Macro Overview

Inflation worries persisted in February as government data revealed stubbornly elevated prices for food and energy. As a result, the Federal Reserve’s policy on additional rate increases continues to bombard the equity and bond markets. The Fed’s concern is that it might relent too soon in combating inflation, so it is expected to continue on its rate increase trajectory until economic data proves otherwise.

Recent economic terms highlighted in the media include soft landing and hard landing. A soft landing indicates a non-recessionary outcome after the Fed stops raising rates, while a hard landing denotes a recessionary environment. Many economists believe that it is too soon to determine which may occur, yet believe that an extended period of rate hikes likens the possibility of an eventual hard landing.

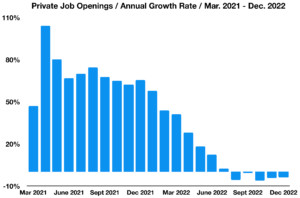

Stronger-than-expected employment data along with surprisingly resilient consumer demand drove the Federal Reserve to raise short-term rates, resulting in rates rising this past month. Mortgage and consumer loan rates rose in February, adversely affecting housing and consumer durables, where interest rates pose a significant factor.

Many analysts believe that the Fed’s current policy of ongoing rate increases might be hinged on stale economic data, including employment and consumer data. Economists view some of these data as lagging indicators, meaning that current economic conditions are not being properly represented.

Recently released data from the Bureau of Labor Statistics reveals that consumers are pulling back on cyclical goods such as clothes and electronics while focusing on food and essential products like toilet paper and toothpaste. Larger ticket items, which are more expensive products such as appliances and autos, are seeing a drop in sales as consumers redirect funds.

Internationally, the European Union continues to see inflation at 10% alongside a 6.1% unemployment rate, translating into economic stagnation per the most recent data releases. As in the U.S., stubbornly high food and energy prices continue to divert consumers from buying what they want versus buying what they need. The Russian invasion of Ukraine continues to pose a challenge to global supply chains and inflationary pressures. Reduced trade with Russia has led numerous countries to replace inexpensive Russian imports with other pricier sources.

A renewed concentration on consumer incomes and inflation is materializing, as average income growth continues to fall behind inflation, meaning that consumers are struggling to maintain regular spending habits without an immediate pay raise. A Federal Reserve Bank of New York survey showed that households expect income growth to drop, creating additional uncertainty for consumers as well as creating a detrimental impact on consumer confidence.

Sources: Eurostat, U.S. Department of the Treasury, Federal Reserve of the U.S., Bureau of Labor Statistics, Labor Department