Doug Kinsey

Artifex Financial Group

2305 Far Hills Avenue, Suite 206

Dayton, OH 45419

855.752.6644

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

A resilient U.S. economy drove equity markets to the best January in 30 years, propelling stock indices to new year gains which had not been seen since January 1989.

Job and wage growth skirted the government shutdown as the number of employed increased in January along with rising wages. The unemployment rate ticked up to 4.0% in January due to 800,000 federal employees furloughed during the month, a temporary effect of the shutdown. The onslaught of increased hiring by companies and higher wages translates into stronger consumer spending throughout the economy.

Federal government offices and agencies were reopened after the 35-day partial shutdown, but only until February 15th, the day when temporary funding ends for federal agencies. The Congressional Budget Office (CBO) released downward revised GDP numbers following the shutdown. The extent of the federal government shutdown has drawn concern from economists and analysts about what effects on economic growth it may produce. Economic affects from prior shutdowns weren’t recognized for months following past shutdowns.

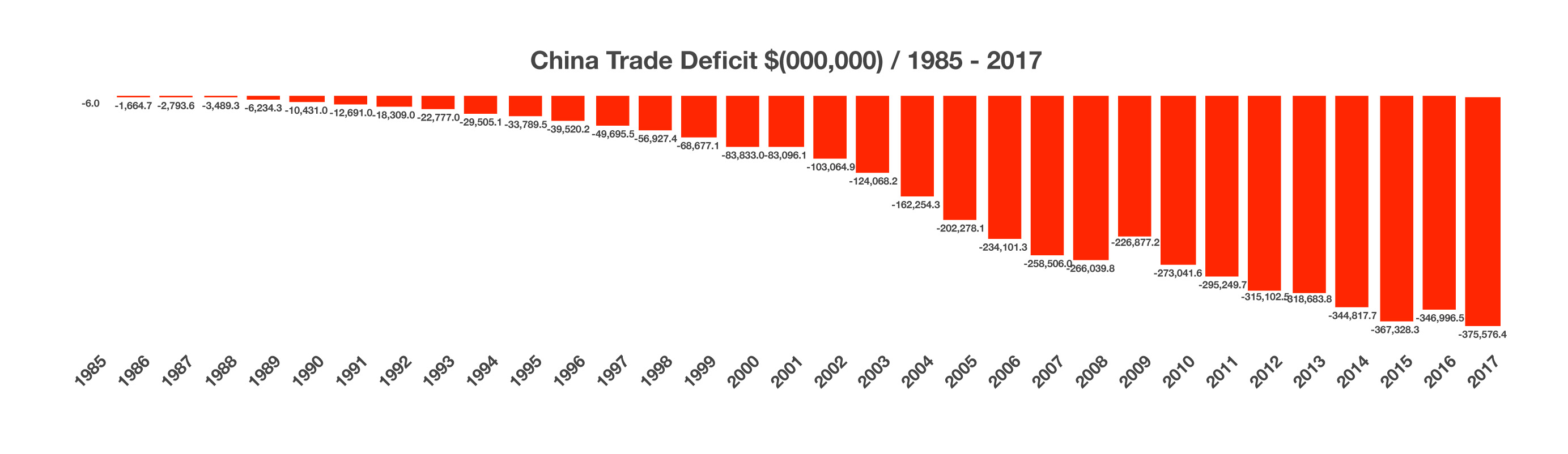

U.S. trade tensions with China continued as negotiators hashed out how to address the excessive trade imbalance between the two countries. U.S. trade representatives have set a deadline for negotiations with China for March 1st, at which point all imported Chinese goods will be subject to a 25% tariff if a compromise isn’t achieved.

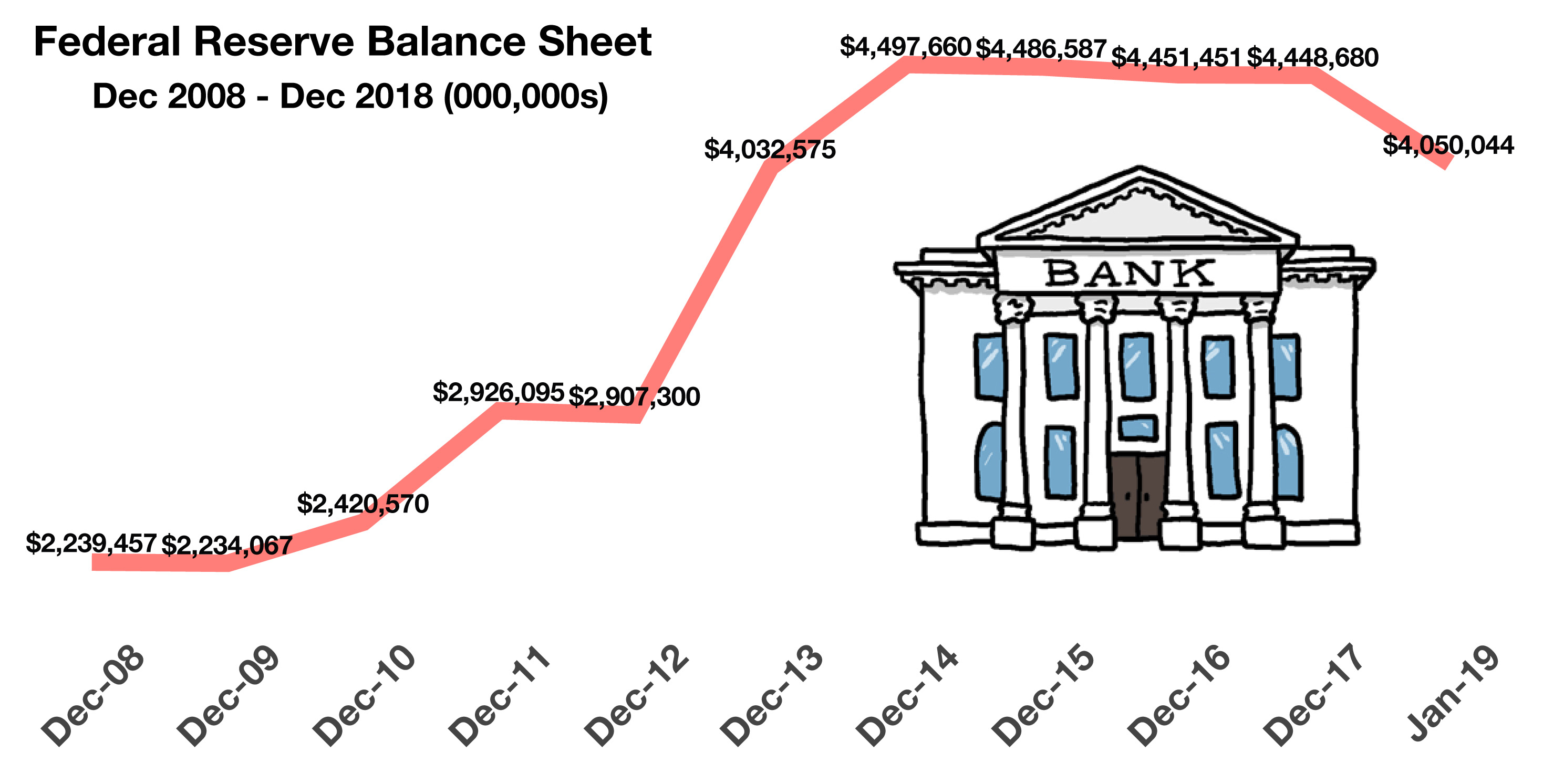

The Fed decided to leave rates unchanged during its January 30th announcement, adopting what it called a “patient rate stance” interpreted by the markets that it would hold off on raising rates for the time being. It also mentioned that it would be flexible in reducing its balance sheet, an indirect method of altering short-term rates.

Congressional leaders have until a March 1st deadline to raise the federal debt limit. The Treasury department, though, can use “extraordinary measures” to continue to finance governmental operations. Congressional decisions to increase the debt limit have become a common political debate over the years.

Britain’s vote two years ago to exit the European Union (EU) has been vigorously contested by the British parliament leading to no formal plan in place to exit. March 29th is the formal date set for Britain to exit the EU, whether or not the country has any plans in place or not.

Some presidential candidates for 2020 have announced higher taxes for top tier American earners, with the notion of possibly lifting tax rates back to pre-Reagan tax levels. Among the tax concepts floated include a wealth tax and raising the top marginal tax rates.

Consumer confidence is being carefully monitored by economists to see if sentiment was hindered by the market pullback and government shutdown. Some economists expect the effect of the polar vortex in late January to result in downward revisions on GDP growth as frozen waterways, cancelled flights, business closures and loss of income lessened productivity.

(Sources: Federal Reserve, CBO, BLS, Dept. of Labor)

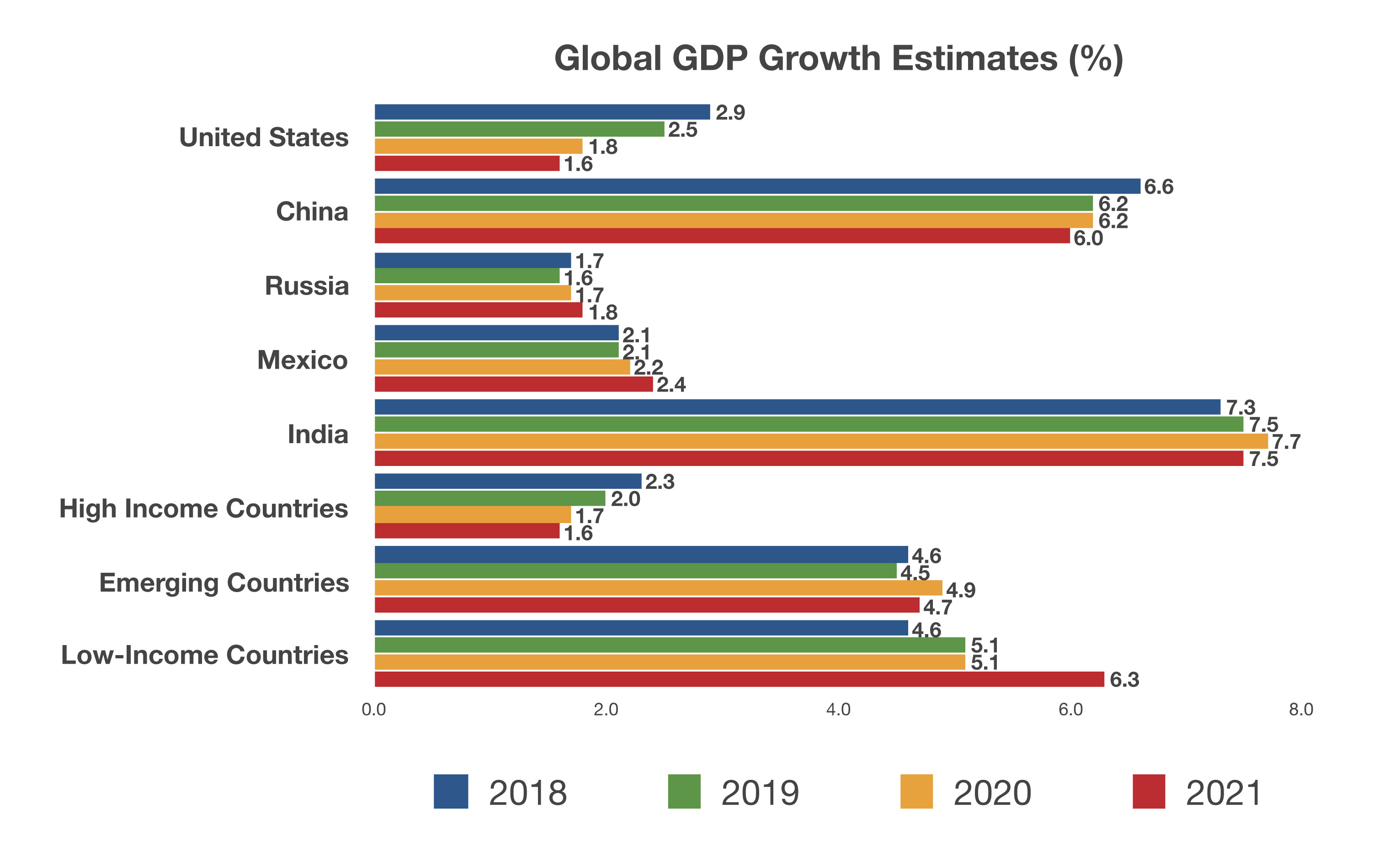

Particularly affecting emerging markets is the heightened cost of debt, with central banks around the world curtailing accommodative policies and raising borrowing costs. For developed economies, growth is estimated to remain consistent for the U.S. yet weaker than expected in Europe. Estimates for 2019 U.S. GDP growth are 2.5%, falling to 1.6% in 2021. Estimates for India and China over the next three years are expected to rise, with China expected to produce a 6% growth rate and India 7.5% in 2021. China and India are expected to eventually surpass the United States in total GDP with current growth estimates, nudging the U.S. from the largest economy globally to the third largest. (Source: World Bank; Global Economic Prospects Jan 2019)

Particularly affecting emerging markets is the heightened cost of debt, with central banks around the world curtailing accommodative policies and raising borrowing costs. For developed economies, growth is estimated to remain consistent for the U.S. yet weaker than expected in Europe. Estimates for 2019 U.S. GDP growth are 2.5%, falling to 1.6% in 2021. Estimates for India and China over the next three years are expected to rise, with China expected to produce a 6% growth rate and India 7.5% in 2021. China and India are expected to eventually surpass the United States in total GDP with current growth estimates, nudging the U.S. from the largest economy globally to the third largest. (Source: World Bank; Global Economic Prospects Jan 2019)