Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

A change in sentiment was prevalent throughout the markets as new rules and regulatory reversals began to take effect. Volatility rose as markets tried to discern President Trump’s policies.

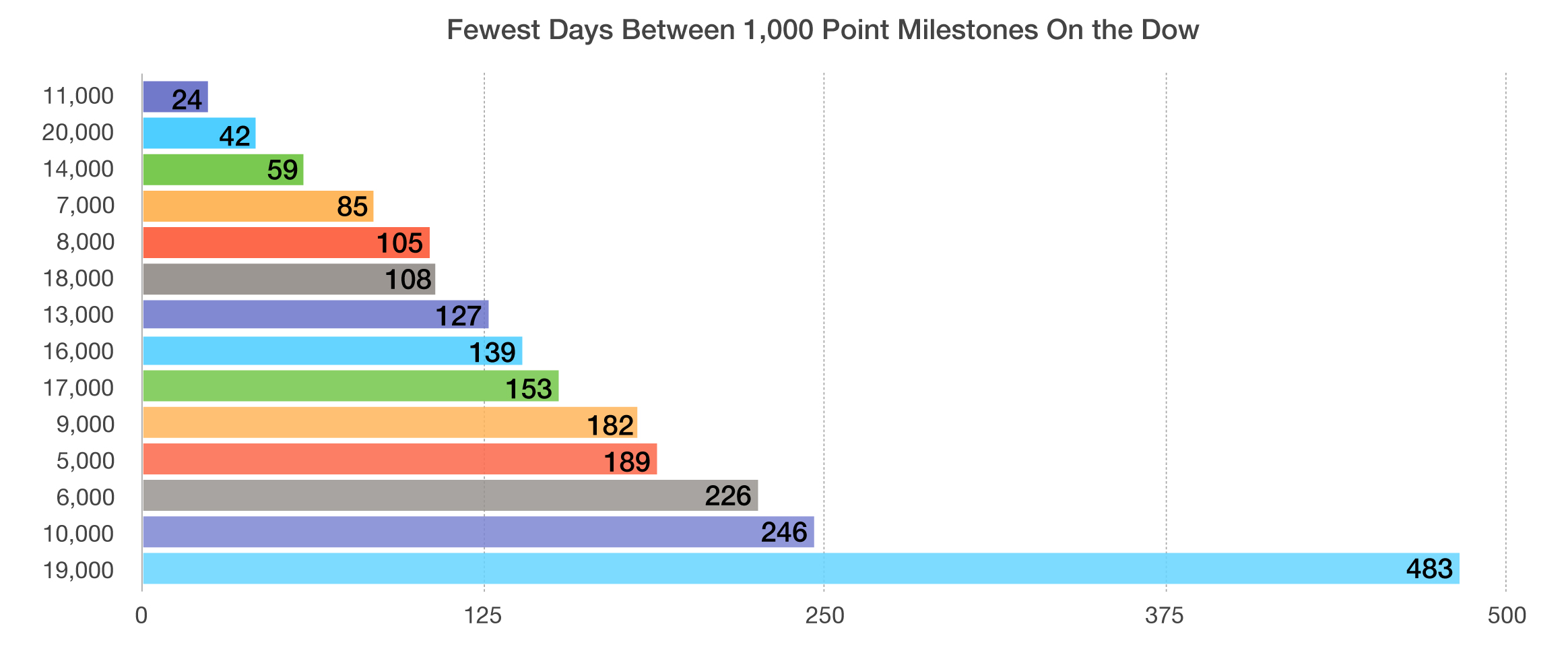

Equity markets propelled to new highs in January as optimism fueled U.S. equities, sending the Dow Jones Industrial Average to a new milestone level of 20,000. The S&P 500 Index and the Nasdaq Composite Index also reached new highs during the month.

Executive orders undertaken by the President were able to derail several rules signed into law by the Obama administration, yet fiscal policy initiatives proposed by President Trump such as tax cuts and tax reform need Congressional approval. The Congressional Review Act (CRA) will allow the Republican led Congress to reverse a number of regulations enacted by the prior administration.

Among President Trump’s first actions as president was to withdraw the U.S. from the Trans-Pacific Partnership, strengthen border parameters with Mexico and temporarily disallow certain immigrants from entering the U.S. Two highly contested oil pipeline projects were granted the ability to advance, the Keystone Pipeline and the Dakota Access pipeline.

Pharmaceutical companies became a Presidential target, as President Trump approached drug makers to lower their prices and manufacture their products in the U.S. The President’s agenda of repealing portions of the Affordable Care Act may also affect premium and medical costs.

Fiscal concepts presented by the President may encourage companies with ample cash to invest in capital rather than buying back their own stock or issuing heftier dividend payouts. A lagging key component of GDP has been capital spending.

The National Federation of Independent Business released their survey of small business optimism, which soared 7.5% to its fifth highest level in over 40 years of survey results.

We believe re-inflation and cyclicality could lead the market in 2017. While the global economy may still be in secular stagnation, cyclical acceleration is clearly underway. Domestically, significant fiscal stimulus is being discussed when the economy is already healthy. Individuals and corporations expect less regulation, increased infrastructure spending, and lower taxes.

In June, none of the global Leading Economic Indicators (LEIs) was higher than the previous quarter. By October, most were higher, confirming our prevailing positive outlook. The market keeps reaching new highs, yet investors remain largely defensive, indicating there is still profit to be made. (Sources: Fed, NFIB, Dow Jones, S&P, Richard Bernstein Advisors LLC)