest growth states in the first quarter, where demographics and the cost of living influence the local economies more than other states.