Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

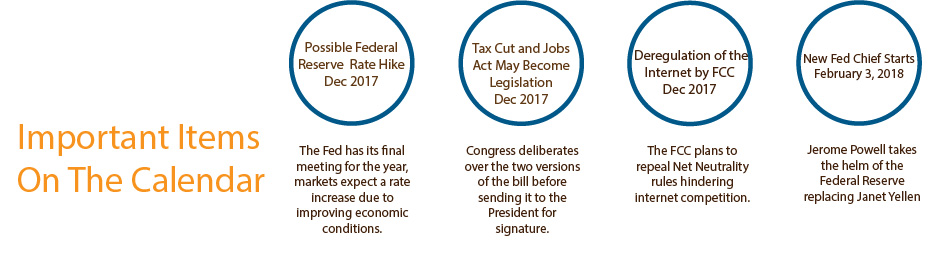

Both chambers of Congress have passed tax reform plans that will invoke among the most significant changes to the tax code since the Tax Reform Act of 1986. Versions of the Tax Cut and Jobs Act passed by the House in November and the Senate in early December will be modified into a single bill following Congressional deliberations.

Enactment of the tax bill would cut taxes by more than $1.4 trillion over 10 years, as estimated by the Joint Committee on Taxation. Other projections also include a rise in the federal deficit, should economic growth not be sufficient to make up for the cost of the tax cuts.

Passage of the tax reform bill may eventually lead to higher inflation because of possible growth in the federal deficit and an expanding economy. Economic expansion produces inflationary pressures that can increase wages and asset prices such as homes and stocks. In addition, tapering of fiscal stimulus in Europe by the European Central Bank (ECB) may also add to international inflationary pressures, which has been one of the ECB’s primary objectives.

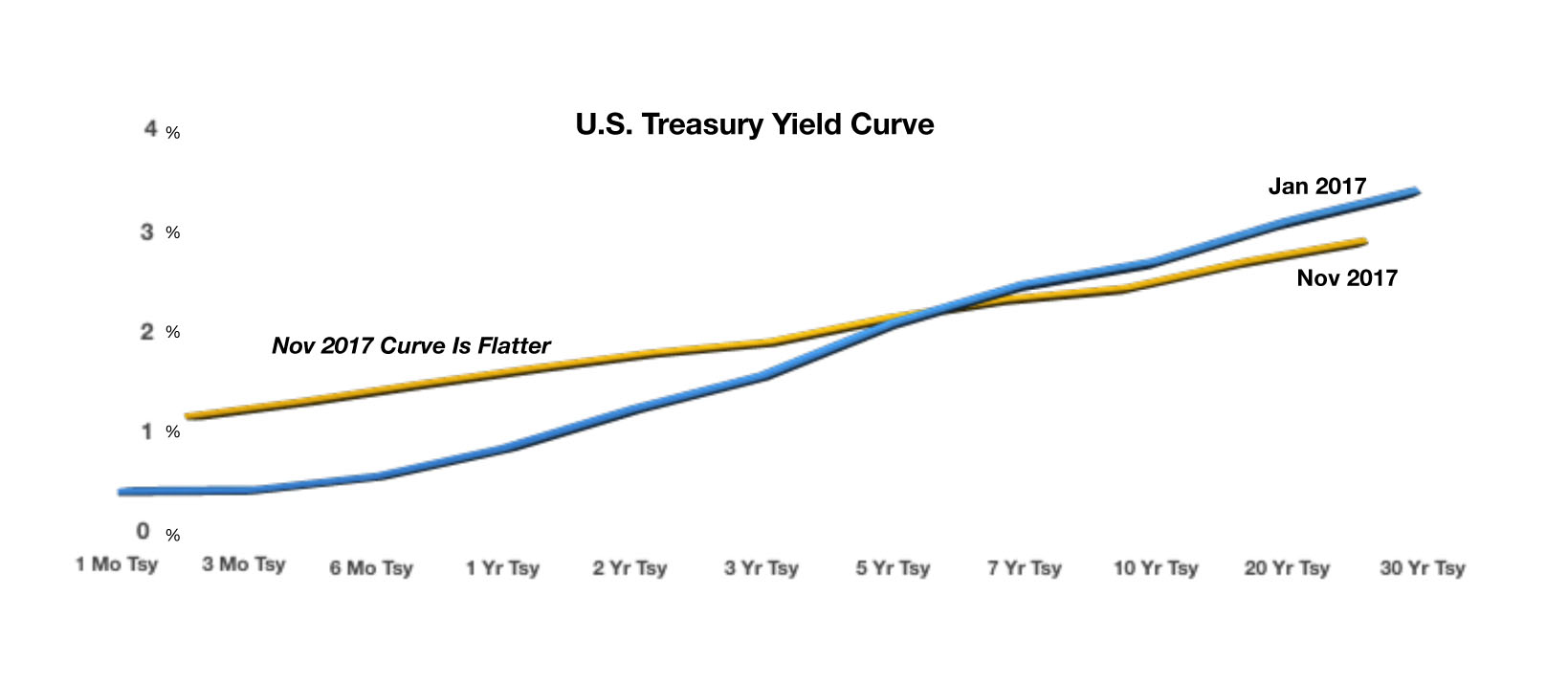

Equity markets rose in November with the Dow Jones Industrial Index climbing past 24,000 and the S&P 500 Index eclipsing the 2600 level, as the likelihood of tax reform passage became more apparent. Companies with strong balance sheets have been out performing those with weak balance sheets, as the market prepares for possible tax ramifications of companies deducting certain interest expenses. Markets expect the Fed to raise short-term rates again in December as improvements in the economy and labor markets materialized further. The unemployment rate dropped to 4.1% in October, the most recent data available from the Labor Department, the lowest rate since December 2000.

The internet will undergo deregulatory efforts with the repeal of an Obama administration rule set in place to regulate the internet with regulations similar to the utility industry. The FCC repealed Net Neutrality in November with the intent of increasing competition and alleviating regulatory oversight.

The Federal Reserve will have a new chief starting on February 3, 2018 with Jerome Powell replacing Janet Yellen. Senate confirmation hearings in late November buoyed markets as Jerome Powell expressed that the steady pace of monetary tightening under Yellen would continue under his watch. Mr. Powell is favored by the banking sector and financial markets because of his hands-on experience over the years.(Sources: Fed, Labor Dept., Dow Jones, S&P, Congress.gov/bill/115th-congress/house-bill/1)