Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

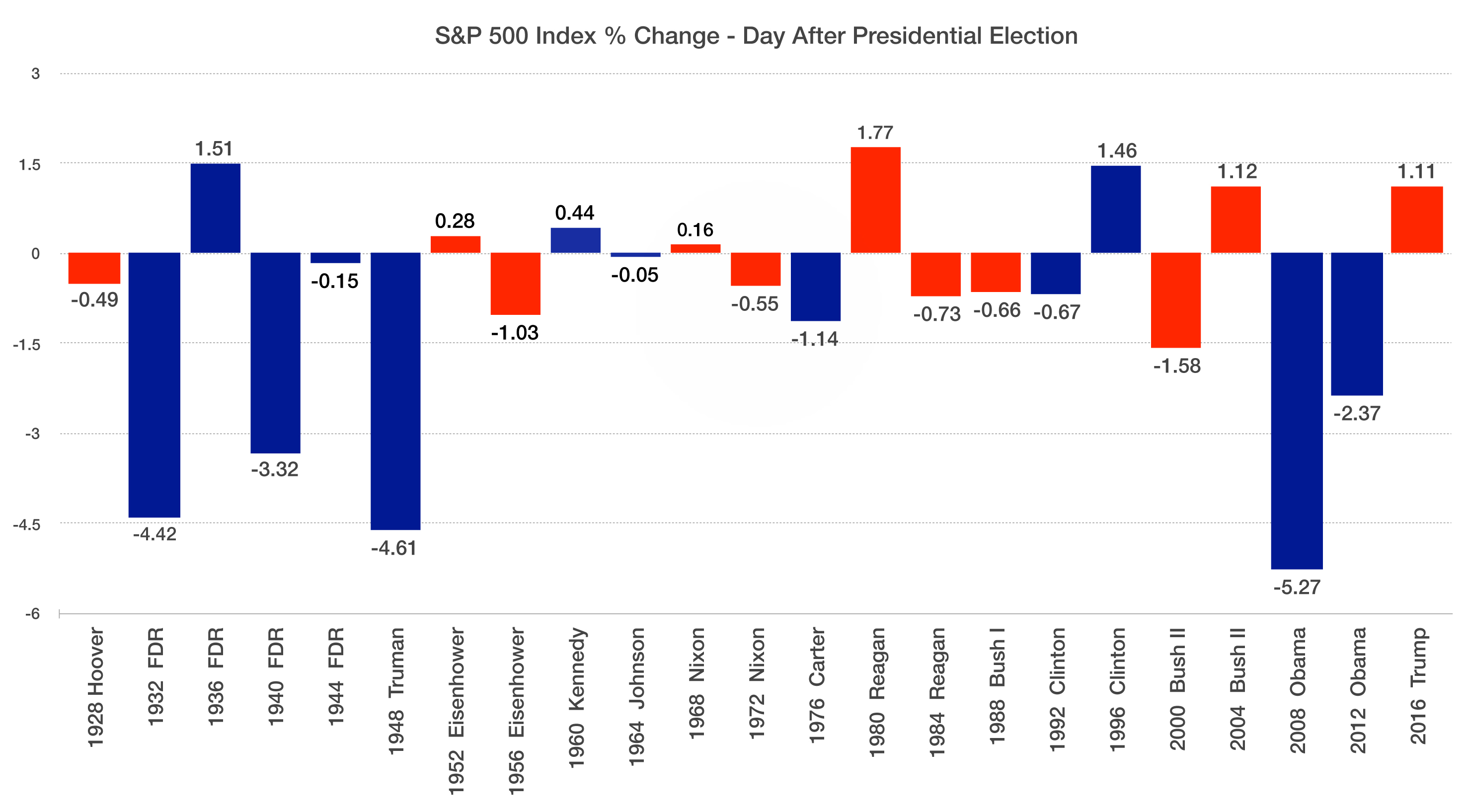

A monumental shift occurred in November as consumer sentiment, interest rates, and equity markets all increased with growth expectations settling in. Infrastructure spending, manufacturing, a friendlier regulatory environment, trade agreements, and fiscal stimulus have become the primary objectives of the president-elect.

A shift towards fiscal stimulus, as proposed by the incoming administration, is expected to help ease the burden on the Federal Reserve. Fiscal stimulus creates higher wages and spending by means of lower taxes, eventually leading to inflationary pressures, which is one of the Fed’s objectives.

Equity markets rallied in November with the Dow Jones Industrial Index breaching the 19,000 level, a record high for the index. The Dow Jones Transportation Average climbed 11% for the month, it’s single largest monthly gain since October 2011. As a leading indicator of economic growth, strong gains in the transportation index are often indicative of improving economic conditions.

A byproduct of rising rates in November, stemming from optimistic economic growth forecasts, led to a considerably stronger U.S. dollar. The challenge for the new administration will be harnessing the dollar’s strength for U.S. imports, yet finding ways to make U.S. products affordable in the world marketplace.

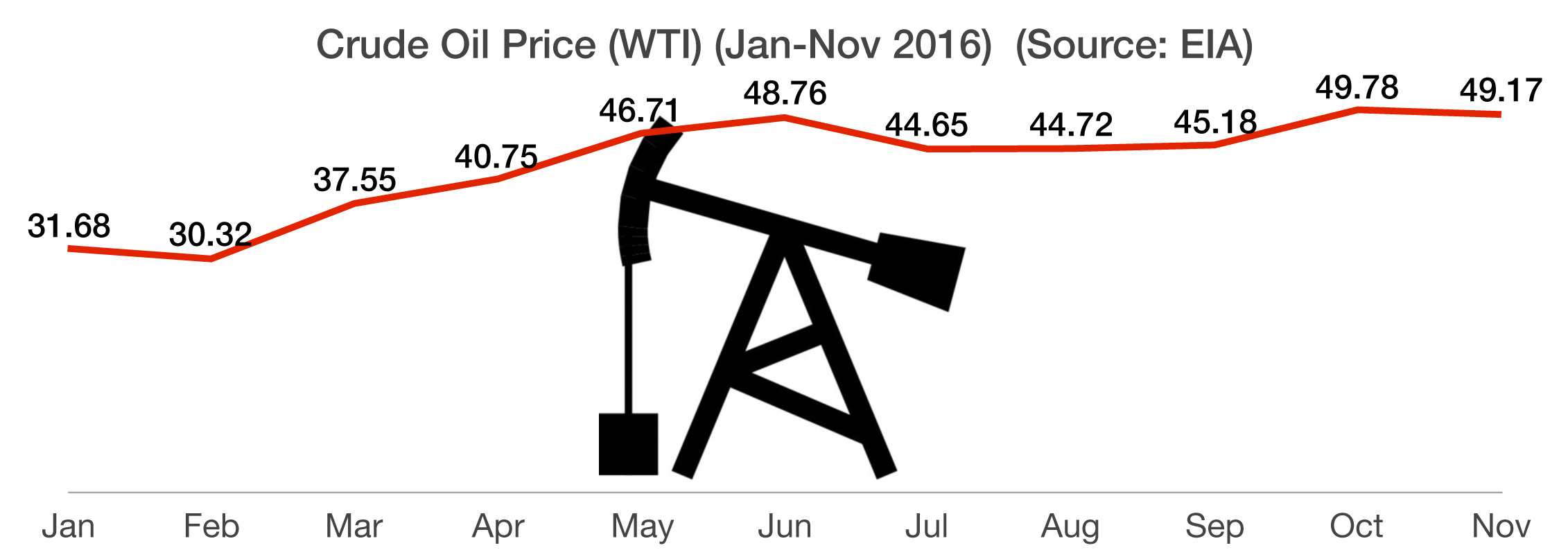

OPEC agreed to cut oil production among its 13 members by 1.2 million barrels a day from the current 33.6 million barrels. The agreed upon reduction would reduce global output by about 1%, while easing high levels of supplies and stabilizing prices.

November saw an accelerating shift in assets from globalization related positions towards domestic related positions. The inflationary effects of economic growth have now replaced the deflationary concerns that lingered since the financial crisis of 2008. Markets are closely watching Trump’s cabinet appointments since several of the appointments are instrumental in orchestrating the direction of various industries, taxes, regulations, and economic growth. The economic climate is different now than it was during prior Republican administrations. When Reagan came into office in 1980, inflation was at 14% and the dollar was at a generational low. Heading into the inauguration, inflation is below 2% and the dollar is at a 13-year high, making dramatic economic improvements difficult to achieve. (Sources: Fed, OPEC, Reuters, BLS)

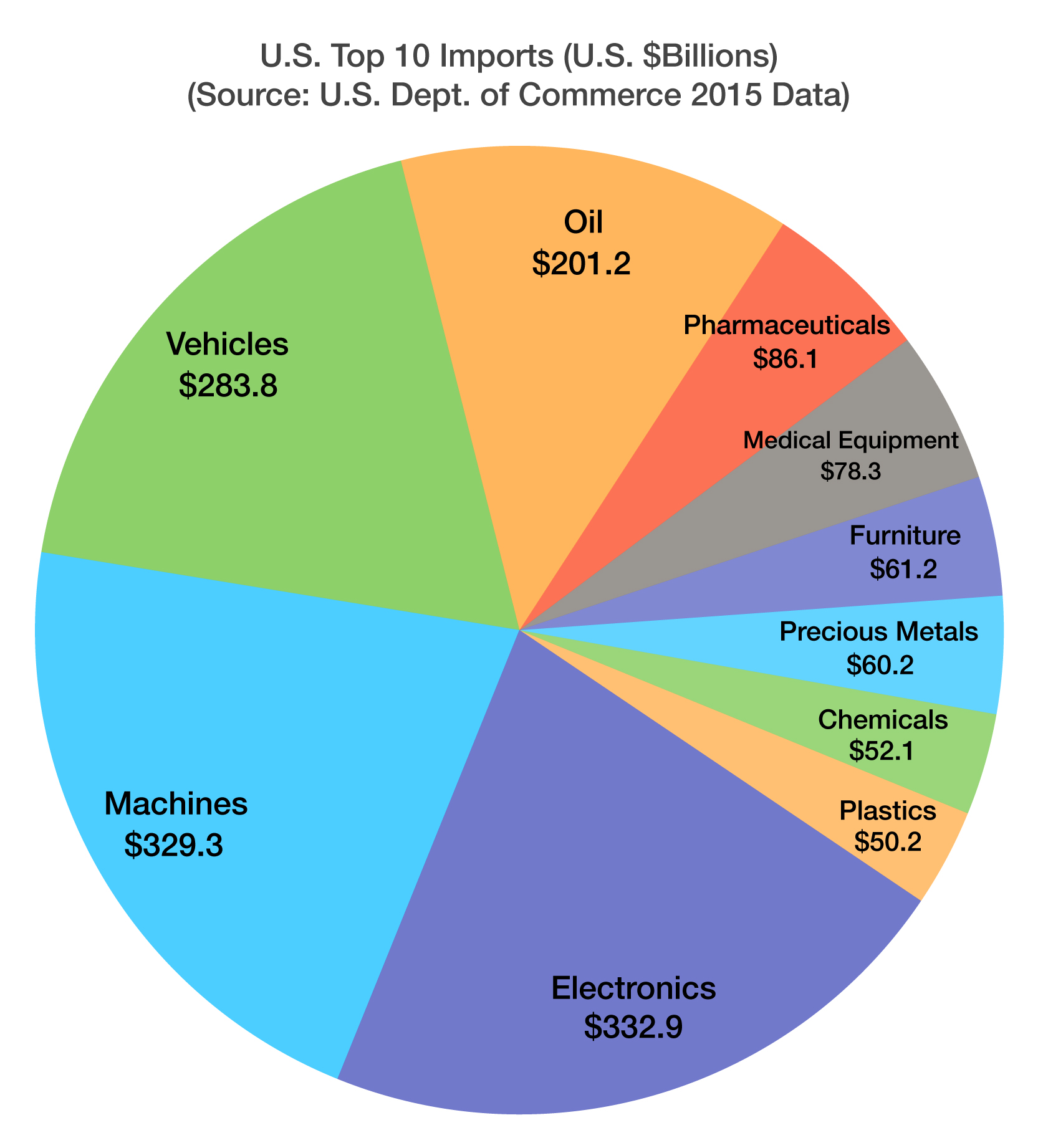

As the president-elect prepares to enter the White House, foreign imports into the U.S. have become a leading agenda item. According to the Commerce Department, the top imports into the U.S. include electronic devices such as mobile phones, computers and TVs, followed by machinery and automobiles. The onset of additional tariffs and import duties might change the makeup of imports dramatically, as consumers tackle higher prices along with some manufacturing possibly shifting to the U.S.

As the president-elect prepares to enter the White House, foreign imports into the U.S. have become a leading agenda item. According to the Commerce Department, the top imports into the U.S. include electronic devices such as mobile phones, computers and TVs, followed by machinery and automobiles. The onset of additional tariffs and import duties might change the makeup of imports dramatically, as consumers tackle higher prices along with some manufacturing possibly shifting to the U.S. Saudi Arabia, OPEC’s largest oil producer, launched an aggressive campaign against U.S. oil drillers two years ago by continuing to produce oil at record levels in order to maintain and build upon its market share.

Saudi Arabia, OPEC’s largest oil producer, launched an aggressive campaign against U.S. oil drillers two years ago by continuing to produce oil at record levels in order to maintain and build upon its market share.