Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Manager’s Comments – Feb 23, 2018

Long-forgotten market volatility is back! With renewed concerns about inflation and rising deficits, bonds have been selling off causing interest rates to rise rapidly and significantly. In turn, this has caused stock investors to book profits and re-evaluate acceptable valuations and expectations. Add to this mix some uncertainty over future Fed and fiscal policies and the net result is greater volatility … or a return to “normalcy.” In other words, equity markets are acting fairly rational, even though the severe swings of late appear emotional. The challenge is in determining whether this rapid rise in rates will be short-lived or sustainable.

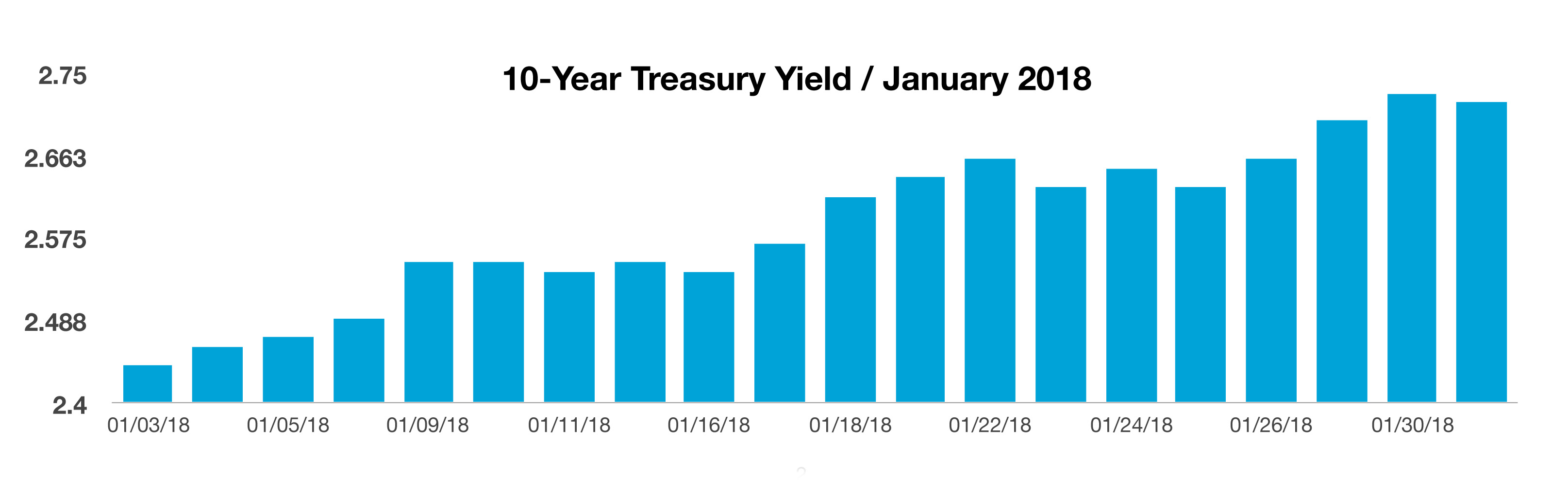

From January 1st, the S&P 500 Index quickly rose 7% to a record close in late January, then plunged 10% over a 10-day period, only to be followed by a rebound of nearly 5% before calming down somewhat over the past week. Even though some of these recent gyrations were very likely fueled by large program trades and various leveraged products, that does not mean that the resulting adjustments have been unwarranted or overdone. In fact, it is probable that recent behavior will persist. I view this recent Correction as “a shot across the bow.” When interest rates are on the move or if there is great uncertainty over their direction, stock prices rarely go unaffected, particularly when they are richly-valued. At this time, it is simply too soon to determine how high rates are headed or how fast they will continue moving.

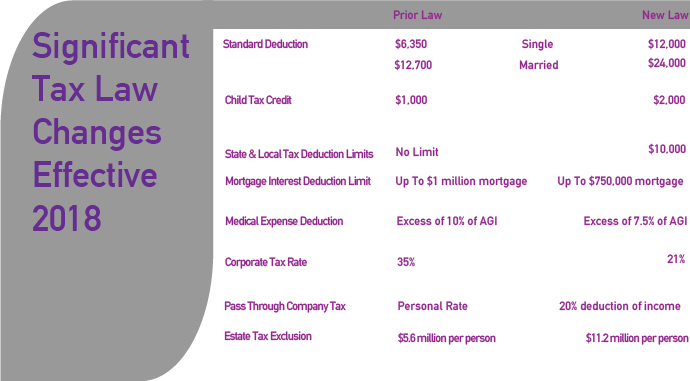

Interest rates should reflect some reasonable premium over inflation. Thus far, higher wages have not crept into the standard consumer inflation gauges. As well, healthcare and housing costs are rising slowly, energy costs are stable and even producer input costs are under control. Therefore, I don’t anticipate runaway interest rates, but rather a slow and measured rise. As an example, the current 10-Year Treasury yield is 2.9%. While this is near a multi-year high, it is low by historical standards and it does represent an adequate premium to the current inflation rate. And Fed Policy while not irrelevant, will follow the course of market interest rates. The Fed now has the cover to push their policy rates toward market rates without spooking the markets – but in a reactionary mode, not yet preemptive.

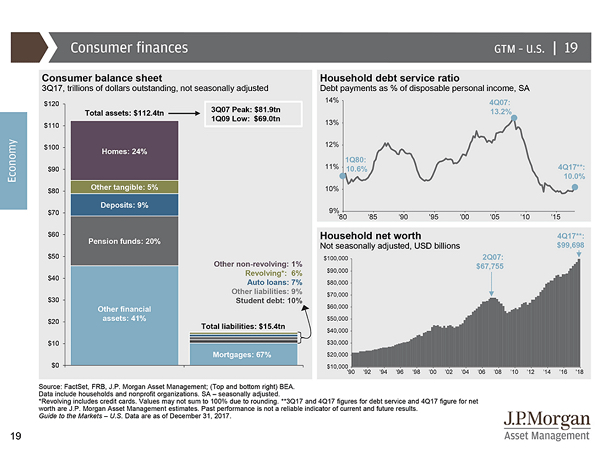

In addition to interest rates, other indicators also point to solid but not exaggerated economic conditions. US employment and regional manufacturing indices are positive and still indicate expansion. The Index of Leading Economic Indicators is still rising, and global conditions are also strengthening. Europe’s composite purchasing manager’s index hit a 12-year high in January. And according to the Organization of Economic Cooperation and Development, the percentage of countries that increased their exports hit a record high in 2017 with the trajectory still pointing north.

In fact, every major world economy is simultaneously growing (most are expanding) according to the Wall Street Journal. Given that roughly 50% of revenue earned by companies in the S&P 500 Index derive overseas, the outlook for corporate profitability continues to improve. Zacks Investment Research, Inc. reports that 70% of the companies in the S&P 500 Index have reported their Q4-2017 results and within this group, total earnings are up almost 15% and revenues are up over 9% from Q4-2016. Expectations for 2018 are even greater despite a consensus outlook of modestly higher interest rates.