Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview – August 2021

An increase in confirmed Delta variant cases globally reignited concerns about reimplementation of quarantines and social distancing restrictions. The rise in newly verified cases come as European countries had started to relax restrictions in place for nearly a year. In the United States, renewed mandates by the Centers For Disease Control & Prevention (CDC) are being criticized by some and welcome by others.

Economists believe that much of the economic growth thus far in 2021 has been attributed to business reopenings, vaccination efforts, and government provided financial assistance. More recent concerns now surround a slowing rate of vaccinations, reinstating Covid restrictions along with possible shut downs for certain areas. Numerous employers and government agencies are starting to require that employees be vaccinated before returning to work.

Rates changed course in early July as doubts about a global recovery and concerns surrounding the Delta variant impeded economic growth projections. Falling interest rates can be an indicator of slowing economic expectations.

Fallout from the pandemic left roughly 811 million undernourished people in 2020, according to the United Nations. World hunger is now outpacing population growth, reaching the highest levels since 2005 as Covid-19 curbed incomes and access to food. Rising food prices globally have placed an additional burden on hundreds of millions of people worldwide.

Inconsistencies and varying mandates among cities and states are making it difficult for businesses and schools to plan for Covid related mandates. Requirements to wear masks as well as to be fully vaccinated to attend schools and public areas has become a politically charged debate.

Sequencing data has become essential to help determine how infectious mutations of Covid-19 are spread and what precautions to take. The complex automated process basically breaks down the DNA structure of an organism revealing how to mitigate its exposure and neutralize it. The process assists biotech and pharmaceutical companies in developing booster shots for existing vaccines.

Natural gas prices rose to multiyear levels as demand increased for electricity generation as a result of elevated summer temperatures throughout the country. Natural gas powers nearly half the electric power plants nationwide, as well as heats millions of homes and businesses during the winter months.

As of the end of July, roughly 50% of the American population had been fully vaccinated as reported by the CDC, encompassing over 163 million people. It is believed that a larger fully vaccinated population may help limit the destructiveness of a probable wave of Delta infections. Federal Reserve member Mary Daly said that the spread of the Delta variant along with low vaccination rates in certain regions of the world pose a threat to the global recovery. She also voiced caution in curtailing stimulus efforts for the U.S. economy.

Data for the U.S. Census Bureau revealed that 15% of people in renter-occupied housing are behind on their rental payments, double pre-pandemic levels. A federal moratorium on evictions extended to July 31st may pose a hardship to renters nationwide.

Arabica coffee beans, the benchmark for the price of coffee worldwide, had its largest price drop since 2008 as supply concerns were lifted. Turbulent weather in Brazil and export issues in Columbia and Vietnam drove prices higher towards the middle of 2020. Lower coffee prices are expected along with an increase in coffee consumption this year, according to the USDA.

Sources: U.S. Census Bureau, USDA, Fed, EIA, U.N., CDC

Rates Pulled Back In July – Fixed Income Overview

Treasury bond yields fell as markets reacted to increasing infections globally. The 10-year Treasury bond yield closed at 1.24% on July 31st, down from 1.45% at the end of June.

The Fed voiced concerns surrounding the Delta mutation and how it might impact economic activity. Monetary support in place since the pandemic began will not start to diminish until “substantial further progress” is made the Fed announced. Plans to indirectly start raising rates are being held back by the Fed until conditions essentially improve.

Sources: U.S. Treasury, Federal Reserve

Stocks Advanced Cautiously In July – Domestic Equity Overview

Concerns surrounding the Delta variant and rapid rise in infections drove equity volatility higher as economic and earnings growth estimates were redrawn. Equity markets were resilient to reestablishments for some Covid restrictions. A lack of clarity produced by recent Delta infections may hinder earnings that were more representative of pre-Delta infections.

Major equity indices advanced cautiously in July as certain industries may reverse direction with the Delta variant inhibiting recent progress made, including travel, leisure, and restaurants. Regardless, major equity indices traded higher in July as recovery expectations and post pandemic momentum temporarily fueled the market.

Sources: Bloomberg, Reuters

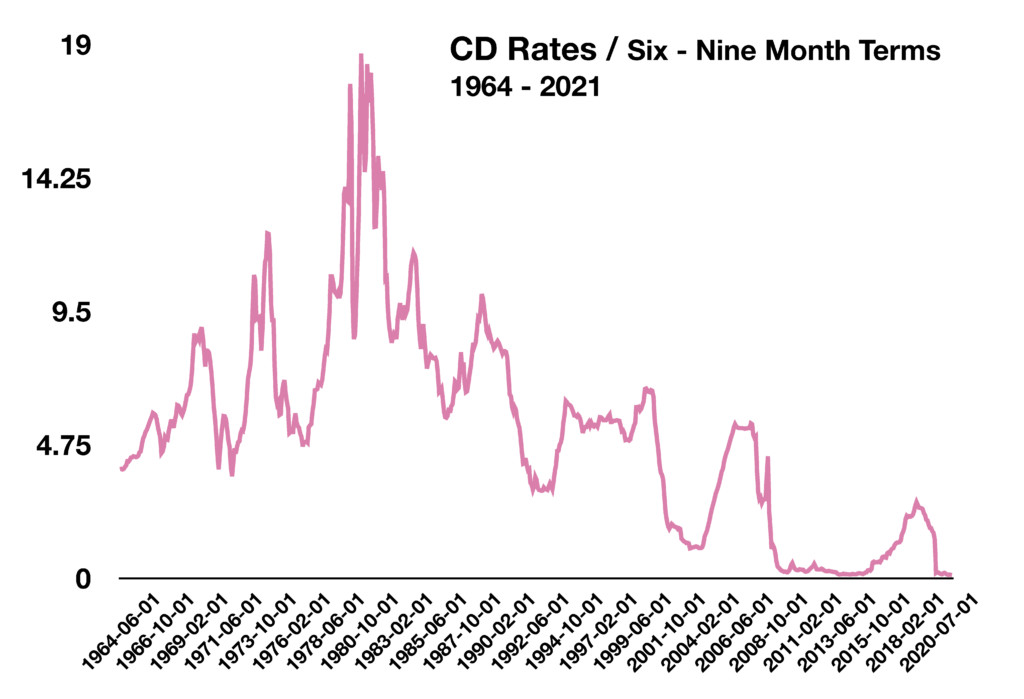

CD Rate History – Historical Note

Not since the days of inflation and high interest rates have Certificates of Deposits (CDs) been perceived as a viable source of income for retirees and conservative savings for working individuals.

For years, banks used CDs as primary marketing products to attract new customers and help build deposit bases. As rates fell substantially, CDs became less attractive, incentivizing banks to find other products to sell. The historically low rates of today have created CD yield wars with rates from .25% to 1.00%, rates not seen since 2002.

Contrary to what most people think, a CD isn’t as liquid as many believe. Banks restrict access to the funds until the maturity date of the investment and impose penalties for early withdrawals.

Data compiled by both the FDIC and the Federal Reserve over the decades has carefully tracked CD rates offered by banks nationwide. The average 3-month CD as of this past month has a rate of 0.09%, a fraction of a comparable 3-month CD in 1983.

The primary drawback of using CDs as an investment is that a fixed rate over a short period of time doesn’t produce the growth that stocks may produce over a long period of time. So when a 3-month CD paid 13.78% in 1979, the inflation rate of 13.3% that same year translated into earning a meager half percentage difference in real terms net of inflation. The challenge today, even with low inflation relative to 1979, is that the average 3, 6, and 12-month CD rate is still below the current rate of inflation.

Source: Federal Reserve Bank of St. Louis

Benefits Of A Trust Versus A Will – Estate Planning

A properly drafted will or trust is essential for anyone that has assets to leave to heirs. Either a will or a trust allows you to designate anyone you wish as beneficiaries. Both a will and a “revocable living trust” allow you to identify who the heirs to your assets will be.

The main difference between the two is that assets held in a trust will avoid probate upon one’s passing, which is inhibitive to the heirs and costly. A trust structured as a revocable living trust can help shelter family assets from taxes by properly placing assets within the trust. For 2021, the first $11.7 million (per individual) $23.4 million (per married couple) is excluded from estate taxes with any assets over that amount taxed at the Federal Estate Tax Rate.

If you own property in another state, a living trust eliminates the need to probate that property in that state. A living trust can immediately transfer management of your property if you become incapacitated either physically or mentally. There is no need to go to court to appoint a guardian or conservator.

If you choose to create a living trust, you should also create what is called a pour-over will. It provides for the distribution of any property that is not included in the trust. It will also allow you to name a guardian for any minor children.

Source: IRS

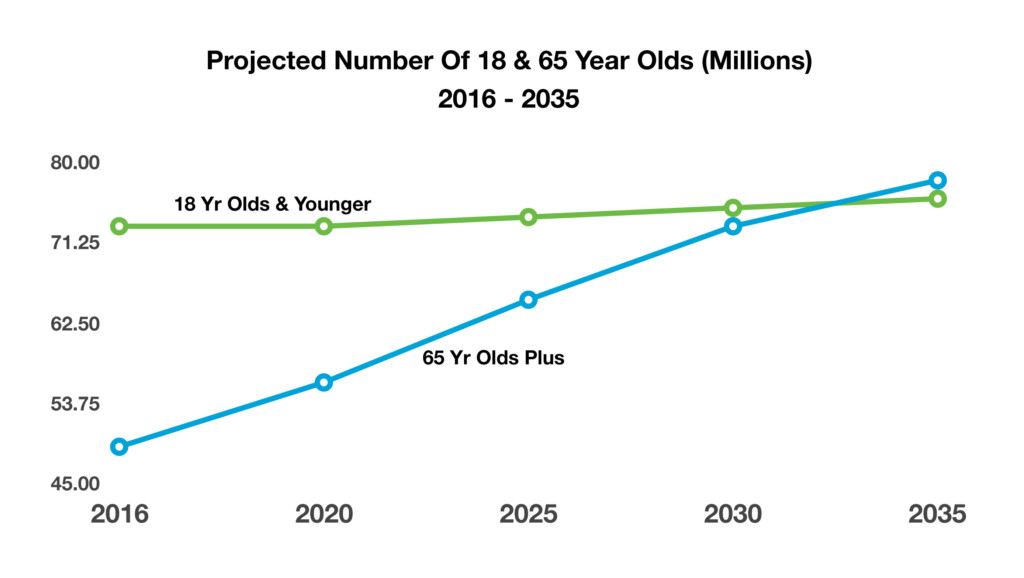

65-Year Olds Projected To Exceed 18-Year Olds – Domestic Demographics

Demographics and population data are carefully tracked by the Census Bureau in order to better determine what the United States may look like in the future.

Over 73 million minors, under 18 years of age, currently out number 46 million older Americans, 65 and over. Younger citizens help spur economic growth and provide essential workers for the labor market. The demographical make-up of the country has been driven by the baby boom generation for decades. Those born between 1946 – 1964 have shaped the economic status of our country while providing economic growth and vitally skilled workers. The first wave of baby boomers reached 65 years of age in 2011, starting a massive shift of individuals from working status to retirement status.

The Census Bureau estimates that by 2035, those age 65 and older will begin to out number 18 years old and under. The number of 65-year olds and older will rise much faster than those 18 and younger creating a strain on the U.S. job market and economy. By 2050, it is estimated that there will be nearly 90 million Americans aged 65 and older. The shrinking pool of minors will eventually lead to lower population growth thus creating a drag on economic growth. A growing elderly population is expected to impact already strained Medicare and Social Security benefits.

Source: U.S. Census Bureau

Tax Repercussions Of The Child Tax Credit – Tax Planning

This past month, around mid-July, millions of Americans received a tax credit deposit to their bank accounts. This was a surprise for many, yet part of the pandemic relief program that slated billions to eligible families with children.

In March of this year, Congress expanded the child tax credit to $3,600 per child for the year, from $2,000. The increased credit was in response to the financial fallout of the pandemic in order to assist families nationwide across all income brackets. The IRS made the first of six monthly payments in July to all eligible families.

The tax credits are based on the most recent tax return filed, so if 2020 hadn’t been filed yet, then payments were based on 2019 tax returns. There is an income phase out at $75,000 for single filers and $150,000 for most married filers. Above these income limits, the tax credit phases out or reduces by $50 for every $1000 of additional income.

Tax repercussions can occur should income be higher than the initial tax return used by the IRS. So if income is higher in 2020 than in 2019, which the IRS may have used for calculation, then taxes may be owed or a portion of the tax credit disallowed.

The maximum tax credit for 2021 is $3,600 for each child under age 6 and $3,000 for each child ages 6-17 through December 31, 2021. Half of the total credit amount will be paid in advance monthly payments starting July 15, 2021 and the other half will be credited when 2021 income tax returns are filed. In order to avoid a possible tax consequence from the advance payments, the IRS is allowing taxpayers to unenroll from the advance monthly payments. The IRS link to unenroll is https://www.irs.gov/credits-deductions/child-tax-credit-update-portal.

Sources: IRS, TaxPolicyCenter

**Market Returns: All data is indicative of total return which includes capital gain/loss and reinvested dividends for noted period. Index data sources; MSCI, DJ-UBSCI, WTI, IDC, S&P. The information provided is believed to be reliable, but its accuracy or completeness is not warranted. This material is not intended as an offer or solicitation for the purchase or sale of any stock, bond, mutual fund, or any other financial instrument. The views and strategies discussed herein may not be appropriate and/or suitable for all investors. This material is meant solely for informational purposes, and is not intended to suffice as any type of accounting, legal, tax, or estate planning advice. Any and all forecasts mentioned are for illustrative purposes only and should not be interpreted as investment recommendations.