What Britain Leaving The EU Means

The EU (European Union) was established following the end of WW II in order to offer financial and structural stability for European countries. Since its establishment, the EU has grown to a membership of 28 countries, abiding by various rules and policies set forth by the EU Council.

One of the responsibilities of member EU countries is to accept and honor immigrants and citizens from other EU countries as part of the human rights initiatives recognized by the EU. Immigration has been a topic of contention among various EU countries for sometime. This was a decisive factor for Britain leaving the EU since its economy and cities have been inundated by foreign-born immigrants seeking jobs and a better quality of life.

The markets have reacted negatively to the announcement, pushing down stocks, the British pound, and bond yields as investors seek the perceived stability of bonds as markets worldwide acclimate.

Since Britain has been part of the EU since 1973, it is expected that the unraveling of British ties from the EU could take years. Contracts, employees, and laws will all have to be revised, reshuffled, and rewritten in order to accommodate the divorce between the two.

Now that the British have decided on leaving the EU, many believe that another referendum could possibly be presented in France and other EU countries. The concern of a domino affect is very realistic, as several other EU members are experiencing similar frustrations as Britain.

Expected effects in the U.S. include:

- Prolonged low interest rates

- More assets flowing into the U.S. from abroad

- U.S. companies altering European contracts

- Stronger U.S. dollar versus the British pound and euro

Sources: EuroStat, EU Council, Europa.eu

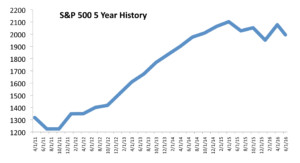

Note that even after Friday’s market tantrum, the S&P 500 is still more than 600 points or 40% higher than it was just five years ago. And, although much has been made of its lackluster performance over the past twelve months, the S&P 500 closed Friday, June 24th only 4.47% off its twelve month high (2,132.82 on July 20, 2015) but a sweet 12.56% higher than its twelve month low (1,810.10 on February 11, 2016).

Note that even after Friday’s market tantrum, the S&P 500 is still more than 600 points or 40% higher than it was just five years ago. And, although much has been made of its lackluster performance over the past twelve months, the S&P 500 closed Friday, June 24th only 4.47% off its twelve month high (2,132.82 on July 20, 2015) but a sweet 12.56% higher than its twelve month low (1,810.10 on February 11, 2016).