Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

Rising interest rates weighed on equity momentum as the expectation of increased borrowing costs and inflation accelerated market volatility. Markets retreated from gains established earlier in the year as higher global yields precipitated a pullback in domestic and international equities.

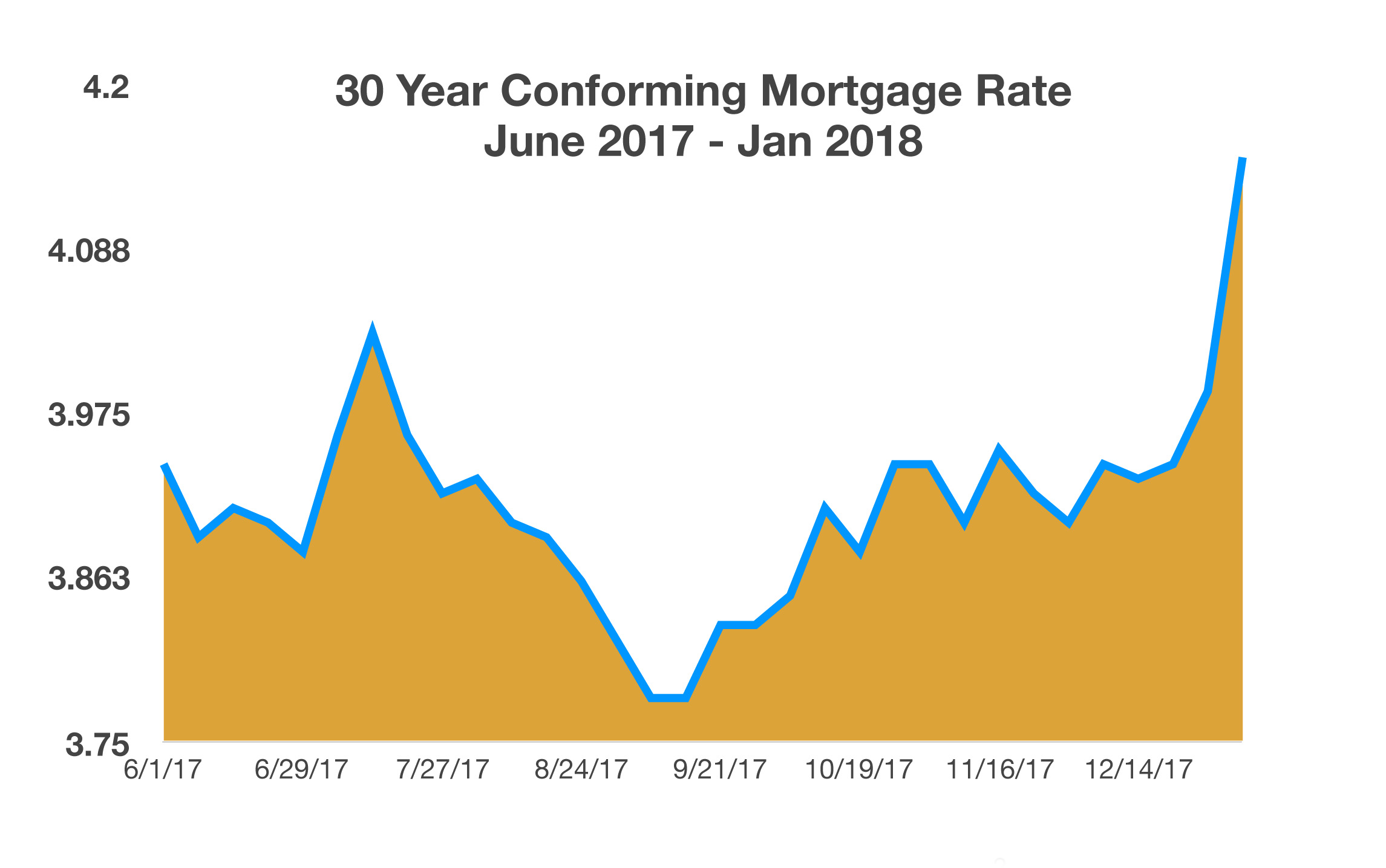

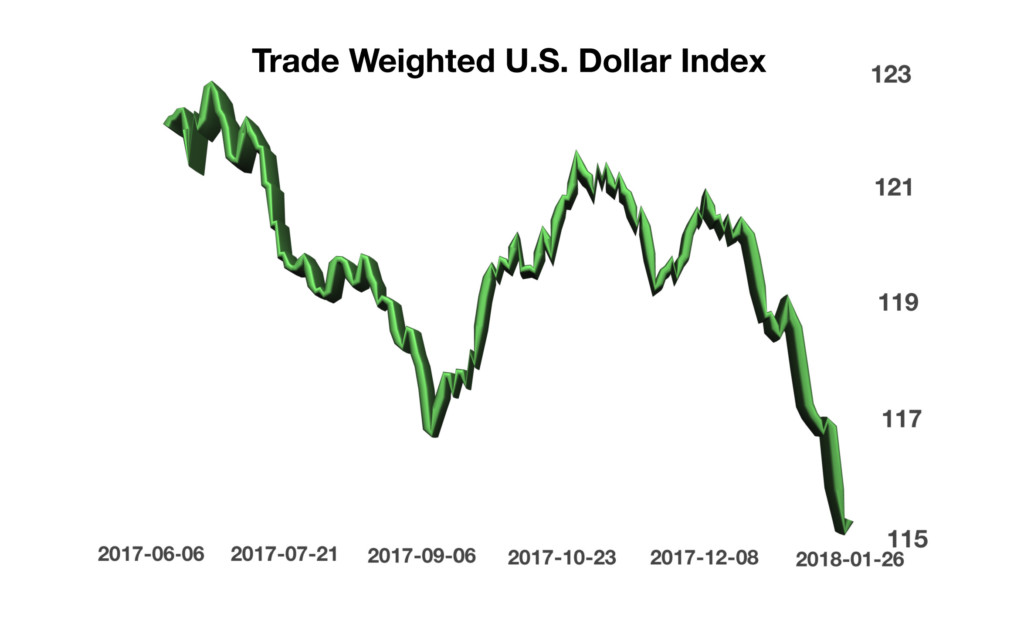

A synchronized global recovery has become the catalyst for increases in commodity prices, inflation and economic growth. Recent oil demand increases by emerging countries have stoked inflation pressures internationally, while news of higher wages in the U.S. fueled further acceleration of inflation fears, driving down bond prices and elevating bond yields. The rise in rates is affecting a broad spectrum of loans from auto and personal to mortgages. The ascent of interest rates in January is expected to continue throughout the year as the Fed slowly starts to unwind its expansive stimulus efforts.

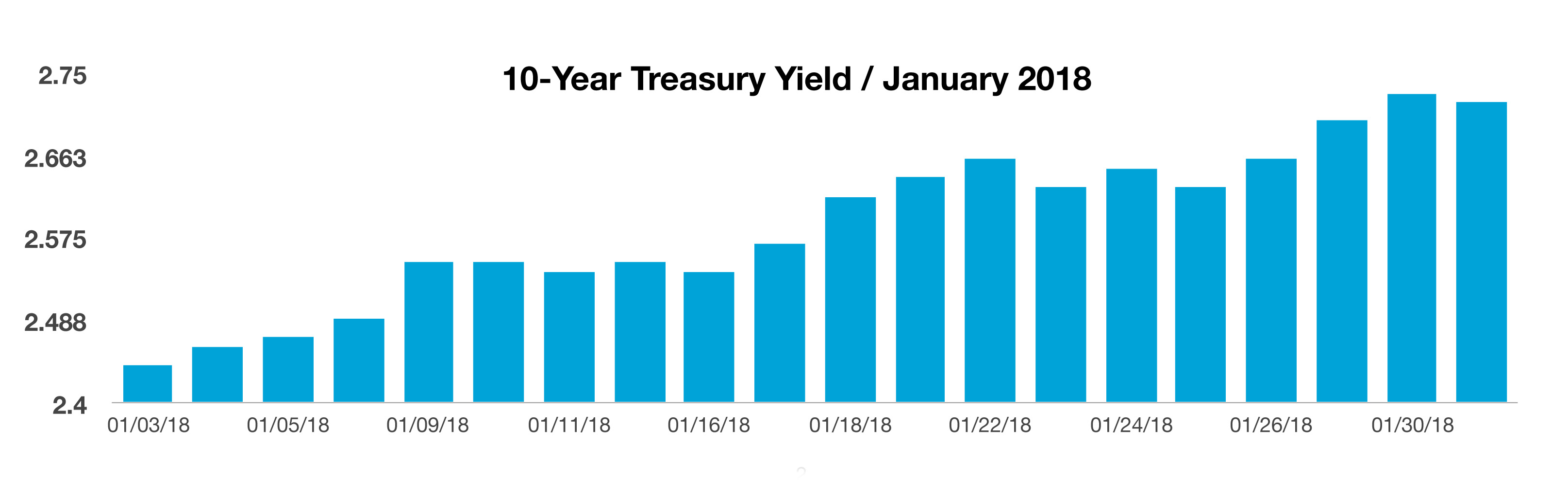

The 10-year Treasury bond yield recorded its steepest monthly increase since November 2016 with short-term and long-term Treasury yields remaining in the tightest range in a half-century. Low rates have allowed companies to borrow cheaply and have forced investors to seek out riskier assets to meet return objectives.

The recent tax changes now allow U.S. corporations to repatriate cash funds overseas and pay a 15.5% tax rather than 35%. An estimated $300 billion is expected to slowly start returning to the United States over the next few months, leading to stock buybacks, hiring, capital investment, and dividend payout increases.

World financial, political and intellectual leaders gathered in Davos, Switzerland, for the annual World Economic Forum. President Trump was the first U.S. president to attend since Bill Clinton in 2000. U.S. representatives discussed plans of establishing revised business and trade arrangements with several nations in attendance.

The Federal Reserve Bank of Atlanta revised its economic growth forecast to 5.4% for the first quarter of 2018, an optimistic revision following improving economic data. The forecast is generated by a model, known as the GDPNow model, which takes various factors into account. The model is also forecasting an increase in consumer spending from 3.1% to 4.0% and an increase in real private fixed investment growth from 5.2% to 9.2%, both significant components for sustainable economic growth.

Sources: Atlanta Fed Bank, Treasury Dept.,www.weforum.org/