Gregory M. Hart, CFP®

Haddon Wealth Management

2 Kings Highway W., Suite 201

Haddonfield, NJ 08033

(856) 888-1744

Stock Indices:

| Dow Jones | 39,807 |

| S&P 500 | 5,254 |

| Nasdaq | 16,379 |

Bond Sector Yields:

| 2 Yr Treasury | 4.59% |

| 10 Yr Treasury | 4.20% |

| 10 Yr Municipal | 2.52% |

| High Yield | 7.44% |

YTD Market Returns:

| Dow Jones | 5.62% |

| S&P 500 | 10.16% |

| Nasdaq | 9.11% |

| MSCI-EAFE | 5.06% |

| MSCI-Europe | 4.60% |

| MSCI-Pacific | 5.82% |

| MSCI-Emg Mkt | 1.90% |

| US Agg Bond | -0.78% |

| US Corp Bond | -0.40% |

| US Gov’t Bond | -0.72% |

Commodity Prices:

| Gold | 2,254 |

| Silver | 25.10 |

| Oil (WTI) | 83.12 |

Currencies:

| Dollar / Euro | 1.08 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 151.35 |

| Canadian /Dollar | 0.73 |

Macro Overview

Global markets shifted positively in November as the Federal Reserve signaled that further rate hikes were less likely as economic conditions and inflation cooled. Stocks and bonds both advanced in November, following the expectations that the Fed may be on track to finalize its rate increase initiatives. Various fixed-income analysts even project interest rate cuts by the Federal Reserve as early as March 2024.

Numerous economists and analysts are encouraged that the Fed may have decided to ease its fight against inflation due to the most recent Consumer Price Index (CPI) release indicating that inflation is easing. November CPI data revealed that inflation rose at the slowest pace since 2021, with the CPI rising at 3.2%, down from 7.1% a year ago.

There is also a growing consensus that the Fed may be able to achieve a soft landing by easing rates slowly and avoiding the risk of recession. The U.S. economy has thus far been incredibly resilient to the Fed’s rate hikes, which have been hawkish over the past year. The Federal Reserve has communicated that it is carefully monitoring the effect of heightened interest rates on consumers and the economy. Some analysts believe that if the economic environment slows more than the Fed expects, then a transition to lowering interest rates might eventually be executed by the Federal Reserve.

Government data disclosed that domestic economic growth, as measured by Gross Domestic Product (GDP) grew at an annual rate of 5.2% in the third quarter of 2023, up from 2.1% in the second quarter of the year, according to the Bureau of Economic Analysis. Since the Federal Reserve tracks GDP growth for inflationary pressures, fourth-quarter data for 2023 will be critical in determining the Fed’s conclusive decisions on the direction of interest rates.

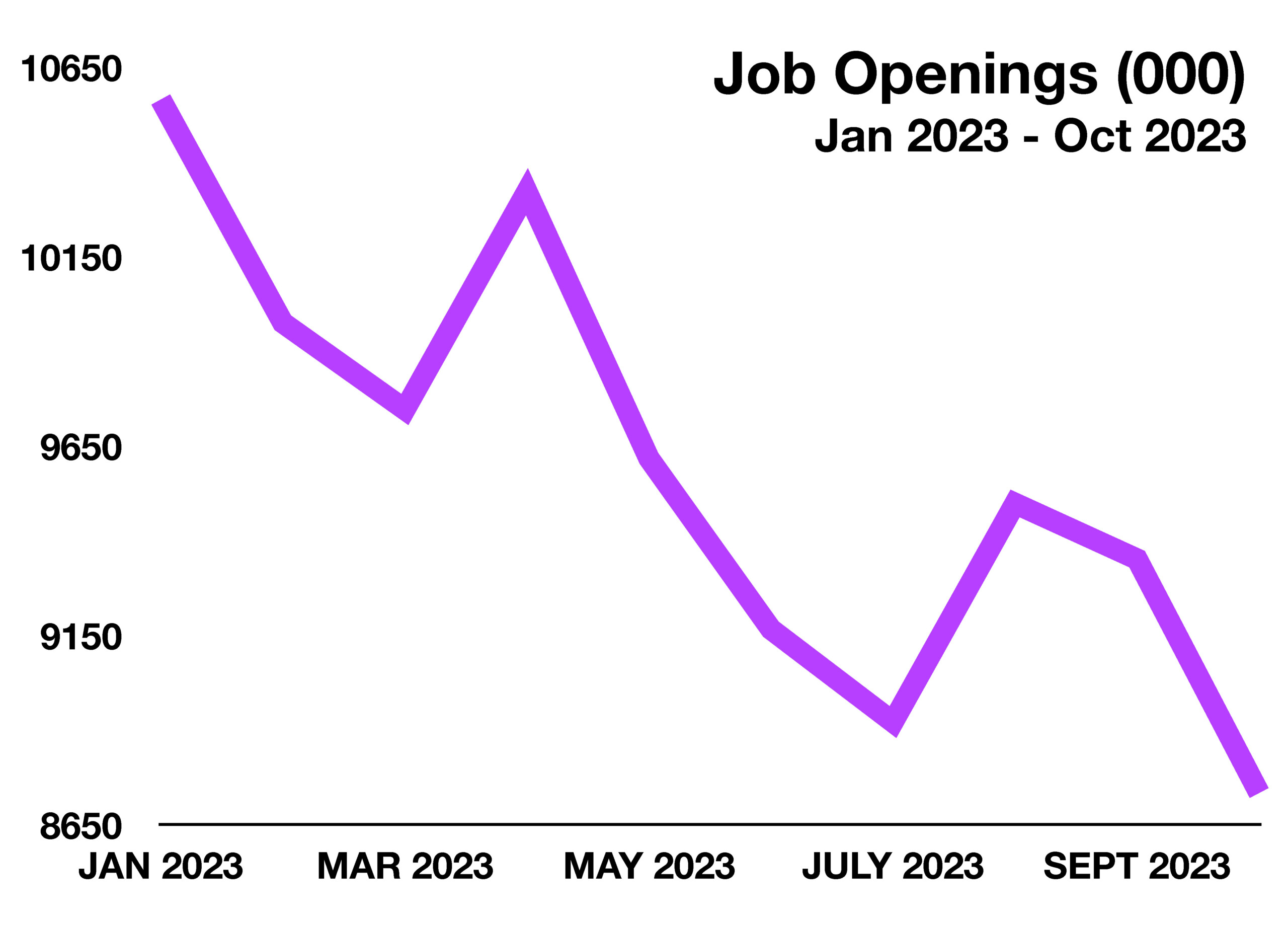

The number of job openings nationwide has been declining all year, with over 11.5 million open positions in January 2023 falling to 8.7 million in October, as revealed by the most recent government data available. Companies in various industries, including technology and leisure, have begun scaling back on hiring and some have even implemented layoffs. Economists view a wavering labor environment as an indication of a possible economic slowdown.

Federal income tax rates are set to increase slightly in tax year 2024, with increases across most income brackets for both single and married taxpayers. The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. Some increases are indexed for inflation while others are set by legislative reform.

Sources: Federal Reserve, Treasury Dept., BEA, Labor Dept., IRS, St. Louis Fed Bank

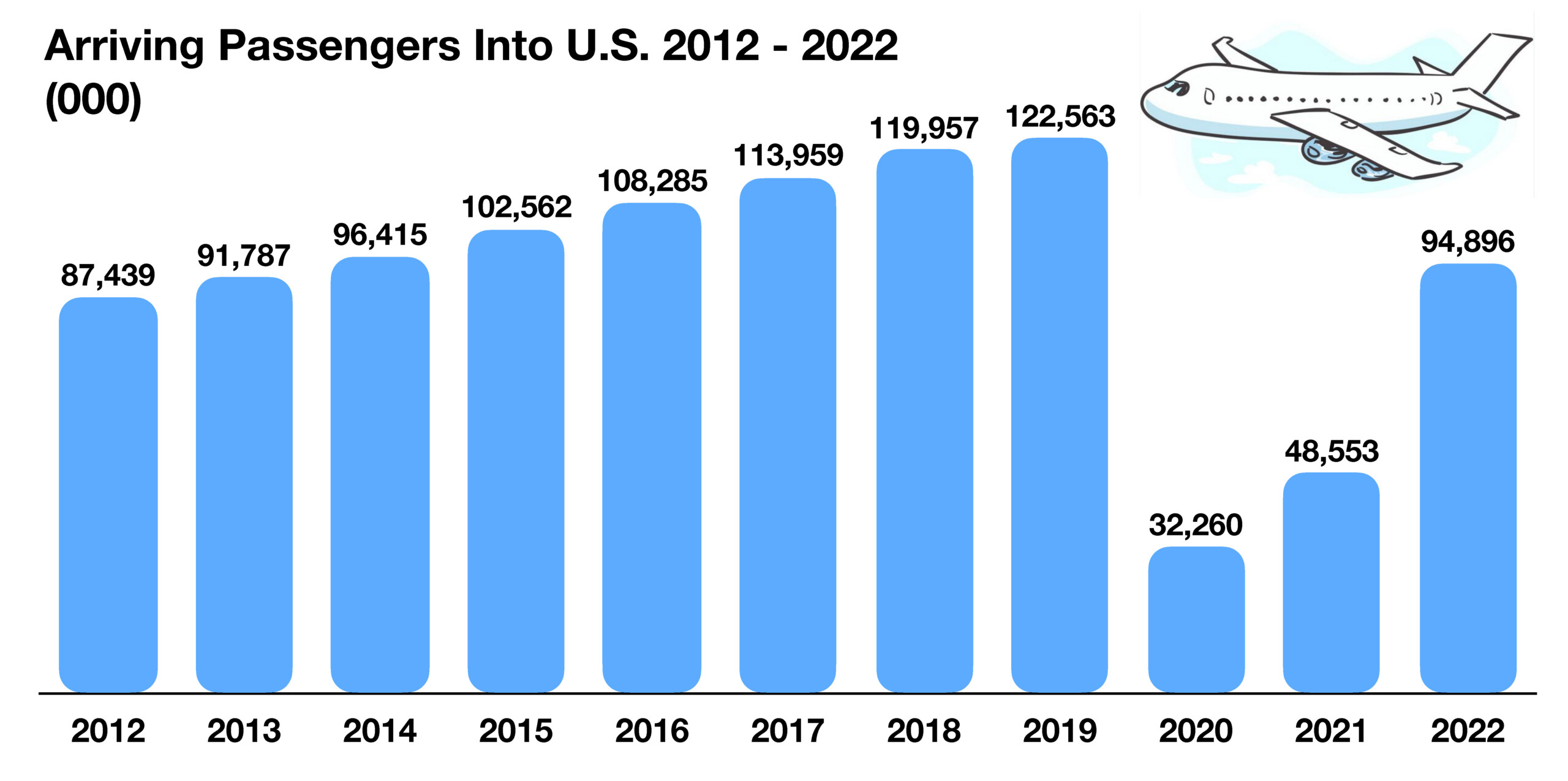

Since the attacks of September 2001, it has become more difficult for foreign travelers to enter the United States, as fewer visas are issued and fewer foreign passports are allowed into the country. The average leisure traveler is age 47.5, which represents a typical consumer in their prime spending years and most likely with children. Thus, the majority of companies in the travel and leisure industries tend to create and focus their activities and themes around the desires and interests of this age group. (Source: U.S. Travel Association)

Since the attacks of September 2001, it has become more difficult for foreign travelers to enter the United States, as fewer visas are issued and fewer foreign passports are allowed into the country. The average leisure traveler is age 47.5, which represents a typical consumer in their prime spending years and most likely with children. Thus, the majority of companies in the travel and leisure industries tend to create and focus their activities and themes around the desires and interests of this age group. (Source: U.S. Travel Association)