Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

The onset of the most recent Covid variant, known as Omicron, stands to stall a global economic resurgence which has been gradual and fragile. The World Health Organization (WHO) reported that the new variant may pose a greater reinfection risk and be more transmissible than previous variants leading to reimposed travel restrictions and restricted trade.

Some economists believe that excessive stimulus efforts to offset the pandemic slowdown may have led to inflationary pressures as enormous amounts of federal debt were issued and consumers spent stimulus funds in a short period.

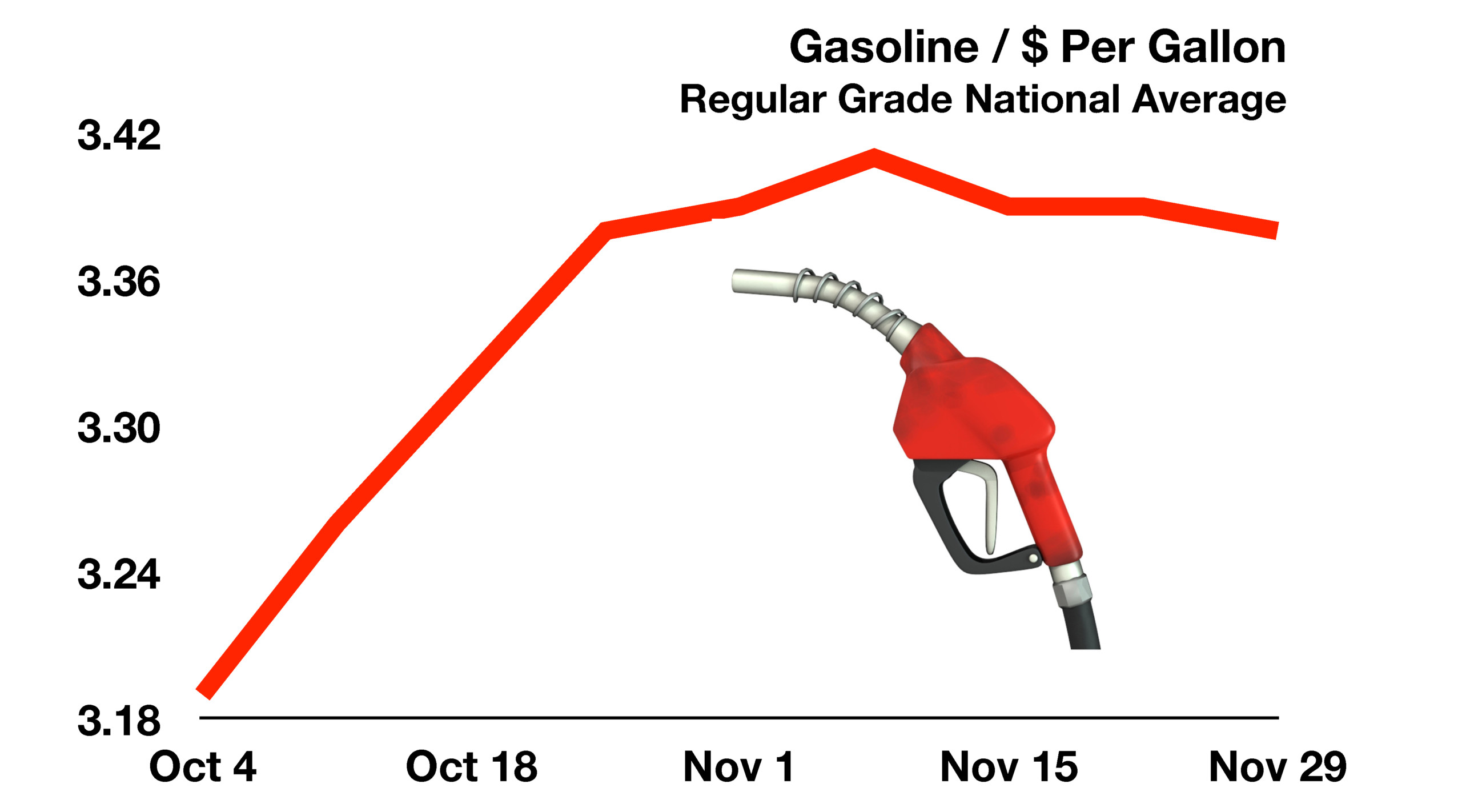

Elevated food and energy prices may start to hinder consumer expenditures and dampen economic growth heading into 2022. Both food and energy account for a significant portion of household expenditures for millions of Americans, leaving less available for discretionary expenditures.

The Federal Reserve faces a new dilemma, slowing inflation simultaneously while also trying to maintain gradual economic expansion. Comments by Fed Chair Jerome Powell validated that the Federal Reserve now recognizes inflation as not transitory but becoming longer term. It is expected that the Federal Reserve will continue to slow its pace of bond buying as a stimulus effort, resulting in a removal of liquidity from the financial markets. Such a strategy is expected to produce higher rates and increased market volatility.

Global equity markets saw a pullback in late November as heightened virus fears drove uncertainty throughout the financial markets. Concern surrounding revised growth estimates drove rates lower as bond prices rose.

The growing popularity of using cryptocurrency for transactions and as an investment is expected to trigger tax consequences for those venturing into the digital currency arena. The IRS announced plans to track and identify digital currency transactions in order to tax gains on transactions. Many are being caught off guard.

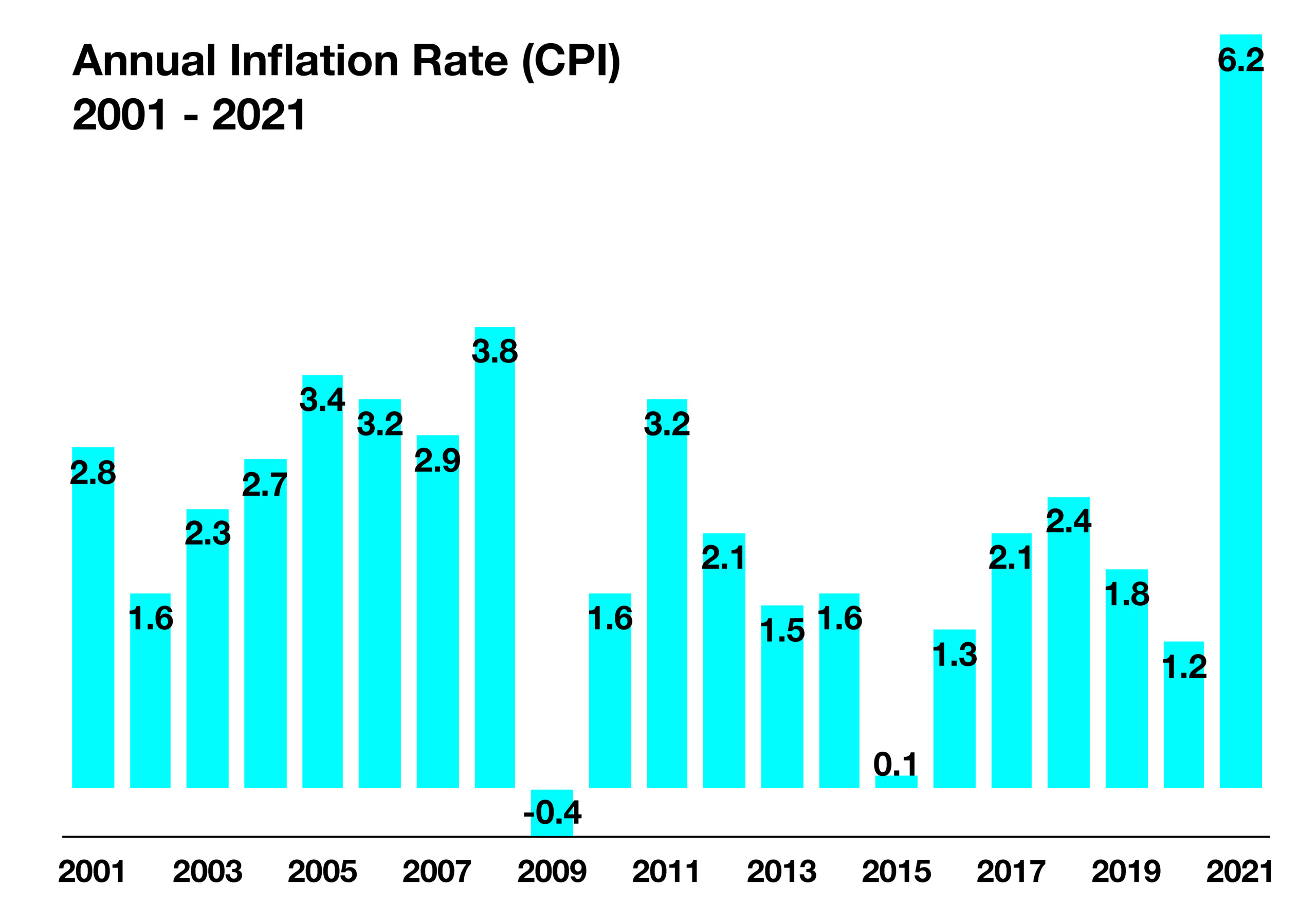

The most recent Inflation data rose 6.2% year over year from October 2020 to October 2021, the largest annual increase since 1990. Supply constraints along with increased consumer demand for goods propelled overall prices higher throughout the economy. (Sources: Fed, WHO, Labor Dept., IRS)

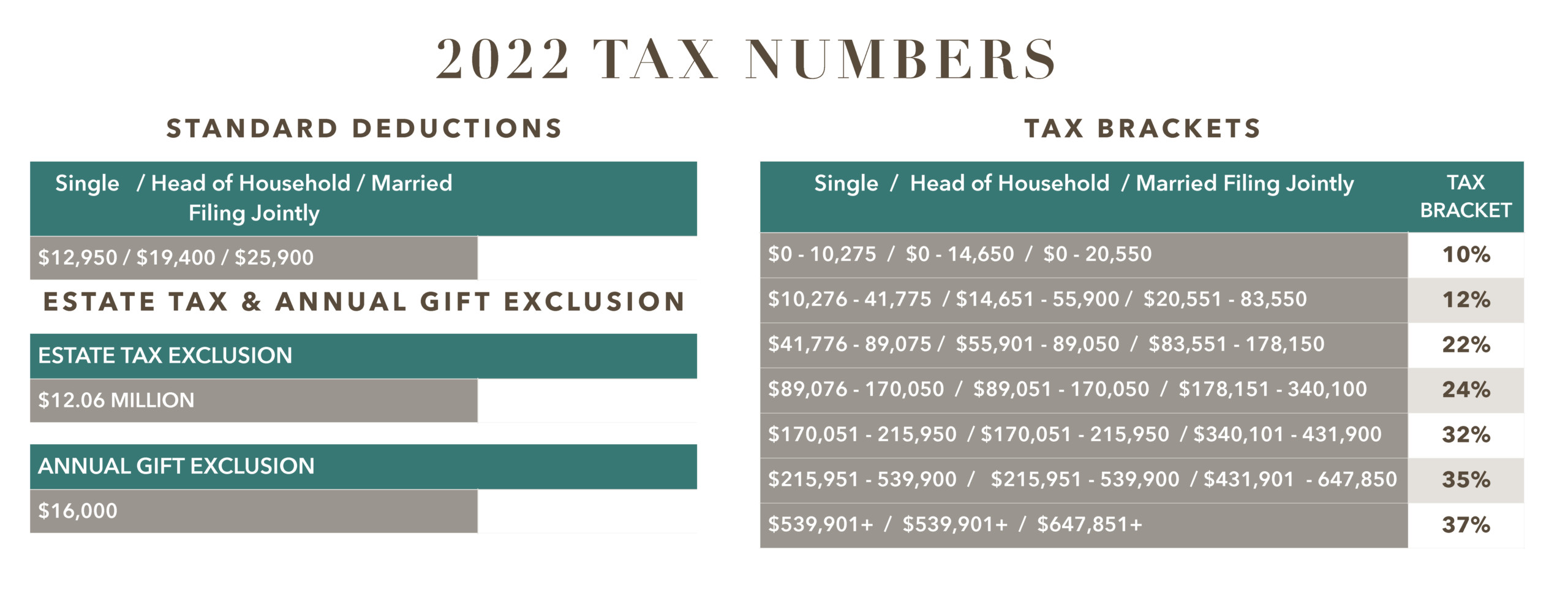

IRS Introduces New Tax Brackets & Standard Deductions For 2022 – Tax Planning

Heading into the new year, the recent higher than expected inflation numbers will also be affecting tax rates for everyone. The IRS has adjusted 2022 tax brackets to reflect the most recent inflation data. Ironically, the adjustment for higher inflation will amount to lower tax rates for many taxpayers. For those earning more in 2022 than in 2021, the applicable tax bracket may actually be lower than the prior tax year because of the inflation adjustment. Standard deductions and estate tax exclusions have also risen for tax year 2022.

Sources: IRS, taxpolicycenter.org, taxfoundation.org