Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Markets have been undermined for weeks by the uncertainty of a phase-one trade deal outlined by U.S. and Chinese trade delegates. Optimism for a probable U.S.-China trade deal stemmed from the progression toward a phase-one deal that might include a rollback of certain tariffs by both the U.S. and China.

Global equity markets continued to elevate in November against a backdrop of political events and optimism surrounding ongoing trade negotiations. With the year end approaching, focus has shifted to the 2020 election, a phase-one trade deal, the Fed maintaining rates, and receding recession concerns.

A broad barometer of the current status of the country’s economic well being is the money supply, which essentially measures the level of cash in savings accounts, checking accounts, CDs, and money market funds. Money supply has grown over 10% during the past quarter, translating into plenty of excess liquidity for financial markets and providing a buffer against any unexpected volatility.

Fixed income analysts expect that the Fed is attempting to normalize interest rates by holding off on any further rate changes until economic data offers a clearer view of where the economy is headed. Analysts believe that subdued inflation exceptions by the Fed may leave rates steady heading into 2020.

There are less global bonds yielding negative rates, down to $11.9 trillion from a peak of $17 trillion in the summer. Lessening negative yields is indicative of a possibly stronger global economy, sparking a drive to equities to capture growth prospects. Some believe that the president’s objective of a weaker U.S. dollar would be beneficial for both international equities and exports of U.S. products around the world.

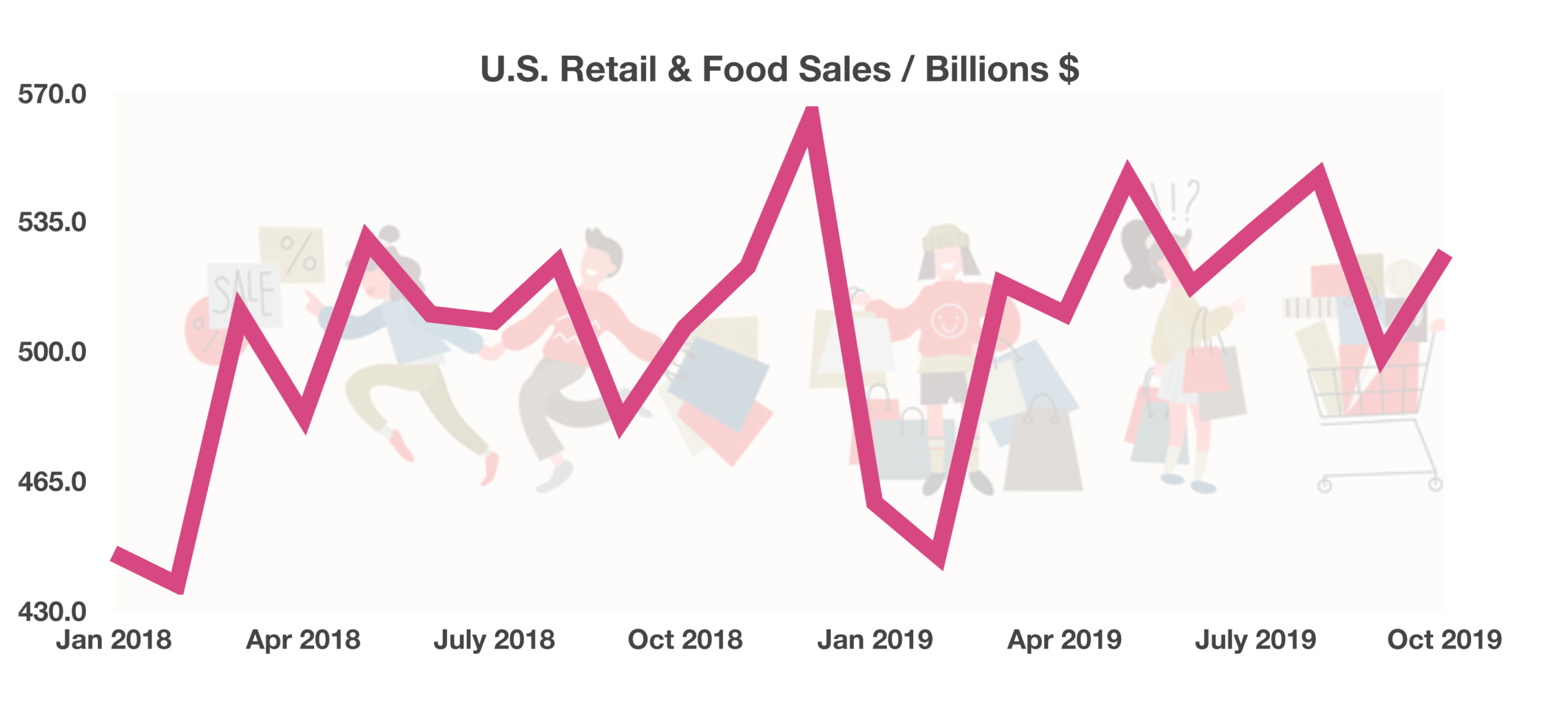

Consumers continue to spend at retail stores and on food heading into the holiday season, buoying economic activity throughout the country. Consumer expenditures represent over two-thirds of GDP, an integral part of the nation’s economy. A continued low-rate environment, along with a strong job market, has allowed consumers to spend generously on retail and food. (Sources: Commerce Dept., Bloomberg, Federal Reserve, BLS)

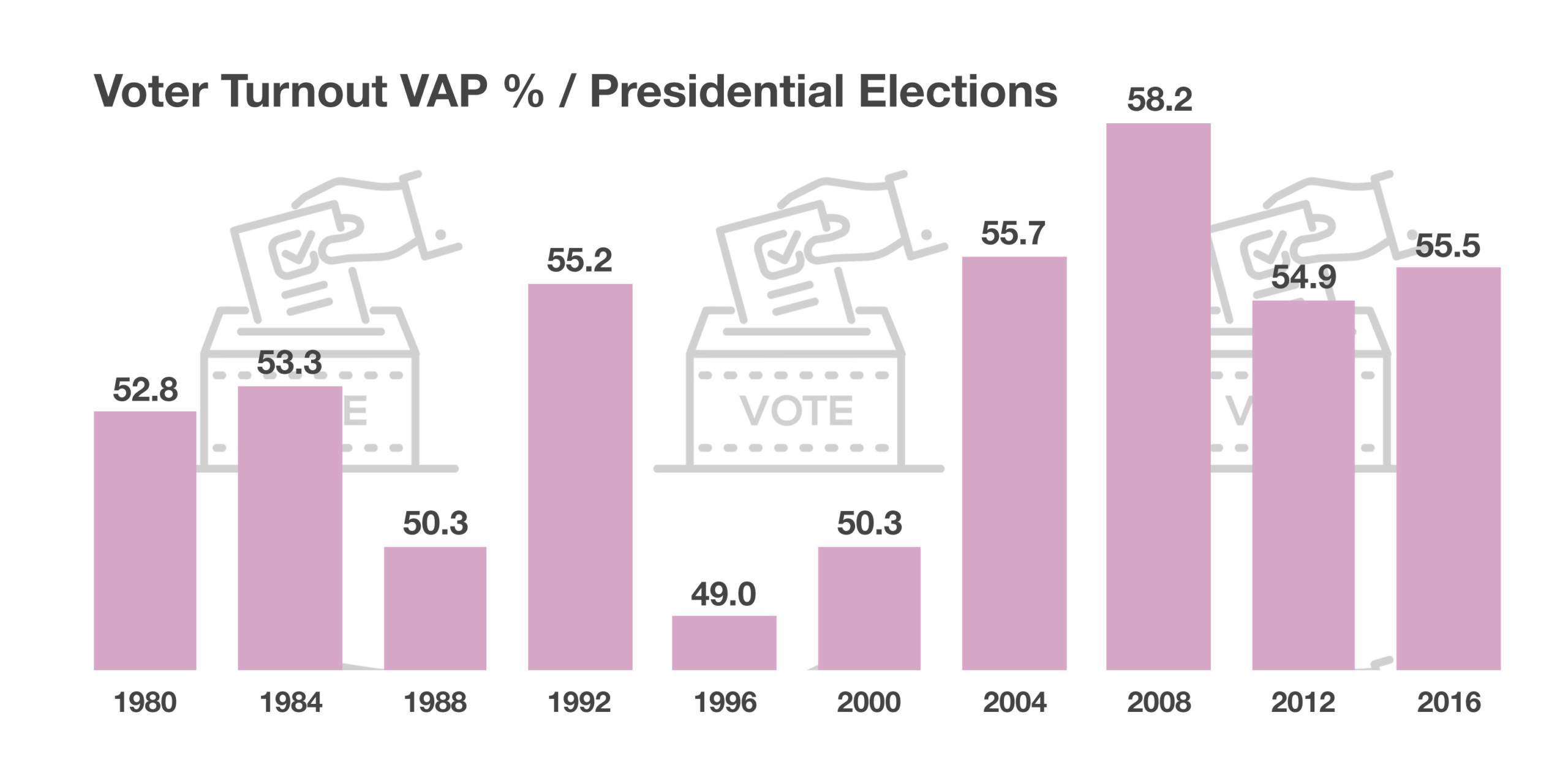

Presidential election voter turnout is tracked by the Bipartisan Policy Center, which monitors voter turnout state by state. The 2016 presidential election saw an estimated 55% of the voting age population (VAP) turn out to vote. Who actually turns out to vote can be driven by the candidates’ policies and how it may affect individuals. The number of voters has varied over the years and has always been very difficult to predict. (Source: Bipartisan Policy Center)

Presidential election voter turnout is tracked by the Bipartisan Policy Center, which monitors voter turnout state by state. The 2016 presidential election saw an estimated 55% of the voting age population (VAP) turn out to vote. Who actually turns out to vote can be driven by the candidates’ policies and how it may affect individuals. The number of voters has varied over the years and has always been very difficult to predict. (Source: Bipartisan Policy Center)

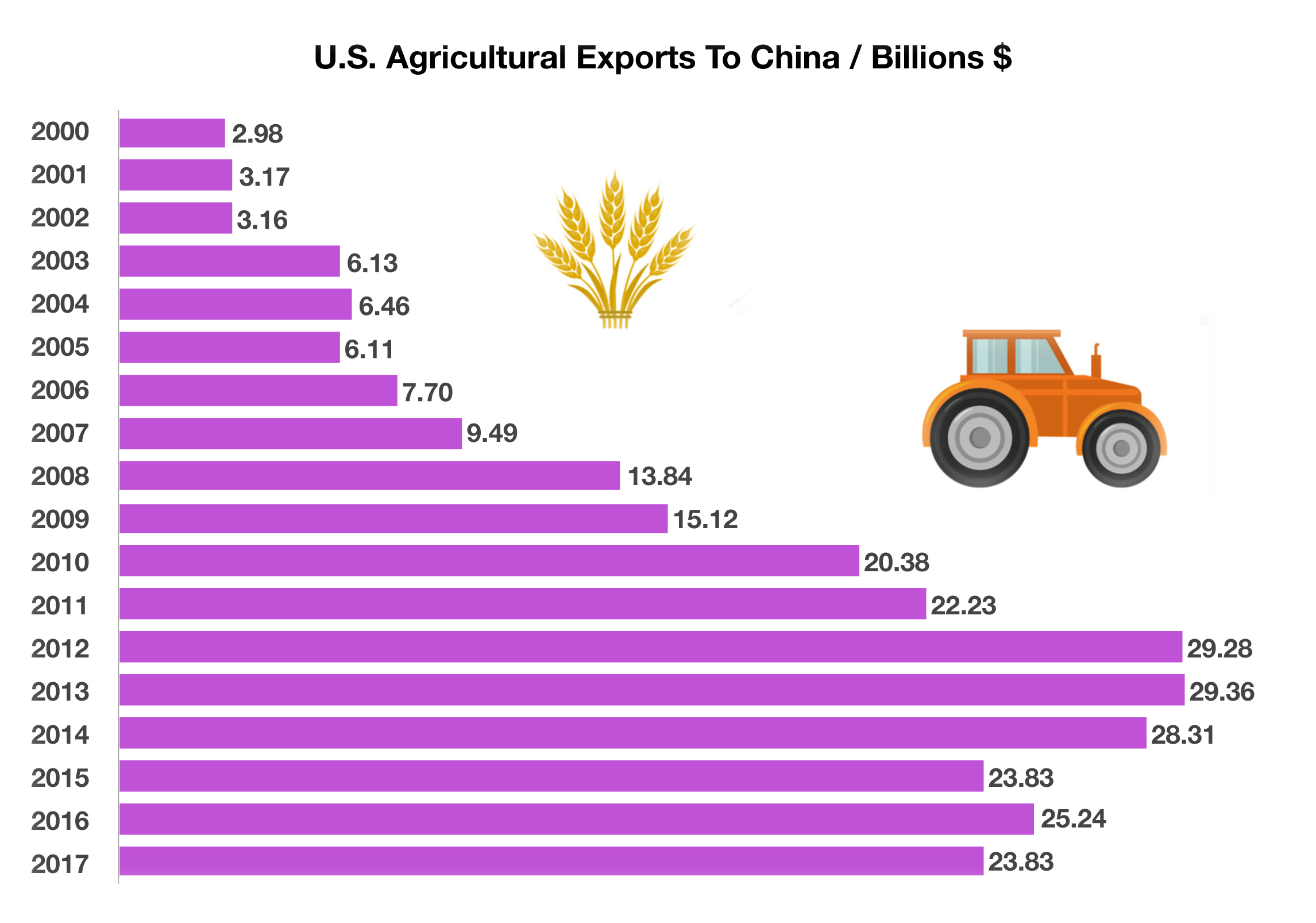

Agricultural products exported to China include soybeans, cotton, pork, corn, and wheat. Soybeans account for the single largest agricultural export, representing over 50% of China’s soybean imports in 2017 alone.

Agricultural products exported to China include soybeans, cotton, pork, corn, and wheat. Soybeans account for the single largest agricultural export, representing over 50% of China’s soybean imports in 2017 alone.