Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

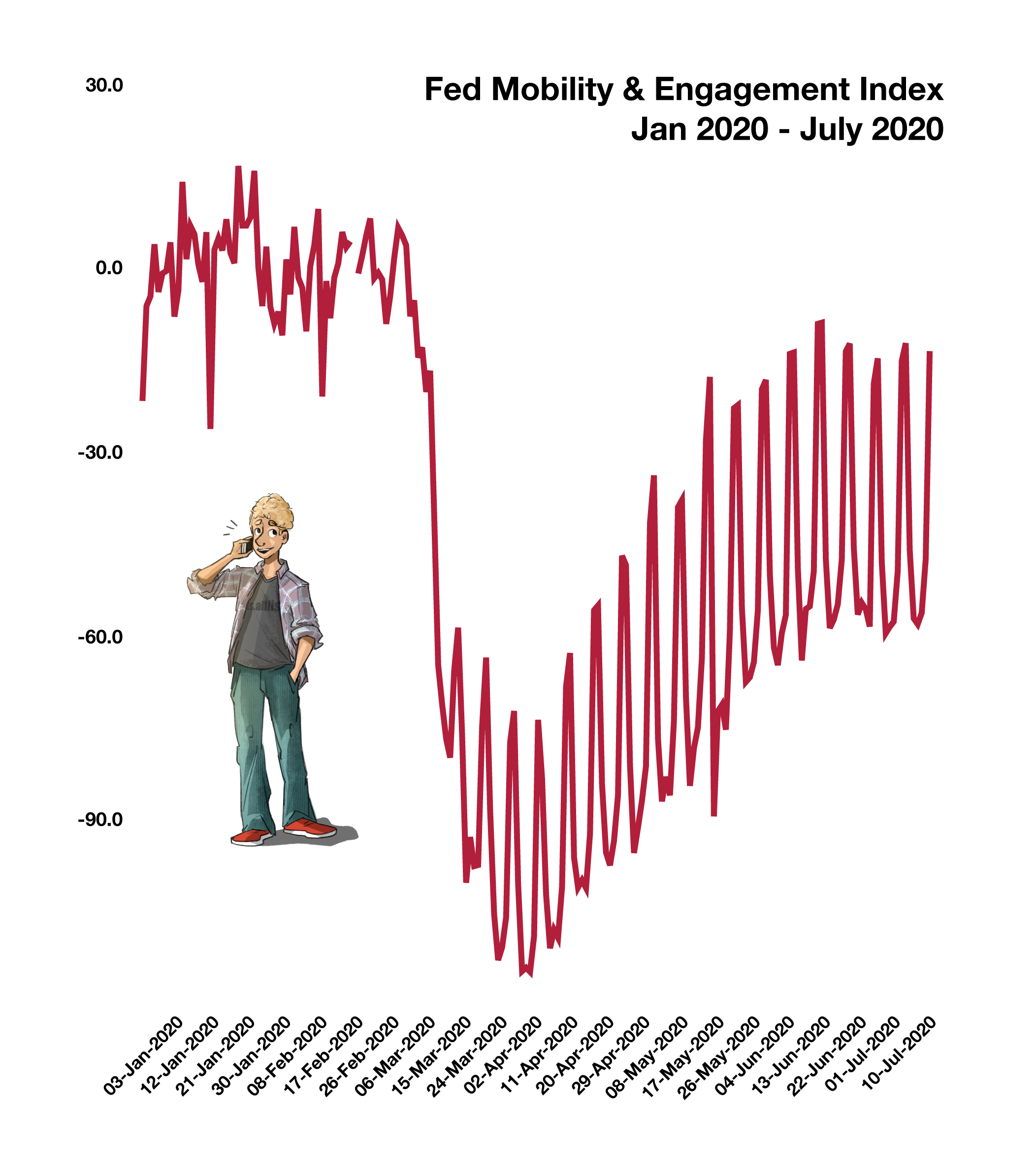

A second wave of mandatory business closures that transpired throughout the country is expected to have more challenging ramifications for many employers than the first wave of shutdowns. The amount of stimulus funds and stimulus programs available to small businesses and individuals was substantial following the initial wave of closures and lock downs in March and April, yet benefits from a second stimulus batch is not expected to be as generous.

Tensions with China escalated as the U.S. State Department identified several Chinese spies accused of gathering sensitive data on coronavirus research as well as absconding with intellectual property. The latest occurrences leave trade negotiations with China in question, which had already been lingering since the pandemic began in March.

Equities rose higher in July driven by decent earnings for U.S. companies and the expectation of successful vaccine trials by several pharmaceutical firms. A rise in viral infections nationwide along with a rollback of re-openings by some states and cities pose a threat of halting a desperately anticipated economic growth spurt.

Congress sought to diffuse an income cliff as provisional government stimulus benefits expired at the end of July. A second stimulus plan is expected to be composed differently than its predecessor, but also targeted towards small businesses and the unemployed.

Gold and silver both reached new highs in July driven by global pandemic concerns and recent tensions surrounding the relations between China and the United States. Gold surpassed its previous high set in 2011 and silver achieved a six-year high.

GDP for the second quarter ending June 30th, shrank by an annualized rate of 32.9%, the lowest quarterly drop on record. A substantial drop was anticipated by economists and analysts. An economic slowdown was even more prevalent in Europe, where GDP within the EU fell by over 48% on an annualized basis.

The Centers for Disease Control and Prevention (CDC) reiterated the importance of re-opening schools in the fall for the benefit of families nationwide. The CDC noted that death rates among school-aged children are much lower than among adults, while the risks attributed to shut down schools affect social, emotional, behavioral health, economic well-being, and the academic achievement of children. Working families are finding it increasingly difficult to work and care for their children at home during the pandemic, especially with school closures. (Sources: CDC, Federal Reserve, BEA, State Dept.)