Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

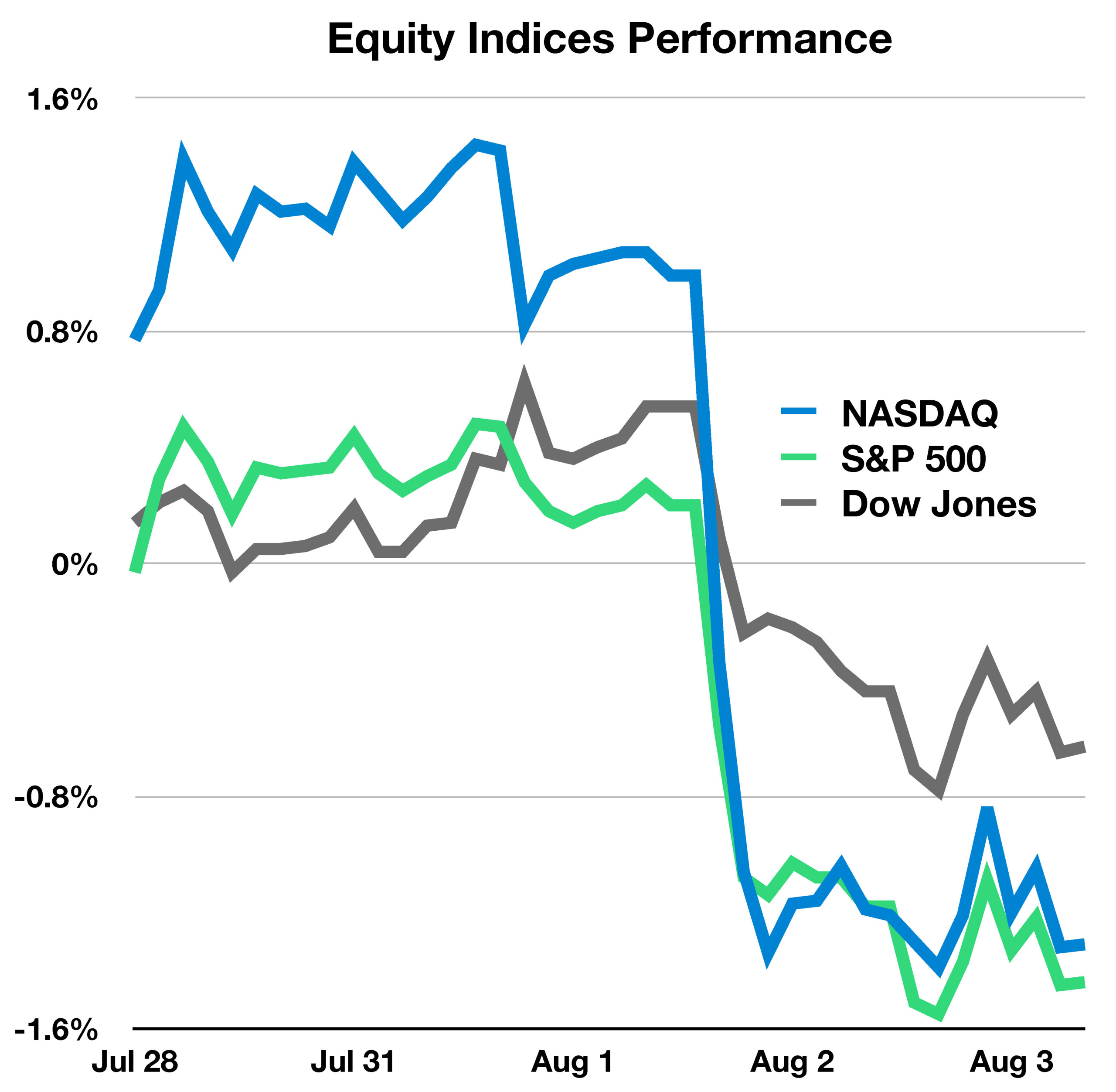

The rating on U.S. government debt was cut from AAA to AA+ by Fitch, one of the three major credit rating agencies. Standard & Poor’s, another primary rating agency, cut its rating on U.S. government debt to AA+ in 2011, which was the first ever downgrade below AAA. Fitch’s reasoning for the downgrade includes a growing federal debt burden, fiscal deterioration, political gridlock, and eroding governance.

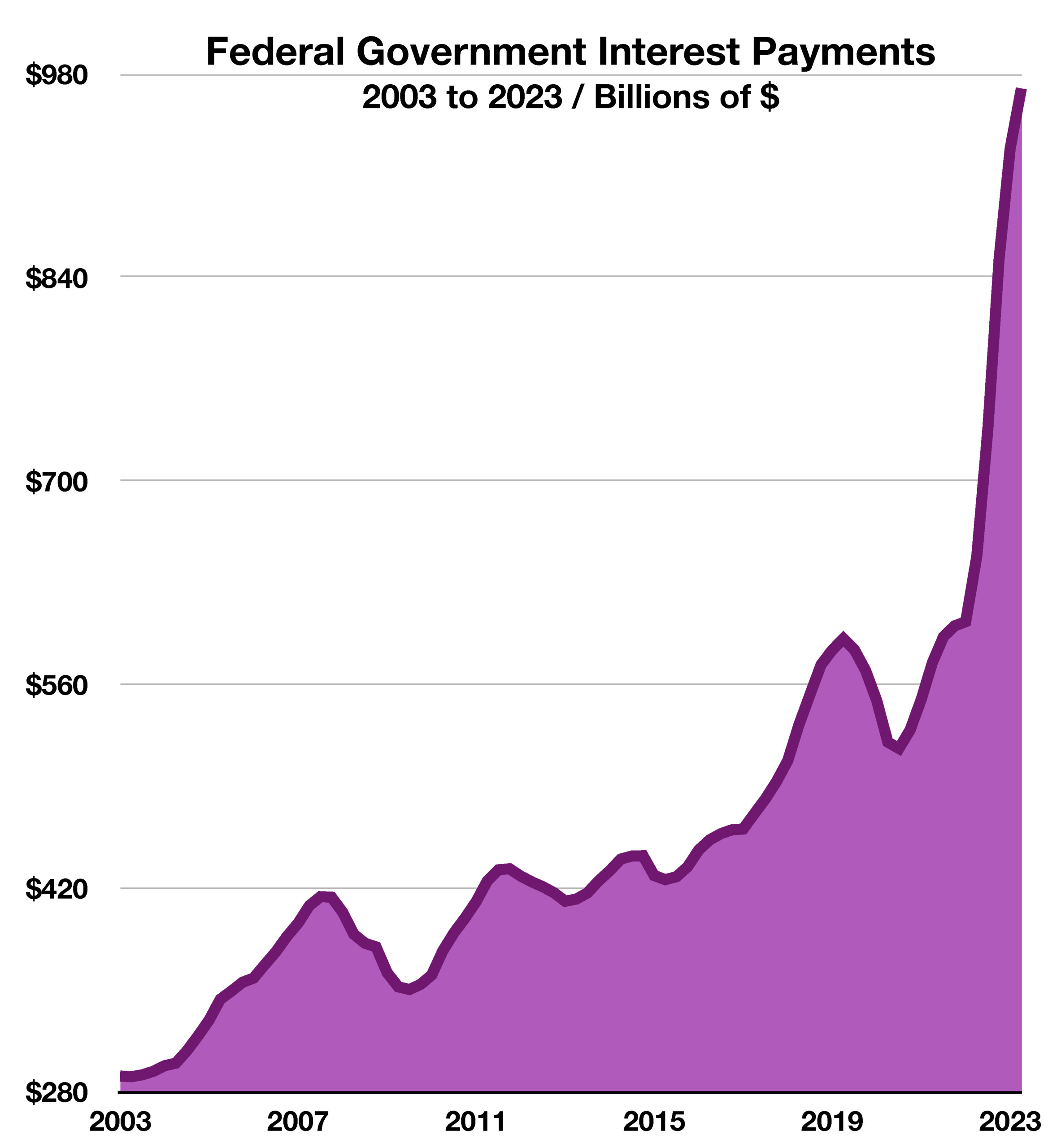

Lower credit ratings make it more costly for the U.S. government to borrow money and issue debt, indirectly raising bond yields on U.S. Treasuries. The recent rise in rates has increased the amount of interest that the government pays, increasing from roughly $520 billion quarterly in 2020 to over $900 billion quarterly in 2023.

U.S. banks are also coming under closer scrutiny by rating agencies as their exposure to commercial real estate loans continues to evolve as a concern. Rising rates on commercial real estate loans along with weaker demand for office and industrial space have intensified the risk of defaults and liquidity constraints.

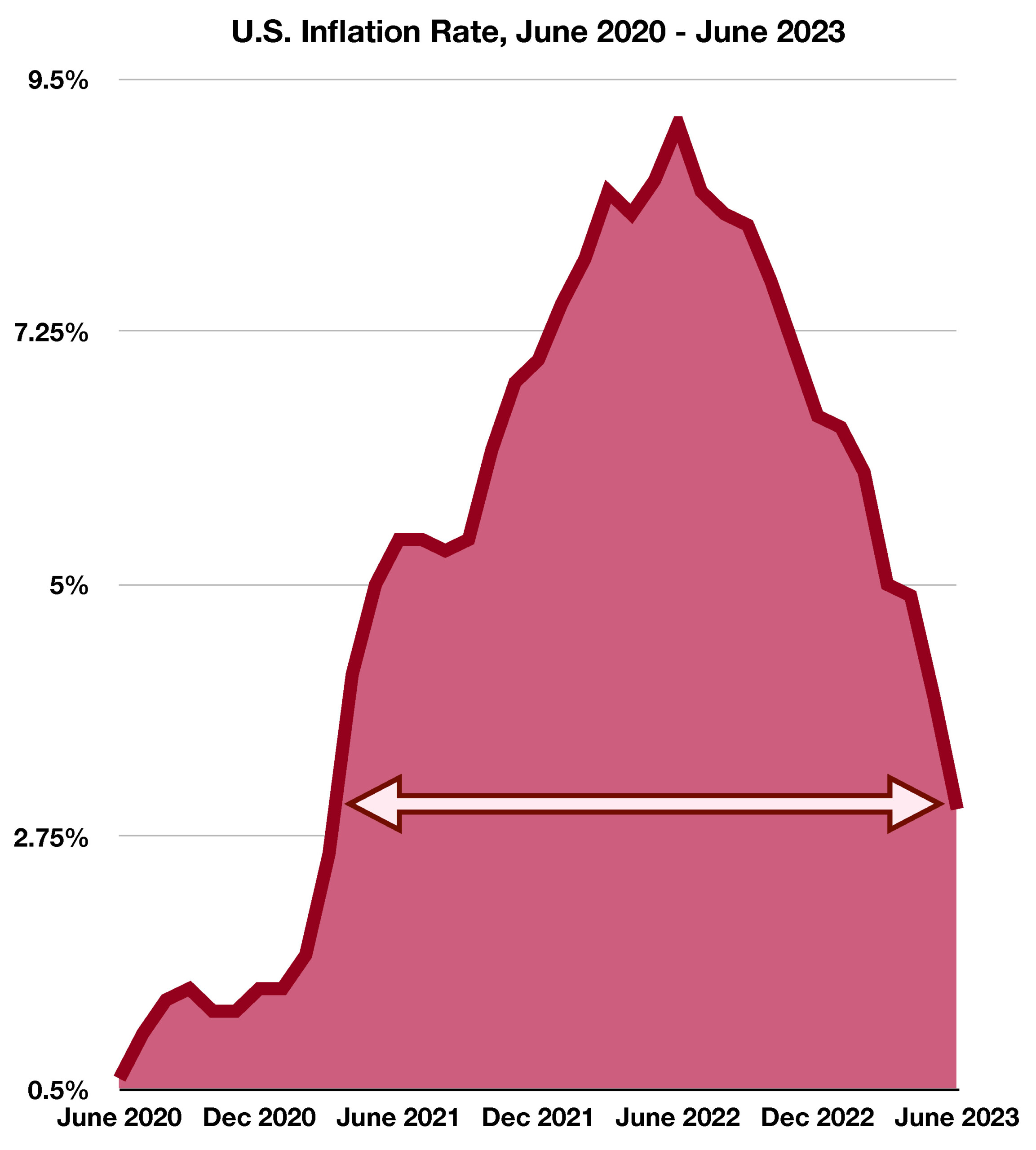

Inflation and the U.S. dollar trended lower in July as evolving economic conditions altered the dynamics of consumer prices and sentiment. Inflation stood at 3 percent in July, the lowest in two years.

Atlanta Federal Reserve Bank President Raphael Bostic said that there is a risk of over-tightening of rates by the Fed. Financial markets are concerned that the Fed may have continued to raise rates to the point that it may have become counterproductive.

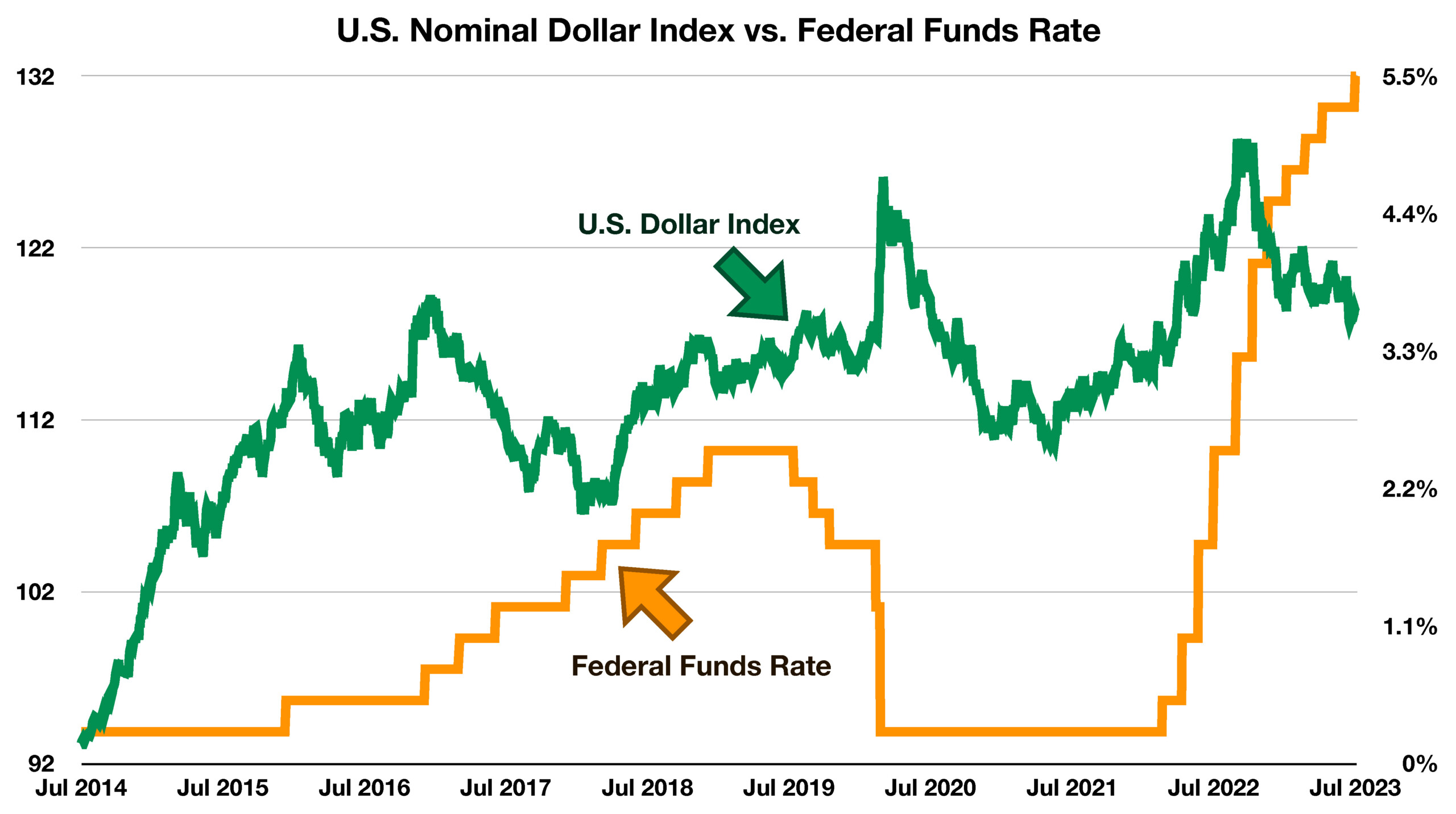

A weakening U.S. dollar is becoming an inflationary concern for consumers and the Fed. A weak dollar is inflationary because a weaker dollar makes imported goods more expensive for consumers, lowering their purchasing power. This is because the U.S. heavily relies on imported goods, such as clothing, autos, phones, computers, and televisions.

The month of July was Earth’s hottest on record, according to data from the Copernicus Climate Change Service, a European Union-funded scientific agency. July’s temperatures surpassed the global monthly average temperature record set in July 2019. Warmer temperatures increase the use of electricity and energy nationwide.

Sources: Bloomberg, Federal Reserve Bank of Atlanta, Fitch, Bureau of Labor Statistics, Standard & Poor’s, Copernicus Climate Change Service

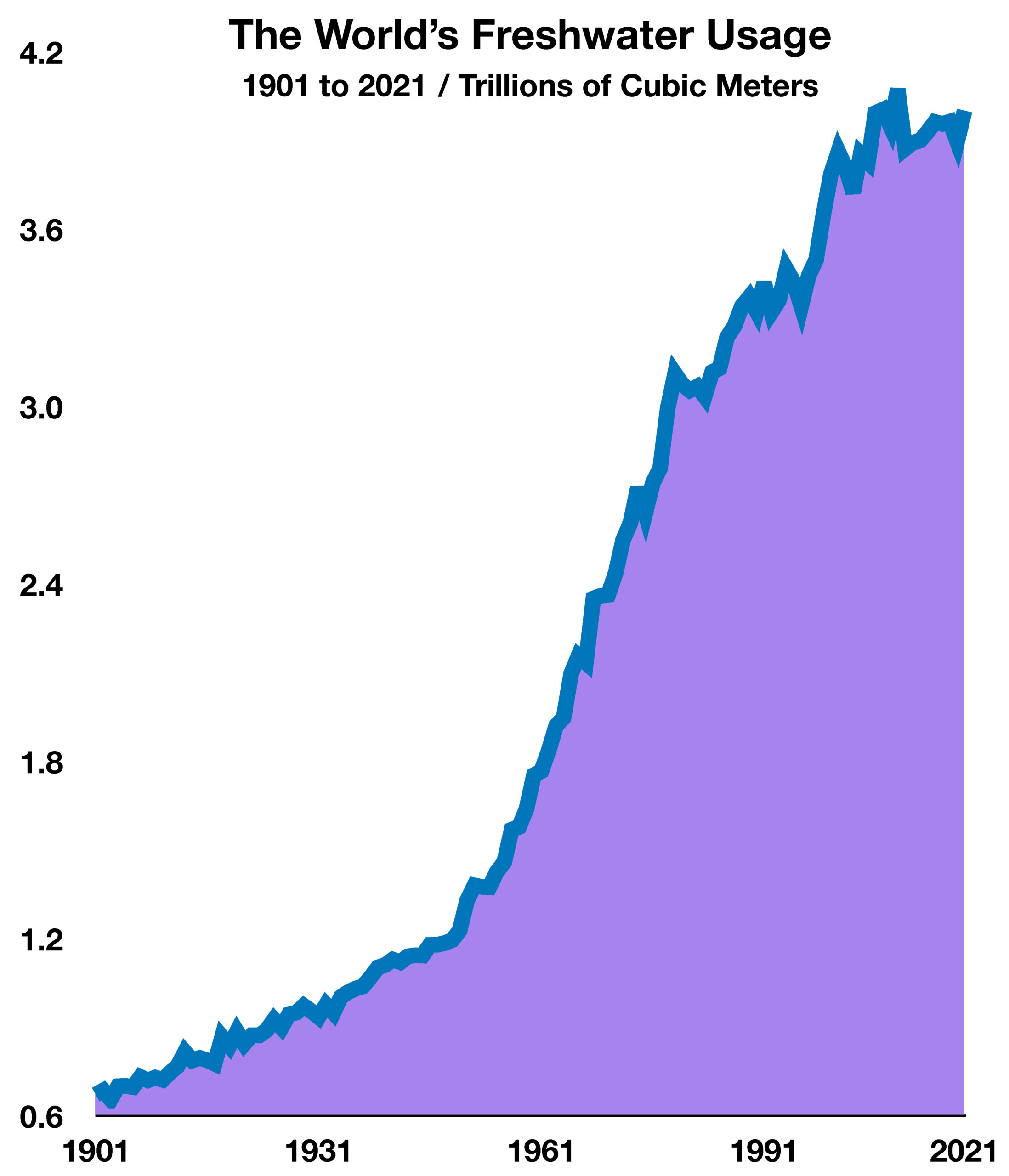

With the global population continuously rising, and water demand greatly outweighing supply, the global water supply has decreased dramatically. However, water treatment innovations may be a growing field that attempts to combat the world’s water crisis by making fresh water more accessible. Over 4 billion people experience severe water scarcity for at least a month each year, and half of the global population will be living under constant water scarcity as early as 2025. By 2040, around 1 in every 4 children will suffer from severe water stress. Global freshwater usage is at a historic high, with the annual usage sitting at around 3.88 trillion cubic meters as of 2017. This is a 65% increase in usage from 1970 and over a 400% increase in the past century. Across the world, droughts and water scarcity are shocking populations. The current American Western mega drought, in states from California to Montana between 2000-2022, is considered the driest period in over 1200 years. Further, four days in July were measured as the hottest day on Earth in over 100,000 years. (Sources: Yale University; UNICEF; A. Park Williams et al.; Our World in Data; Food and Agriculture Organization; AQUASTAT, World Bank, University of Maine, U.S. National Centers for Environmental Prediction.)

With the global population continuously rising, and water demand greatly outweighing supply, the global water supply has decreased dramatically. However, water treatment innovations may be a growing field that attempts to combat the world’s water crisis by making fresh water more accessible. Over 4 billion people experience severe water scarcity for at least a month each year, and half of the global population will be living under constant water scarcity as early as 2025. By 2040, around 1 in every 4 children will suffer from severe water stress. Global freshwater usage is at a historic high, with the annual usage sitting at around 3.88 trillion cubic meters as of 2017. This is a 65% increase in usage from 1970 and over a 400% increase in the past century. Across the world, droughts and water scarcity are shocking populations. The current American Western mega drought, in states from California to Montana between 2000-2022, is considered the driest period in over 1200 years. Further, four days in July were measured as the hottest day on Earth in over 100,000 years. (Sources: Yale University; UNICEF; A. Park Williams et al.; Our World in Data; Food and Agriculture Organization; AQUASTAT, World Bank, University of Maine, U.S. National Centers for Environmental Prediction.)