Premier Consulting Partners, LLC

395 North Service Road- suite 206

Melville, New York 11747

p. 516.358.3932

f. 516.358.3926

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Equity markets responded positively to news that the availability of vaccinations was imminently close. Major equity indices reached new highs in November as elements of uncertainty eased with promising vaccine trials and finalized election results. With the election behind us, attention now turns back to the pandemic and its ongoing effects on the U.S. and international economies.

A lingering stimulus “cliff” has left millions of Americans in a quandary, as members of Congress failed to produce and pass a stimulus plan in order to provide essential benefit payments to struggling families. The hold up in extending existing benefits as well as establishing new benefits, is expected to be resolved by year end and effective early 2021.

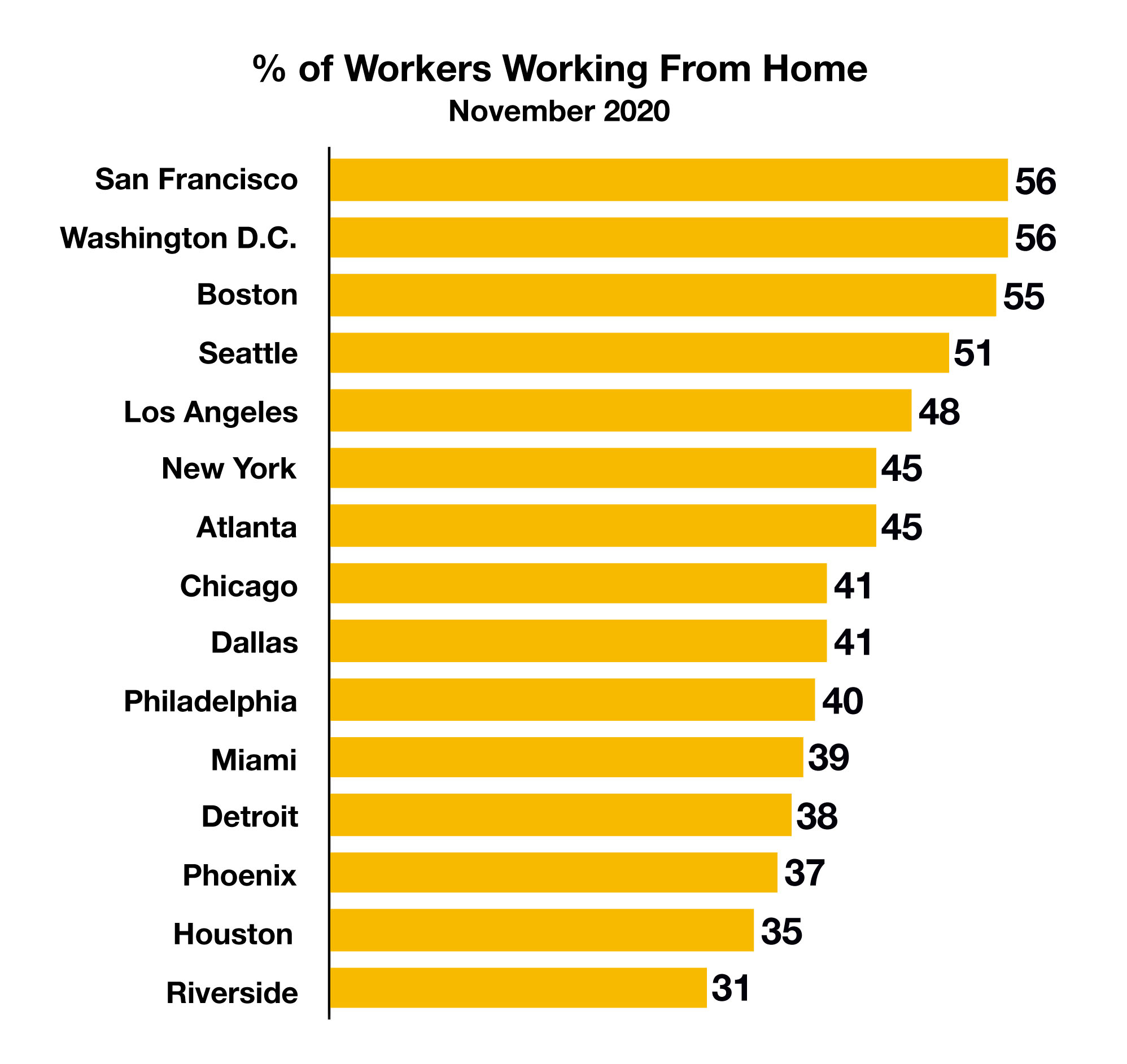

Industries that saw the biggest job gains in November were also the same industries that lost the most jobs during the onset of the pandemic. Positions experiencing the largest gains are retailers, food services, and hospitality, which are also expecting to have the greatest challenges over the next few months.

The Center for Disease Control (CDC) as well as various health organizations estimate that the first COVID-19 vaccines will be available as early as mid-December in the United States. High risk individuals, including first responders and hospital workers will be among the first to receive vaccinations.

The anticipated disbursement of vaccines, which are expected in early 2021, are presumed to boost consumer sentiment and social mobility throughout the country. The widespread availability of COVID-19 vaccines, possibly from various pharmaceutical companies, are also projected to expand economic growth estimates.

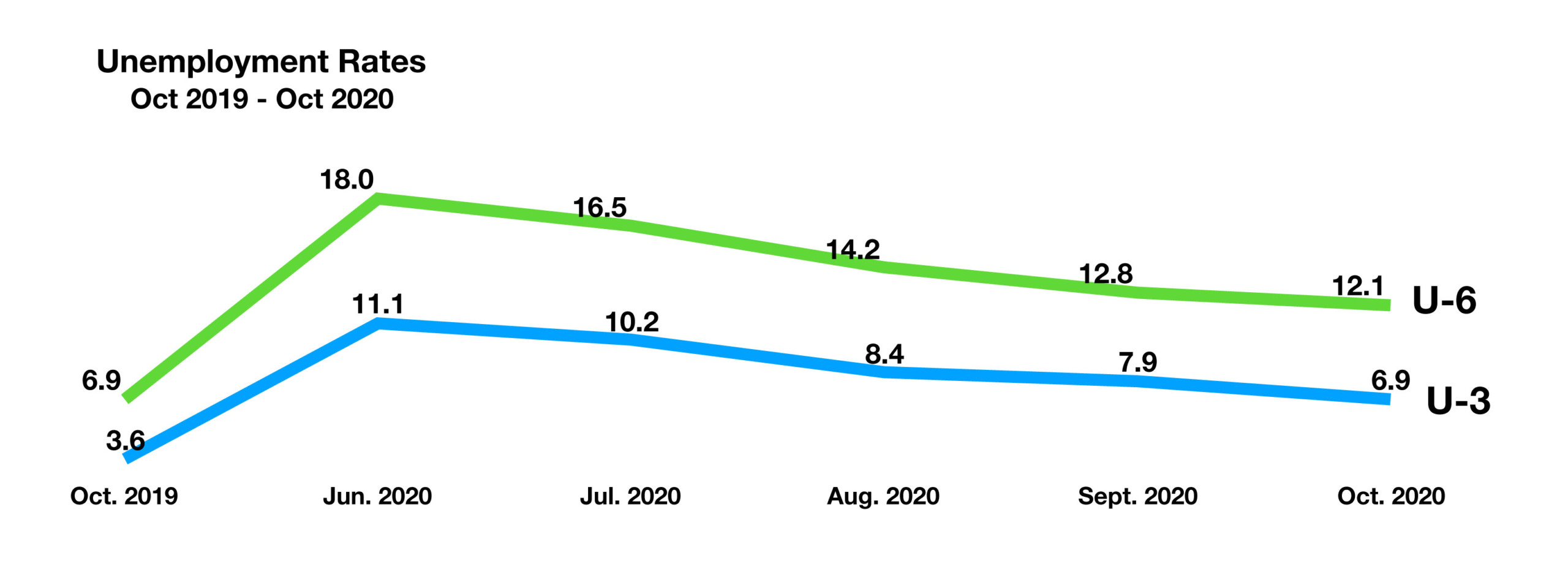

Elevated unemployment continues to persist as large and small employers have scaled back on hiring and wages, creating ongoing frustrations for millions of unemployed workers nationwide. Fraudulent unemployment claims have become a growing issue, as the pandemic has lowered barriers to applying for and accessing benefit payments.

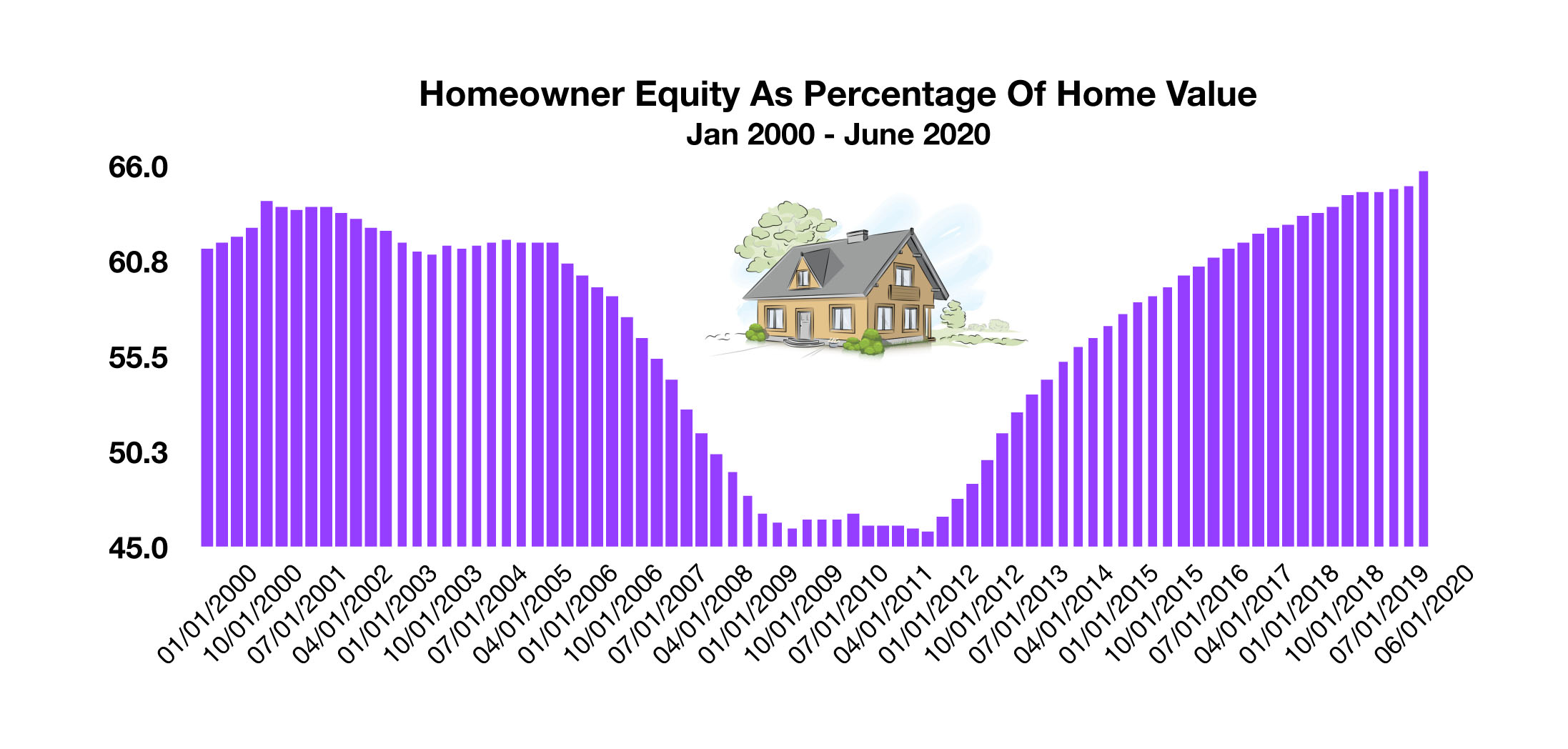

Absent any fiscal stimulus or year end pandemic relief funds, it is expected that the Federal Reserve will provide any essential stimulus by way of bond purchases. The Fed’s ambitious purchases of long-term bonds has kept long term rates low, helping to buoy consumer credit and the housing market.(Sources: Federal Reserve, CDC, BLS, Dept of Labor, IRS, Social Security Admin.)