Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Where is the U.S. in the Business Cycle?

This is a credit cycle, not a business cycle. All depends on the price and availability of credit. Having said that, this is the late stage of the cycle where in the past, the Fed took away the punch bowl by raising interest rates. They appear intent on reprising that role, based in part on the theory that wage growth is about to accelerate as the labor market tightens. Shamrock’s market strategist thinks this is wrong. About 60% of the employable population is actually working vs. the high at 64.5% in 2000. That 4.5% difference amounts to over 12 million people, some of whom need training and some need to physically move to where the jobs are located. New skills will be needed and people re-trained. Susan Berger, chartist extraordinaire, commented recently that there have been five technology cycles during the last 250 years of Kondratieff Winters. They are:

1. The Industrial Revolution – 1771

2. Steam and Railways – 1829

3. The Age of Steel and Heavy Engineering – 1875

4. The Age of Oil, Electricity, Mass Production and Autos – 1908

5. The Age of Information and Technology – 1971

The current phase of Kondratieff’s Winter is witnessing another burst of innovations. Artificial intelligence, self-driving cars, designer drugs, space travel, stem cell rejuvenation of organs, all these are signs that a new economy is unfolding. Where are we in the U.S. cycle? Late stage, but the money printers (cheap credit) have not yet run out the clock.

Credit Problems Spreading

Immediately prior to the last seven recessions, the U.S. experienced an inverted yield curve. Despite the Fed raising interest rates and announcing plans to unwind their balance sheet, investors continue to flood into Treasuries.

The spread between the 10-year Treasury and the 2-year is around 80 bps now, down from 265 bps just 3.5 years ago. It has a way to go before dipping below zero, but this is the lowest level it has been since Q3 of 2007, just before the Oct. 11 2007 peak in the S&P 500 of 1576. The ensuing slide in the SPX took it down to 666 on March 6, 2009, a drop of 58%.

Fed Chair Janet Yellen and company are trying to prick a bubble, and desperately hope the process will be smooth and easy. After all, if injecting trillions into the markets with Quantitative Easing lifted markets slowly and steadily, why wouldn’t its removal?

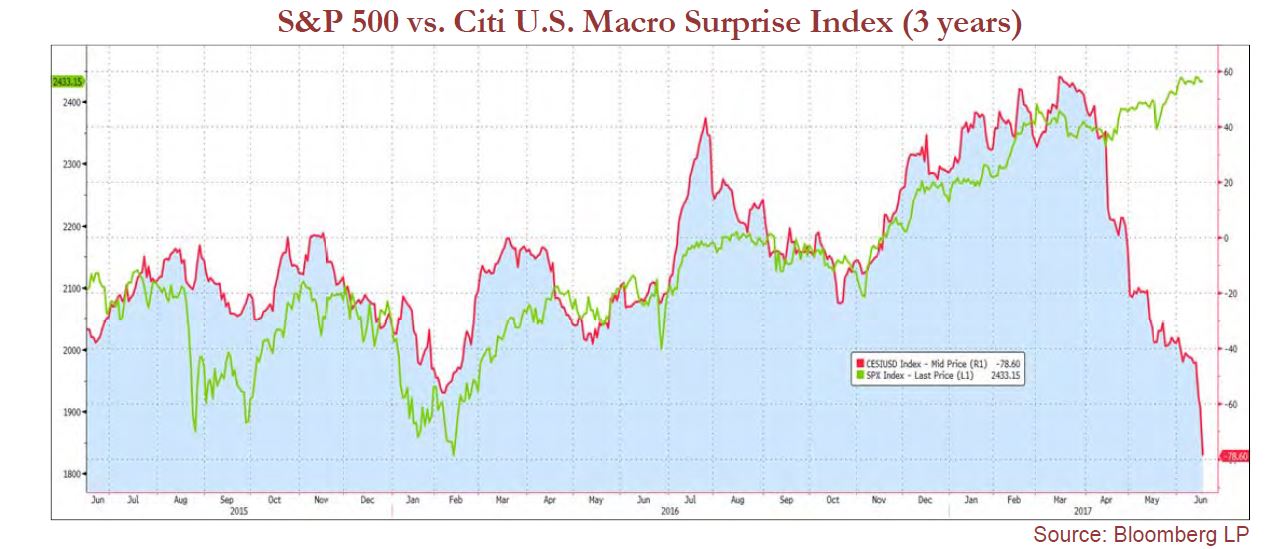

The terminology being used for the Fed’s actions is “tapping the brakes,” but with two increases in six months, and more expected by the end of the year, combined with a balance sheet selloff, it feels a quite a bit more severe than a “tap.” The Citi Macro Surprise Index below shows that economists are adjusting their expectations downward quickly, but the actual data is falling even quicker than their reduced numbers. The last time the Macro Surprise Index was this low was in 2011, when Ben Bernanke started “Operation Twist.”