U.S. Oil Crushing Saudi Finances – Oil Industry Review

Saudi Arabia launched an aggressive campaign against U.S. oil drillers over a year ago by continuing to produce oil at record levels in order to maintain and build upon its market share. Saudi Arabia’s relentless approach to put U.S. shale drillers out of business is an indication of how serious a threat U.S. oil production has become to OPEC and its members.

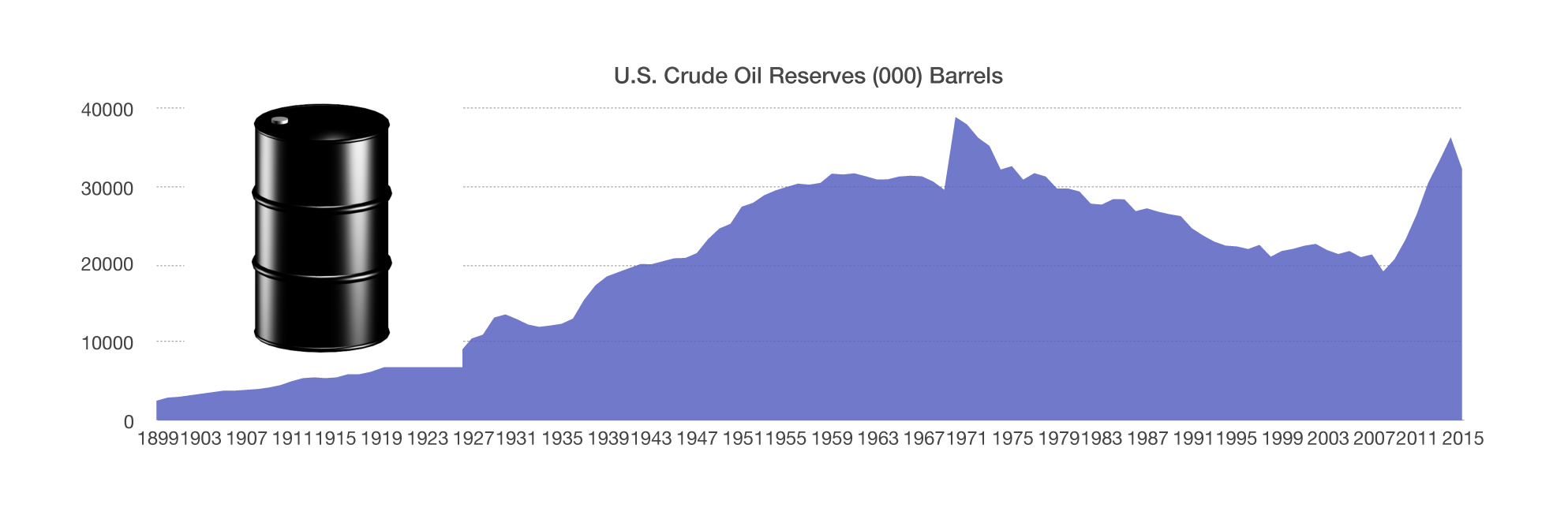

The U.S. shale industry, known for its fracking technology to extract oil from shale rock formations, has continued to surprise the world oil markets with its resistance to low prices. U.S. drillers have thus far been able to beat Saudi Arabia’s “pump and dump” strategy to lower oil prices in order to maintain market share.

Saudi Arabia’s government spent much more than it collected in 2015. Oil exports account for about 75% of the country’s revenue, so when oil was trading at $100 plus a barrel, the country had a surplus. Huge budget surpluses are turning into deficits and generous social programs are being replaced with austerity measures and cuts.

S&P downgraded Saudi Arabia’s debt in October, making it more expensive for the country to borrow money. Last year alone, $4 billion in bonds were sold in order to supplement the country’s shortfall from oil’s collapse. The IMF released a report in 2015 identifying that Saudi Arabia’s breakeven price is $105 per barrel, more than twice the level of current prices.

Even as the world’s lowest-cost oil producer, Saudi Arabia still relies on higher prices in order to balance its budget. So with 75% of Saudi Arabia’s revenue derived from oil exports, the government has amassed a $100 billion budget deficit in 2015 and announced tough austerity measures for 2016.

Sources: EIA, CIA World Factbook, Worldbank, S&P