Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

August 2019

Macro Overview

Trade tensions escalated as the U.S. announced a 10% tariff commencing September 1st on $300 billion of Chinese imports that haven’t yet been subject to any tariffs. The additional tariffs would essentially apply to nearly all imports from China. Another $250 billion in Chinese imports have already been subject to a 25% tariff for the past few months.

Trade data from the Commerce Department shows imports from China have declined 12.6% over the past year, yet imports from South Korea, Taiwan, and Vietnam rose 9.2% during the same period. Other Asian countries are becoming substitute exporters of goods to the U.S. as Chinese exports to the U.S. have been subject to increasing tariffs.

Analysts and economists believe that a continuing low interest rate environment will help to offset the impact of escalating tariffs, as the low cost to borrow for consumers minimizes some of the tariff costs passed along to consumers.

Stock indices climbed in July to reach new record levels, driven by indications that the Federal Reserve was on track for an imminent rate cut. Equity and bond markets continued to move higher following a strong June, propelled by improved earnings and gradual economic expansion.

The newly elected Prime Minister of the United Kingdom is positioning the country for departure from the EU, also known as Brexit, on October 31st. Britain’s exit from the EU has several other European countries closely monitoring how the exit will be orchestrated. The British currency, the pound, has fallen to its lowest levels against the euro since September 2017.

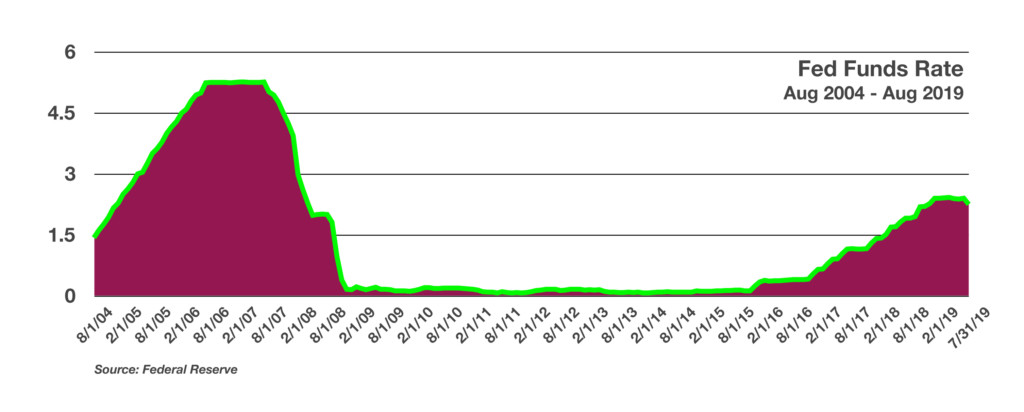

The Federal Reserve cut the Fed Funds rate on July 31st, making it the first rate cut since 2008. Markets pulled back as the Fed Chairman signaled that additional rate cuts were not expected to be ongoing. The rate reduction follows a series of gradual rate increases that began in 2015. The Fed Funds rate is a monetary policy tool used by the Federal Reserve to control the interest rate charged by banks for funds loaned amongst each other. It eventually affects consumer loans and mortgage rates as banks adjust to the modified Fed Funds environment.

Even as the 10-year Treasury yield fell below 2.00% in July, it is still offering a more attractive yield than most other developed country government bonds. Yields for 10-year government bonds in Germany and Japan yielded -0.44% and -0.16% respectively. Such negative yields mean that investors are basically paying the governments of Germany and Japan to hold on to their funds.

The U.S. economy has thus far not participated in the international slowdown prevalent in other countries. Stimulus efforts by the central banks around the world have lowered rates to where $14 trillion of global bonds are generating negative yields.

The Senate passed legislation to suspend the debt limit for two years through July 31, 2021. The suspension of the debt limit will eliminate the risk of default until the Senate votes on increasing it again in 2021.

Sources: Commerce Department, Federal Reserve, Treasury Department

Low Rates & Improved Earnings Send Stocks To Highs In July – Equity Overview

While stocks were driven by a Fed rate cut expectation in July, earnings also became a focal point as economic weakness abroad and a strong dollar have created a challenge for earnings of U.S. multinational firms.

U.S. corporate earnings have proven to be more resilient than expected as earnings beat expectations for a swath of companies in the equity indices. The ability for companies to continue earnings increases in a slow growth environment is optimistic for the equity markets.

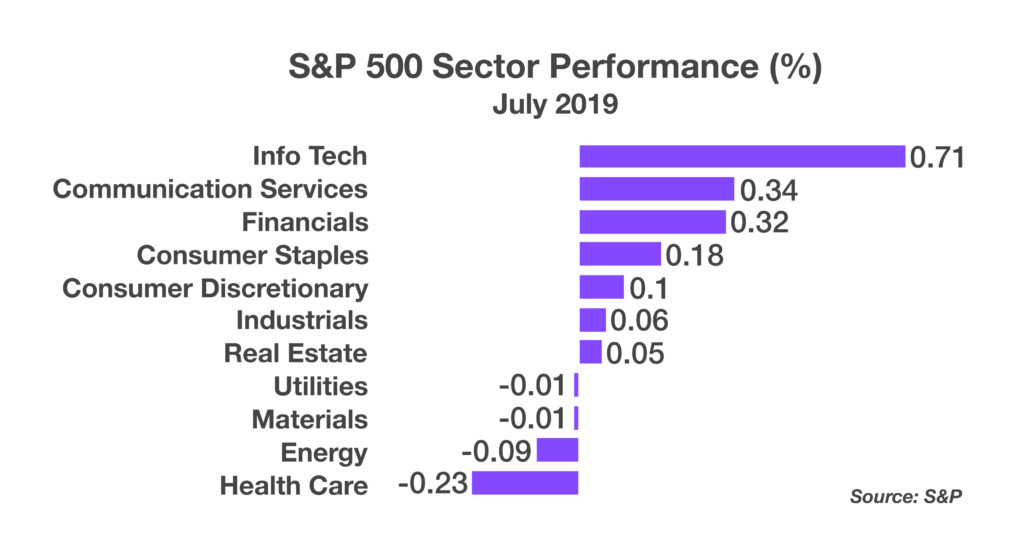

Sectors leading the equity markets in July included Information Technology, Communication Services, and Financials. Driven by better than expected earnings and revenue growth, the sectors were also influenced by the low rate environment and continuing consumer demand.

Sources: S&P, Federal Reserve

Rates Drop Further – Fixed Income Overview

Fed Chair Jerome Powell communicated that the reduction in the Fed Funds rate was not going to be a series of reductions, but rather a wait and see approach contingent on economic progress over the next few months.

The Fed’s reduction to the Fed Funds rate was the first since 2008 when the financial crisis had begun. The Fed Funds rate was essential zero from the end of 2008 to the beginning of 2016 when the Fed started raising the target rate again.

The 10-year Treasury yield dropped in July to its lowest level since 2016 as markets assessed the Fed Chairman’s comments surrounding any possible rate cuts over the next few months. The Fed Funds futures market is pricing in a near certain possibility of another rate reduction in September 2019.

Negative interest rates outside the U.S., combined with expectations of weaker economic growth and minimal inflation, have weighed on long-term Treasury bond yields.

Sources: Federal Reserve, U.S. Treasury

Mortgage Rates Drop But Homes Are Still Expensive – Housing Market Review

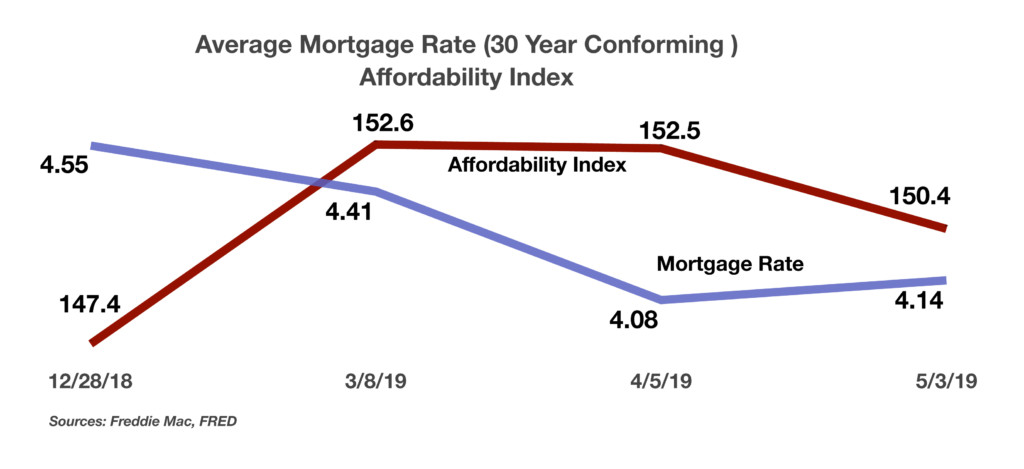

Falling interest rates have prompted an increase in mortgage activity as the cost to borrow for home buyers has become less expensive. Mortgage rates fell in late July to the lowest levels since late 2016, with the average on a 30-year fixed rate conforming loan falling to 3.75%, down from 4.94% in November 2018.

The challenge for many homebuyers has been rising home prices and affordability throughout the country. Slow rising wages and stagnant incomes have, for the most part, not kept up with rising home prices. Even though mortgage rates have dropped, housing prices are still elevated to the levels that force many to wait or rent until housing prices drop.

Data tracked by the Federal Reserve Bank of St. Louis and Freddie Mac reveal that even as mortgage rates fell since the beginning of the year, affordability still declined. Affordability is the ability of a homebuyer to purchase a home and pay for all related expenses with an existing income.

Mortgages accounted for two-thirds of the $13.67 trillion in U.S. household debt in the first quarter. Because they are typically paid off over decades, mortgage rates tend to be correlated with 10-year Treasury bond yields rather than with the short-term rates controlled by the Federal Reserve.

Sources: Federal Reserve Bank of St. Louis, Freddie Mac

Social Security Scams

An increase in fraudulent calls from people claiming to be from the Social Security Administration have taken different forms with the intent to obtain sensitive information.

Individuals are receiving phone calls displaying the Social Security Administration’s (SSA) phone number on caller ID. The callers are reportedly attempting to obtain personal information, including Social Security numbers. If you receive this type of call, you should not engage with the caller or provide personal information or payment in response to any requests or threats.

A caller-ID “spoofing” scheme misusing the Social Security Administration (SSA) Office of the Inspector General’s (OIG) Fraud Hotline phone number. The OIG has received recent reports of phone calls displaying the Fraud Hotline number on a caller-ID screen. OIG employees do not place outgoing calls from the Fraud Hotline 800 number. You should not engage with these calls or provide personal information.

Fraudulent phone calls from people claiming to be from SSA. Recent reports have indicated that unknown callers are using increasingly threatening language. The callers say that due to improper or illegal activity with your Social Security number (SSN) or account, you will be arrested or face other legal action if they fail to call a provided phone number to address the issue. You should not engage with these calls or provide any personal information.

Calls displaying 1-800-772-1213, SSA’s national customer service number, as the incoming number on caller ID. People who have accepted these calls said the caller identifies as an SSA employee. In some cases, the caller states that SSA does not have all of the person’s personal information, such as their Social Security number (SSN), on file. Other callers claim SSA needs additional information so the agency can increase the person’s benefit payment, or that SSA will terminate the person’s benefits if they do not confirm their information. This appears to be a widespread issue, as reports have come from citizens across the country.

Source: Office of the Inspector General; Social Security Admin., https://oig.ssa.gov/newsroom/scam-awareness

**Market Returns: All data is indicative of total return which includes capital gain/loss and reinvested dividends for noted period. Index data sources; MSCI, DJ-UBSCI, WTI, IDC, S&P. The information provided is believed to be reliable, but its accuracy or completeness is not warranted. This material is not intended as an offer or solicitation for the purchase or sale of any stock, bond, mutual fund, or any other financial instrument. The views and strategies discussed herein may not be appropriate and/or suitable for all investors. This material is meant solely for informational purposes, and is not intended to suffice as any type of accounting, legal, tax, or estate planning advice. Any and all forecasts mentioned are for illustrative purposes only and should not be interpreted as investment recommendations.