Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Happy Holidays!

As the holiday season is upon us, we find ourselves reflecting on the past year and our partnership with you. We appreciate and value our relationship and look forward to working with you in the years to come. it has been quite a year for us all!!! As we say goodbye to 2019, may 2020 be prosperous and bring health and happiness to you and your loved ones.

Backdoor Roth IRA

What is a Backdoor Roth IRA?

A backdoor Roth IRA is a way for people with high income to still fund a Roth IRA and sidestep the Roth’s income limits. It allows you to set aside additional money for retirement that grows tax-free and can be withdrawn tax free.

How do I create a backdoor Roth IRA?

You will simply do a Roth conversion. This can be accomplished by either making a contribution to your traditional IRA and completing a Roth conversion or, you can rollover existing traditional IRA funds into a Roth—as much as you want at one time, even if it’s more than the annual contribution.

Keep in mind that this is not a tax dodge. You still need to pay taxes on any money in your traditional IRA that hasn’t already been taxed. You will also owe taxes on whatever money it earns between the time you contributed to the traditional IRA and when you converted it to a Roth IRA.

Why might you be interested in doing a backdoor Roth IRA?

No required minimum distributions. Traditional IRA’s require you to start taking your distributions at age 70 ½, but Roth IRAs allow you to have tax deferred growth for as long as you choose. You can take out a little at a time or you can keep it in the account for your heirs.

Backdoor Roth contributions can mean significant tax savings over time. This is because Roth distributions, unlike Traditional IRA distributions, are not taxable nor are qualified Roth distributions counted as income. You make a contribution with after-tax dollars with the tax benefit being realized on the back-end with tax-free withdrawals. This characteristic is very beneficial if you think your tax rates are going to rise in the future.

This is an amazing tool to be able to set more money aside for retirement, while taking advantage of the tax benefits it offers.

Backdoor IRA’s are complex and take time to complete. If not done correctly they could mean big tax consequences for you. We would recommend that if you are interested in taking advantage of a Backdoor Roth IRA to contact us and we will be happy to walk you through the process and get it set up for you.

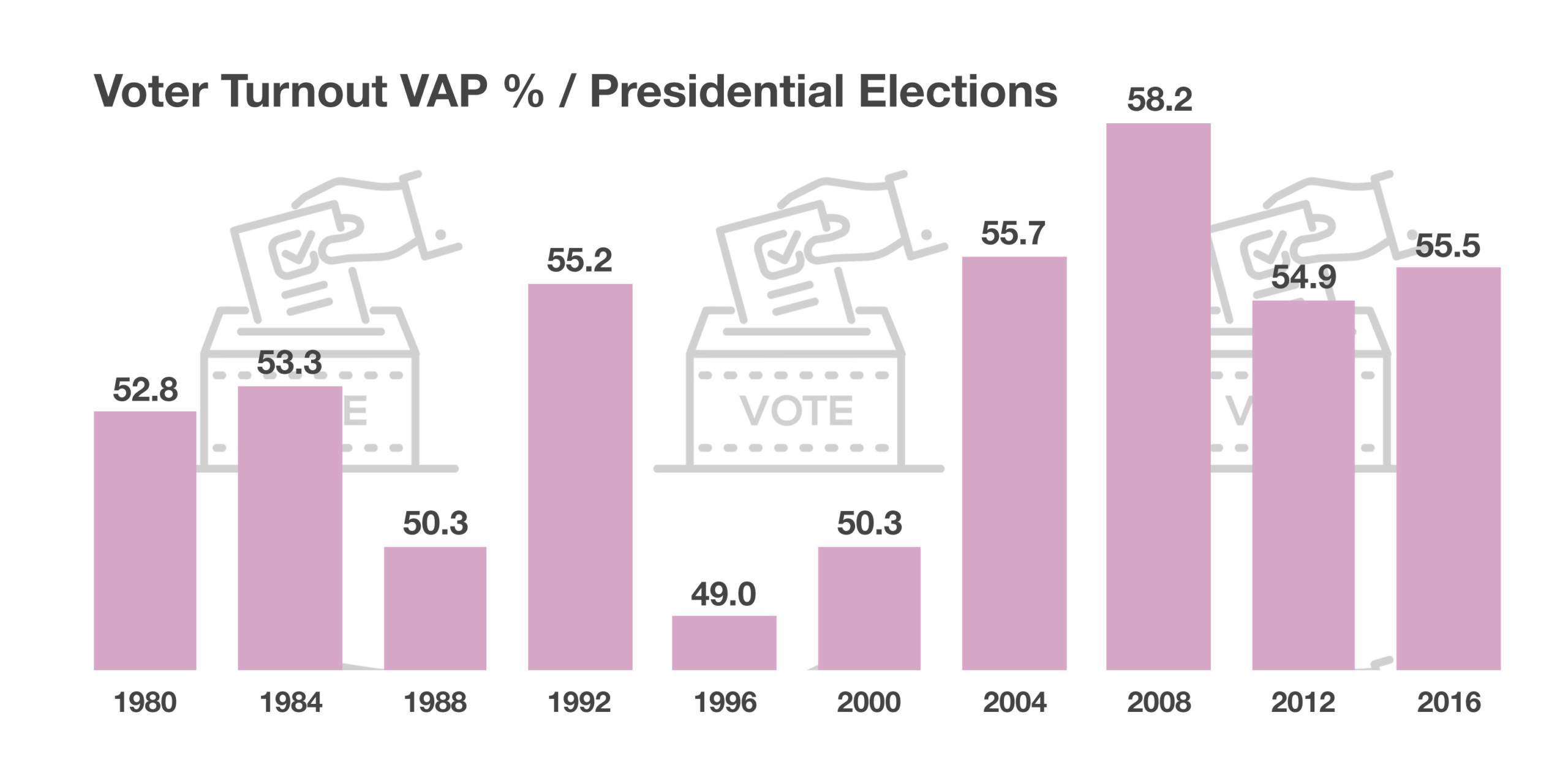

Presidential election voter turnout is tracked by the Bipartisan Policy Center, which monitors voter turnout state by state. The 2016 presidential election saw an estimated 55% of the voting age population (VAP) turn out to vote. Who actually turns out to vote can be driven by the candidates’ policies and how it may affect individuals. The number of voters has varied over the years and has always been very difficult to predict. (Source: Bipartisan Policy Center)

Presidential election voter turnout is tracked by the Bipartisan Policy Center, which monitors voter turnout state by state. The 2016 presidential election saw an estimated 55% of the voting age population (VAP) turn out to vote. Who actually turns out to vote can be driven by the candidates’ policies and how it may affect individuals. The number of voters has varied over the years and has always been very difficult to predict. (Source: Bipartisan Policy Center)

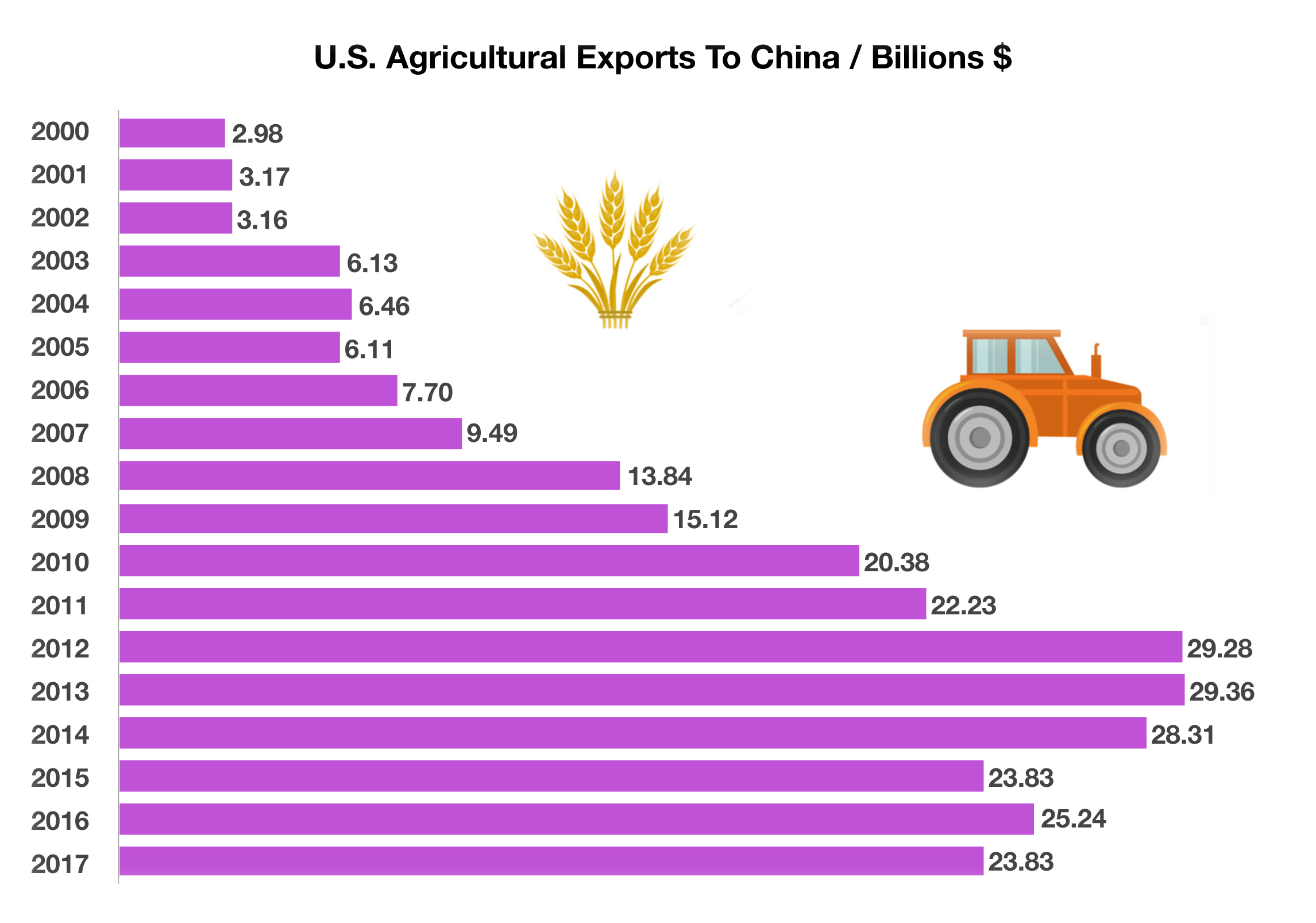

Agricultural products exported to China include soybeans, cotton, pork, corn, and wheat. Soybeans account for the single largest agricultural export, representing over 50% of China’s soybean imports in 2017 alone.

Agricultural products exported to China include soybeans, cotton, pork, corn, and wheat. Soybeans account for the single largest agricultural export, representing over 50% of China’s soybean imports in 2017 alone.