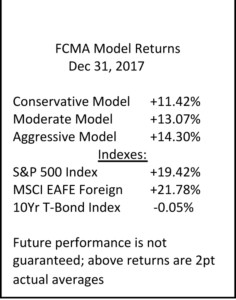

FCMA’s Model Portfolios Siezed the Year with gains, net of fees, for 2017 as follows:

Conservative Model +11.42%, Moderate Model +13.07%, and Aggressive Model +14.30%! The market recorded double digit earnings by yearend! Economic indicators are strong and unemployment has reached its lowest since pre-2008, at 4.1% as of December 2017 with GDP estimated at 2.7% for 2017.

Welcome to our newest employees at Foresight

2018 New Savings Limits Announced

The US Government has announced several savings limit increases for 2018. 401(k) savings limit raises to $18,500, and if age 50+ rises to $24,500. IRAs remain the same at $5,550 and 50+ $6,500. HSAs savings raise to $3,450 for Individual and $6,900 for a family in 2018, both up from 2017 ($3,400 Individual and $6,750 for family). Also, Social Security to raise 2% in 2018, the largest raise since 2012. See our website www.fcmadvisors.net for more details on the savings limits for 2018.

A New White Paper by Foresight: titled Retirement Plan Costs Beware! A Mutual Fund Share Class Study- and Why the Cheapest Fund Class May Not be the Best! This assists trustees of retirement plans and helps them to understand the complex pricing of the mutual funds. Contact us if you would like a copy emailed to you.

New Analytics at Foresight- Hidden Levers

Foresight has implemented a new tool called Hidden Levers which allows us to analyze portfolios by putting them through a stress test from history and simulate how the portfolio will react in today’s market. We intend to utilize this tool on all the Foresight portfolios and will review its outcomes with you in your annual review meeting.

HSAs at Foresight

We now offer Health Savings Accounts which can be invested in our Model Portfolio strategies of Aggressive, Moderate, and Conservative. The HSA savings is a triple win for the consumer because you get to save in the HSA and get a tax deduction, then it grows tax deferred, and when you use the HSA for medical expenses it is tax free! There are also optional debit cards with our HSA program. Please call if you are interested in further details 734-429-4680.