Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

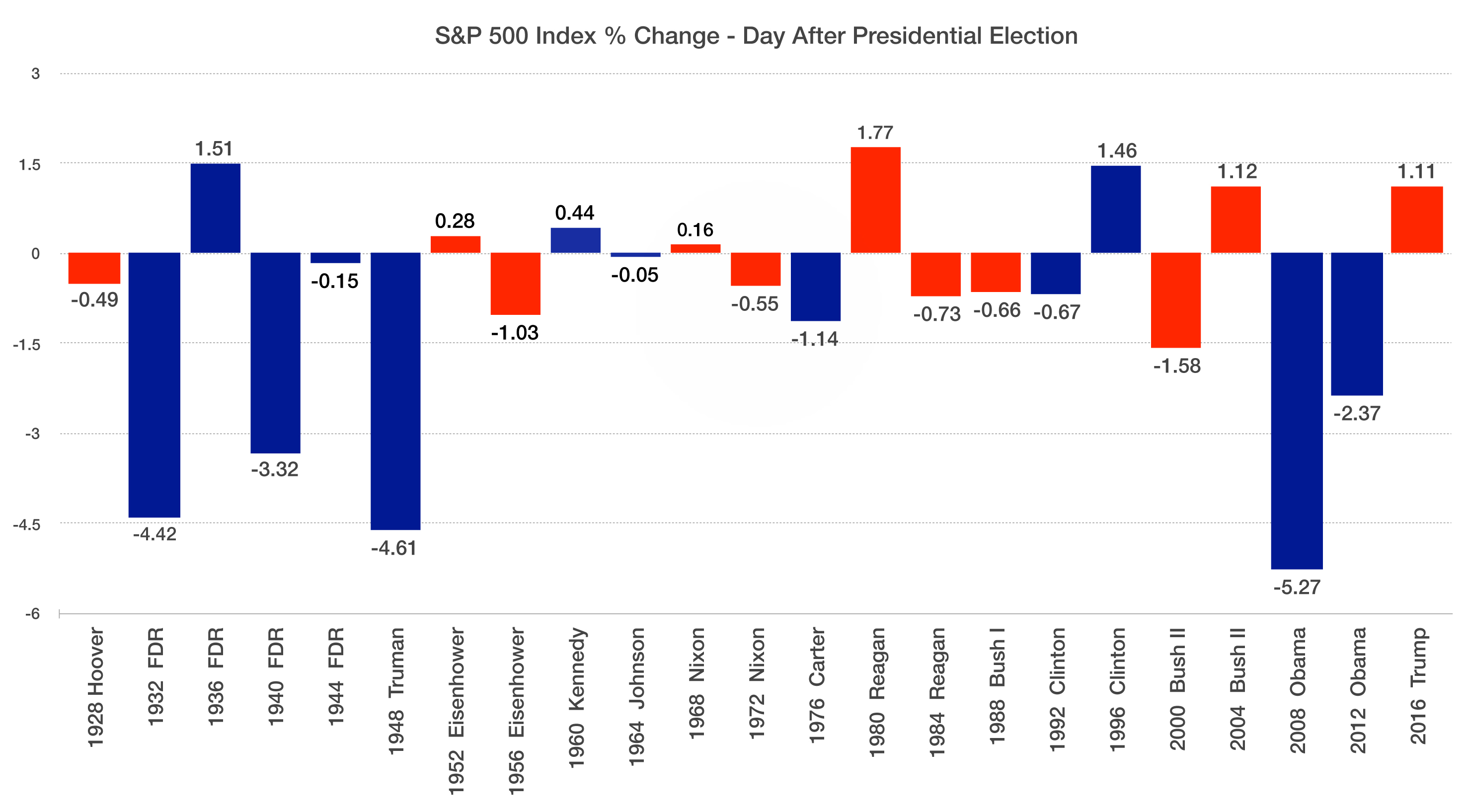

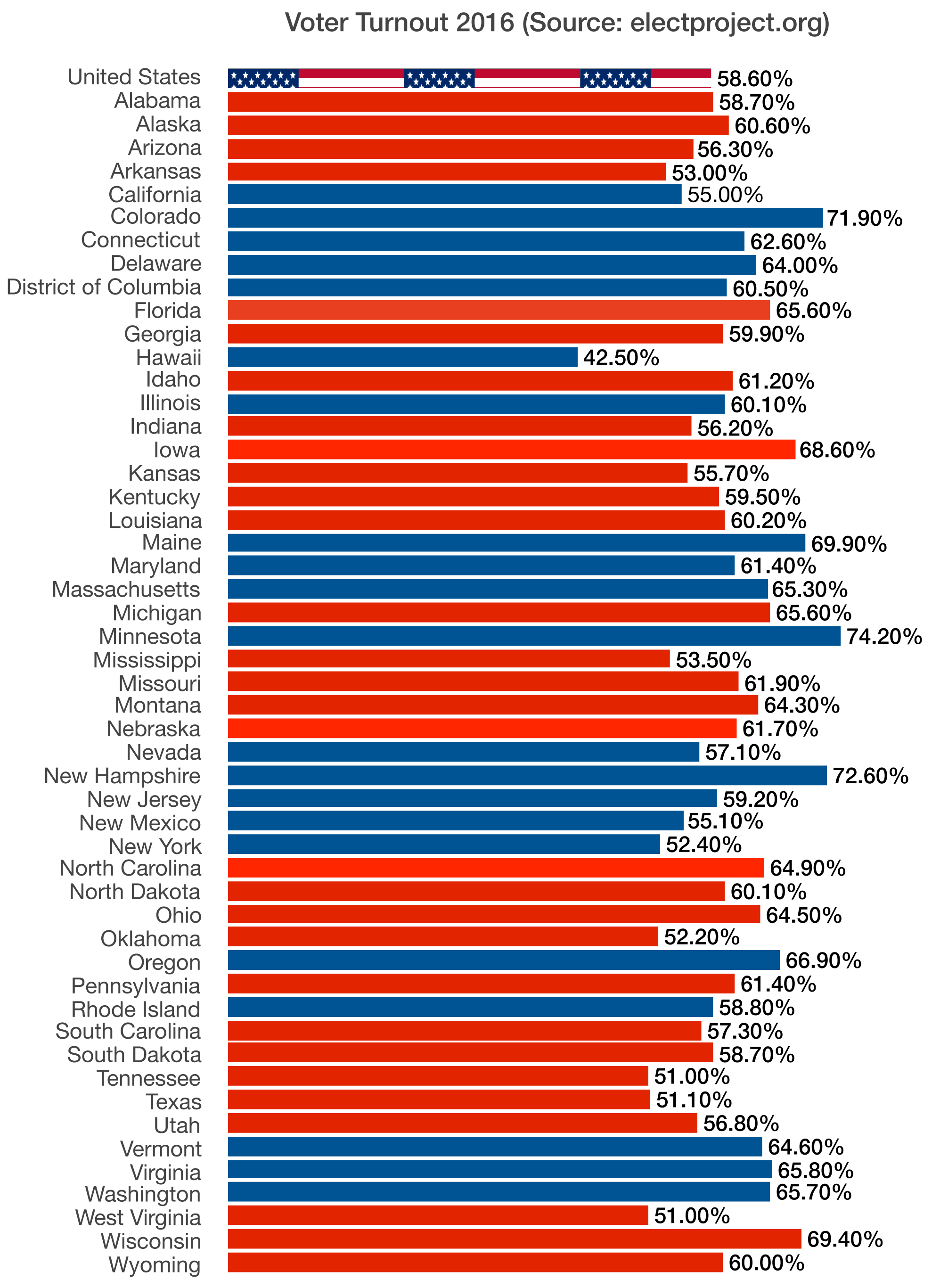

A monumental shift occurred in November as consumer sentiment, interest rates, and equity markets all increased with growth expectations settling in. Infrastructure spending, manufacturing, a friendlier regulatory environment, trade agreements, and fiscal stimulus have become the primary objectives of the president-elect.

A shift towards fiscal stimulus, as proposed by the incoming administration, is expected to help ease the burden on the Federal Reserve. Fiscal stimulus creates higher wages and spending by means of lower taxes, eventually leading to inflationary pressures, which is one of the Fed’s objectives.

Equity markets rallied in November with the Dow Jones Industrial Index breaching the 19,000 level, a record high for the index. The Dow Jones Transportation Average climbed 11% for the month, it’s single largest monthly gain since October 2011. As a leading indicator of economic growth, strong gains in the transportation index are often indicative of improving economic conditions.

A byproduct of rising rates in November, stemming from optimistic economic growth forecasts, led to a considerably stronger U.S. dollar. The challenge for the new administration will be harnessing the dollar’s strength for U.S. imports, yet finding ways to make U.S. products affordable in the world marketplace.

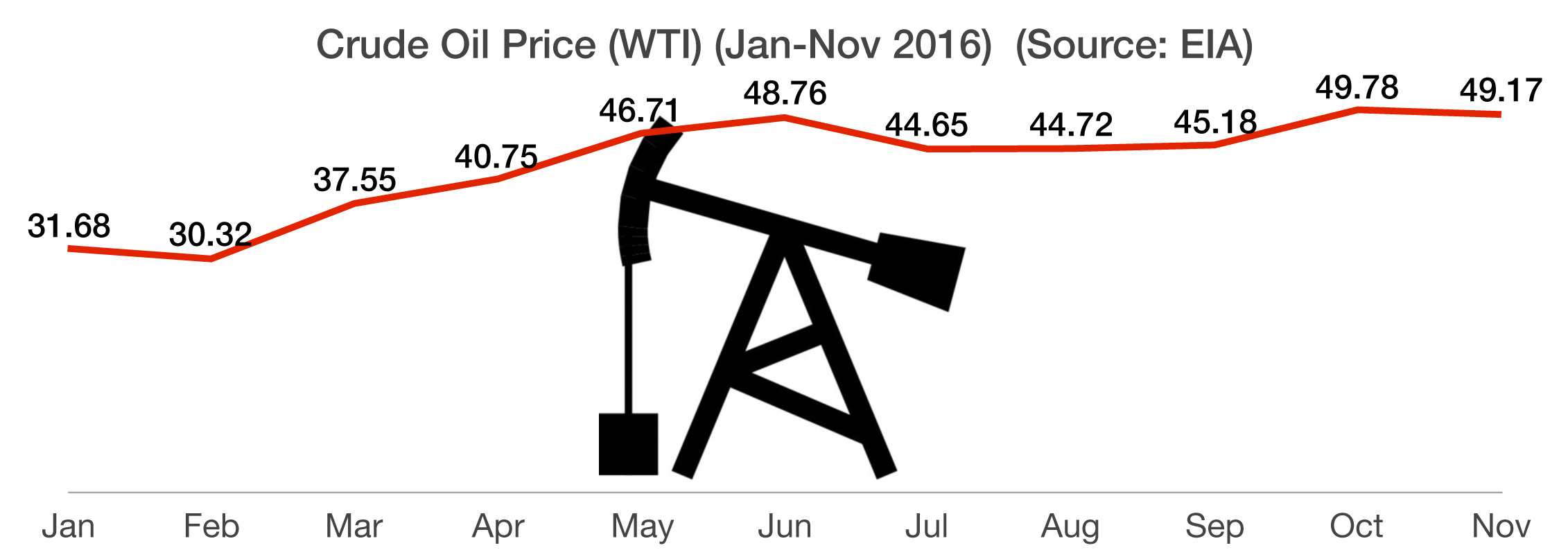

OPEC agreed to cut oil production among its 13 members by 1.2 million barrels a day from the current 33.6 million barrels. The agreed upon reduction would reduce global output by about 1%, easing high levels of supplies and stabilize prices.

Markets are closely watching Trump’s cabinet appointments since several of the appointments are instrumental in orchestrating the direction of various industries, taxes, regulations, and economic growth. (Sources: Fed, OPEC, Reuters, BLS)

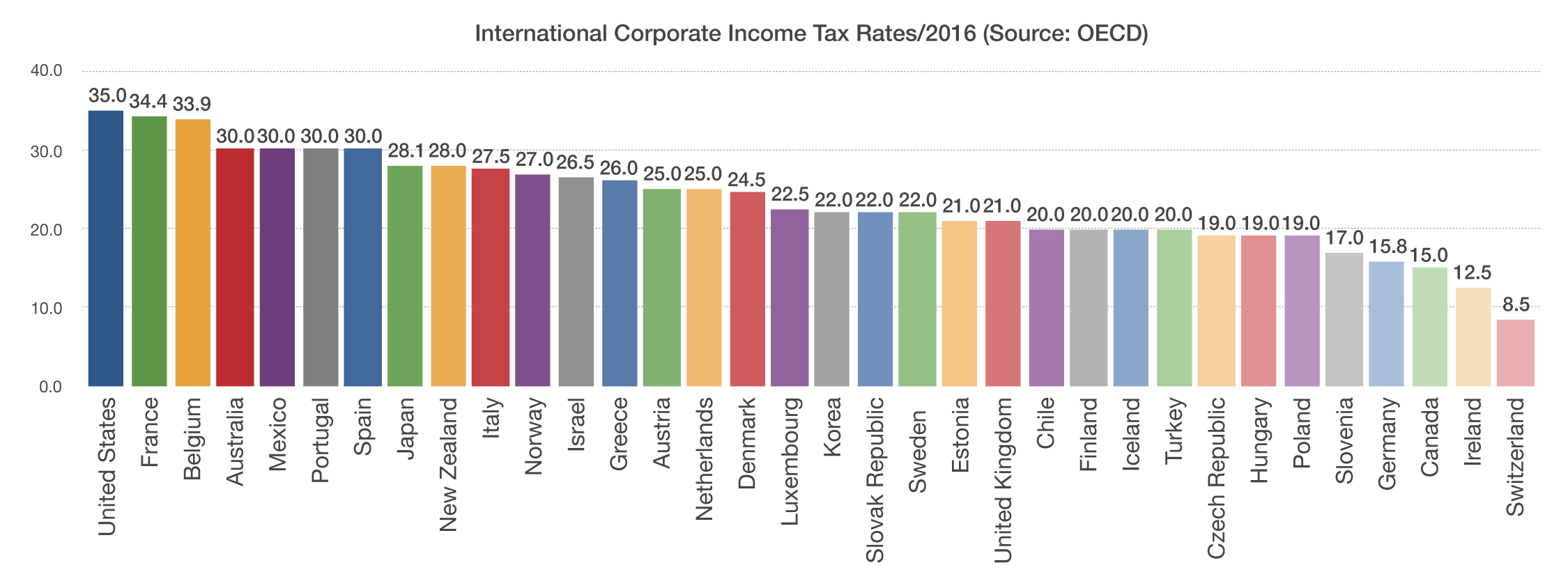

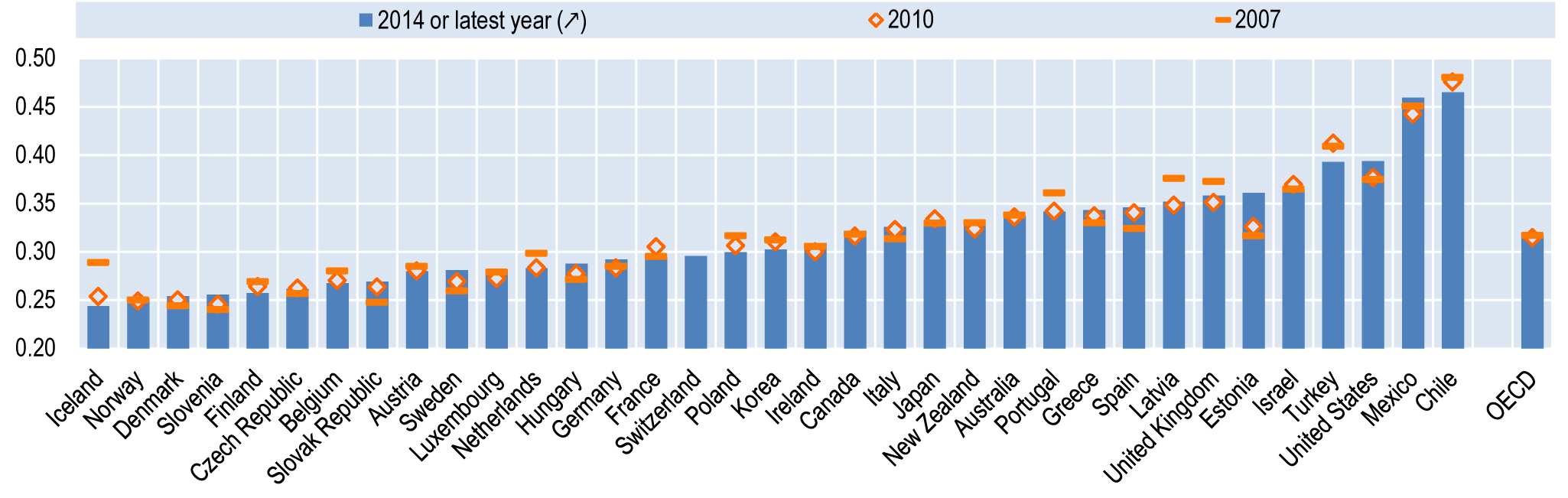

Is the U.S. any more unequal than other countries? A report from the Organization for Economic Co-operation and Development (OECD) suggests that it is. Looking at all developed nations, OECD researchers found that the average “score” of inequality, from 0-1, was right around 0.318 (see graphic), with higher scores indicating a bigger gap between the wealthiest citizens and the average working person. (A “0” score would indicate that everybody enjoys exactly the same income, while a “1” score would mean that one person took home all the income.) America, home to Wall Street and its multi-million-dollar bonuses, came in with the third-highest income inequality, behind only Chile and Mexico, and far more unequal than the world’s most egalitarian societies in Scandinavia: Iceland, Norway, Denmark and Finland. (Turkey came in at a virtual tie with the U.S.)

Is the U.S. any more unequal than other countries? A report from the Organization for Economic Co-operation and Development (OECD) suggests that it is. Looking at all developed nations, OECD researchers found that the average “score” of inequality, from 0-1, was right around 0.318 (see graphic), with higher scores indicating a bigger gap between the wealthiest citizens and the average working person. (A “0” score would indicate that everybody enjoys exactly the same income, while a “1” score would mean that one person took home all the income.) America, home to Wall Street and its multi-million-dollar bonuses, came in with the third-highest income inequality, behind only Chile and Mexico, and far more unequal than the world’s most egalitarian societies in Scandinavia: Iceland, Norway, Denmark and Finland. (Turkey came in at a virtual tie with the U.S.) What will you do in 2017 to improve your financial health? Do you know your “retirement number” – that magic portfolio amount that will allow you to live a lifetime of independence, free of financial worry? Is your investing plan on track to achieve your number? How will you convert that retirement portfolio to a stream of income that considers inflation, market volatility, and the prospects for long life? Do you feel like Uncle Sam wants too much of the money he didn’t earn? If these and other financial questions are distracting you from the joy of the season, make a resolution. Call Wayne Firebaugh and set a time to share a cup of coffee (or in Wayne’s case a glass of iced tea) and discuss some answers.

What will you do in 2017 to improve your financial health? Do you know your “retirement number” – that magic portfolio amount that will allow you to live a lifetime of independence, free of financial worry? Is your investing plan on track to achieve your number? How will you convert that retirement portfolio to a stream of income that considers inflation, market volatility, and the prospects for long life? Do you feel like Uncle Sam wants too much of the money he didn’t earn? If these and other financial questions are distracting you from the joy of the season, make a resolution. Call Wayne Firebaugh and set a time to share a cup of coffee (or in Wayne’s case a glass of iced tea) and discuss some answers.